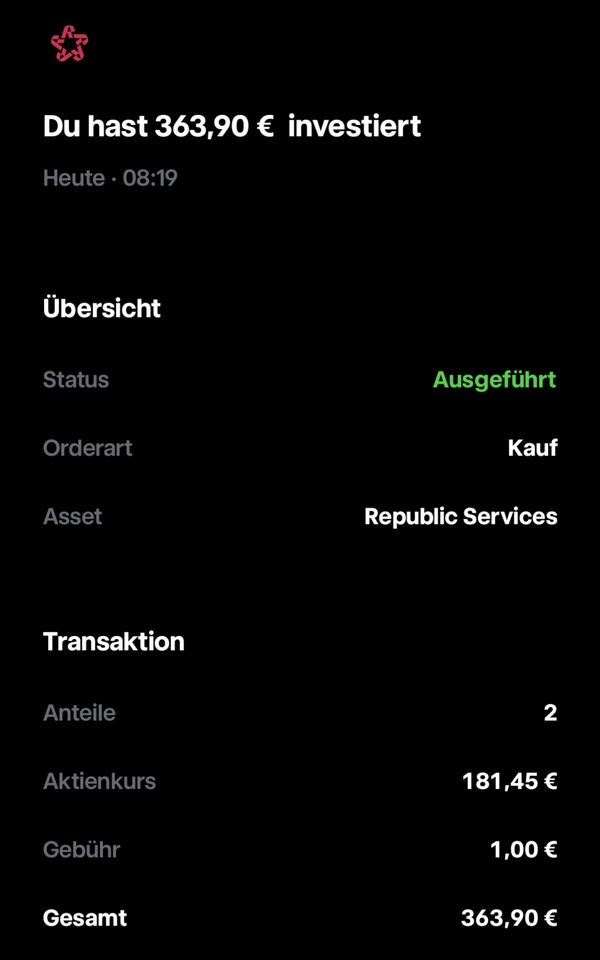

Republic services Q3 2024 $RSG (+2,48 %)

Financial performance:

Republic Services reported strong financial performance in the third quarter of 2024, with total revenue growing 6.5% compared to the same period in 2023, reaching $4,076.2 million. Net income for the quarter was $565.7 million, or $1.80 per diluted share, compared to $480.2 million, or $1.52 per diluted share, in the third quarter of 2023. Adjusted net income was $568.3 million, or $1.81 per diluted share, an increase from $488.3 million, or $1.54 per diluted share, a year ago.

Balance Sheet Analysis:

As of September 30, 2024, Republic Services had total assets of $31,814.2 million, an increase from $31,410.1 million at the end of 2023. Current assets decreased slightly to $2,348.4 million from $2,381.0 million. Total liabilities increased to USD 20,585.4 million from USD 20,866.6 million. Shareholders' equity increased to USD 11,230.2 million from USD 10,543.5 million.

Income statement:

Revenue for the nine months ended September 30, 2024 was USD 11,986.0 million, compared to USD 11,132.9 million for the same period in 2023, and the company achieved 210 basis points of Adjusted EBITDA margin expansion. Selling, general and administrative expenses amounted to USD 406.0 million for the quarter, representing 10.0% of revenue and a slight decrease from 10.5% in the prior year.

Cash Flow Analysis:

Cash flow from operating activities for the nine months ended September 30, 2024 was USD 2,914.0 million, compared to USD 2,719.3 million in 2023. Adjusted free cash flow decreased to USD 1,736.5 million, compared to USD 1,827.4 million in the prior year. The company invested USD 1,357.4 million in property, plant and equipment during the reporting period.

Key figures and profitability:

The company's net profit margin expanded by 130 basis points. The adjusted EBITDA margin increased by 210 basis points. Days sales outstanding improved slightly to 41.2 days from 42.0 days.

Segment analysis:

The Collection segment, which includes residential, small container and large container services, contributed 67.3% of total revenue for the quarter. The Environmental Services segment showed significant growth, with net sales increasing to USD 464.7 million compared to USD 404.8 million in the previous year.

Competitive Analysis:

Republic Services continues to focus on strategic pricing and cost management to remain competitive. The company's commitment to sustainability and circular initiatives positions it well in the environmental services industry.

Forecasts and management commentary:

Management emphasized the execution of strategic priorities, including pricing ahead of cost inflation and effective cost management, as key performance drivers. The company expects to continue to benefit from these strategies in future periods.

Risks and opportunities:

Significant risks include economic conditions, interest rate changes and integration challenges from acquisitions. Opportunities lie in the expansion of sustainability initiatives and the optimization of operating processes.

Summary and strategic implications:

Republic Services showed a robust financial performance with significant sales growth and margin expansion. The company's strategic focus on pricing and cost management as well as sustainability initiatives supports long-term growth potential. The balance sheet remains strong, with increasing equity and manageable debt. The company is well positioned to capitalize on market opportunities while managing potential risks.

Positive statements:

Revenue growth: Republic Services reported a 6.5% increase in total revenue in the third quarter of 2024 compared to the same period in 2023, indicating strong company performance.

Increase in net profit: The company reported net income of $565.7 million for the quarter, compared to $480.2 million in the prior year, reflecting improved profitability.

EBITDA margin expansion: Adjusted EBITDA margin expanded 210 basis points, reflecting effective cost management and operational efficiencies.

Strong operating cash flow: Cash flow from operating activities increased to USD 2,914.0 million for the nine months ended September 30, 2024, highlighting robust cash generation.

Strategic focus on sustainability: The company's commitment to sustainability and circular initiatives positions it well in the environmental industry and is in line with market trends.

Negative statements:

Decline in free cash flow: Adjusted free cash flow decreased to USD 1,736.5 million from USD 1,827.4 million in the prior year, indicating a decrease in funds available for discretionary purposes.

Increased liabilities: Total liabilities increased slightly, which could affect the company's leverage and financial flexibility.

Increase in interest expenses: Interest expense increased to $405.8 million for the nine months ended September 30, 2024, compared to $378.8 million in 2023, potentially impacting net income.

Volume decline: The company experienced a 1.2% decrease in volume for the three months ended September 30, 2024, which could impact future revenue growth.

Integration risks: The company faces integration challenges in acquisitions, which could pose risks to the realization of expected benefits.