The project is also in the red this week - and this time all values are affected.

Let's take a look at the current status of the project together Tenbagger der Zukunft together:

As a reminder, the project started with around €2,500, which was divided almost equally between the five stocks in the portfolio.

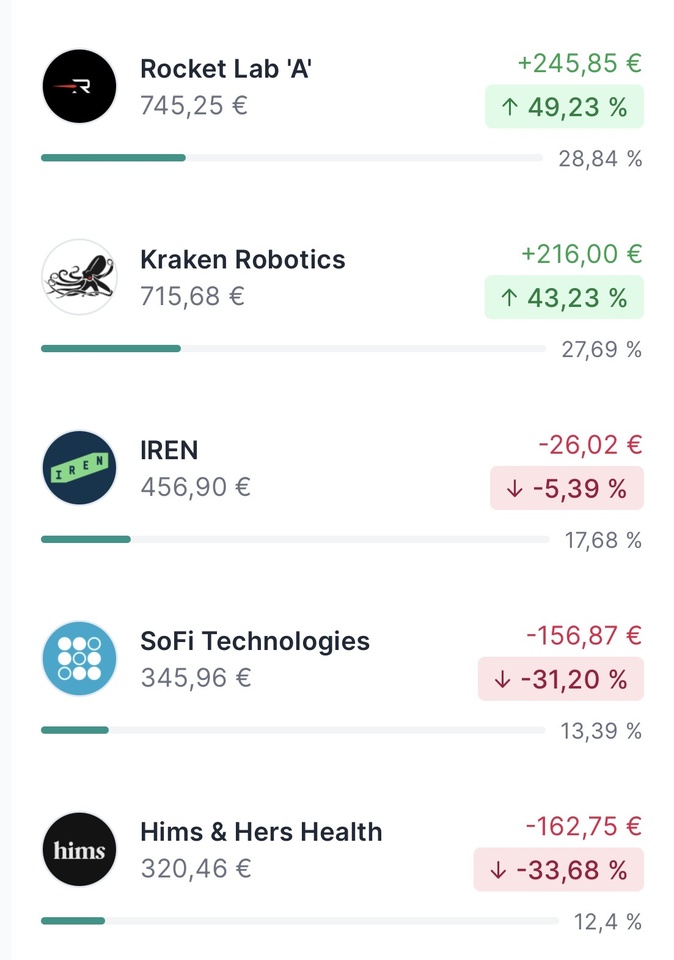

Below are the five stocks selected by you for the project and their performance to date since 12.11.2025:

- Rocket Lab +49% 📈 $RKLB (-0,43 %)

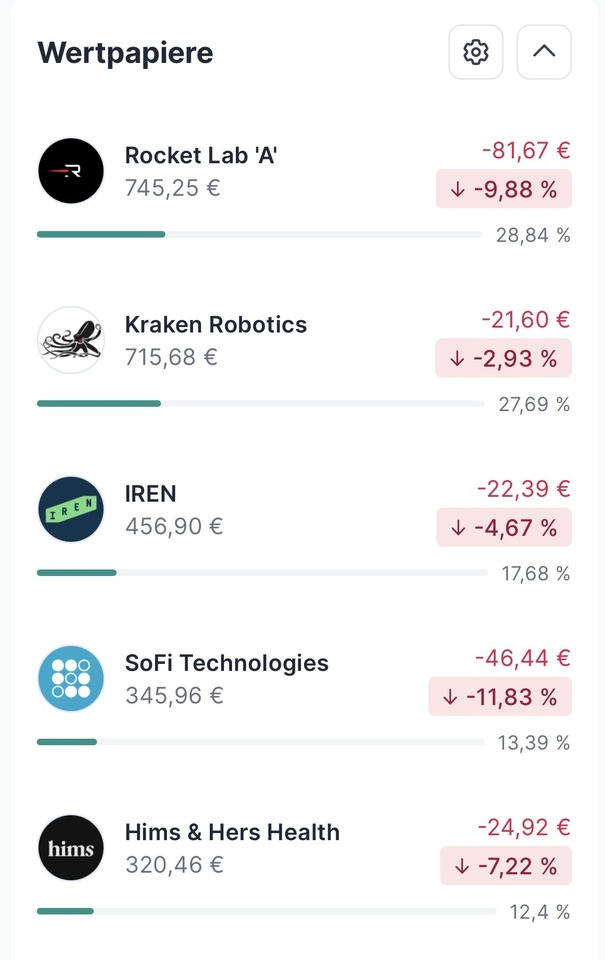

- Since last week: -10% 📉

- Kraken Robotics +43% 📈 $PNG (-0,05 %)

