𝑮𝒓𝒆𝒆𝒆𝒏 𝑬𝒏𝒆𝒓𝒈𝒚 𝒎𝒂𝒍 𝒂𝒏𝒅𝒆𝒓𝒔!

You asked for it and here is the analysis! I ask the management team, consisting of @MScottInvesting

@GoDividend

@Divmann

@California_Dreamin

@InvestmentPapa

@christian

@Barsten

@Der_Dividenden_Monteur

@Simpson

@Dr27589

@RealRose

@Klambam@RoronoaZoro

@Zackdela79

@Doe to contact me in order to transfer my consulting fee. Normally, advance payments are not customary. The matter is correspondingly urgent!

Greencoat UK Wind PLC $UKW (-1,59 %)

GB00B8SC6K54

𝗜. 𝗨𝗻𝘁𝗲𝗿𝗻𝗲𝗵𝗺𝗲𝗻𝘀𝗽𝗿𝗼𝗳𝗶𝗹:

Greencoat UK Wind PLC is a closed-ended investment company based in the United Kingdom. The company has a diversified portfolio of interests in around 40 operational wind farms in the UK with a total net capacity of 1,289.8 megawatts (MW). The company's portfolio consists of interests in special purpose vehicles (SPVs) that hold certain wind farm assets. [1] [2] The strategy, which specifically targets dividend streams, is also explicitly communicated on the company's homepage.

Greencoat UK Wind PLC is managed by Greencoat Capital LLP, which owns other investment trusts. Greencoat Renewables PLC should also be mentioned here. Greencoat Renewables also invests in wind farms in Ireland, Sweden and France. In addition, Greencoat Renewables is planning to establish a further foothold in the solar market, although this hardly exists at present. The business model has a similar structure and is based on dividend streams.

In the pictures I have added a map showing the wind farms in which Greencoat UK Wind (UKW) is invested.

The company's investment objective is to provide investors with an annual dividend that increases in line with Retail Price Index (RPI) inflation, while maintaining the capital value of the investment portfolio on a long-term real basis through the reinvestment of surplus cash flow and the use of debt. [1]

According to NAV factsheet June 2022:

"The Company's aim is to provide investors with an annual dividend that increases in line

with RPI inflation (7.72p with respect to 2022) while preserving the capital value of its

investment portfolio in the long term on a real basis through reinvestment of excess cash

flow." [6]

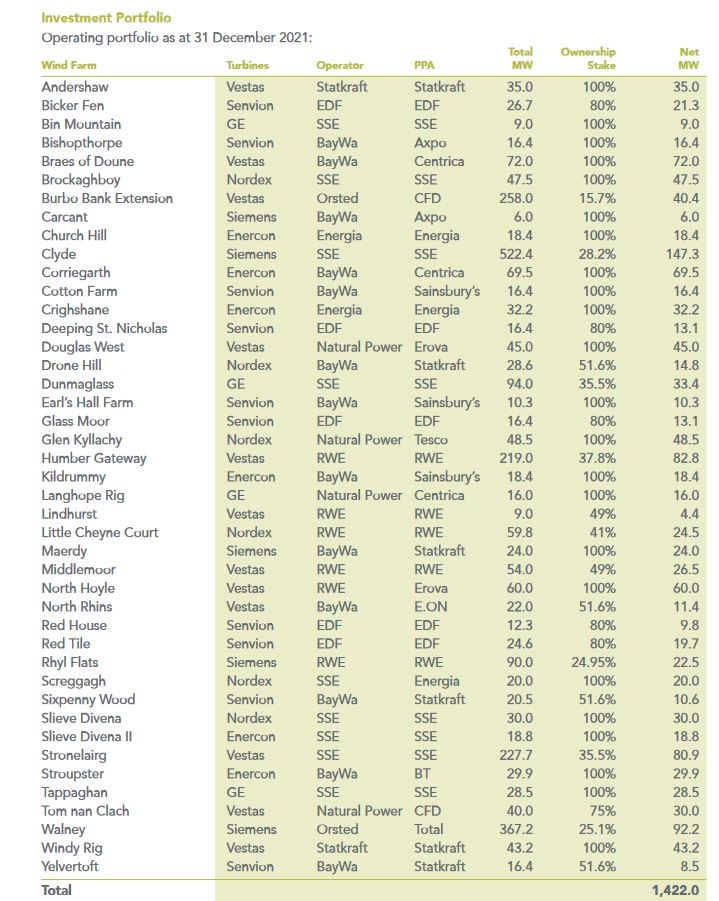

As you can see, UKW is not a typical green energy stock. UKW is simply an investment company with an exclusive focus on wind power in the UK. But which wind turbines does UKW invest in? There are several, and the operators are large corporations that you might recognize (non-exhaustive list):

