Fortunately I waited here. I actually expected the NYSE to go up quite a bit here...

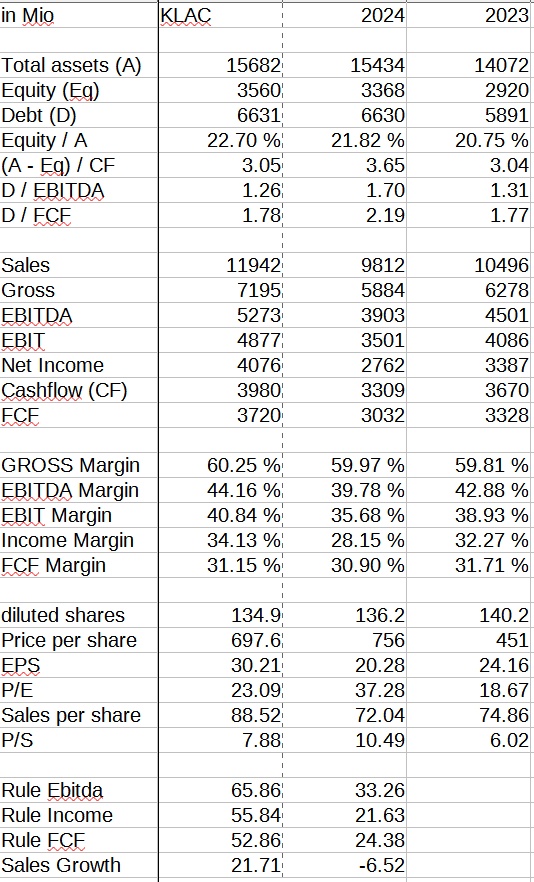

$KLAC (+1,4 %) at 22 P/E I will gladly take

Postes

34Fortunately I waited here. I actually expected the NYSE to go up quite a bit here...

$KLAC (+1,4 %) at 22 P/E I will gladly take

$KLAC (+1,4 %) fits perfectly into my prey scheme.

Share behaves unchanged on mega figures. Has been on my watchlist for a long time anyway.

Positive:

Negative:

What do you think about $KLAC (+1,4 %)

Valuation doesn't look too high for these numbers

The first column contains my expectations for FY 2025

This results in a forward P/E (9 months) of approx. 23

Aftermarket after quarterly figures

+21% Carvana $CVNA (+1,98 %)

+11% Twilio $TWLO (+1 %)

+9% Sprouts Farmers Market $SFM (+4,46 %)

+7% Booking $BKNG (+1,31 %)

+7% Paycom Software

+5% Allstate

+4% Transocean

+3% Clorox $CLX (+2,37 %)

+2% KLA $KLAC (+1,4 %)

+1% Starbucks $SBUX (+2,49 %)

+1% Omega Healthcare

+0% Microsoft $MSFT (+0,15 %)

-1% Amgen

-1% DoorDash $DASH (+1,74 %)

-1% AFLAC

-1% Public Storage

-2% Equinix

-3% Meta $META (+0,4 %)

-4% MicroStrategy $MSTR (+1,77 %)

-4% Coinbase $COIN (+8,63 %)

-6% MetLife

-6% MGM Resorts

-6% Riot Platforms $RIOT (+5,52 %)

-7% eBay $EBAY (+0,56 %)

-7% Ventas

-9% Robinhood Markets $HOOD (+5,61 %)

-10% Roku

-11% Monolithic Power Systems

-13% Aurora Innovation

$KLAC (+1,4 %)

| KLA Corporation Q1'25 Earnings Highlights:

🔹 EPS (Non-GAAP): $7.33 (Est. $7.04) 🟢

🔹 Revenue: $2.84B (Est. $2.75B) 🟢; UP +18.6% YoY

Q2'25 Guidance:

🔹 Revenue: $2.95B +/- $150M (Est. $2.85B) 🟢

🔹 Non-GAAP EPS: $7.75 +/- $0.60 (Est. $7.40) 🟢

🔹 Non-GAAP Gross Margin: 61.5% +/- 1.0%

Key Financial Metrics (Non-GAAP):

🔹 Net Income $988M (vs. $786M in Q1'24)

🔹 Free Cash Flow: $934.8M (Last 12 Months: $3.15B)

🔹 Operating Cash Flow: $995.2M (Last 12 Months: $3.42B)

🔹 Capital Returns: $765.5M this quarter (YTD: $2.64B)

Business Highlights:

🔸 Revenue Growth Drivers: Strong performance despite customer challenges, with sequential revenue growth expected through 2024 and into 2025.

