Discussion sur GDAXI

Postes

4928.11.2024

Uniper raises profit outlook for 2024 - reserves released + Swinging stock market continues with price gains + Rents in Germany will rise in 2025

The nationalized energy group Uniper $UN01 is more optimistic about the end of the financial year due to the reversal of a provision. The company announced on Wednesday evening that adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) will be between 2.5 and 2.8 billion euros in 2024. Uniper had previously expected between 1.9 and 2.4 billion euros. Adjusted net profit is expected to amount to 1.5 to 1.8 billion euros. Most recently, the company had assumed a maximum of 1.5 billion euros. Uniper has resolved long-standing legal disputes by way of a settlement, the company said. This will lead to a reversal of the provision formed for this purpose, which will be recognized in profit or loss for the 2024 financial year in the fourth quarter. Investors welcomed the news. The Uniper share recently rose by 3 percent compared to the Xetra closing price on the Tradegate trading platform.

The search for direction on the DAX $GDAXI could continue with price gains on Thursday. Two hours before the Xetra start, the broker IG valued the leading German index 0.4 percent higher at 19,336 points. It thus stands out slightly from the international stock markets. In the USA, the indices had shown weakness on the day before the Thanksgiving holiday and in Asia the picture was mixed with gains in Japan and losses in China. Reports that the USA, under the leadership of outgoing President Joe Biden, is considering new sanctions to restrict Beijing's access to important semiconductors weighed particularly heavily on Hong Kong. Japanese shares rose due to the weakness of the yen.

Rents at LEG real estate $LEG (-3,05 %) are rising. "We will increase rents slightly more in 2025," Lars von Lackum, CEO of Germany's second-largest real estate group LEG Immobilien, told Handelsblatt. "We assume that the increase in rents will be above 4 percent." In the current year, the Düsseldorf-based company, which has more than 166,000 apartments, expects its privately financed rents to grow by 3.8 to 4.0 percent. Its larger rival Vonovia $VNA (-2,13 %) has already announced that rents will rise in 2025. When presenting its nine-month figures, the DAX-listed group forecast rental growth of around 4 percent for 2025. The pressure on rents will therefore continue in the coming year. Lackum also justified the further increases with the effects of the rent index, which will only gradually allow rents to be adjusted to inflation. (Handelsblatt)

Thursday: Stock market dates, economic data, quarterly figures

Stock exchanges in the USA closed (Thanksgiving Day)

ex-dividend of individual stocks

Imperial Brands GBP 0.54

Quarterly figures / company dates Europe

07:00 Adler Group quarterly figures

07:30 Manz quarterly figures

08:00 Deutsche Beteiligungs AG Annual results

No time specified:

- Delivery Hero: Subsidiary Talabat: Last day to subscribe for shares for private and institutional investors

- Rational AG: Capital market day

- Remy Cointreau half-year figures

Economic data

- 02:00 KR: Bank of Korea, outcome of the Monetary Policy Council Base Rate meeting PROGNOSIS: 3.25% previously: 3.25%

- 09:00 ES: HICP and consumer prices (preliminary) November HICP PROGNOSE: +2.3% yoy previously: +1.8% yoy

- 10:00 EU: ECB, M3 money supply and lending October M3 money supply FORECAST: +3.4% yoy previously: +3.2% yoy

- 11:00 EU: Economic Sentiment Index November Economic Sentiment Eurozone PROGNOSE: 95.1 PREV: 95.6 Industrial confidence Eurozone PROGNOSE: -13.0 PREV: -13.0 Consumer confidence Eurozone PROGNOSE: -13.7 PREV: -13.7 PREV: -12.5

- 14:00 DE: Consumer Prices (preliminary) November FORECAST: -0.2% yoy/+2.3% yoy Previous: +0.4% yoy/+2.0% yoy HICP FORECAST: -0.5% yoy/+2.6% yoy Previous: +0.4% yoy/+2.4% yoy

