The markets continue to react extremely sensitively to changes in interest rate expectations - particularly to statements from Federal Reserve officials. Comments by the President of the New York Fed, John Williams, recently led to a significant increase in the implied probability of an interest rate cut in December, after this possibility had previously been largely priced out of the market.

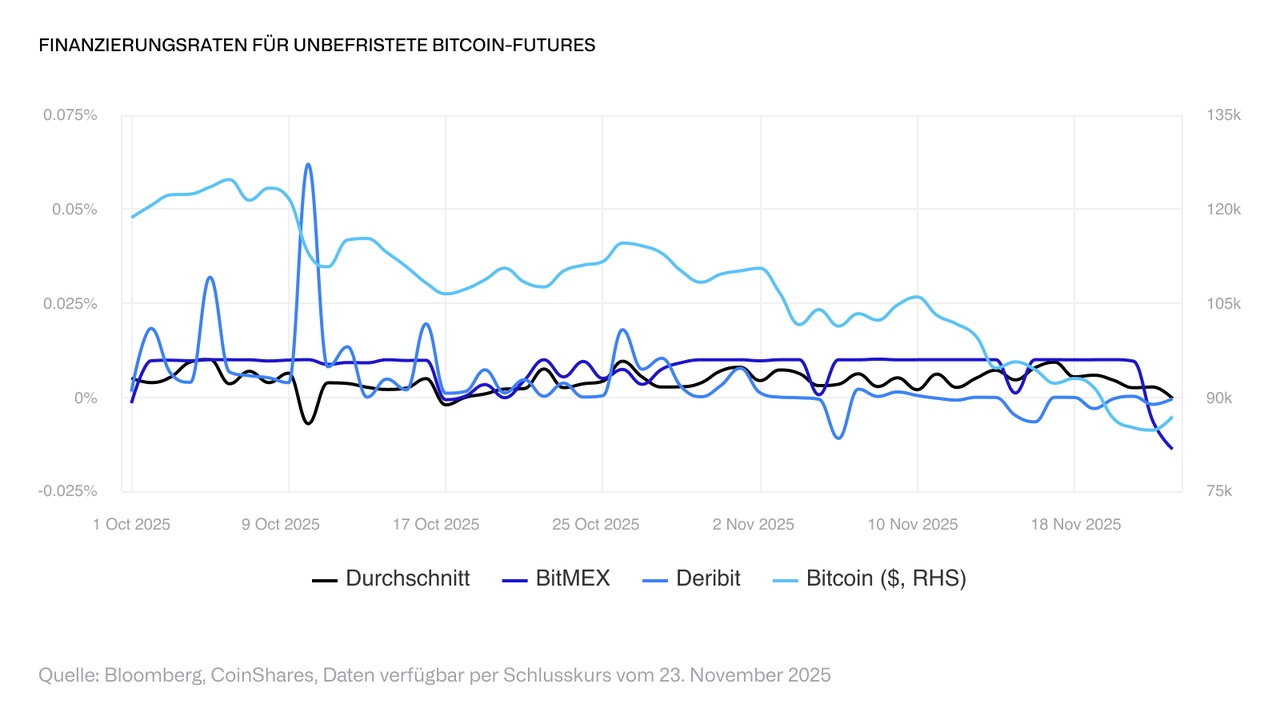

#bitcoin The US dollar temporarily fell below the USD 85,000 mark and market depth remains low. Structurally, traders are interpreting the recent price behavior as a possible "dead cat bounce"as Bitcoin continued its decline on Monday morning. Funding rates remain negative on some exchanges; even BitMEX, which usually moves more slowly, turned bearish over the weekend. The positioning suggests that many are bracing for the possibility of further downside.

The on-chain data also shows increasing pressure. A growing proportion of investors are now in loss positions: The proportion of supply that is in profit has fallen from close to one hundred percent at the high to around 60 percent. Realized losses in US dollars have reached record levels, underscoring the extent of the recent capitulation. Overall sentiment has deteriorated and market direction is likely to depend heavily on position adjustments until a resilient macroeconomic stimulus emerges. $BITC (-0,61 %)