- Since last week: -3% 📉

- Iris Energy -5% 📉 $IREN (-0,13 %)

- Since last week: -5% 📉

- SoFi Technologies -31% 📉 $SOFI (+0,58 %)

- Since last week: -12% 📉

- Hims & Hers -34% 📉 $HIMS (-0,14 %)

- Since last week: -7% 📉

Since start:

Last 7 days:

Unfortunately, none of the stocks were able to end the week on a positive note. Even the not-so-bad quarterly figures from $SOFI (+0,58 %) could not counteract this (see SoFi Quartalszahlen by Klein-Anleger)

_________________________

The beta value is: 2.57 (last week: 2.25)

The beta value (β) of a share measures its performance

Marktvolatilität compared to the overall market: a beta of 1 means the share moves in sync with the market; a beta > 1 means it fluctuates more (e.g. at 1.5 it rises or falls by 1.5 % if the market rises/falls by 1 %); a beta < 1 shows less fluctuation, while a beta < 0 indicates an opposite movement to the market. It helps investors to assess the systematic risk (market risk) of a share.

_________________________

Due to the sometimes high volatility, the stocks are represented as follows

Rocket Lab: 29% (-1% since last week)

Kraken Robotics: 28% (+1% since last week)

Iris Energy: 18% (+1% since last week)

SoFi Technologies: 13% (-1% since last week)

Hims & Hers: 12% (-1% since last week)