21.10.2024

iPhone 16 gets off to a strong start: Apple registers 20% more sales in China + SAP is too valuable for the German stock exchange + DAX outlook: 20,000-point mark remains firmly in sight + 11 DATEs that will be important this week + Jefferies lowers Munich Re to 'Hold' - target 485 euros

Apple $AAPL (+0,82 %) can score points in China with a successful launch of the new iPhone 16. According to a Bloomberg report based on data from Counterpoint Research, sales in the first three weeks after the market launch were 20 percent higher than the previous year's model, with the more expensive versions of the new iPhone doing particularly well. Sales of the Pro and Pro Max models increased by 44 percent. According to Counterpoint analyst Ivan Lam, the start of production of the iPhone 15 last year was still characterized by supply bottlenecks, which slowed down the initial sales figures. These problems have largely been overcome with the iPhone 16.

The software company SAP $SAP (-0,31 %) was the first to reach the new DAX cap of 15 percent. What now? Over the past year, the value of the German software group SAP has risen sharply. The company is currently valued at 212 euros per share on the Dax. Twelve months ago it was less than 130 euros.

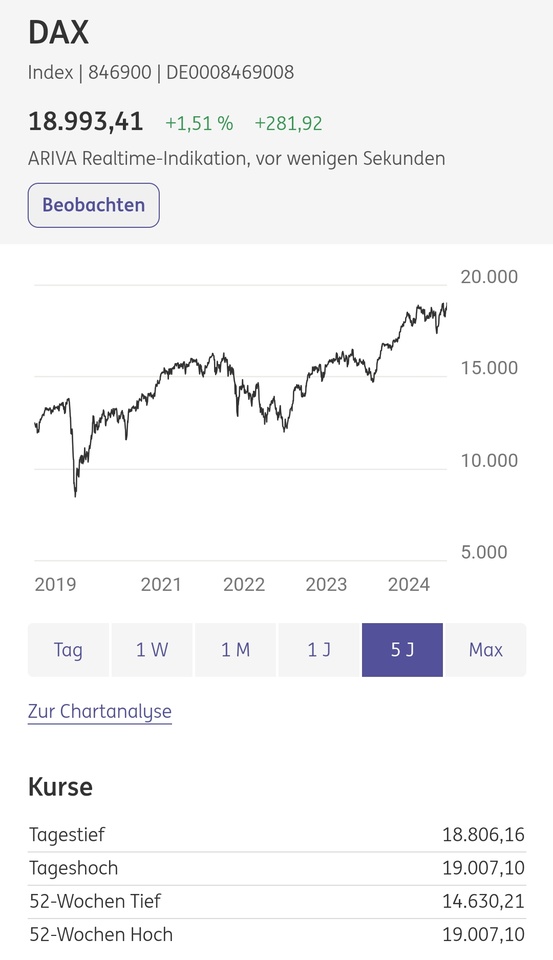

With an increase of around 0.4 percent to 19,657 points, the DAX $GDAXI went into the weekend last Friday. This means that the stock market barometer could launch another attack on the 20,000-point mark in the coming week. Investors can find out which topics could influence the price trend in the DAX outlook. Do you think the 20,000 points will fall?

The analyst firm Jefferies has Munich Re $MUV2 (+0,82 %) from "buy" to "hold" and lowered its price target from 495 to 485 euros. In a study published on Monday, analyst Philip Kett mentioned that the reinsurer's share price had reached record highs despite Hurricane Milton. He reassessed his estimates and came to the conclusion that there was hardly any room for rising market expectations. His price target had already been exceeded.

11 DATES that will be important this week

1 China's central bank cuts key interest rates

The People's Bank of China is likely to ease its monetary policy further. Analysts expect it to lower its reference rates for 5-year and 1-year corporate loans to 3.65% (currently: 3.85%) and 3.15% (3.35%) respectively. This expectation is not only fueled by the announcement of comprehensive economic policy measures to stimulate growth, but also by statements made by central bank governor Pan Gongsheng. According to reports in the Chinese local media, he held out the prospect of a reduction of 20 to 25 basis points at an event.

