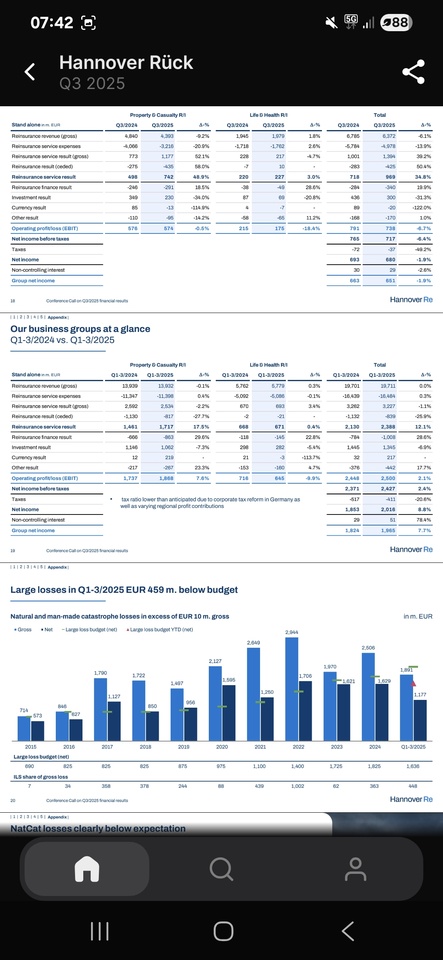

Following a very strong business performance, Hannover Re has raised its profit forecast for 2025 to around EUR 2.6 billion. In the first nine months of the year, net profit rose by 7.7 percent to EUR 2.0 billion, while the return on equity of 22 percent was well above the target figure.

Property and casualty reinsurance in particular developed profitably: the combined ratio improved to 86 percent and major losses remained well below budget at EUR 1.18 billion. Life and health reinsurance also posted stable results, while investments achieved a return of 2.8 percent despite targeted loss realizations.

For 2026 Hannover Re expects a further increase in Group net income to at least EUR 2.7 billion and a return on investment of around 3.5 percent.

At the same time, the dividend policy was adjusted: In future, around 55 percent of net profit is to be distributed, with the aim of a stable or rising dividend. Overall, the reinsurer confirms its strong market position and is ideally positioned for further profitable growth.