🔸 Customer Investments: Focused on leading-edge AI and high-performance computing applications.

🔸 Operational Excellence: Disciplined execution and a robust product portfolio position KLA to capture semiconductor growth opportunities.

CEO Rick Wallace’s Commentary:

🔸 "KLA’s Q1 results reflect our continued outperformance and sequential revenue growth. We remain optimistic about semiconductor market growth in Q4 2024 and 2025, as KLA supports customer investments in advanced technologies."

The ASML share fell 20% after after poor quarterly figures and a lowered outlook. Major customers such as Samsung and Intel are buying fewer machines because they are postponing investments. Buy, hold or sell ASML? What do you think?

In the Podcast episode 61 "Buy High. Sell Low" we talked about ASML in detail. Link in the profile description.

$ASML (-0,38 %)

$INTC (+0,53 %)

$005930

$AMD (-0,12 %)

$NVDA (-0,03 %)

$2330

$AMAT (-0,37 %)

$MU (-0,29 %)

$KLAC (+1,4 %)

$LRCX (-0,8 %)

+ 1

A few years ago, I invested in $KLAC (+1,4 %) a few years ago 🤑 and have been waiting for a good opportunity to invest in $ASML (-0,38 %) to get in.

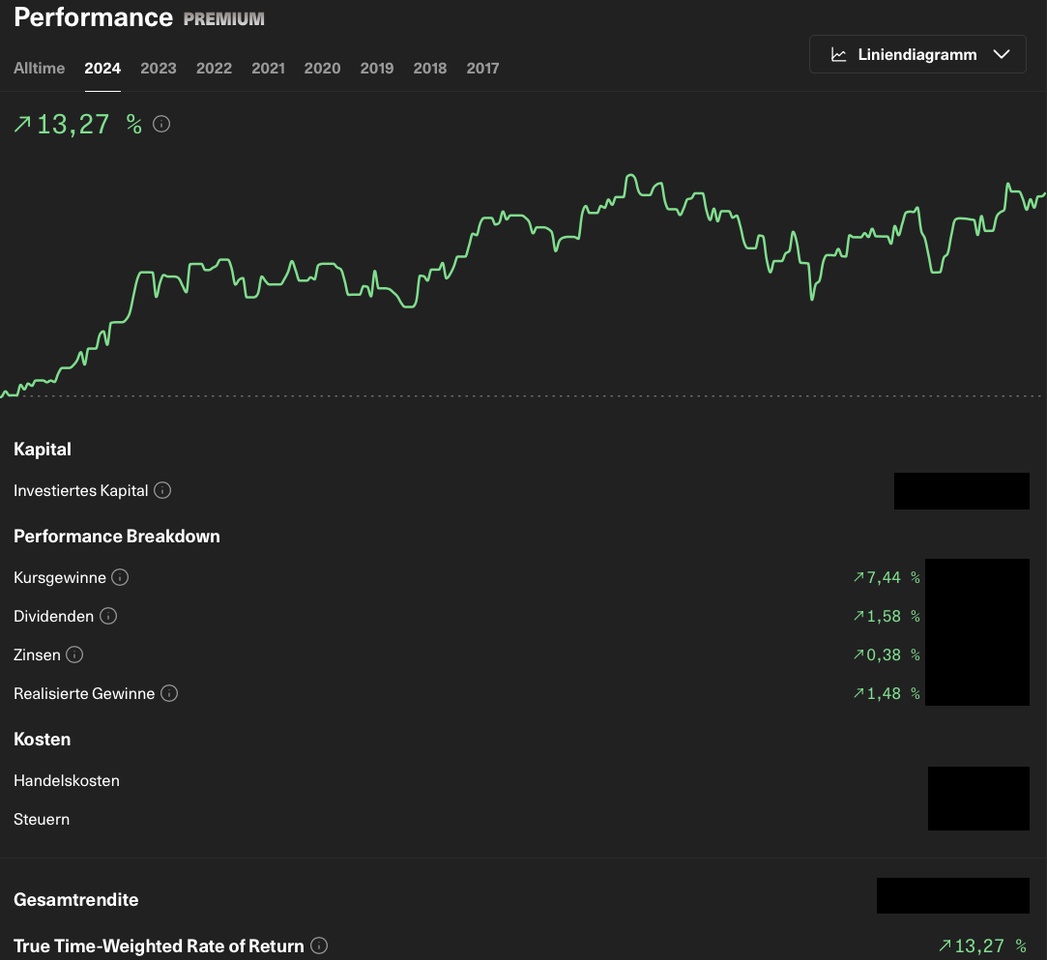

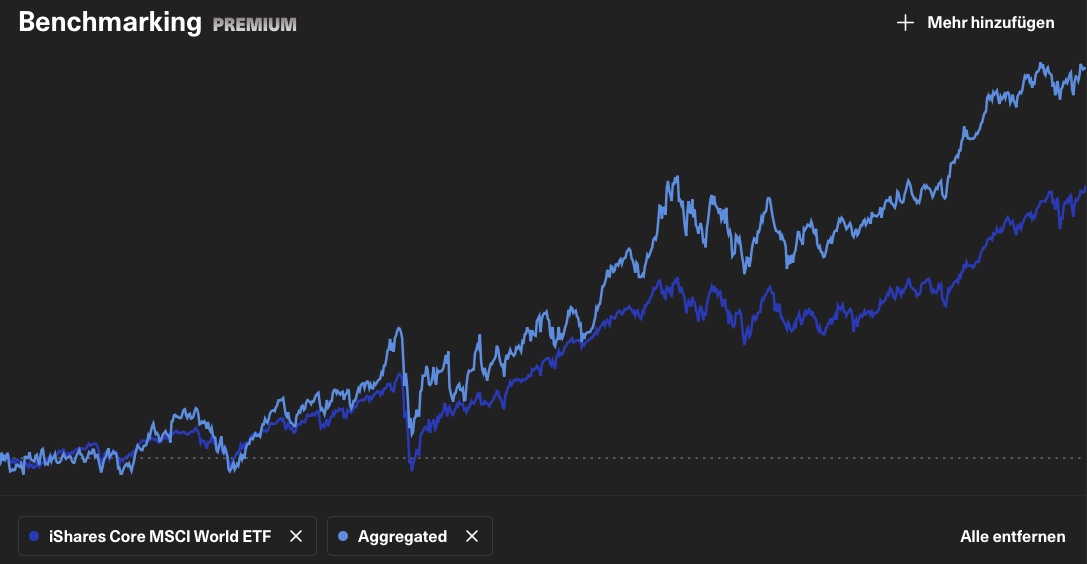

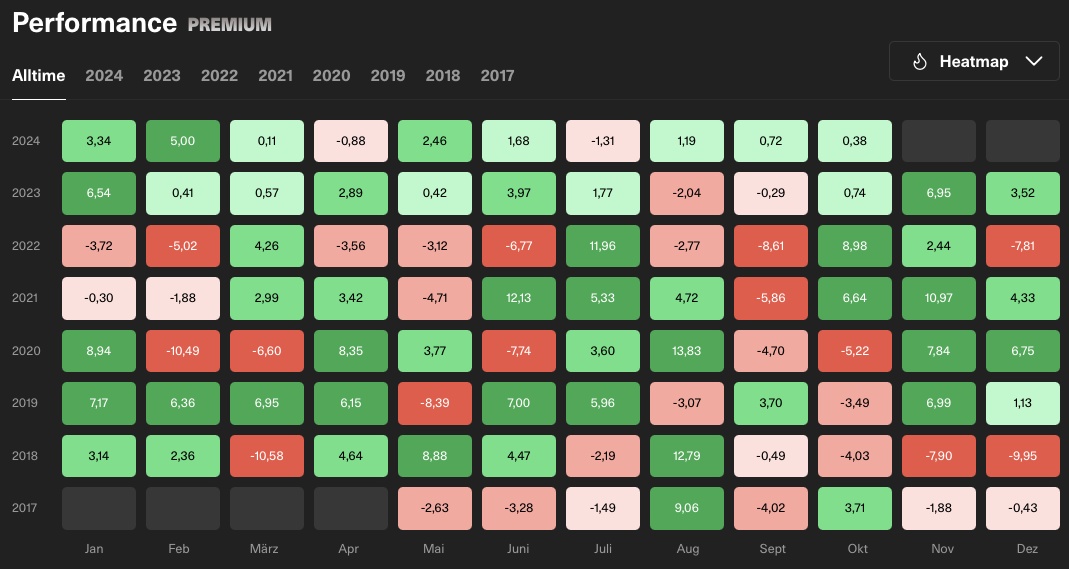

Interim conclusion: my YTD performance in 2024

The third quarter of 2024 ended just over a week ago and the fourth and final quarter of the year has begun. Time to draw an interim conclusion on the performance of my portfolio. The aim of my portfolio is - as every year - to beat the MSCI World benchmark. However, I am also aware that it will not work every year and that the overall performance should rather be compared over a period of 3-5 years. Nevertheless, it is a way for me to analyze how my portfolio is performing compared to the benchmark.