>>> Monday, October 21, 2024; 3:00

2nd IMF hardly changes growth forecasts - focus on government debt

Economists and politicians are meeting in Washington for the annual meeting of the International Monetary Fund (IMF) and World Bank. The agenda initially includes the publication of the current World Economic Outlook (3.00 p.m.) and the Global Financial Stability Report (4.15 p.m.) on Monday, followed by the Fiscal Monitor on Tuesday (3.00 p.m.). The opening speech by IMF chief Kristalina Georgieva indicates that the IMF will primarily discuss the high and rising level of public debt and look for ways to strengthen economic growth in order to improve debt sustainability. There will also be no shortage of calls for austerity. The finance ministers and central bank governors of the G20 will meet on Thursday.

>>> Monday, October 21, 2024, 15:00

3. SAP $SAP (-0,31 %)defies the weak economic environment

SAP appears to be unaffected by the weak economy. According to analysts' expectations, the Group seamlessly continued the growth of its cloud business in the third quarter. Even slight disruptive factors such as investigations in the USA and the departure of three board members have not thrown the Walldorf-based software giant off track. SAP will present its figures on Monday shortly after 22:00 after the close of the US stock exchange. An analysts' conference will take place at 23:00.

>>> Monday, October 21, 2024; 22:05

4. deutsche Börse $DB1 (+0,53 %)remains on course for growth with Simcorp

Deutsche Börse should have remained on course for growth in the third quarter. The figures are likely to be characterized by the integration of Simcorp and a good development in the Trading & Clearing division. The exchange operator will probably confirm its targets for the year as a whole. Larger acquisitions are currently not an issue, not only because of the ongoing integration of Simcorp, but probably also due to the change in the Group's top management.

>>> Tuesday, October 22, 2024; 19:00

5th Deutsche Bank $DBK (+0,55 %)with good investment banking - Postbank helps

The fact that Deutsche Bank is currently attracting less attention than a certain Frankfurt-based competitor is unlikely to be changed by the third quarter report. The bank will deliver solid figures and confirm its targets. Although the bank recently had to raise its forecast for risk provisioning, things are going well in the investment bank. CFO James von Moltke recently said that significant growth is expected, particularly in the M&A and issues business. The bank will also see a positive effect on earnings from the reversal of the Postbank provision, as it will not need the full EUR 1.3 billion for the settlement with the former Postbank shareholders. In this context, statements on new share buybacks should also be of interest.

>>> Wednesday, October 23, 2024; 7:00 a.m.

6 Beiersdorf $BEI (-2,27 %)on the home straight after the summer quarter

After the first nine months, Beiersdorf should be on track for its full-year targets for both sales and EBIT margin. The summer quarter is likely to have benefited from strong demand for sun protection and the derma skin care brands. The innovation Epicelline and the launch of Eucerin Face in the USA should also be well received. On the other hand, further declines in sales for the luxury cosmetics brand La Prairie in China. Nevertheless, organic sales growth at Group level and in both the Consumer and Tesa segments is likely to have been in line with the target range - with Consumer tending towards the upper end and Tesa and the Group towards the lower end. Following a pull-forward effect in the second quarter, Tesa could deliver somewhat weaker results in the third quarter. With the second quarter figures, Beiersdorf had explained that the development in the US market and at La Prairie in the second half of the year would be decisive for the positioning in the target range.

>>> Thursday, October 24, 2024; 07:00

7. symrise $SY1 (-0,52 %)could raise the forecast

Symrise is likely to have increased sales and margins in the third quarter. According to analysts, strong sales in both divisions and better pricing should have contributed to this. The focus is on the forecast. In August, CFO Olaf Klinger held out the prospect of a review after the end of the quarter and a possible increase - which is expected by the market. However, analysts at UBS also point out that the fragrance and flavor manufacturer usually gives conservative forecasts. Investors may also ask about the planned sale of the business with ingredients and flavor enhancers for feed for fish farming.

