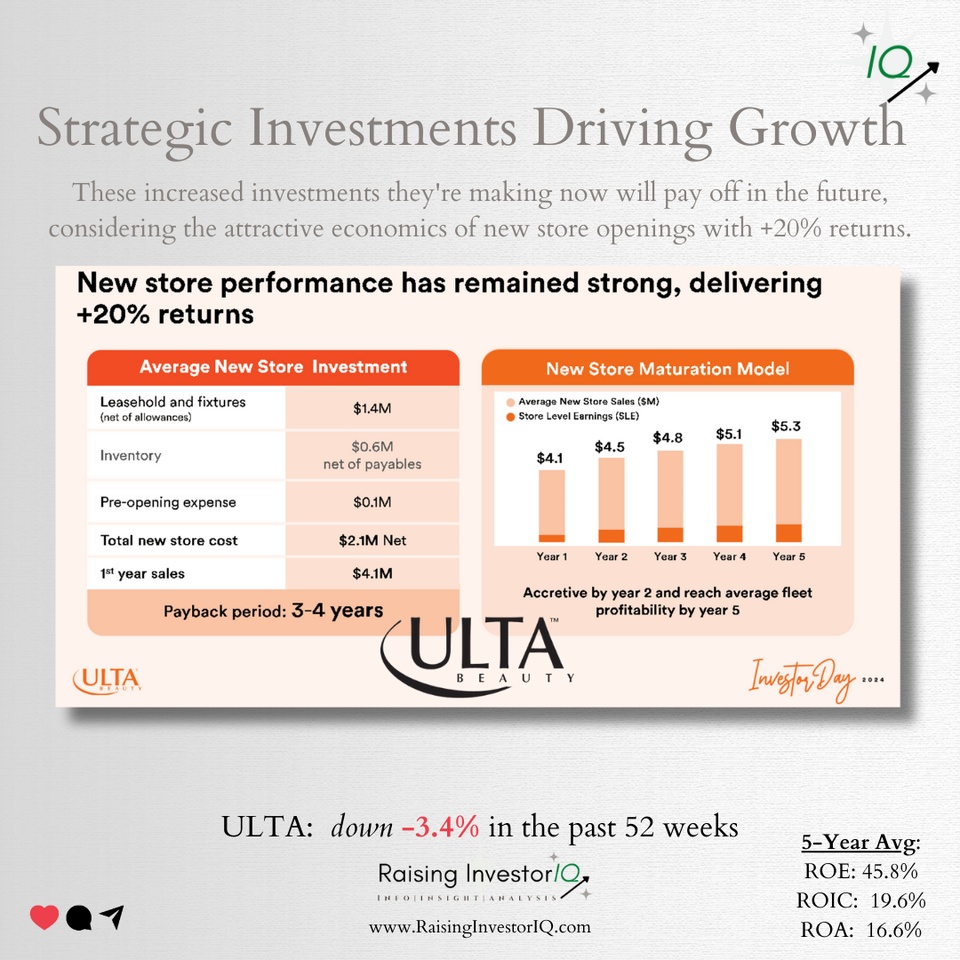

After a period of increased investment in its digital infrastructure, ULTA is back to focusing on expanding its physical store presence, increasing their stores investments as a percentage of total capital expenditures from 55% in 2022 and 2023 to 70% long-term.

Ulta Beauty Action Forum

ActionActionDiscussion sur ULTA

Postes

27$ULTA (-1,32 %) has been one of our favorite holdings.