-RWE

-EDF

-Orsted

-BayWa

A large portfolio comes directly from RWE. The largest turbine manufacturers in these wind farms are Vestas (44%) and Siemens (23%). [3]

There are different shareholdings by UKW in the wind farms. An overview of the wind farms, their operators and the proportion of shares held by UKW is attached. [3]

Wind farms by region according to NAV factsheet June 2022 and in brackets according to AR 2021 [3]:

-Scotland: 47 (46%)

-England: 37% (38%)

-Northern Ireland: 11% (11%)

-Wales: 5% (5%)

But how exactly does FM generate revenue and profit? Quite simply! As an investment company with corresponding shareholdings, UKW mainly receives dividends. In addition, the investments and wind farms must be valued annually, which is done using a DCF valuation method. If the valuations increase, this generates a revaluation, which is directly reflected in the turnover. It is important to understand that no cash flows are generated by the valuation adjustments. This is shown in the annual report as "Unrealized movement in fair value of investments".

Sales components summarized according to Annual Report 2021 (2020) [3]:

-Dividends received (Dividends received): 226,328 (123,748)

-Unrealized movement in fair value of investments: 155,551 (9,763)

-Interest on shareholder loan investment received: 39,804 (20,793)

If the investment activities and the valuations of the investments increase, turnover increases. Valuations are classically based on the DCF method. Valuations could therefore fall if the electricity price falls or the wind blows less.

𝗜𝗜. 𝗞𝗲𝗻𝗻𝘇𝗮𝗵𝗹𝗲𝗻 [𝟰]*:

-KGV 2021: 7.68

-P/E 2022e: 2.87

-P/E 2023e: 6.48

-P/E 2024e: 7.28

-PEG 2022e (P/E ratio/growth rate): = I do not allow myself to make a judgment here. EBIT growth is extremely volatile due to the current situation and the development of electricity prices. It is not really possible to make a sensible statement here. Classification: A favorable PEG ratio would be achieved with growth of 8-10% (rule of thumb: < 1 = very favorable).

-KBV 2022: 1.15

-Sales growth: 2022: 312%; 2023: -46%; 2024: -8%

-EBIT growth: 2022: 325%; 2023: -49%; 2024: -8%

-Dividend yield: 2021: 5.11%, 2022: 5.45%, 2023e: 5.87%, 2024e: 6.09%

*As at 16.10.22

Sector key figures Europe [5]:

-P/E ratio Investment & Asset Management companies: 11.72

-Growth Investment & Asset Management companies: 14.02

-PEG Investment & Asset Management companies: 0.84

But is UKW now cheaply valued? One could almost think so. But in order to make a final judgment, we need to take a closer look at the business model and the financials in the next section.

𝗜𝗜𝗜. 𝗥𝘂𝗯𝗿𝗶𝗸 - 𝗪𝗮𝘀 𝘄ü𝗿𝗱𝗲 𝗕𝘂𝗳𝗳𝗲𝘁 𝘀𝗮𝗴𝗲𝗻 (𝗗𝗮𝘁𝗲𝗻 𝗮𝘂𝘀 𝗱𝗲𝗺 𝗔𝗻𝗻𝘂𝗮𝗹 𝗥𝗲𝗽𝗼𝗿𝘁 𝟮𝟬𝟮𝟭 [𝟯]):

Criteria to be read in detail:

https://app.getquin.com/activity/XcuRrJwmyP

Due to the very straightforward business model, I deviate somewhat from my usual "Buffett Approach". UKW has hardly any operating activities and focuses on investments and divestments - that's it!

A. Income statement:

A net margin of 92% was achieved for the 2021 financial year. EBIT almost corresponds to revenue. However, this is hardly surprising and therefore not unusual for an investment company. Profit has been rising steadily for 3 years. However, this is mainly due to new acquisitions, which in turn pay dividends: There have also been no significant write-downs on investments during this period.

Profit 2021: GBP 363.22 million

Profit 2020: GBP 104.40 million

Profit 2019: GBP 43.29 million

Profit 2018: GBP 202.38 million

Profit 2017: GBP 59.87 million

B. Balance sheet:

The balance sheet looks similarly "boring". The assets side consists almost exclusively of the investment holdings. The liabilities side has a loan of GBP 950,000, which is repaid annually and accounts for around 23% of total assets. The credit line is also increased again as required.

The business model is simple: receive dividends, pay dividends and increase the credit line or carry out a capital increase as required. Nothing else actually happens. The cash flow is fully utilized. If the credit line is increased, it is used in full for investments and dividend payments. The same applies to capital increases. Depending on requirements, one of the two (loan vs. capital increase) is used as a source of cash. As the dividend is based on inflation, we are currently forced to do this to some extent.

But does this type of dividend policy make sense? I would like to take a brief look at the cash flow statement! Because here it becomes even clearer exactly what UKW's strategy looks like.