>>> Thursday, October 24, 2024; 07:30

9. Mercedes-Benz $MBG (+0,68 %)burdened by weakness in China

Burdened by the weak market environment and increasing price pressure, Mercedes-Benz recently had to lower its outlook for this year twice within a short space of time. The reluctance to buy has hit the DAX-listed company particularly hard in China, where sales of particularly expensive and high-margin luxury cars have increasingly lost momentum. However, there are also positive aspects that analysts are emphasizing at the Stuttgart-based premium car manufacturer, such as its commitment to the dividend payout ratio and share buybacks. The management should emphasize this again when presenting the quarterly figures so that the mood does not change even more.

>>> Friday, October 25, 2024; 07:30

10th Ifo business climate index rises in October

Economists expect the Ifo Business Climate Index to have risen again in October for the first time since April - to 85.6 (September: 85.4) points. Nevertheless, the situation of the German economy is tricky. From a cyclical perspective, an Ifo increase would indicate an improvement. Energy prices are no longer weighing so heavily on the economy and the effects of high key interest rates are slowly easing. However, the structural problems in the automotive industry, which is so important for Germany, are likely to persist for some time to come, and the rest of the export-oriented industry will also have to adjust to the new geopolitical conditions for some time to come.

>>> Friday, 25.10.2024; 10:00

11. at Porsche $P911 (-0,59 %)everything depends on the final quarter

The situation at Porsche has become increasingly gloomy in recent months. It was already foreseeable at the beginning of the year that the many model changes would entail high expenses and that the environment in China would be difficult. However, this was recently compounded by delivery problems, production interruptions and considerably tougher competition. When the figures for the third quarter are presented, analysts are only expecting a return of just over 11 percent - but Porsche is aiming for 14 to 15 percent for the year as a whole. The management's comments on the final quarter will therefore be the linchpin in terms of target achievement.

>>> Friday, October 25, 2024; 17:30

Monday: Stock market dates, economic data, quarterly figures

ex-dividend of individual stocks

CVS Health USD 0.67

Caterpillar 1.41 USD

Bank of New York Mellon USD 0.47

Husqvarna (B) SEK 2.00

Quarterly figures / company dates Europe

03:00 Logitech quarterly figures

07:35 Forvia SE sales 3Q

18:30 Metro Trading Statement 4Q

22:05 SAP quarterly figures

23:00 SAP Analyst Conference

Economic data

- 08:00 DE: Producer prices September FORECAST: -0.2% yoy/-1.0% yoy previously: +0.2% yoy/-0.8% yoy

- 16:00 US: Index of leading indicators September FORECAST: -0.3% yoy previous: -0.2% yoy

- 19:30 US: Federal Reserve Bank of Minneapolis President Neel Kashkari speaks at Chippewa Falls Area Chamber of Commerce event

- 23:00 US: Federal Reserve Bank of Kansas City President Jeffrey Schmid speaks at CFA Society Kansas City event

18.10.2024

ECB cuts interest rates in the eurozone + TSMC rises significantly + Netflix wants to become a magnet for TV advertising + Gold price rises above the USD 2,700 mark for the first time + DAX expected to be slightly weaker after record high

The European Central Bank (ECB) cuts interest rates in the eurozone again. The deposit rate, which sets the trend on the financial market and which banks receive for money parked with the ECB, will be reduced by 0.25 percentage points to 3.25 percent, as the central bank announced in Frankfurt. The decision had been expected

Taiwan Semiconductor Manufacturing Co $TSM (+3 %) jumped after the chipmaker posted a net profit of T$325.26 billion ($10.1 billion) in the three months to Sept. 30. The figure was higher than the Reuters estimate of T$300.2 billion. TSMC also gave an optimistic outlook for the current quarter, citing improved capacity utilization among other factors.

The lower-priced subscription with advertising will Netflix $NFLX (-0,58 %) a reliable growth driver. In the countries in which it is available, the advertising offer accounted for more than half of new subscriptions in the past quarter. The number of users with such subscriptions rose by 35 percent within three months. The video streaming market leader wants to use the momentum to become more attractive to advertising customers. This could ensure that more advertising expenditure is diverted from traditional TV to the internet service. In several countries - including Germany - Netflix had abolished what was once the cheapest ad-free price tier. The result is that customers who want to save money end up with an advertising subscription. Netflix gained more than five million new customers in the last quarter. The streaming provider now has a total of around 282.7 million customer households - and expects to have around 600 million viewers.

