Due to the high demand, here are a few pictures and first experiences from the broker.

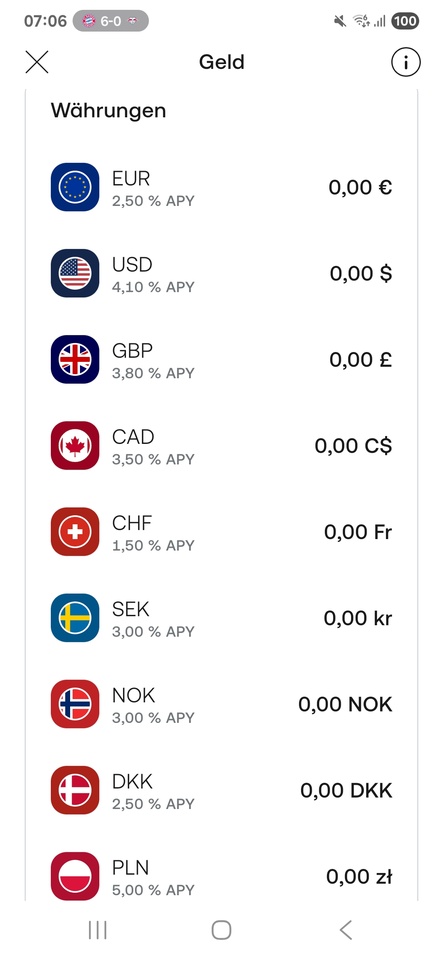

Call money in different currencies. Choose which currency you trust the most.

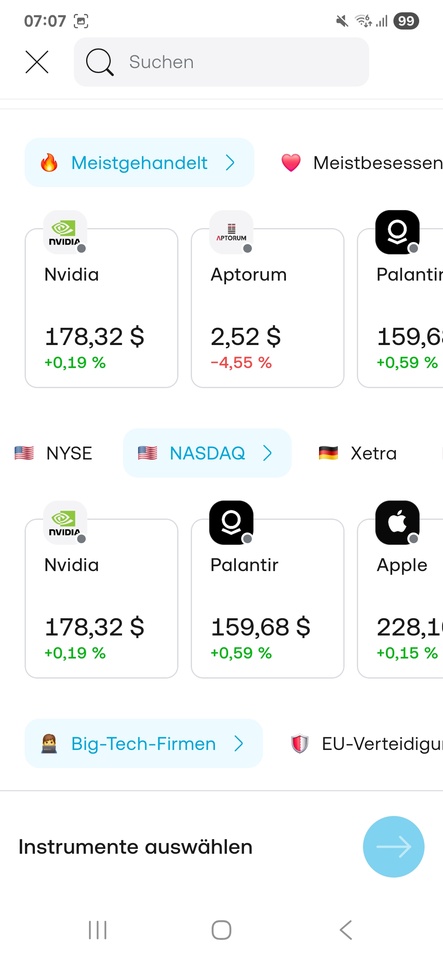

Trade €/$/P on different stock exchanges.