C. Cash flow statement:

Cash relevant transactions for UKW summarized:

Annual loan repayment (-)

Increase in credit facility (+)

Payment of dividends (-)

Receipt of dividends (+)

Cash from capital increases (+)

As mentioned above, not a great deal happens. As a result, operating cash flow and free cash flow can sometimes be negative. This means that there is little strategic leeway, as the company is always trying to cover dividends and investments through capital and loan increases. But that is also simply the business model.

Capital increases in 2020: GBP 400,000

Capital increases in 2021: GBP 450,000 in November 2021 and GBP 197,618 in February 2021

A relevant article regarding the GBP 450,00 capital increase:

https://quoteddata.com/2021/11/greencoat-uk-wind-raises-450m-high-demand/

So we see that UKW needs capital increases, which have an impact on the share price (share price dilution), If you look at the share price development of UKW, you can see that hardly any share price performance is possible here. On the other hand, UKW naturally has a good dividend yield.

From 2014 to the peak in 2022, the share price "soared" from the original €1.19 to €1.95. [7] The share is therefore not a particularly high performer and should not be expected to be.

Such a dividend strategy is not unusual and should be viewed neither positively nor negatively. However, you should be aware of the yield expectations!

So what would Buffett say? Probably not much. The share doesn't really have a moat and it is unlikely to beat the market. Unless wind turbines are the outperformer in the next few years 😊

𝗜𝗩. 𝗞𝗲𝘆 𝗡𝗼𝘁𝗲

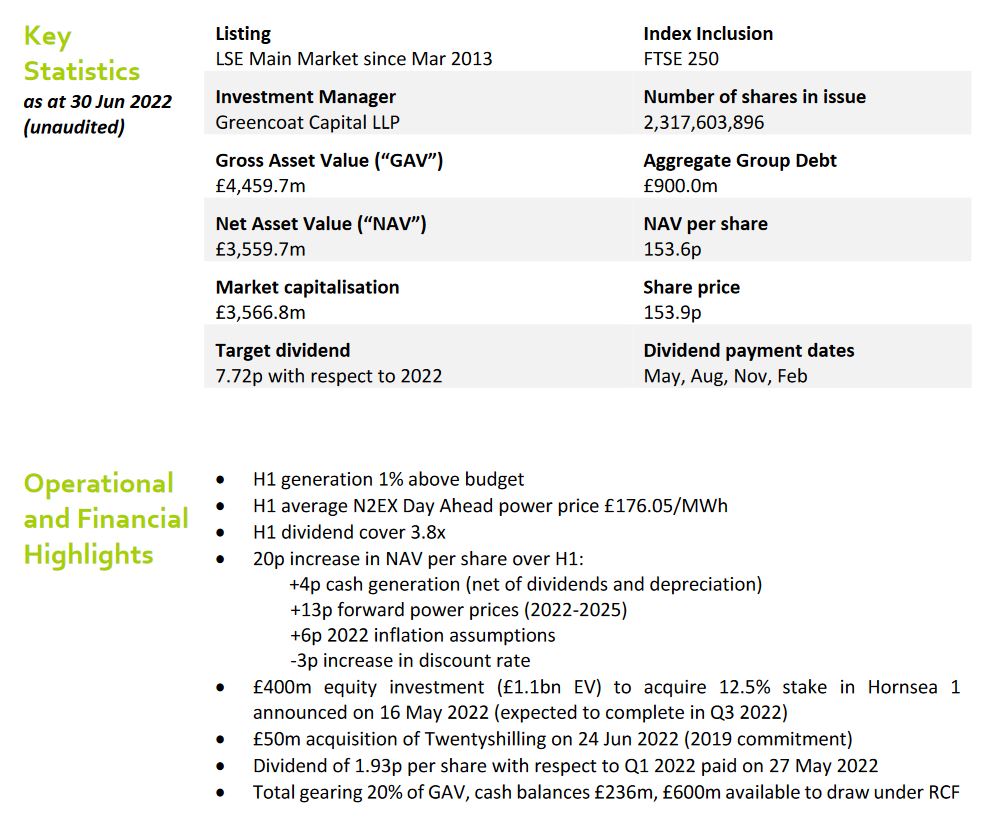

UKW regularly publishes NAV reports (NAV = Net Asset Value), which assess the value of the assets (wind farms). This provides regular information on business development and asset valuation.

The assets are valued using the DCF method.

Excerpt from the semi-annual report:

"The DCF valuation is produced by discounting the individual wind farm cash flows on an unlevered basis."

For more information on the valuation of assets and companies, please refer to the following articles:

Little guide of valuation:

https://app.getquin.com/activity/laOUVhfFDI?lang=de&utm_source=sharing

Impairment according to IAS 36:

https://app.getquin.com/activity/vCLDnzrHFv?lang=de&utm_source=sharing

The NAV reports compare the relevant information, such as NAV, market capitalization (shares x price) or target dividend, based on inflation (RPI). It is therefore possible to deduce from the reports how the business (wind, electricity price), the valuations and the cash requirements for the dividend are developing.