_________________________

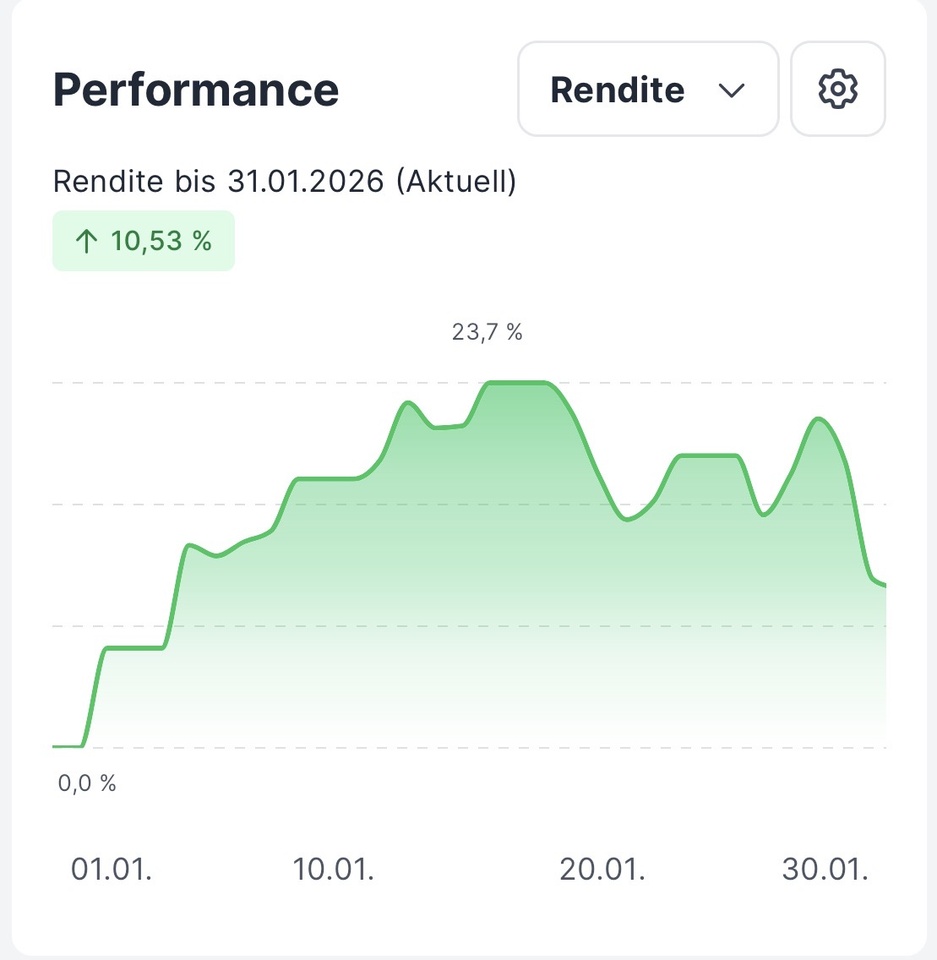

Yield:

Since the start of the project:

The return on the portfolio is currently positive and is at +4,7% 📈, at the last update it was still at +12,6%📈.

The yield reached its lowest point on 21.11. at -17,7% 📉, the high on 16.01. with +23,7% 📈.

Since the beginning of the year:

+10,5% 📈

_________________________

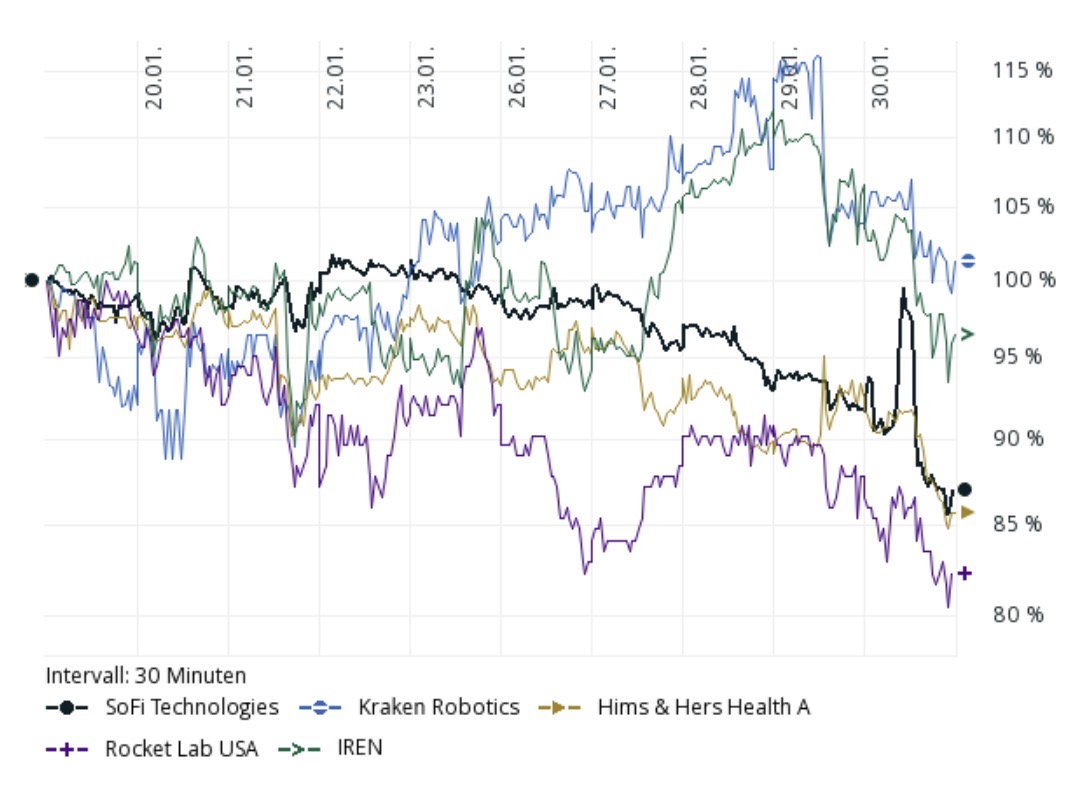

Below is the trend over the last ten days:

As always, I look forward to your thoughts! Have a nice weekend :)