$ADBE (+0,33 %)

$CRM (-1,05 %)

$NOW (+2,04 %)

$HUBS (+0,34 %)

$UBER (+1,42 %)

$INTU (+2,72 %)

$MSFT (+1,32 %)

$ORCL (+2,62 %)

$IBM (+0,06 %)

$ACN (+0,02 %)

Once popular US software names are lagging behind. Are they a good investment?

Key findings

- Software stocks have significantly lagged AI stocks for most of 2025.

- According to Morningstar analysts, US software stocks are significantly undervalued and many have solid fundamentals despite recent price declines.

- Morningstar analyst Dan Romanoff recommends ServiceNow as an attractive buy.

The artificial intelligence craze has driven many tech stocks to record highs, with the exception of one notable group: software. In fact, many of the largest software stocks are posting significant losses this year. And according to Morningstar equity analysts' metrics, some of them appear to be bargains.

The losses are fueled by lingering fears that AI could fundamentally change the software industry, either by reducing licensing revenue as tasks become easier and less labor-intensive to complete without human intervention, or by making traditional software applications completely obsolete. "There are big concerns," says Dan Romanoff, Senior Equity Research Analyst at Morningstar. "Nobody really knows how this is going to play out."

Combine this with the fact that software companies generate little revenue from AI, a changing forecast for US interest rate cuts and a continued economic slowdown after the Covid-era software boom, and you have a scenario for a "drastic" sell-off that has accelerated since July and intensified last week with dem Einbruch des Technologiesektors intensified even further last week.

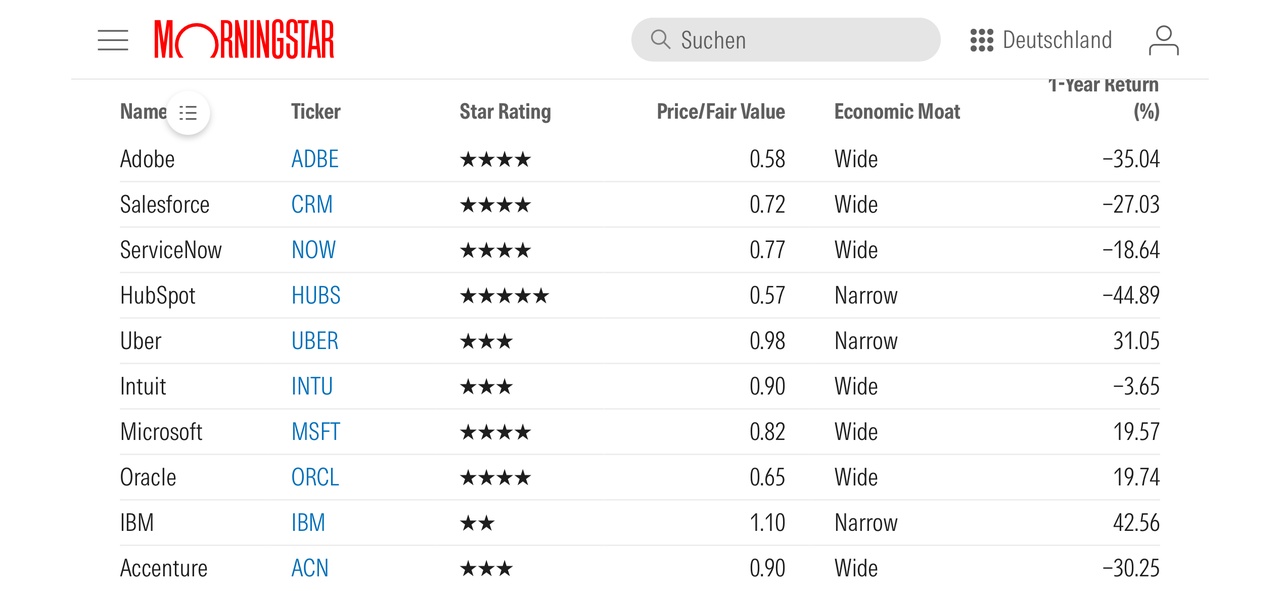

A side effect of these losses has been a sharp fall in valuations, with large software companies such as ServiceNow NOW, Salesforce CRM and Adobe ADBE were trading at discounts of 20% or more.

After several quarters of strong gains, there is still plenty of upside potential, according to Romanoff. Even though the pandemic-induced surge in sales has slowed, software stocks regularly outperform the S&P 500 Index in terms of sales growth. "They offer me a lot of attractive elements that haven't really changed," he says, even in the face of new advances in AI.

The software sell-off in the US

While technology stocks in general have soared, the software sector has struggled. Adobe is down 35% over the last 12 months and 27% so far in 2025, pointing to its worst quarter since the bear market in 2022. Salesforce has lost 27% in the last 12 months and is also heading for its worst year since 2022 The shares of HubSpot HUBS have fallen by 45%. The shares of Accenture ACN have fallen by 30 %. ServiceNow shares have fallen by 18 %.

One exception is Microsoft MSFTwhose share price has risen by 19 % in the past year. The company was an early investor in OpenAI and is benefiting from the positive impact of AI on its Azure cloud business.

The Morningstar Global AI & Big Data Consensus Index, which includes stocks commonly held by AI-focused funds and ETFs, has risen by 26.6% over the past year. The Morningstar Software Index has risen by just 2.6 % in the same period. Both indices include Microsoft, which has invested heavily in AI, as well as other mega-cap technology companies such as AlphabetGOOGL/GOOG and Meta Platforms META.

The Morningstar US Software Application Index, which includes software infrastructure companies as well as Microsoft, has fallen by more than 7 % over the past year. The Morningstar US Market Index on the other hand, has risen by 12.9 %.