NAV 30.06.2022: GBP 3,559.7 million

NAV 31.03.2022: GBP 3.459.2 million

NAV 31.12.2021: GBP 3.093.7 million

NAV 30.09.2021: GBP 2,549.0 million

Market capitalization 30.06.2021: GBP 3.566.8 million

Market capitalization 31.03.2022: GBP 3,531.6 million

Market capitalization 31.12.2021: GBP 3,257.8 million

Market capitalization 30.09.2021: GBP 2,564.7 million

In this context, I also refer to the revenue component "Unrealized movement in fair value of investments", which may change accordingly based on the valuations.

UKW benefited in the valuation primarily from electricity prices and further acquisitions. From 2020 to 2021, the NAV valuation increased primarily due to investments (GBP 569 million) and valuation adjustments (GBP 116 million) [3].

The June 2022 NAV report also shows that GBP 400 million in cash was required via a capital increase to acquire 12.1% of the Hornsea 1 wind farm. This acquisition should therefore recoup the GBP 400 million in the long term.

𝗩. 𝗣𝗲𝗲𝗿 𝗚𝗿𝗼𝘂𝗽/𝗞𝗼𝗻𝗸𝘂𝗿𝗿𝗲𝗻𝘇 [𝟯]:

As FM is not a classic green energy stock, the peer group is also completely different. To summarize and for your own analysis, here is a small list of relevant investment companies:

-Foresight Solar Fund $FSFL (+1,4 %)

-Bluefield Solar Income Fund $BSIF (-1,17 %)

-John Laing Environmental Assets Group $JLEN

-The Renewables Infrastructure Group $TRIG (-1,01 %)

-Next Energy Solar Fund $NESF (-2,27 %)

𝗩𝗜. 𝗥𝗶𝘀𝗶𝗸𝗲𝗻/𝗡𝗮𝗰𝗵𝘁𝗲𝗶𝗹𝗲:

-Exclusively dependent on the development of wind farms and the electricity price.

-Valuation risks in the course of electricity price changes.

-Dividend linked to inflation of the Retail Price Index (RPI). Ensures attractive dividends, but also leads to borrowing and capital increases (but low equity ratio). Strategic scope therefore limited.

-Greencoat Renewables PLC allows limited investments outside the UK, which limits growth opportunities.

𝗩𝗜𝗜. 𝗩𝗼𝗿𝘁𝗲𝗶𝗹𝗲:

-No operating risks from operations, maintenance and therefore hardly any operating costs.

-No currency risks due to UK focus.

-Stable environment/weather conditions for wind turbines in the UK.

𝗩𝗜𝗜𝗜𝗜. 𝗙𝗮𝘇𝗶𝘁:

VHF operates a respectable business in terms of climate change. However, anyone looking for high returns will not be happy here. UKW is careful to use its cash flow each year for investments and dividends. If further cash is required for this, a capital increase is carried out, which dilutes the share price. The business model is simple and involves low operational risks. However, you should not expect big returns either. The business is also not very diversified.

I also see a disadvantage in the strategic alignment and growth potential. Due to other investment trusts, such as Greencoat Renewables PLC, which is run by the same management, it is unlikely that investments will be made in France, Sweden or Ireland to avoid getting in each other's way. There is at least a certain barrier here.

Greencoat Renewables PLC $GRP (+1,27 %) is somewhat more broadly diversified due to its European business and also harbors growth potential in the PV market. The market capitalization and NAV are still somewhat smaller than those of UKW, also due to the lower turnover and profit. However, I have not carried out a larger analysis for this investment company. However, this company could also be of interest to all FM fans 🌝

However, if you want a regular dividend with a steady share price performance as an addition to your portfolio, UKW could be the right choice. Because the dividend will remain high and the investments serve climate change.

As always, no investment advice!

Sources:

[1] https://de.marketscreener.com/kurs/aktie/GREENCOAT-UK-WIND-PLC-12888956/unternehmen/

[2]

https://www.greencoat-ukwind.com/about-us/who-we-are

[3]

[4]

https://de.marketscreener.com/kurs/aktie/GREENCOAT-UK-WIND-PLC-12888956/fundamentals/

[5]

https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datacurrent.html

[6]

[7]

https://www.boerse.de/aktien/GREENCOAT-UK-WIND-Aktie/GB00B8SC6K54

Graphic:

Portfolio map:

https://www.greencoat-ukwind.com/portfolio

Wind turbines: -directly from the Annual

Report 2021-->

Company homepage:

https://www.greencoat-ukwind.com/disclaimer-country

Greencoat Renewables PLC: