It was an honor for me (over 40% plus). Slowly but surely I am reducing tobacco from my portfolio as an individual position. I still have $MO (+1,67 %)

$BATS (+0,49 %) and $IMB (+0,14 %)

Philip Morris Action Forum

ActionActionDiscussion sur PM

Postes

72More information here.

The lawsuit will affect the global operating business of $PM (+1,85 %) and $BATS (+0,49 %) hardly or not at all.

- The settlement must be paid off by the Canadian Cigarette Subsidiaries.

- The SFB in Canada will not be affected.

- The cigarette business outside Canada will also not be affected.

The nice thing about this is that the Canadian cigarette business is already practically "worthless". So it has no impact on long term growth anyway.

BAT $BATS (+0,49 %) PM $PM (+1,85 %) and JT $2914 (+0,2 %) will have to pay a settlement of almost 24 billion US dollars in Canada.

I hope that all three will withdraw from the Canadian business.

The United Kingdom bans disposable vapes.

Deadline for suppliers is June 1, 2025.

France has also recently introduced a ban on disposable vapes, which will come into force on January 1, 2025.

Japan Tobacco $2914 (+0,2 %)

re-enters the South Korean HTU market.

The Group withdrew from South Korea in 2021. The market is now controlled by $PM (+1,85 %) and KT&G $033780 which have around 90% of the market share, with the remainder falling to $BATS (+0,49 %) . Now JT wants to re-enter the market with ploom x (which will most likely also be the platform for $MO (+1,67 %) in the USA) to re-enter the market.

This should be quite interesting as it will test brand loyalty. It is not yet clear whether loyalty to HTU products is as high as for cigarettes.

The FDA has seized 3 million illegal vapes worth about 76 million dollars.

I hope that many more seizures will follow.

Why $MO (+1,67 %) is now also rising is a mystery to me.

- No exposure to the stabilizing / slightly growing international cigarette market.

- No exposure to the growing international HTU market.

- No exposure to the growing international nicotine pouch market.

- No exposure to emerging markets.

So no exposure to what made the $PM (+1,85 %) made the numbers so good.

Philip Morris International $PM (+1,85 %)

Q3 Earnings 2024

Volume in billion

Total: 203 units +2.9%

HTU: 35.3 sticks +8.9%

Oral: 4.4 pouches +22.2%

Cigarettes: 163.2 sticks +1.2%

Volume Oral in Mln Cans

Nicotine pouches: 164.6 +43.6% (3 months) +55.8% (9 months)

Snus: 61.3 +1.6% +1.7%

Moist snuff: 34.1 +2.6% +0.1%

Sales Q3 in Mln

Total: 9900$ +8.4% reported +11.6% organic

SFB: 3800$ +14.2% +16.8%

Combustibles: 6100$ +5.2% +8.6%

Proportional

SFB: 38%

Combustibles: 62%

Gross Profit

Total: 6500$ +9.5% +13%

SFB: 2600$ +15.9% +20.2%

Combustibles: 3900& +5.7% +8.7%

Proportionate

SFB: 40%

Combustibles: 60%

Operating income

Total: 3700$ +8.4% + 13.8%

EPS

Reported: 1.97$ +49%

Adjusted: 1,91$ +14,4%

Adjusted ex currency: 1.97$ +18%

Total industry volume (HTU & cigarettes) shows an increase of 1.3% (3 months) 1.2% (9 months). The international market appears to be not only stabilizing but also growing slightly.

HTU

IQOS is now the second largest nicotine brand in the world and continues to expand its market share.

E-Vapor

Veev has sold around 1.3 billion sticks (1ml = 10 sticks) since the beginning of the year.

Oral

The supply problems seem to be easing and sales are normalizing. Outside the USA, the volume has even increased by 70%. Zyn is now active in 30 markets.

Combustibles

Marlboro has the highest market share since the spin-off in 2008.

I am more than satisfied with the results. It's nice to see how profitable SFB is (70% gross profit margin). I am sure that Q4 will be similarly good.

PM now stands for Printing Money

Philip Morris International $PM (+1,85 %) will bring IQOS back to the USA this weekend.

Several events will be held in Austin Texas to connect with consumers. More information regarding the US launch is expected to be available in the Q3 Report on October 22nd.

BAT $BATS (+0,49 %) PM $PM (+1,85 %) and JT $2914 (+0,2 %) will have to pay a settlement of almost 24 billion US dollars in Canada.

I hope that all three will withdraw from the Canadian business.

