celsius holding Q3 2024 $CELH

Financial performance:

- Revenue: In Q3 2024, revenue amounted to approximately USD 265.7 million, a decrease of 31% compared to USD 384.8 million in Q3 2023. Revenue up to September 30, 2024 was USD 1.02 billion, an increase of 5% compared to the previous year.

- Net income: Net income in Q3 2024 fell by 92% to approximately USD 6.4 million compared to USD 83.9 million in the previous year.

- Adjusted EBITDA: Adjusted EBITDA in Q3 2024 decreased by 96% to approximately USD 4.4 million, compared to USD 103.6 million in the previous year.

Balance sheet overview:

- Cash on hand: The company had cash and cash equivalents of approximately USD 903.7 million as of September 30, 2024.

- Working capital: As at September 30, 2024, working capital was approximately USD 1.074 billion.

Income statement:

- Gross profit: Gross profit in Q3 2024 amounted to USD 122 million, a decrease of 37% compared to USD 194 million in the prior-year period. Gross margin decreased to 46 % of revenue, compared to 50.4 % in the previous year.

Cash flow overview:

- Operating activities: Cash flows from operating activities were approximately USD 187.2 million for the nine months ended September 30, 2024.

- Investing activities: Approximately USD 21 million was used in investing activities.

- Financing activities: Around USD 18.5 million was invested in financing activities.

Key figures and profitability metrics:

- Gross margin: In Q3 2024, the gross margin was 46%, compared to 50.4% in Q3 2023.

- Net profit margin: The net profit margin was approximately 2.4% in Q3 2024, compared to 21.8% in the previous year.

Segment information:

- North America revenue: In Q3 2024, revenue in North America amounted to approximately USD 247 million, a decrease of 33% compared to USD 371 million in the previous year.

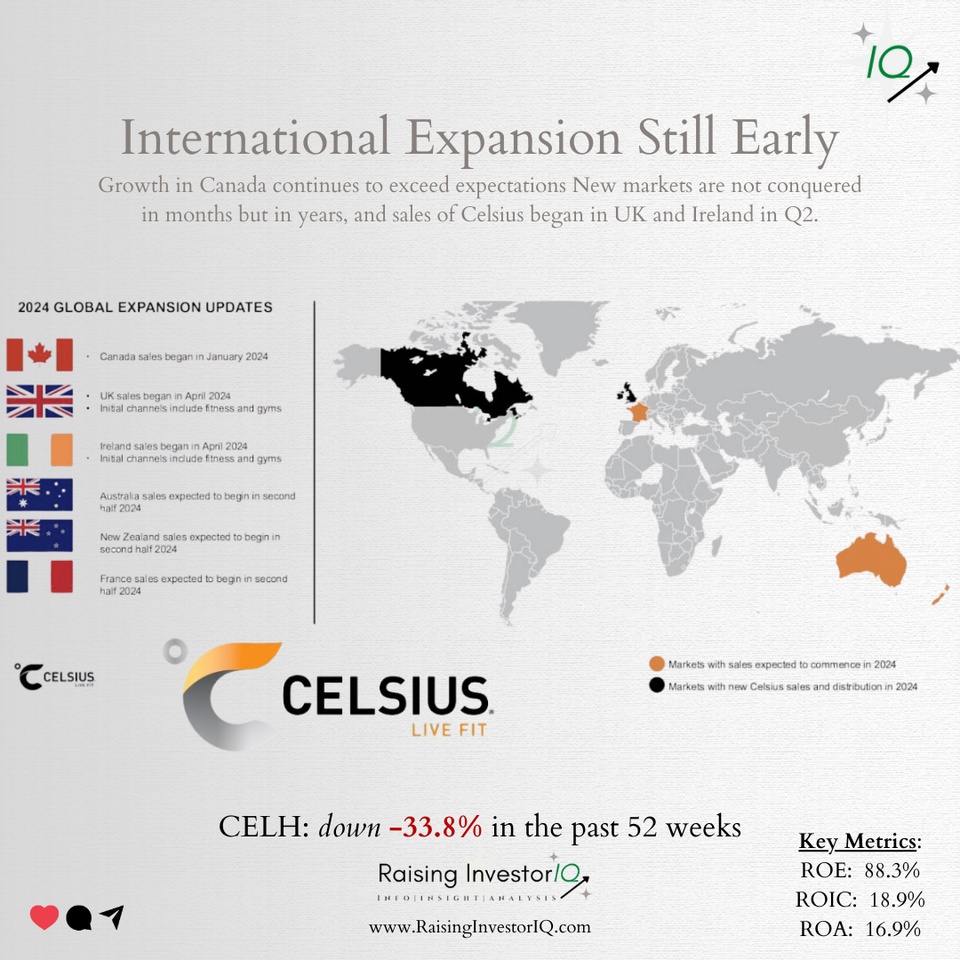

- International revenue: Increased by 37% to USD 18.6 million in Q3 2024 compared to the same period last year.