Romanoff explains that many software stocks have solid fundamentals under the surface and are attractive for investors. This is true even if the AI hype is clouding the outlook. "It's almost like the opposite of the internet bubble around 2000, when everything shot up for no real reason," he says. "Now software is on a downward trajectory."

Why are software company share prices falling?

One of the immediate concerns investors have about AI and software is how the new technology will affect the traditional license-based pricing model that many software-as-a-service companies use. Customers typically pay per license per month for access to the application. If AI leads to efficiencies for a company, that company may need fewer licenses. "If fewer licenses are issued, your revenue as a software company goes down," Romanoff explains. Another concern is of a more existential nature: if AI can make a company more efficient, it could potentially replace the need for a software application altogether.

And although investment and revenue figures in the hundreds of billions of dollars surround AI companies like Nvidia NVDA and OpenAI, Romanoff says the monetization of AI by software companies has so far been "generally uninspiring." Among the companies he studied, with the exception of Microsoft and Amazon AMZNhe estimates that only 1% of revenue comes from AI. "If everyone is building these huge data centers and everyone is announcing these $100 billion deals, but software companies are only creating tiny incremental revenue streams from AI, that's not beneficial for software in general," he says. On the other hand, these low revenue figures could also be a sign that a complete takeover of the industry by AI is not yet happening.

There are also broader macroeconomic factors weighing on software stocks. Romanoff points to investor expectations of faster and larger rate cuts than the Federal Reserve has actually made. Software companies tend to be high-growth companies with most of their cash flows expected in the coming years.

After all, after a huge spike during the Covid-19 pandemic, software sales fell. Investors looking for that explosive growth can now find it elsewhere in the market. "This has weighed on software stocks," explains Romanoff.

Software stocks post strong gains and positive forecasts

Although these fears persist, software companies have reported strong sales growth and promising forecasts in recent quarters. "Overall, the results are consistently positive," says Romanoff. "Many are exceeding expectations, many forecasts are above expectations." However, although "the fundamentals are quite good", share prices have not recovered.

For example die Ergebnisse of Adobe für das dritte Quartal exceeded analysts' expectations in terms of sales growth, operating margins and forecasts. The company also reported increasing momentum in its suite of AI solutions. Nevertheless, the company's share price has fallen further.

Software shares appear significantly undervalued

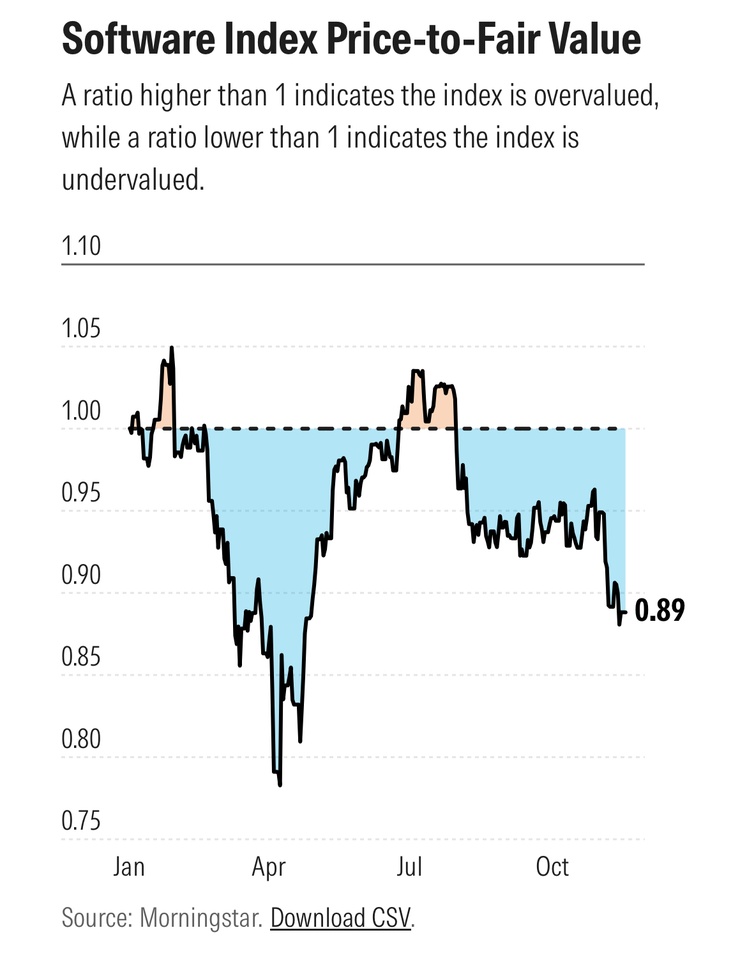

As the share prices of software companies have fallen, so have their valuations. On November 17, the software index had a price-to-book ratio of 0.89, meaning that the average share was trading at an 11% discount to its fair value estimate. At the beginning of the year, the index was still trading at a premium of up to 5%. The Morningstar US Market Index is currently trading at a discount of 6%.

Some companies are offering even bigger discounts. Adobe shares are undervalued by around 40%, as are HubSpot shares. Salesforce shares are trading 28% below their fair value estimate. ServiceNow shares are undervalued by 23%. Overall, Romanoff estimates that the stocks he monitors are undervalued by around 30% on average. "That's pretty extreme."

Are software shares a good investment?

In view of stable sales, high switching costs and high cash flow margins, "software is very attractive", says Romanoff. He particularly likes the SaaS platform ServiceNow due to its high revenue growth compared to competitors. The share is rated 4 stars and has a broad economic moat.

In addition, there is Microsoft, which has robust software sales and is one of a small group of AI "hyperscalers". Romanoff believes the stock, which he considers undervalued despite its 20% rise this year, is well positioned to benefit from AI in the long term.

Source