The gold price $GOLD continued to soar at the end of the week, reaching another record high on Friday night. The price of a troy ounce (approx. 31.1 grams) passed the 2,700 dollar mark for the first time and at times cost almost 2,712 dollars. Most recently, the price was slightly lower, but still 0.65 percent above Thursday's level. The price of gold has been rising sharply for months - a year ago, a troy ounce cost less than 2,000 dollars. Traders cited the upcoming US presidential election in a few weeks as one of the reasons for the recent rise. It remains to be seen who will win the US election on November 5 - Republican Donald Trump or Democrat Kamala Harris.

According to the Dax $GDAXI record of almost 19,675 points the previous day, investors on the German stock market are likely to take it easy for the time being on Friday. Broker IG put the leading German index at 19,521 points, down 0.3 percent, a good two hours before the Xetra start. On Thursday, the European Central Bank cut its key interest rate and, with a view to possible further steps, indicated that it would wait and see how the economy develops. Overall, there were no surprises

surprises from the ECB. The data from overseas was mixed at the end of the week. Although Wall Street set further records, the momentum waned over the course of trading. The Asian stock markets were unable to find a common direction. Although China's economy grew slightly more strongly than expected in the third quarter, growth continued to cool.

Friday: Stock market dates, economic data, quarterly figures

ex-dividend of individual stocks

Procter & Gamble USD 1.01

Colgate-Palmolive 0.50 USD

Quarterly figures / company dates USA / Asia

12:55 Procter & Gamble quarterly figures

13:00 American Express Quarterly figures

Quarterly figures / Company dates Europe

07:20 Volvo AB Quarterly figures

10:30 Man and Machine Presentation 9 Month figures

Economic data

- 01:30 JP: Nationwide consumer prices September

- 04:00 CN: GDP 3Q | retail sales 9/24 | industrial production 9/24 | fixed asset investment to 9/24

- 08:00 DE: Building permits

- 10:00 EU: ECB, Current Account August | Survey of Professional Forecasters

- 11:00 DE: IG Metall Mitte, second wage negotiation with employers of the metal and electrical industry in Hesse, Rhineland-Palatinate and Saarland

- 14:30 US: Housing Starts/Permits September Housing Starts FORECAST: -0.4% yoy previous: +9.6% yoy Building Permits FORECAST: -1.7% yoy previous: +4.9% yoy

- 16:30 US: Federal Reserve Bank of Atlanta President Raphael Bostic, speech at Millsaps College in Jackson, Mississippi

- 18:30 US: Federal Reserve Bank of Atlanta President Raphael Bostic speaks at the Mississippi Council on Economic Education Forum as part of the American Enterprise Luncheon

No time specified:

- DE: Chancellor Scholz - Meeting with US President Biden | Participation in EU Summit and Euro Summit

- EU: S&P, rating review Greece | Great Britain | Italy

Share of companies in the development of the DAX

34.8% SAP $SAP (-0,31 %)

13.1% Allianz $ALV (+0,43 %)

10.9% Munich RE $MUV2 (+0,82 %)$MURGY (+0,47 %)

10.2% Deutsche Telekom $DTE (-0,3 %)

7.3% Rheinmetall $RHM (+1,76 %)

5.2% Siemens Energy $ENR (+2,25 %)

5.1% Adidas $ADS (-1,05 %)

3.6% Deutsche Bank $DBK (+0,55 %)

9.8% remaining 32 shares together

>> Which ones are you invested in?

Source: HQ Trust Research, as of August 2024

$LYY7 (+0,49 %)

$DAX

$GDAXI

$EXS1 (+0,52 %)

$EXIC (+0,54 %)

#dax

#deutschland

DAX breaks 19,000 points for the first time today. New all-time high. +21% in 12 months. 🇩🇪📈💶👑🏆🥇 #dax

$GDAXI

$DBXD (+0,56 %)

$LYY7 (+0,49 %)

$DAX

☢️ Opinion at TIEJEY ☢️

$GDAXI - DAX - Short

✅ Next stop - 18073€

❗️❗️❗️ Investments are speculative and carry a high level of risk. Every investment is unique and involves unique risks. When trading with shares and other securities, your capital is capital is at risk. ❗️❗️❗️

$DE000SY6RHW9

@tiejey

$SY6RHW

Hello to all!

