Another stupid question, but perhaps a valid one for a beginner.

Many people swear by one of the ETFs listed below. My largest position so far is the $IWDA (-0,93 %) because it has felt pretty good to me so far.

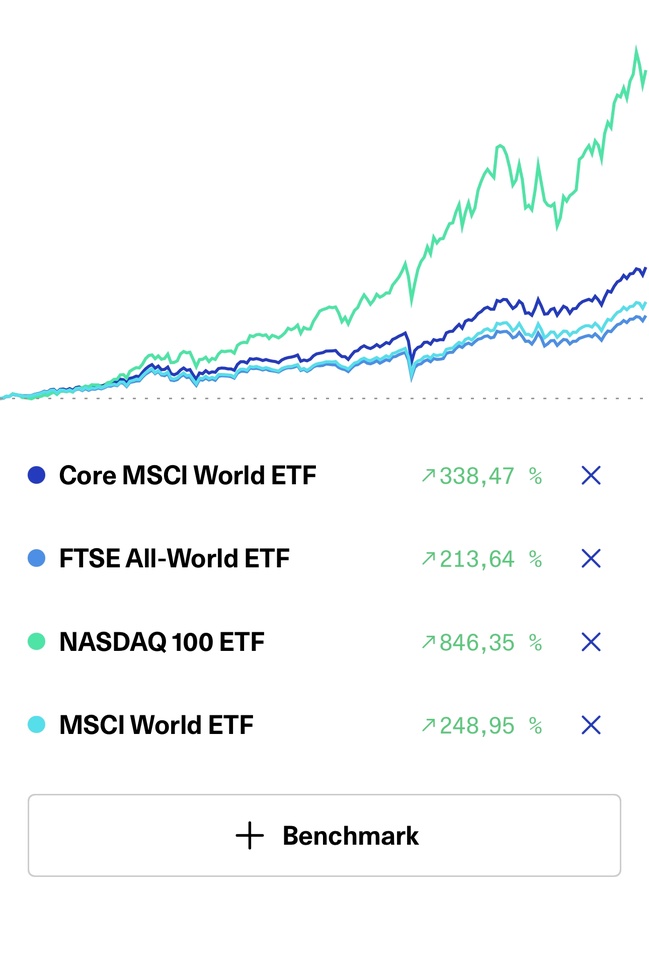

Now the question: Why not put everything into the $CSNDX (-1,12 %) ?

Obviously there are clear differences in the returns of the various ETFs. Why do some people swear by the "worse" ones in comparison?

And how do I find out which one is best for me?

I just want to build up assets in the long term and thus improve my pension, for example.

Possibly 2-3 more positions for buying a house or just a nest egg.

Thank you in advance! ✌🏼

PS: This is now my third post here and I think the feedback and your help here is just great!