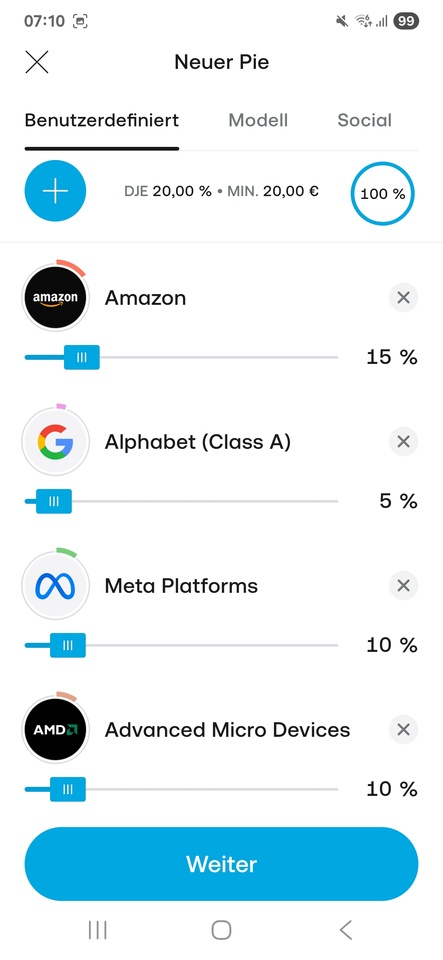

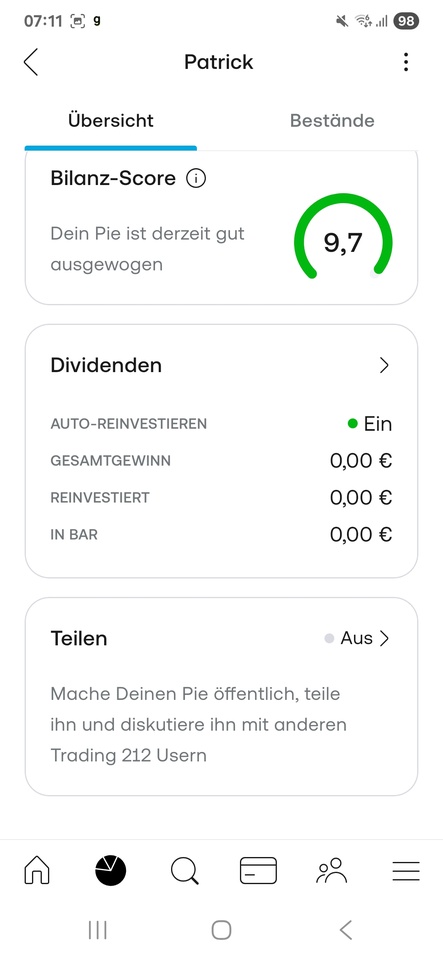

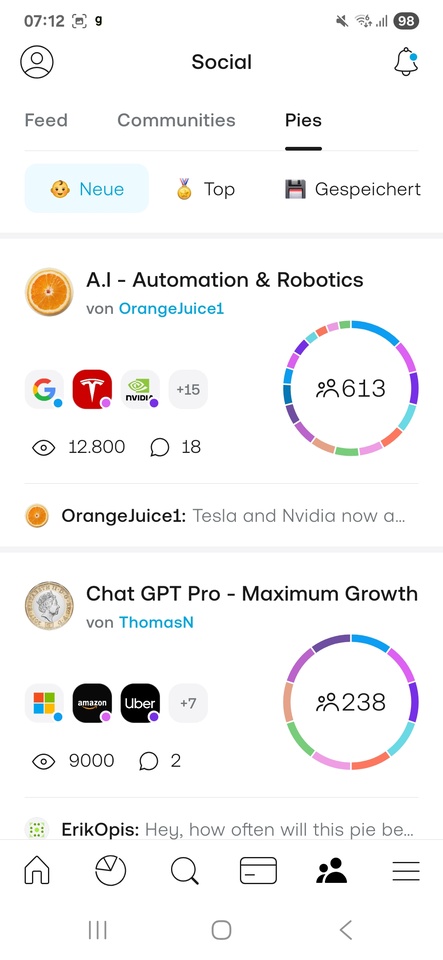

Pies. What are pies? Create your own ETF with up to 50 shares. Enter your own weighting, should the dividends be paid out or reinvested directly? If you want, you can also carry out automatic rebalancing.

Pay with the card worldwide at the best exchange rate

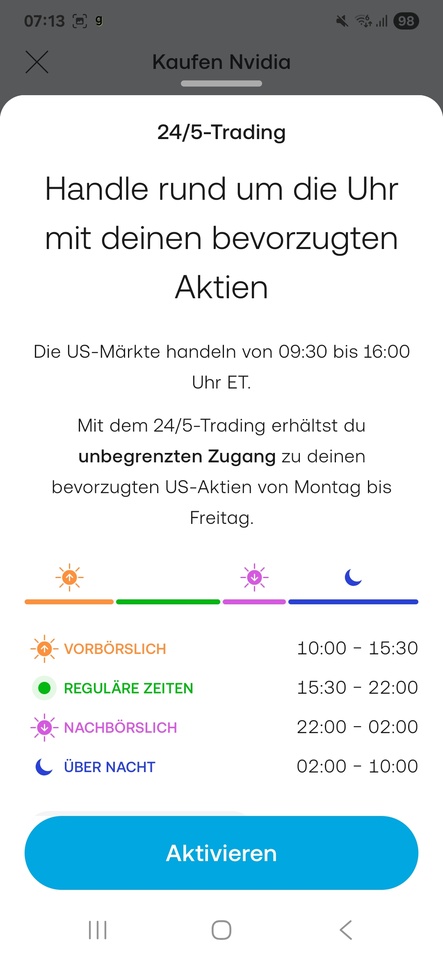

Step by step, 24/5 trading is also being introduced for us shares. Which is particularly interesting during the reporting season.

And last but not least, a community. Put your pie online and let others copy it or copy a pie from others yourself.

I hope I was able to give you a little insight into 212 trading. I only joined on Wednesday and am still working my way through it.

In my opinion, taxes should be paid by the broker. Users who have been using the broker for a while can probably tell you more about this.

Cfd trading is also possible.

The registration from downloading to the first purchase takes about 10-15 minutes.