First of all: I have created some headings to bring in structure. That said, it is not a post of analytical significance and should not be treated as such. Take it with a bit of humor and pick out bits and pieces that interest you. Also feel free to write a comment. I will answer it with pleasure.

2 days ago I read a post about losing 5000€ on derivatives.

Of course, I don't intend to start a competition about who lost more or less money. Nevertheless, I think it is interesting to share experiences in dealing with derivatives.

After all, everyone who starts trading thinks they are now making oodles of dough. In hubris, people like to ignore the big warning that 89% of traders lose money.

How it all began

My experience was 3 years ago and it started on 10/03/2020 at the young age of 13.

If you think about the date, you will notice that this was the beginning of the corona crisis. Only until that time the young @TheAnalyst not yet, how he should arrange this virus into the total economic events.

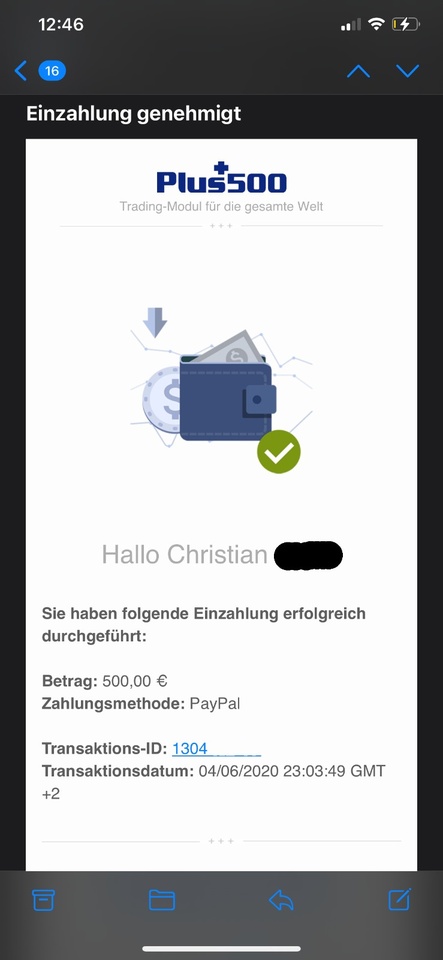

After about 3 months of demo trading and a bunch of Youtube videos about trading strategies, I thought it was time to handle real money. Of course, the amount was limited to money earned by myself. So on 04.06.2020 the time had come, the first 500€ rolled into the account. (Attachment 1)

Full of anticipation, trading began. A few trades went great and I made friends with currencies and oil derivatives. I also created an accurate Excel spreadsheet of profits and losses to keep accurate records.

The beginning of the end

However, my other trades went rather less well and the stress took me fully, so that I could hardly grasp a clear thought.

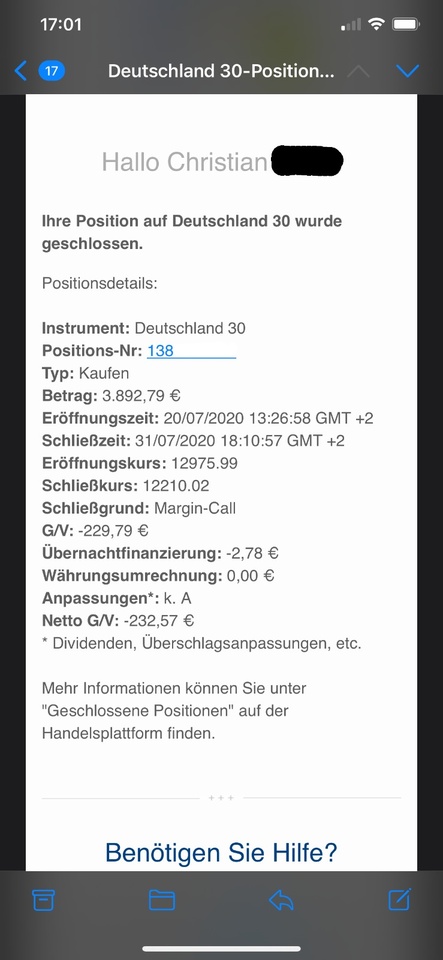

In addition, I could not imagine that the $GDAXI would fall to 12,900 points and below, but that happened soon.