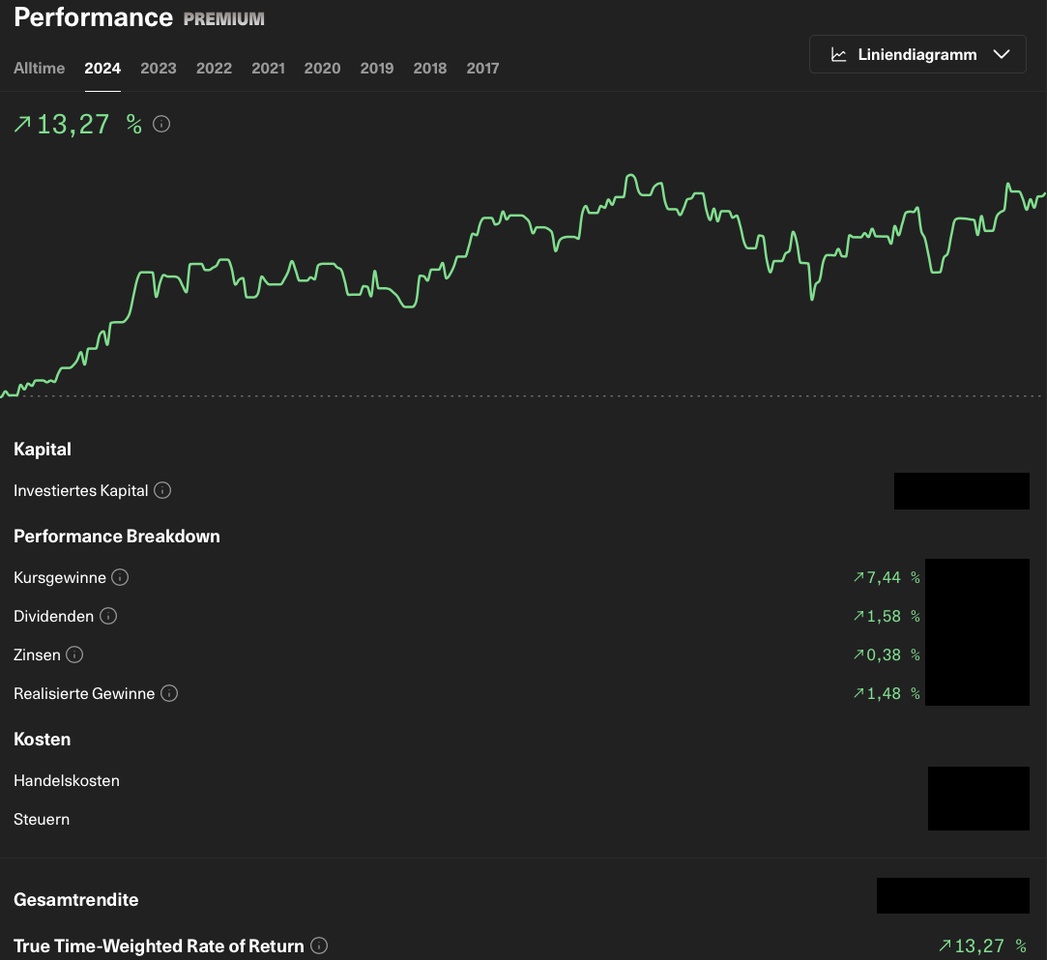

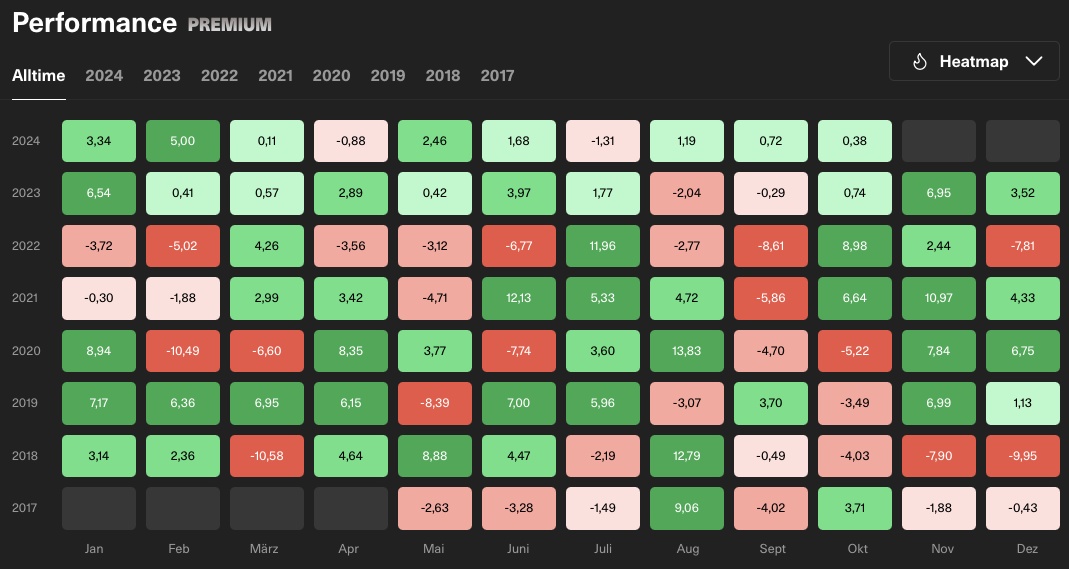

Interim conclusion: my YTD performance in 2024

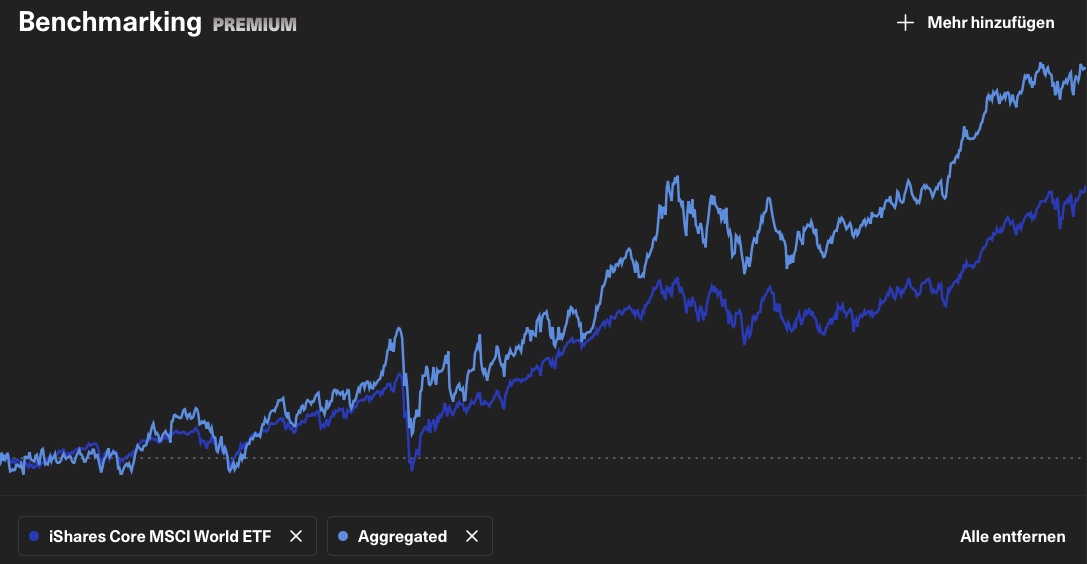

The third quarter of 2024 ended just over a week ago and the fourth and final quarter of the year has begun. Time to draw an interim conclusion on the performance of my portfolio. The aim of my portfolio is - as every year - to beat the MSCI World benchmark. However, I am also aware that it will not work every year and that the overall performance should rather be compared over a period of 3-5 years. Nevertheless, it is a way for me to analyze how my portfolio is performing compared to the benchmark.

The MSCI World, measured in euros on the ETF $IWDA (+0,72 %)has so far had a YTD performance of +19.24% so far. My portfolio is at +13.27%. So far this year I have underperformed the MSCI World underperformed.

The overall picture since June 2017 looks better:

With a TTWROR performance of +177.47%, I am well ahead of the MSCI World with +121.17%. That is an average outperformance of +3.68% per year since June 2017.

An important note at this point: I do not adapt my strategy to current circumstances, but invest in high-quality companies - regardless of whether AI stocks are performing or whether oil stocks are the hot shit on the market. In this respect, phases of underperformance are normal and predictable.

UNDERPERFORMER

Time to take a look at the YTD underperformers.

Dino Polska $DNP (+7,02 %)

-14.5%

As I have only been invested here since March 2024, I have chosen the total return since purchase as performance. I expect a significantly better performance here in the long term. The position will be held and not increased or sold.

ASML $ASML (-0,38 %)

