@ActionChris what is actually going on with $ELEPHANT (-0,64 %) going on?

Discussion sur ELEPHANT

Postes

3$ELEPHANT (-0,64 %) MONEY makes not only 98% of Cryptos look stupid - but pretty much everything else out there that carries a % sign ...

Since my first post 240% in profit, tendency "rising"!

Wanted to start meaningful debates on the subject at the time, however, there was not much to see except 🆘 and limited comments...

ELEPHANT MONEY is a DeFi project with an extremely poorly chosen name, but conceived by a person who used to be the CTO at Fidelity Investments - finance is therefore his daily bread.

I'm not saying this thing is the last Pepsi in the desert, but I think it's definitely a thing worth taking a closer look at.

Before Hate comes again - I don't invest an hour to offer a detailed text here, because besides Hate from

"super-intelligent-investors" & "🆘" not much comes around. But all those who are open to new things should really take a closer look at this.

Elephant Money is like all Cryptos HIGHLY SPECULATIVE & YOU should only use funds for this, on which you are not dependent.

💥Do your own Research! No Financial Advice💥

Elephant Money = Crap ?

Here the post: https://getqu.in/w0jY0f/p4IoJ8/

So since our @ActionChris has been upset about the comments and reactions of people to his project presentation $ELEPHANT (-0,64 %) and has also expressed about the few well-founded criticism I have taken on the times.

I say in advance - I find it a cheek to present such a project - but more about that in a moment.

What is Elephant Money:

Elephant Money is a crypto project on the BSC - Chain. It consists on the one hand of the $ELEPHANT (-0,64 %) Token and the $Trunk Token.

First about Elephant:

Each transaction is subject to a 10% transaction tax. From this 5% is distributed to the holders and 5% goes into the liquidity pool. $ELEPHANT (-0,64 %) The liquidity pool is used by the protocol, among other things, to generate returns in order to partially finance the redemption of $Trunk later on. I take already times in advance that these transaction taxes usually always for problems on durable worry, besides yield for the Treasury with the project-own token seems to me relatively nonsensical - but more to it later!

IDO

The IDO took place via a so-called Liquidity Drive Event. (Basically you pay BNB into a pool and get Elephant - the price of Elephant is not determined from the beginning but is measured by the participation in this event) - This is nothing new and nothing bad per se.

Supply

The Supply breaks down into 3 major camps 1. 25% Liquidity Pool on Pancakeswap 2. 25% was available for exchange in the Liquidity Drive event explained above and 49% went to a "graveyard" address - I'll explain these in a moment.

Basically, the supply split here is fine.

Graveyard Address

The Graveyard Address collects tokens bit by bit how exactly this works I couldn't read in the whitepaper maybe you can enlighten me here @ActionChris . Anyway as soon as this address has collected 51% of the supply (it starts at 49%) a transaction can be triggered on the website which sells 0.5% of the total supply on the market for BNB and this is then thrown together with 0.5% of the Elephant supply into the liquidity pool.

I think this is highly problematic, since a project can usually only cope with such large protocol-led sell-offs in very strong growth phases, and as soon as the buying pressure decreases, this always causes immense losses among the holders.

Such a thing is trunk

Elephants Money "over-collateralized" Stablecoin I deliberately put that in quotes because that's not really true.