Apparently, I also lacked the strong nerves at that time to hold the shorts I made against the short counter-movements. This was probably also due to the fact that at this time I still could not imagine a huge recession to witness.

So the whole game took its course and gradually more and more margin call warnings came into my email inbox. In total there were 23 (attachment 2).

It is probably not worth mentioning that I liked to use levers in the range of 10 - 50. After all, I really wanted to make money.

Based on my firm conviction that the market can never fall further and will turn in a few days at the latest, 4 more deposits fluttered into the account after hardest persuasion work with my father (attachment 3). The margin calls had to be covered 😉

I went about my normal everyday life, only with the difference of constantly having to think about the rates and also the margin calls. My table tennis training became an ordeal. Every 5-10 minutes I had to look at my phone and if necessary inject another cash injection to keep the game going. After all, you only make a loss when you realize it🧐

The plan was to cover the margin calls until the prices would rise again.

In addition to training, my working hours were also significantly disturbed by thoughts of and glances at the price data.

Unfortunately, I woke up one morning to find the notification on my phone. One of my positions was closed due to a margin call. The largest one. (Exhibit 4). Well OTC there are just movements when you trade against the broker🙁🤷♂️

New strategy

At some point I realized that the shit was pretty much hitting the fan. After a long talk with my father and I closed all the positions I still had open. I changed tactics and was able to make consistent profits.

Unfortunately, these were by far less than the high losses I was incurring. Nevertheless, my body and especially my fingernails thanked me for giving the margin calls a break.

However, it took me far too long to work the loss back in, so I thought.

The END

In the meantime I had become 14 years old and that gave me an idea. This idea was then also successful and I closed officially on 17.05.2021 my trading account. I know that this is not an execution of the end and the new strategy, but I have to keep it so short, because I do not think it is appropriate to share them here. Anyone who thinks a little will surely come up with it.

Conclusion

I don't want people to read this post and feel encouraged to also recklessly go down this path. But the opposite is equally undesirable. I will probably open an account with a trading broker again in the near future. But this time with better planning and the prior knowledge from this first time.

The lesson covers a variety of areas. At the core, however, are experiences that you make yourself. Namely, the feelings that overflow the body during trades and against which you can hardly do anything. However, you can learn to understand which actions you take based on your feelings and thereby filter out an opinion that is as objective as possible.

Of course, there are also tactical lessons to be learned. In the time after my trading, I focused mainly on analysis. I assume that in some ways it is a defense mechanism to prevent the loss of control I experienced in trading in the future. Nevertheless, it is a development that has already brought me many benefits and a better understanding of certain events.

I hope it's a nice little story to sweeten your holiday a bit.

By the way, if anyone needs a reading editor they are welcome to use Hemingway. Actually I use it to make the language in texts as simple as possible, so that for example the conversion rate of websites is better. If someone wants to try it out, he can sign up via this link. My advantage is that I move up a few places in the queue for the AI supported version ;)

https://4.hemingwayapp.com/beta?inviteCode=96f43c32-c737-4ee3-91ac-21cf1dba911e

Dream big. Be brave. TheAnalyst

As every Sunday, the most important news of the last week and dates of the coming week.

here the dates of the coming week as a video:

https://youtube.com/shorts/nasFIUyppOU?feature=share

Monday:

Several gradations at $ENR (+2,25 %):

Jeffries downgraded Siemens Energy from 'Buy' to 'Hold', with a price target cut from EUR25 to EUR16.50. Analyst Simon Toennessen expects two years of losses at Siemens Gamesa. The parent company could fathom higher costs at the subsidiary for years.