-6.6%

Also a fairly new position. In July 2024 I started to build up a larger position in several tranches. I expect a significantly better performance here in the longer term.

Alphabet $GOOGL (-0,6 %)

+3.8%

This is also a position that I only built up in August 2024. The plan is to continue to build up the position at this valuation level using a savings plan.

OUTPERFORMER

If you have a number of underperformers in your portfolio, there should ideally also be a few outperformers. My top 3 YTD outperformers are:

KLA Corp $KLAC (+1,4 %)

+38.3%

I established this position in April 2023 at a price of €336.80 per share. I have not bought or sold since then.

Costco $COST (+3,88 %)

+35.43%

I have been a shareholder in this outstanding company since September 2022. Since then, the position has been increased several times through acquisitions - most recently in May 2023 at a price of €455.45 per share.

Philip Morris $PM (+1,85 %)

+27.9%

This year has so far been a very good year for the "Big Tobacco" stocks. So I am not only pleased about the performance of $PM (+1,85 %) but also about $BATS (+0,49 %)which I also have in my portfolio. I invest continuously in both via a savings plan and enjoy regular dividends.

CONCLUSION

My top 3 underperformers are all stocks that I only bought this year and will hopefully perform better over time. The top 3 outperformers are all stocks that I have had in my portfolio for a long time and have performed very well overall since then. One "honorable mention" is also deserved $CMG (+1,99 %)which, with a YTD performance of +25.9%, just failed to make it into the top 3.

How are things looking for you this year?

Stay tuned,

Yours Nico Uhlig

Titres populaires

Meilleurs créateurs cette semaine