Last of this month, the basis of my portfolio

As simple as it gets

Postes

24...and thus places itself in the midfield of the individual positions and, with further expansion, the upper third of the individual positions in the table will be in sight next 😘

So much for "achieving more together" @Tenbagger2024 💪🏻

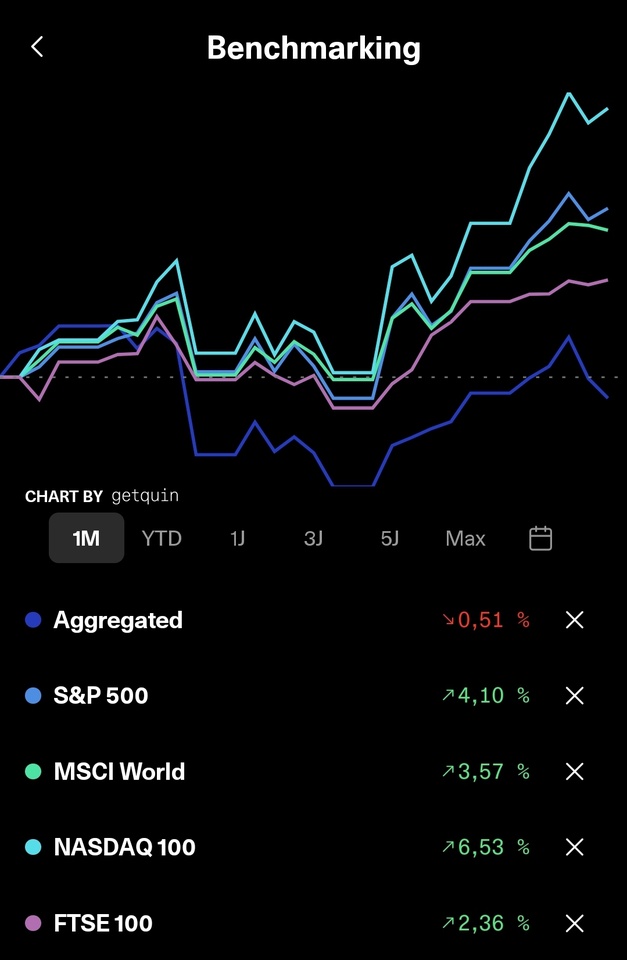

Hi everyone, here's a little insight into the October results of my portfolio, and well, there are also some down months - it can't always be a steep upward trend.

However, I am basically satisfied with everything and the minus in October is really within a very manageable range.

If you look at the current year as a whole...

...you quickly realize why I am still very satisfied with the future. It may not be a high performer, but for a value dividend portfolio it's still enough to build on 🫠

》IRR 21.22%《

》TTWROR 61.01%《

I am also relaxed about the future in the long term, because...

...everything is still relaxed at the upper end and let's see what else the crystal ball has in store for the future 🍊 😅

Especially since the goal of generating the FSA 1000/2000€ as quickly as possible through dividend payments has been optimally achieved, creating the potential for me to simply let profits run and not be dependent on sales, although sometimes a small take-away and later re-entry will probably be on the program more often...but that's how you keep feeling your way 🤫

However, as well as dividends, there is also some really good news: the second check-up after my operation in June was still negative and the third is due next month. The first year is always the most critical and so it's important to keep 👍🏻 and push through da....

...but let's stick to the subject of dividends...

In October, the yield was a bit lean and there was only €64.01 net dividend, which still means +76.02% YTD 💪🏻

But things are looking much better again this month, well, minus the beloved tax...

...which brings us to the top and flops of the month:

Top 3

🟢 $RIO (+0,67 %) +10,32% (+16,32%)

🟢 $FTWG (+0,93 %) +3,93% (+10,65%)

🟢 $YYYY (+0,63 %) +3,87% (+7,46%)

Flop3

🔴 $HAUTO (+0,56 %) -12,47% (+13,96%)

🔴 $MUX (+0,95 %) -6,16% (+20,82%)

🔴 $DTE (+0,29 %) -5,96% (-4,68€)

Purchases:

Disposals:

》none《

And so we continue into November with the year-end forecast, which has already been raised twice...and I wish us all a successful November ✌🏻

Going for a 3 fund ETF portfolio: foundation/dividend/growth. The switch for the foundation has been made. S&P 500 is gone and welcome to FTSE All World. Nice low fees of 0.15% ($VWRL (+0,63 %) has 30% higher costs) and, my strong preference: distributing.

Foundation: Invesco FTSE All World

Dividend: $TDIV (+0,23 %)

Growth: $BTC (-0,55 %) and still looking for a good growth etf like $EQQQ (+0,83 %) but I don't like long term investing in 1 country or sector.

$FTWG (+0,93 %) In turbulent times, it's nice when a few toads come in from boring positions every now and then.

I actually almost fell off my chair this morning, after only two weeks my securities account was successfully moved from TR to ING. After all the experience reports here, I was already worried and didn't want to deal with all the crap.

But lo and behold, it was transferred correctly, top👍

I also topped up a bit straight away to test the process. Sure, the costs are higher than with the neobrokers, but the security and support are worth the few euros a month to me.

Although I started investing when I was 18, buying shares in Spanish companies such as $SAN (+2,7 %) and $IBE (+0,92 %) , as well as an MSCI World fund offered by my lifelong bank (which had some rather high commissions that I wasn't aware of at that time), I sold everything a couple of years ago to buy my first home.

Last year, I decided to start investing again, following a DCA strategy with ETFs and high-quality stocks. Ideally, I would not have bought and sold so much this year, but it can be difficult to manage the emotions generated by the market.

My investment plan is to have the following allocation:

- 50% in ETFs (40% $FTWG (+0,93 %) , 5% $JEPQ (+0,65 %) and 5% $JEGP (+0,2 %)).

- 10% in crypto ($BTC (-0,55 %) only).

- 40% in high-quality individual stocks.

I would love to receive recommendations for stocks to add to my portfolio, particularly European ones, as I struggle to find good investment ideas there. Alternatively, I would welcome suggestions for modifications to my current portfolio.

Meilleurs créateurs cette semaine