Project cash flow instead of book profit

Good morning on this snowy Monday,

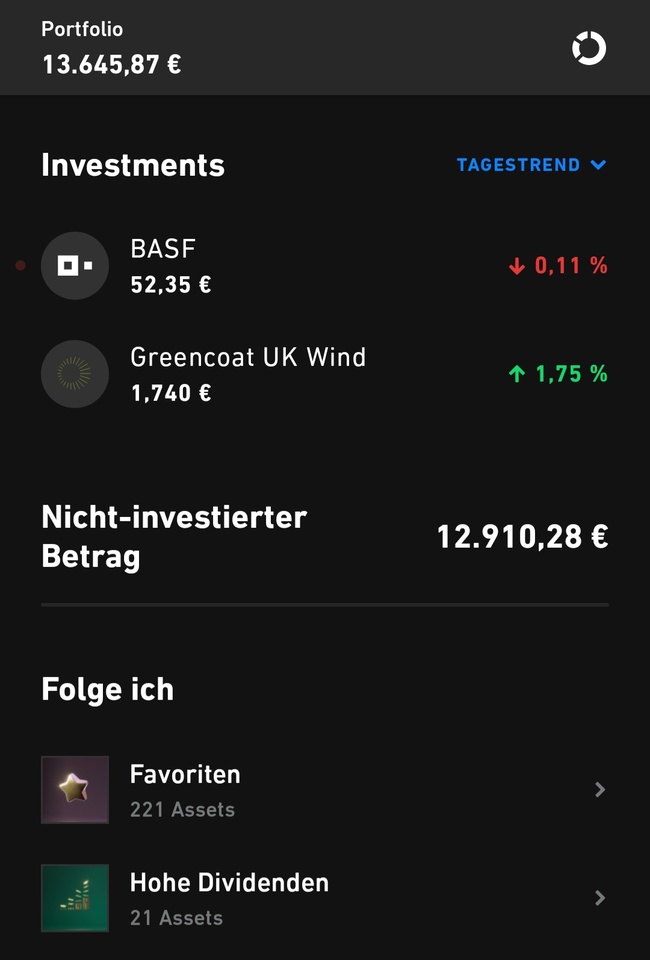

Maybe one or the other has already noticed that my deposit at getquin has become a little smaller🤓

I have moved 95% of my stocks from Trade Republic to my Maxblue portfolio in the last weeks, mostly blue chips and reliable dividend payers like $CAT (-0,14 %)

$MRK (+1,06 %)

$JNJ (+0,32 %) etc. but also moved my first position from $HTGC (+0,68 %) and $AFG (+0 %)

40 stocks in total.

The thought behind this is quite simple, I want to focus more on strong dividends and live up to my username:

Starting this year, all earned expenses will be reinvested in high dividend stocks, with the cash flow generated in this way, I would then like to save a World ETF every month.

I like the idea that tax-free income is invested and works for me.

As of today only $BAS (-0,39 %) and the holy $UKW (-0,66 %) in the depot.

Tonight should then again $HTGC (+0,68 %) & $AFG (+0 %) should follow, as new old acquaintances.

For the whole I have now plundered my expense account and it is invested comfortably in the next few months little by little.

Of course, I continue to invest in value, but that runs for now only in the background and is financed from my base salary.

If it is sometime possible to display depots on the profile page separately I will enter the shares here again.