Thank you for your constructive tips, suggestions and criticism!!! 👍🏻👌🏻 (@Chucky075 , @DADlikesCRYPTO , @Aktienmasseur , @Meikl_22 , @Dividenden-Sammler , @Berliner_Weltenbummler , @Epi)

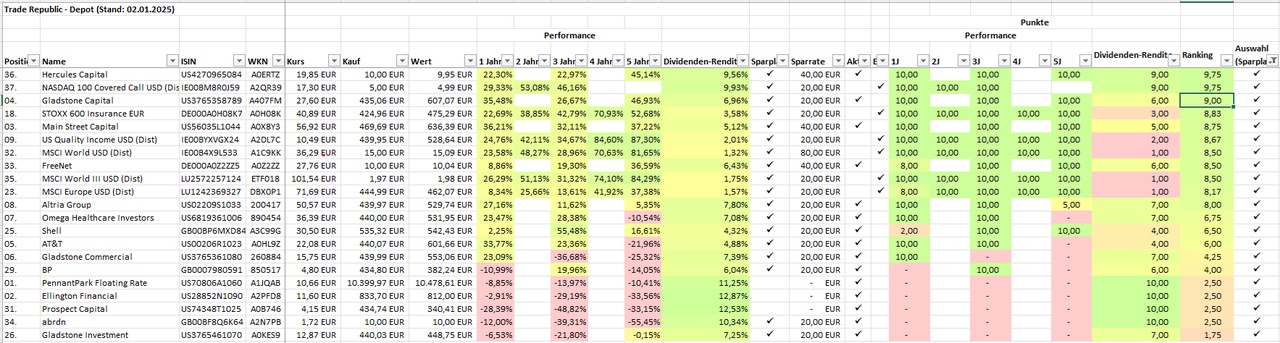

I sat down and picked my portfolio apart. I evaluated each stock & ETF. I took a close look at the performance and dividend yield of the individual stocks and rated them according to points. Based on this points plan, I selected 6 ETFs for the new portfolio.

From 22 ETF titles, only 6 ETFs remain. I have selected the following ETFs:

- $HMWO (-0,36 %)

EUR 460.00 from the savings rate (approx. 82.14%)- $AHYQ (+0,19 %)

EUR 40.00 from the savings rate (approx. 7.14%)- $FUSD (-0,76 %)

EUR 40.00 from the savings rate (approx. 7.14 %)- $EXH5 (+0,08 %)

EUR 40.00 from the savings rate (approx. 7.14 %)- $XIEE (-0,77 %)

EUR 40.00 of the savings installment (approx. 7.14 %)- $QYLE (-0,7 %)

EUR 40.00 from the savings installment (approx. 7.14 %)

All shares remain in place and are saved through savings plans. Furthermore, I have decided to leave the remaining 16 ETFs in the portfolio, but not to save any more.

The allocation of the portfolio should consist of 70% ETFs and 30% individual shares. The savings installment is EUR 800.00 per month. EUR 240.00 will be invested in individual shares and EUR 560.00 in the above-mentioned ETFs.

What do you think?

Do you have any tips or ideas?

Of course, I hope I've found the right approach now. 🙈🙊