Position bought... I was planning to anyway and since I'm an optimist, I'll buy before the figures on 01.05. Let's see what happens...

American Financial Group Action Forum

ActionActionDiscussion sur AFG

Postes

17$BAS (-5,27 %) Psoition dissolved in the donation depot.

Would really like to go more for dividend growth here,

for the remaining cash flow is $AFG (+4,02 %) and later $HTGC (+0,27 %) planned, both of which are healthier.

Reallocation will be made on Thursday in Hermle, ex-day of $MBH3 (-0,56 %)

American Financial Group announced today that Jason J. Maney has been named Executive Vice President of American Money Management Corporation ("AMMC"), AFG's subsidiary that provides investment management services to AFG, its insurance subsidiaries and certain third-party investment companies. Mr. Maney joined AMMC in 2002 as an investment professional after several years in the public accounting and insurance industries and has served as AMMC's Senior Vice President since 2011.

Mr. Maney earned a Bachelor of Science in Business Administration from Miami University and holds the Chartered Financial Analyst (CFA) designation.

AFG also announced today that John B. Berding has been elected President of AFG, effective immediately. Mr. Berding will continue to serve as President of American Money Management Corporation ("AMMC"), AFG's subsidiary that, in addition to his new role, provides investment management services to AFG, its insurance subsidiaries and certain third-party investment introduction companies. Mr. Berding assumes this leadership role at AFG, which was previously co-chaired by Carl H. Lindner III and S. Craig Lindner, who will continue to serve as AFG's Co-Chief Executive Officers. With this new position, Mr. Berding will work with the Co-Chief Executive Officers on strategic planning and capital management issues.

Just as an aside, in case anyone has AFG in their portfolio. 😎

Source: afginc.com

$AFG (+4,02 %) further diversifies its portfolio and acquires crop failure insurance from Illinois, plus there would still be enough capital for a few special dividends 🥹

Now can @Simpson grow his tomaccos with peace of mind.

Attached is the message from Seeking Alpha:

Once again an update on my cashflow project.

For 4 days in Stuttgart, I was able to *cough* by the generous food allowance in Germany a $AFG (+4,02 %) Share treat.

Tax-free income is invested 💪

In addition, I wanted to share with you gladly at the use:

I had 4 days of service there on an ultra-precision machine that is used to make laser mirrors out of copper, which $ASML (-0,38 %) needs machines for its lithography.

Manufacturing tolerance on one mirror: 2 microns

To put this in perspective: The average human hair is 80µ thick, so you have to cut a hair 78 times to get 2µ.

Other products that can be made with this machine, maybe some of the users have in mind;

Contact lenses.

Who would like to look at such a machine times can watch the linked Youtube video.

#germanengineering #boersengehandelteralltag

Project cash flow instead of book profit

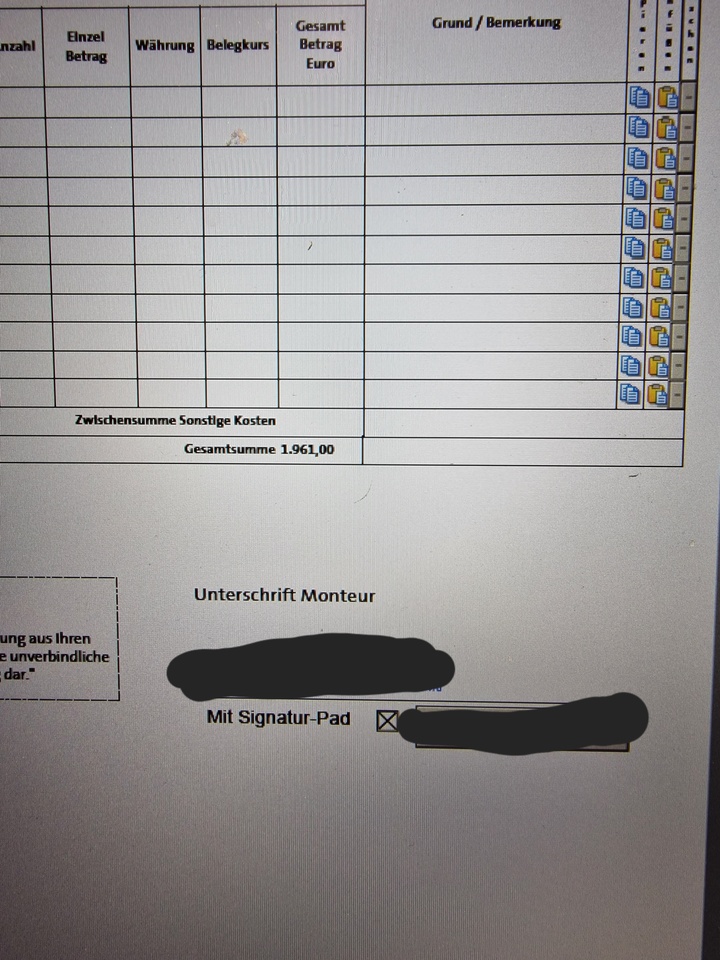

Month-end closing January:

January was a rather bad month for me,

Since the expense rates in Eastern Europe are rather low.

3 weeks in Czech Republic

bring in 1961€.

After deducting the hotel and living expenses (canned beer and canteen) I am left with about 1200 euros, which this month in $AFG (+4,02 %) & $HTGC (+0,27 %) invested to provide me with dividends 🥰

Greetings from 🇲🇰

Project cash flow instead of book profit

Good morning on this snowy Monday,

Maybe one or the other has already noticed that my deposit at getquin has become a little smaller🤓

I have moved 95% of my stocks from Trade Republic to my Maxblue portfolio in the last weeks, mostly blue chips and reliable dividend payers like $CAT (-2,91 %)

$MRK (+2,67 %)

$JNJ (+0,03 %) etc. but also moved my first position from $HTGC (+0,27 %) and $AFG (+4,02 %)

40 stocks in total.

The thought behind this is quite simple, I want to focus more on strong dividends and live up to my username:

Starting this year, all earned expenses will be reinvested in high dividend stocks, with the cash flow generated in this way, I would then like to save a World ETF every month.

I like the idea that tax-free income is invested and works for me.

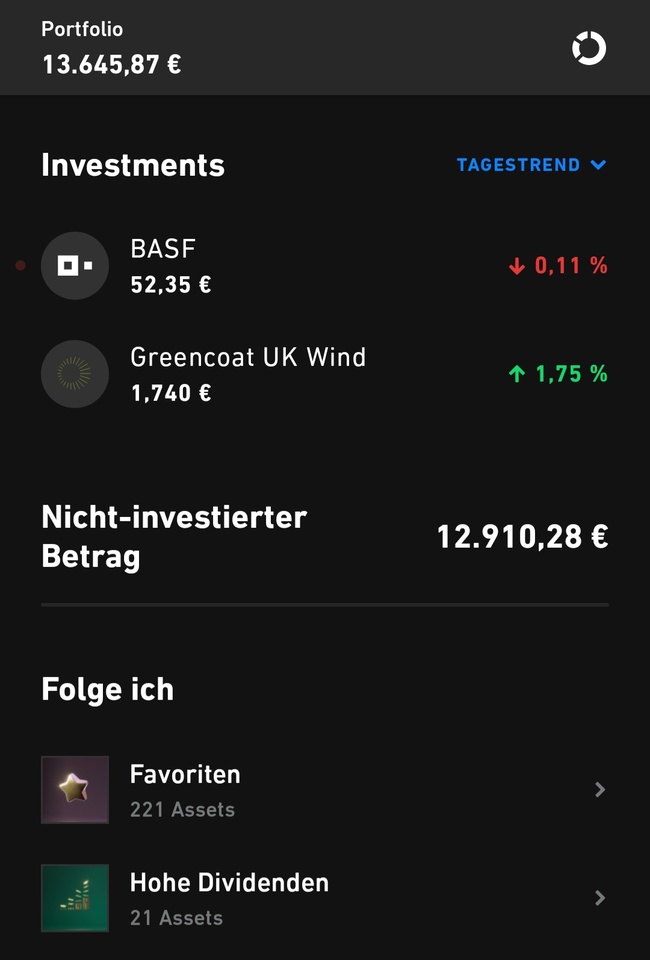

As of today only $BAS (-5,27 %) and the holy $UKW (-0,31 %) in the depot.

Tonight should then again $HTGC (+0,27 %) & $AFG (+4,02 %) should follow, as new old acquaintances.

For the whole I have now plundered my expense account and it is invested comfortably in the next few months little by little.

Of course, I continue to invest in value, but that runs for now only in the background and is financed from my base salary.

If it is sometime possible to display depots on the profile page separately I will enter the shares here again.

Titres populaires

Meilleurs créateurs cette semaine