Deutsche Bank Research left the rating at 'Hold' but lowered the price target to EUR20 from EUR26. According to analyst Gael de-Bray, the valuation is attractive, but the uncertainty remains too high.

Citigroup downgraded the stock to 'Neutral' from 'Buy' while lowering the price target to EUR18 from EUR29. Analyst Vivek Midha believes that the company can no longer plan ahead after the profit warning.

DZ Bank also downgraded Siemens Energy from 'Buy' to 'Hold' and lowered the share price from EUR27 to EUR16. Analyst Alexander Hauenstein emphasized that currently too many questions remain unanswered.

https://goldesel.de/Artikel/abstufungen-und-verbrannte-erde-bei-siemens-energy

#Markowitz has died. Harry Markowitz was a crucial pioneer of #portfolio theory and Nobel laureate. He was instrumental in making correlation matter when considering portfolio risk. That is, a portfolio can be less risky despite having risky stocks if individual stocks have little correlation in performance. Among stocks from the same industry, for example, the correlation is often quite high, while other industries correlate less. Other asset classes even less. From a risk perspective, it can therefore also make sense to add gold or cryptos to the portfolio.

https://de.m.wikipedia.org/wiki/Harry_Markowitz

The #ifo business climate index has weakened further. The value fell to 88.5 points. Experts had expected 90.7 points. The ifo business climate index surveys executives and is used to derive the economic barometer.

70 % of the $GDAXI-companies expect AI to change their business model in the next few years. 90% of DAX companies plan to use AI applications.

Tuesday:

The USA's economic engine 🇺🇸 continues to hum. New orders for durable goods surprisingly increased. Month-on-month, orders rose by 1.9%; a decline of 0.9% had been expected.

https://m.ariva.de/amp/usa-auftrge-fr-langlebige-gter-legen-unerwartet-weiter-10767671

Wednesday:

$BAYN (+4,67 %) is facing a setback in its search for a successor to Xarelto. The Regeneron Group's application for approval of the eye drug Eylea initially failed at the U.S. regulatory agency. Bayer holds the marketing rights to Regeneron's drug.

https://goldesel.de/Artikel/bayer-rutscht-auf-neues-tief

De#bankenstrinesstest in the USA 🇺🇸 was positive. In the face of a severe economic downturn, the 23 banks tested were able to maintain a capital ratio of 10.1% on average. The aim was to remain above the minimum ratio of 4.5%.

Thursday:

EU consumer confidence 🇪🇺 improved somewhat, similar to the U.S. 🇺🇸.

Friday:

Morgan Stanley has upgraded its rating for $ST5 (+0,12 %) upgraded its rating from 'Equal-weight' to 'Overweight'. At the same time, the price target was reduced from EUR 53 to EUR 45. The share is currently trading below EUR 30. Analyst Manfredi Bizzarri believes that now is the right time to buy Steico. There would continue to be headwinds from the construction industry and competitors, but expectations are now probably at rock bottom. The company should soon start growing again, as Steico's niche is attractive in the long term.

https://goldesel.de/Artikel/zeit-fuer-den-einstieg-bei-dieser-aktie

Production at #china 🇨🇳 continued to decline. However, the stock markets in China still rose. The main reason was that Li Qiang (Premier) advocates policies that increase domestic demand.

The #inflation in the euro zone is falling more sharply than expected, to now 5.5% compared with the same month last year. In Germany, there was an increase from 6.1% to 6.4% compared with the previous month. However, one-off effects such as the EUR 9 ticket and the fuel price discount played a role here. Experts had expected an increase of 5.7% in Europe.

Key dates in the coming week:

Monday: 1:50 manufacturing index (Japan)

Tuesday: 8:00 Trade Balance (DE)

Wednesday: 20:00 FOMC Minutes (USA)

Thursday: 11:00 Retail Sales (EU)

Friday: 14:30 Labor Market Report (USA)

Titres populaires

Meilleurs créateurs cette semaine