$LLY (+5,07 %) | Eli Lilly Q3'24 Earnings Highlights:

🔹 Revenue: $11.44B (Est. $12.18B) 🔴; UP +20% YoY

🔹 Adjusted EPS: $1.18 (Est. $1.45) 🔴; UP from $0.10 YoY

Segment and Product Revenue:

🔹 Mounjaro: $3.11B (Est. $3.62B) 🔴; UP +121% YoY

🔹 Trulicity: $1.30B (Est. $1.21B) 🟢; DOWN -22% YoY

🔹 Zepbound: $1.26B (Est. $1.63B) 🔴; UP +1.2% QoQ

🔹 Verzenio: $1.37B (Est. $1.39B) 🔴; UP +32% YoY

🔹 Taltz: $879.6M (Est. $839.4M) 🟢; UP +18% YoY

🔹 Jardiance: $686.4M (Est. $823.7M) 🔴; DOWN -2.1% YoY

🔹 Humalog: $534.6M (Est. $423.6M) 🟢; UP +35% YoY

Geographic Performance:

🔹 U.S. Revenue: $7.81B; UP +46% YoY (driven by Mounjaro and Zepbound)

🔹 International Revenue: $3.63B; DOWN -12% YoY (excluding divestitures, UP +33% YoY)

Operational Highlights:

🔹 Gross Margin: 81% of revenue; UP 0.6 percentage points YoY

🔹 R&D Expenses: $2.73B; UP +13% YoY

🔹 Marketing & Administrative Expenses: $2.10B; UP +16% YoY

FY24 Guidance:

🔹 Revenue: $45.4B-$46.0B (Prior: $45.4B-$46.6B) 🔴

🔹 Reported EPS: $12.05-$12.55 (Prior: $15.10-$15.60) 🔴

🔹 Non-GAAP EPS: $13.02-$13.52 (Prior: $16.10-$16.60) 🔴

Product and Pipeline Developments:

🔸 FDA Approval: Ebglyss (atopic dermatitis)

🔸 Japan Approval: Kisunla (early Alzheimer's)

Positive Phase 3 Results:

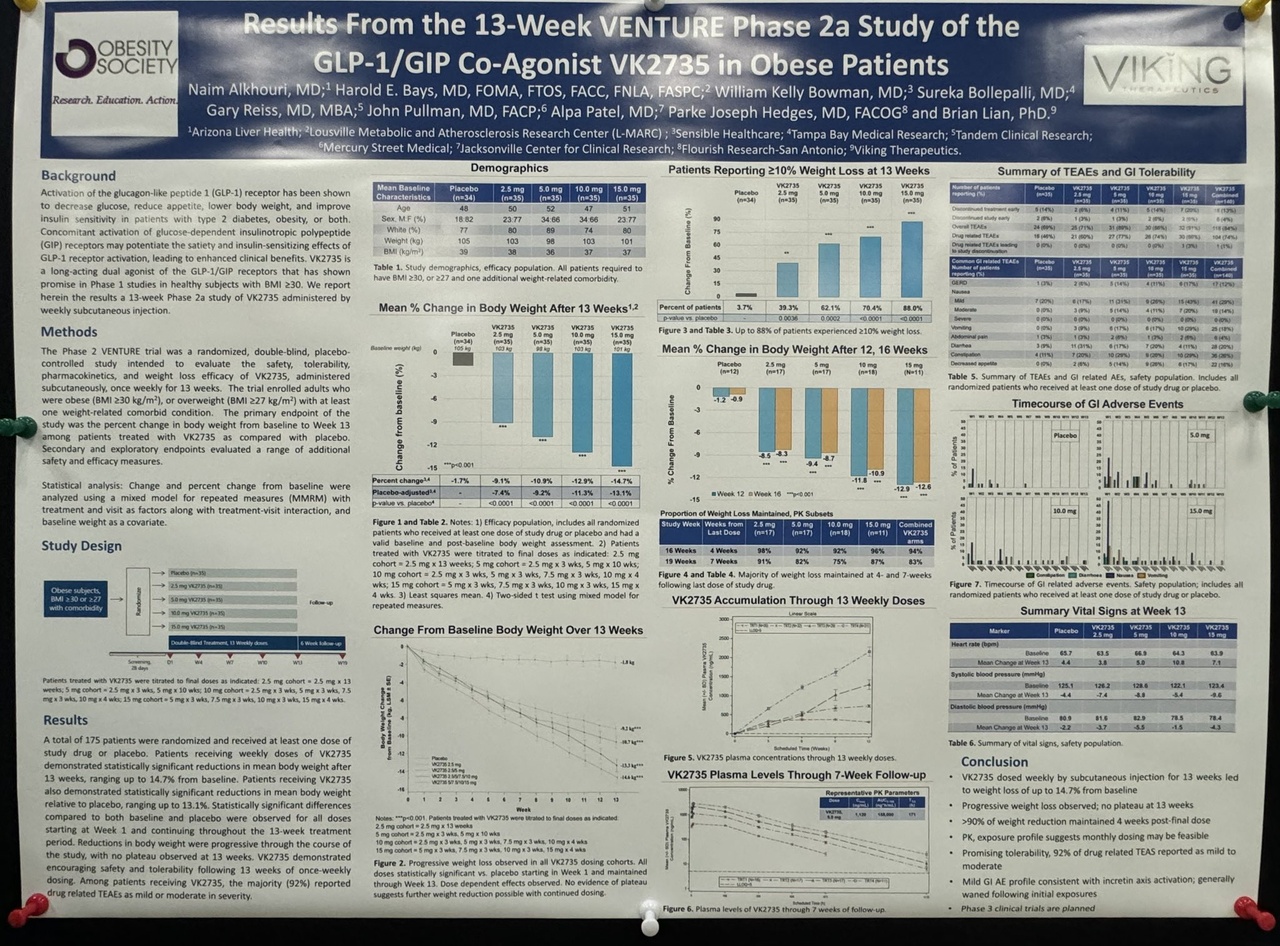

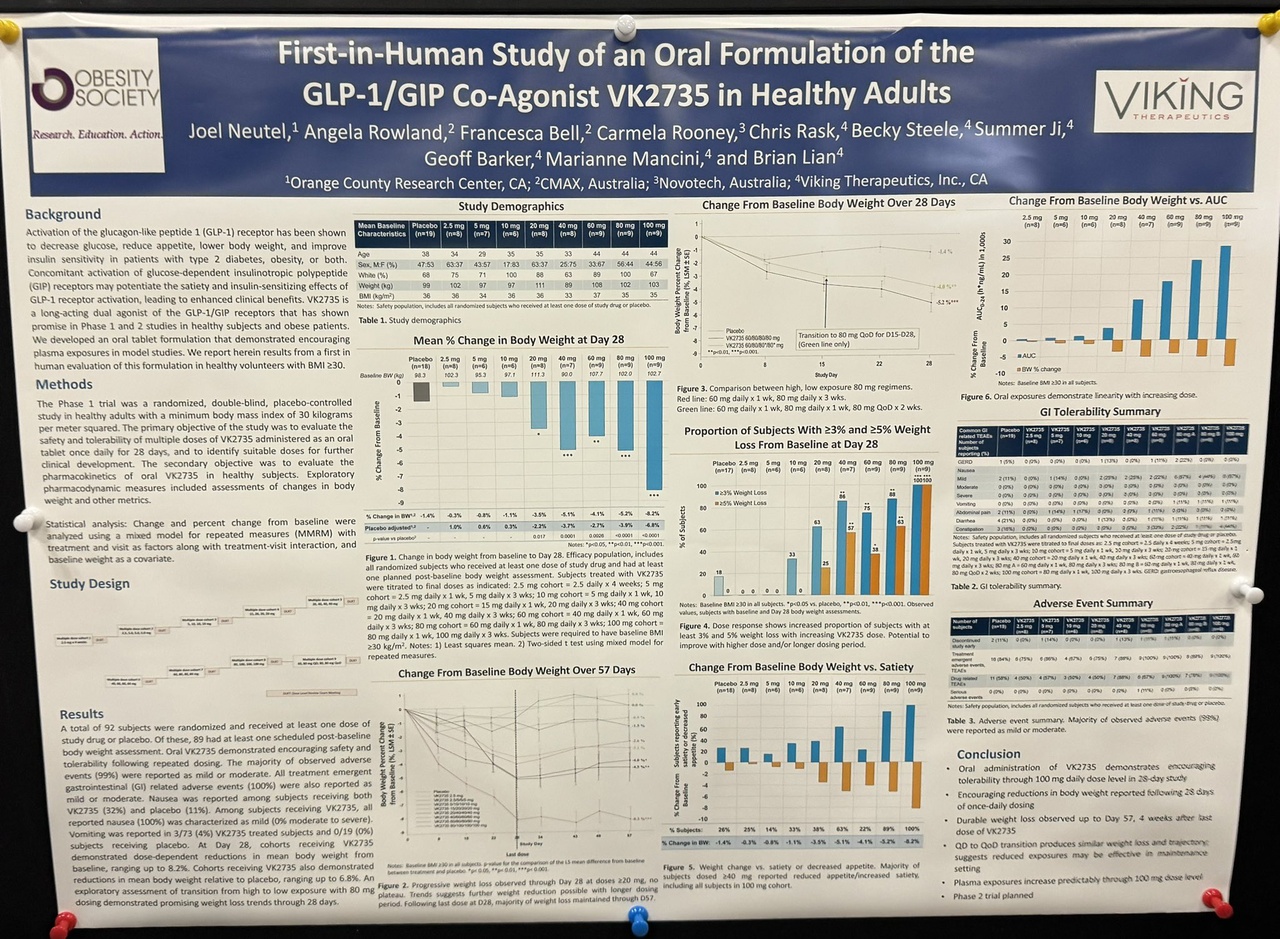

🔸 Tirzepatide (Mounjaro/Zepbound): 94% reduced risk of type 2 diabetes in pre-diabetic adults

🔸 TRAILBLAZER-ALZ 6 study: Reduced incidence of ARIA-E with modified dosing

🔸 Key Investments: $1.8B expansion in Ireland; $4.5B for Indiana Medicine Foundry

CEO David A. Ricks' Commentary:

🔸 "While Mounjaro and Zepbound showed robust growth, we are equally pleased with the 17% growth in non-incretin products. Lilly’s recent approvals and expanded pipeline position us well for sustained future growth."

Initiatives and Developments:

🔸 Acquisition of Morphic Holding to enhance immunology pipeline

🔸 Launch of Zepbound single-dose vials in the U.S. via LillyDirect

🔸 New product launches and expanded manufacturing capabilities underway