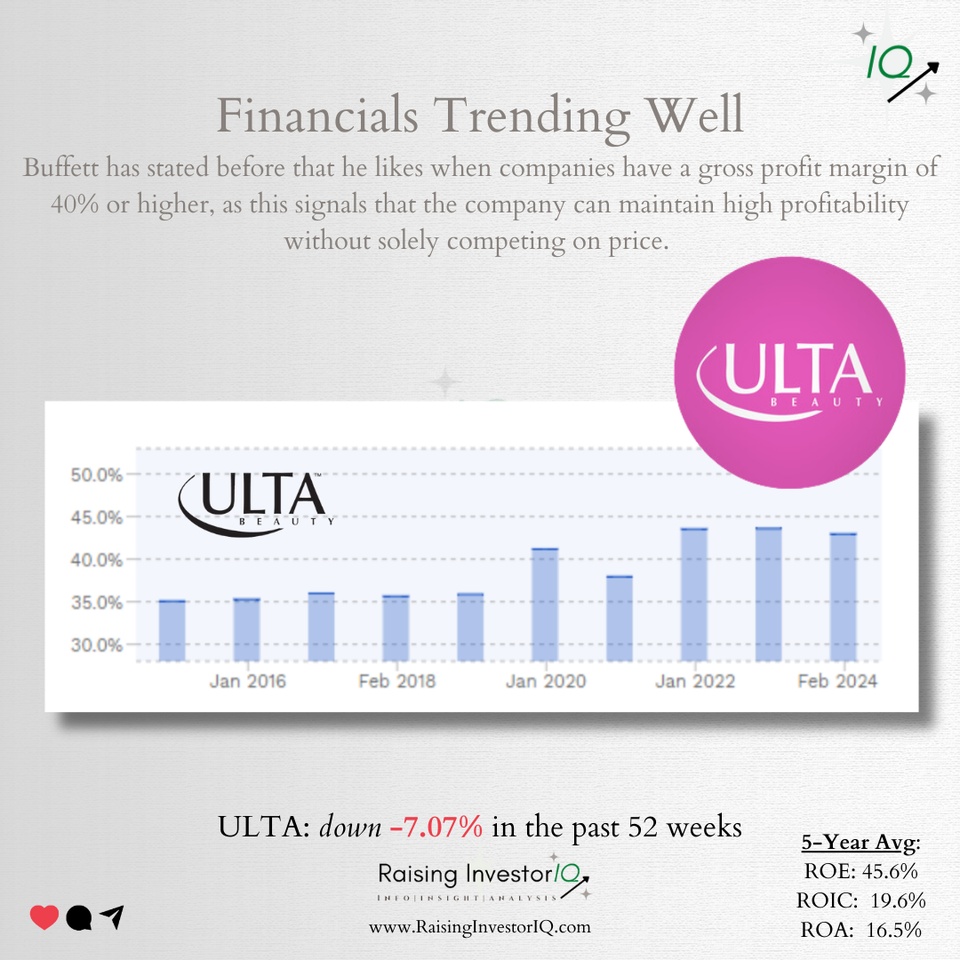

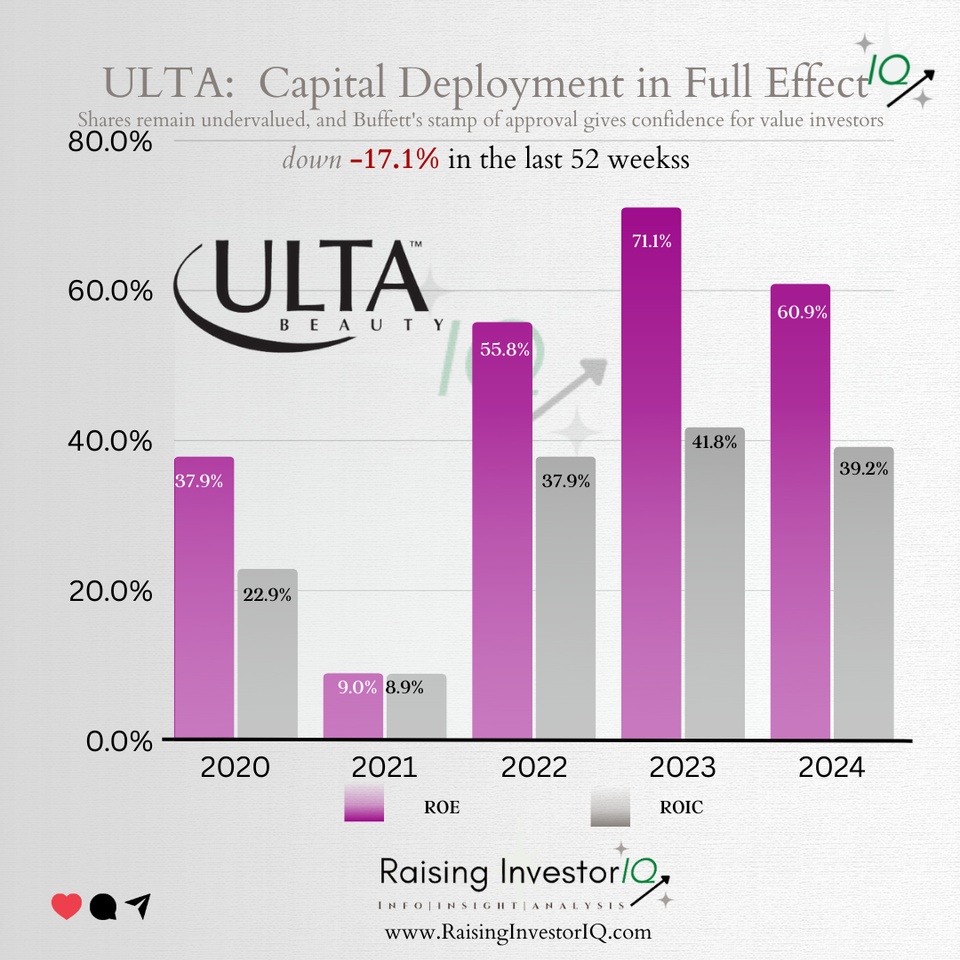

Take a look at its historical ROE. For the trailing 12 months, this figure comes out to 55%, and the five-year average is 46.9%. Generally, an ROE over 20% is considered to be very high in that industry.

The company has also achieved this high level of ROE without the use of much debt.

Looking for a recommendation for a good and inexpensive stock screener

Hello everyone,

I am looking for a good and preferably inexpensive stock screener that can help me make better investment decisions. It would be important to me that it has a user-friendly interface and covers current figures as well as all possible indicators, oscillators and technical criteria.