The MSCI World, measured in euros on the ETF $IWDA (+0,72 %)has so far had a YTD performance of +19.24% so far. My portfolio is at +13.27%. So far this year I have underperformed the MSCI World underperformed.

The overall picture since June 2017 looks better:

With a TTWROR performance of +177.47%, I am well ahead of the MSCI World with +121.17%. That is an average outperformance of +3.68% per year since June 2017.

An important note at this point: I do not adapt my strategy to current circumstances, but invest in high-quality companies - regardless of whether AI stocks are performing or whether oil stocks are the hot shit on the market. In this respect, phases of underperformance are normal and predictable.

UNDERPERFORMER

Time to take a look at the YTD underperformers.

Dino Polska $DNP (+7,02 %)

-14.5%

As I have only been invested here since March 2024, I have chosen the total return since purchase as performance. I expect a significantly better performance here in the long term. The position will be held and not increased or sold.

ASML $ASML (-0,38 %)

-6.6%

Also a fairly new position. In July 2024 I started to build up a larger position in several tranches. I expect a significantly better performance here in the longer term.

Alphabet $GOOGL (-0,6 %)

+3.8%

This is also a position that I only built up in August 2024. The plan is to continue to build up the position at this valuation level using a savings plan.

OUTPERFORMER

If you have a number of underperformers in your portfolio, there should ideally also be a few outperformers. My top 3 YTD outperformers are:

KLA Corp $KLAC (+1,4 %)

+38.3%

I established this position in April 2023 at a price of €336.80 per share. I have not bought or sold since then.

Costco $COST (+3,88 %)

+35.43%

I have been a shareholder in this outstanding company since September 2022. Since then, the position has been increased several times through acquisitions - most recently in May 2023 at a price of €455.45 per share.

Philip Morris $PM (+1,85 %)

+27.9%

This year has so far been a very good year for the "Big Tobacco" stocks. So I am not only pleased about the performance of $PM (+1,85 %) but also about $BATS (+0,49 %)which I also have in my portfolio. I invest continuously in both via a savings plan and enjoy regular dividends.

CONCLUSION

My top 3 underperformers are all stocks that I only bought this year and will hopefully perform better over time. The top 3 outperformers are all stocks that I have had in my portfolio for a long time and have performed very well overall since then. One "honorable mention" is also deserved $CMG (+1,99 %)which, with a YTD performance of +25.9%, just failed to make it into the top 3.

How are things looking for you this year?

Stay tuned,

Yours Nico Uhlig

Semiconductor shares since their 52-week highs

-61% Intel $INTC (+0,53 %)

-54% Aixtron $AIXA (-2,14 %)

-45% STMicroelectronics $STMPA (-1,72 %)

-44% Micron Technology $MU (-0,29 %)

-37% Globalfoundries $GFS (-2,07 %)

-36% BE Semiconductor $OXVE

-33% Lam Research $LRCX

-29% AMD $AMD (-0,12 %)

-29% Qualcomm $QCOM (-0,3 %)

-28% ON Semiconductor $ON (-1,56 %)

-27% ASML $ASML (-0,38 %)

-26% Applied Materials $AMAT (-0,37 %)

-26% Elmos Semiconductor $ELG (-0,47 %)

-24% Microchip Techn. $MCHP (-1 %)

-23% ARM $ARM (-1,08 %)

-23% Synopsys $SNPS (-2,03 %)

-23% Infineon $IFX (-0,83 %)

-22% NXP Semiconductors $NXPI (-0,46 %)

-20% Cadence Design $CDNS (+0,45 %)

-17% Nvidia $NVDA (-0,03 %)

-17% VanEck Semicon. ETF $IE00BMC38736 (+0,49 %)

-17% Nordic Semi $NRS

-17% KLA Corporation $KLAC (+1,4 %)

-13% Marvell Technology $MRVL (+0,81 %)

-12% TSMC $2330

-11% Broadcom $AVGO (+1,15 %)

-7% Texas Instruments $TXN (+2,43 %)

-6% Monolithic Power Syst. $MPWR (-1,03 %)

>> Which stocks are you invested in and how are they performing? Which of these stocks do you have on your watchlist? #semiconductor

#halbleiter

Meilleurs créateurs cette semaine