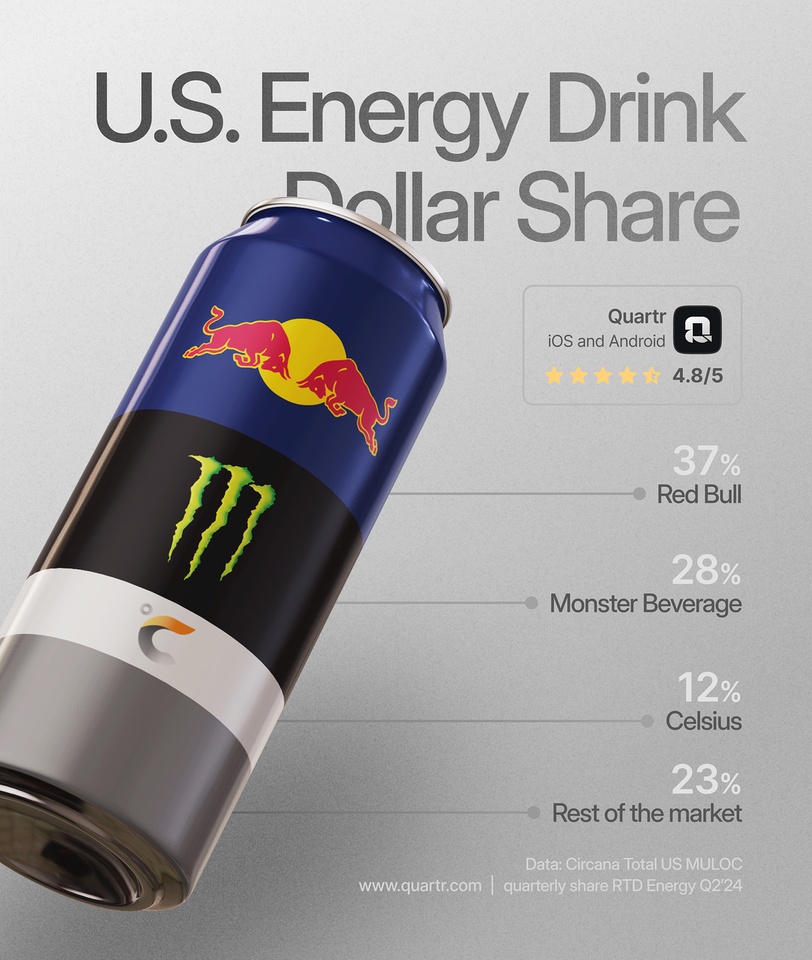

Competitive position:

- Market share: Celsius holds 11.6% market share in energy drinks in the US and is ranked 3rd in the overall market ranking.

Forecasts and management commentary:

- Outlook: No forecast is currently provided.

- Focus: Management is focusing on expanding product availability and increasing consumption frequency.

Risks and opportunities:

- Risks: Challenges in terms of supply chain optimization, market conditions and macroeconomic factors.

- Opportunities: Expansion into new markets and growing demand for sugar-free products.

Summary of results:

Positives:

- Strong liquidity: Solid cash balance of over USD 900 million.

- International growth: International sales increased by 37%.

- Strategic acquisition: Acquisition of Big Beverages to promote vertical integration.

- Market share resilience: Strong market position in the US energy drink market.

- Positive consumer trends: Growth in the sugar-free energy drink segment.

Negative aspects:

- Decline in sales: Significant decline in sales of 31% in Q3 2024.

- Decline in net result: Net result fell by 92%.

- Margin pressure: Gross margin decreased by 440 basis points.

- Inventory optimization: Sales were impacted by inventory optimization by distributors.

- Lack of forecasting: No provision of future forecasts creates uncertainty.