So far I have used the following online tools:

- SimplyWallstreet - I would possibly take out a premium subscription here, but I don't think the 20$/month is exactly cheap

- DER AKTIONÄR - (very clear and good for a quick look at charts + 200 and 50 sma. However, the site often bends and does not open the charts. (maybe due to the Safari browser used?)

- TradingView - actually great for charts + indicators. However, I sometimes find it difficult to impossible to adjust the chart, zoom or whatever I do wrong to get a clear picture.

- Stock finder - I know it exists and have already used it for a few free stocks but can't say more yet.

I realize that there are many paid tools, but maybe there is something in the free or low-cost range that offers a solid performance? Or where a premium subscription really pays off? What do you personally use and what experiences have you had with it?

Thanks for your recommendations!

Best regards

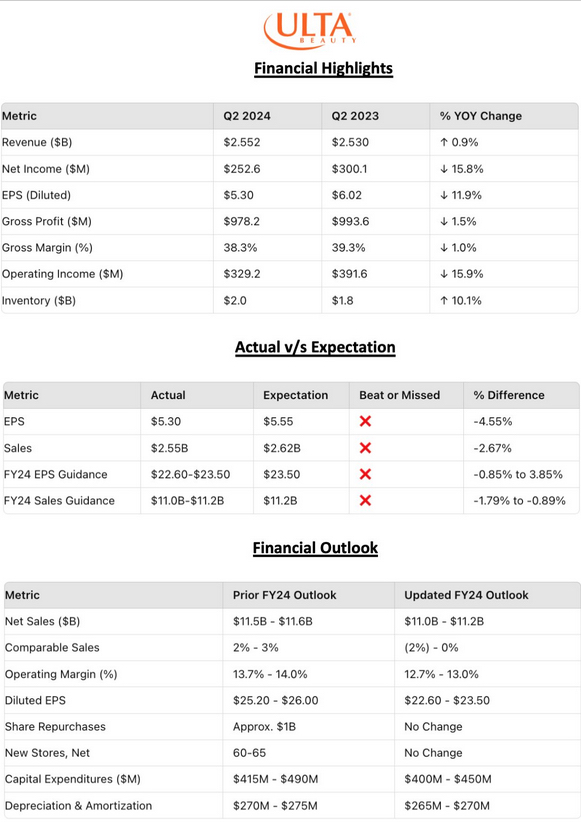

$ULTA (-1,32 %) - Highlights Q2 Earnings:

- EPS: 5.30 $ (estimated 5.51 $)

- Sales: 2.55 billion $ (estimated 2.62 billion $)

Fiscal year guidance:

- Earnings per share: $22.60-23.50 (estimate: $25.26)

- Sales: $11.0 billion to $11.2 billion. (Estimate: 11.495 billion US dollars)

Key figures and performance:

- Net sales growth Q2 2024: +0.9% YoY

- Comparable sales growth Q2 2024: -1.2% YoY

- Gross margin: 38.3% (decrease of 100 basis points compared to the previous year)

- Operating result: USD 329.2 million (decrease from USD 391.6 million year-on-year)

- Net income: USD 252.6 million (down from USD 300.1 million in the previous year)

- Selling and administrative expenses: USD 644.8 million (increase compared to USD 600.7 million in the previous year)

- Inventory: USD 2.0 billion (increase of 10.1% compared to the previous year)

Operating highlights:

- New store openings: 17 in Q2; 29 for the full year

- Share buybacks: 549,852 shares for USD 212.3 million in Q2

- Total number of stores: 1,411

Comment from CEO Dave Kimbell:

- "Our second quarter performance was not in line with expectations due to a decline in comparable store sales. We are taking steps to counteract these trends and continue to focus on increasing sales and customer traffic."

Buffett's Stamp of Approval

$ULTA (-1,32 %) one or our favorite positions that we've held and endorsed since 2018 now with Buffett's Stamp of Approval.

Aanyone else bullish on the long-term value of this recently beaten down stock🤔?

Two new positions with first tranches opened this week in $ULTA (-1,32 %) and $DG (-0,02 %)

Why ULTA? Cosmetics and hygiene products are always bought, Ulta has absolute supremacy in North America and very loyal customers. Sephora is catching up, but is still behind Ulta. I also think the business is currently valued very favorably.

Why Vinci? I want to have a little more energy & infrastructure in my portfolio and Vinci really convinced me. Well diversified across various sectors, highly regarded by employees and positioned worldwide. The largest revenue driver is in construction with €31 billion, followed by energy with €19 billion, highways with €6 billion and airports with €4 billion.

Long-term investment horizon.

If you have any other exciting companies in the Vinci sector, please feel free to comment.

BREAKING : $ULTA (-1,32 %) - Ulta Beauty stock is up 12.7% in after-hours trading as "Buffett" opened a position of 690,000 shares in it.

The position represents 0.10% of Berkshire Hathaway's total equity portfolio $BRK.B (+1,54 %) 😂.

Crazy market ! 🤭

However, I find it funny that the price jumps so much because of a 0.10% position 😂.

You can turn positive again that quickly ☺️✌️

Titres populaires

Meilleurs créateurs cette semaine