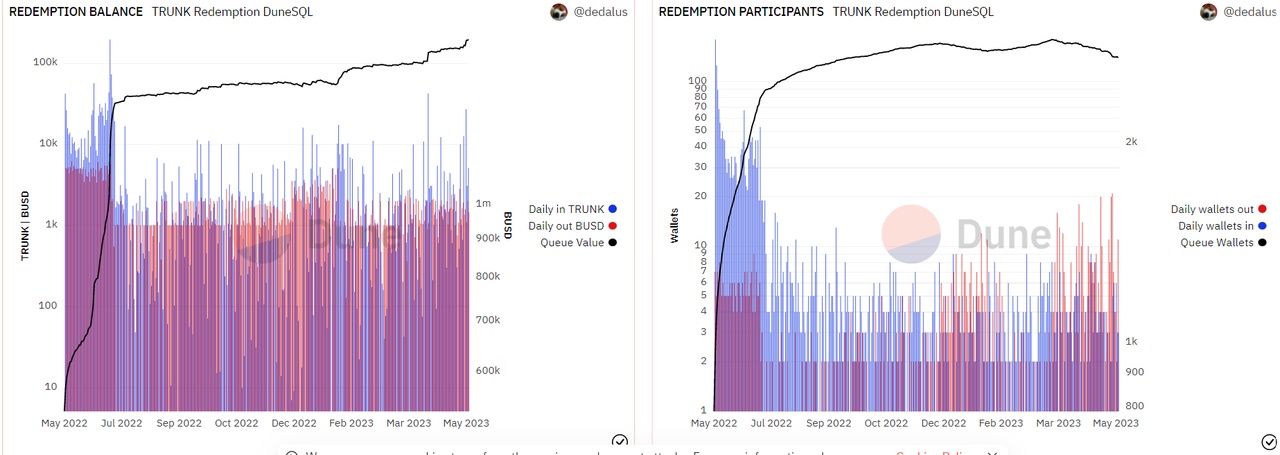

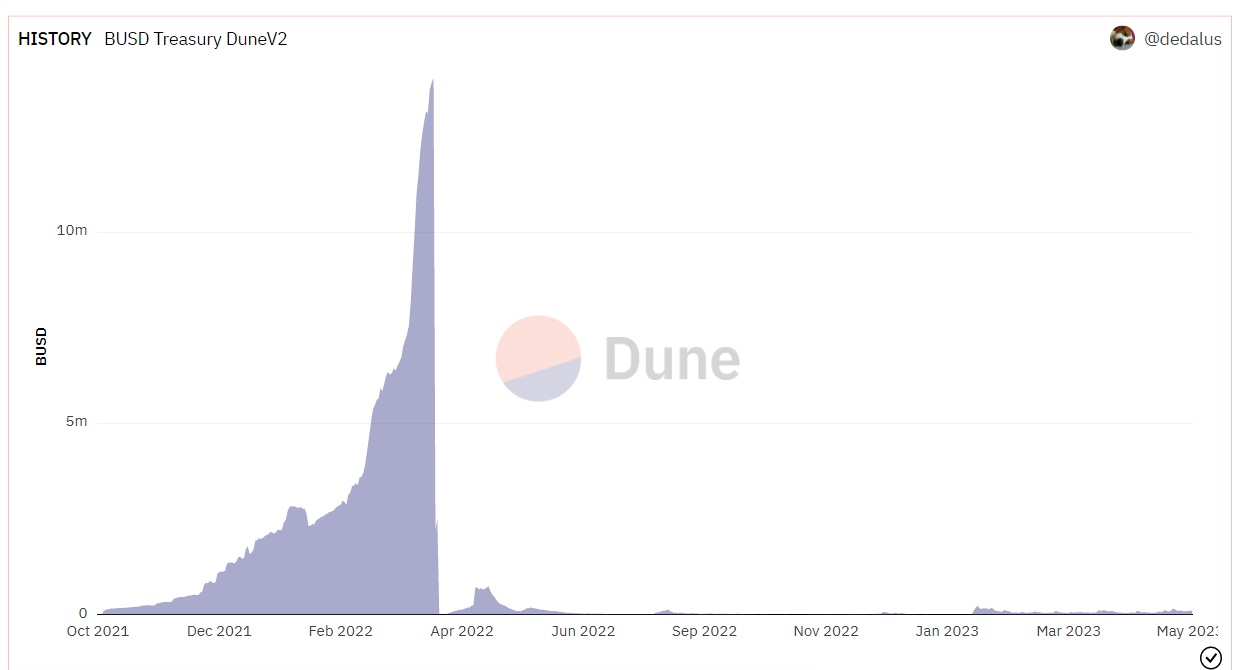

Trunk can basically be minted 1:1 for BUSD and in turn be paid out 1:1 for BUSD (redemption) the whole thing runs through a queue: That means I have to sit in a queue with my Trunk and wait until there is enough money for the redemption in the redemption pool. The idea behind this is that the treasury of Elephant - produces returns - and thus trunk can be paid out gradually.

Funnily enough I can give you some facts.

In the last 24h, a total of about 50 people were paid out worth a total of about 6000 BUSD. That was rather a good day often it is only 3-4000 BUSD.

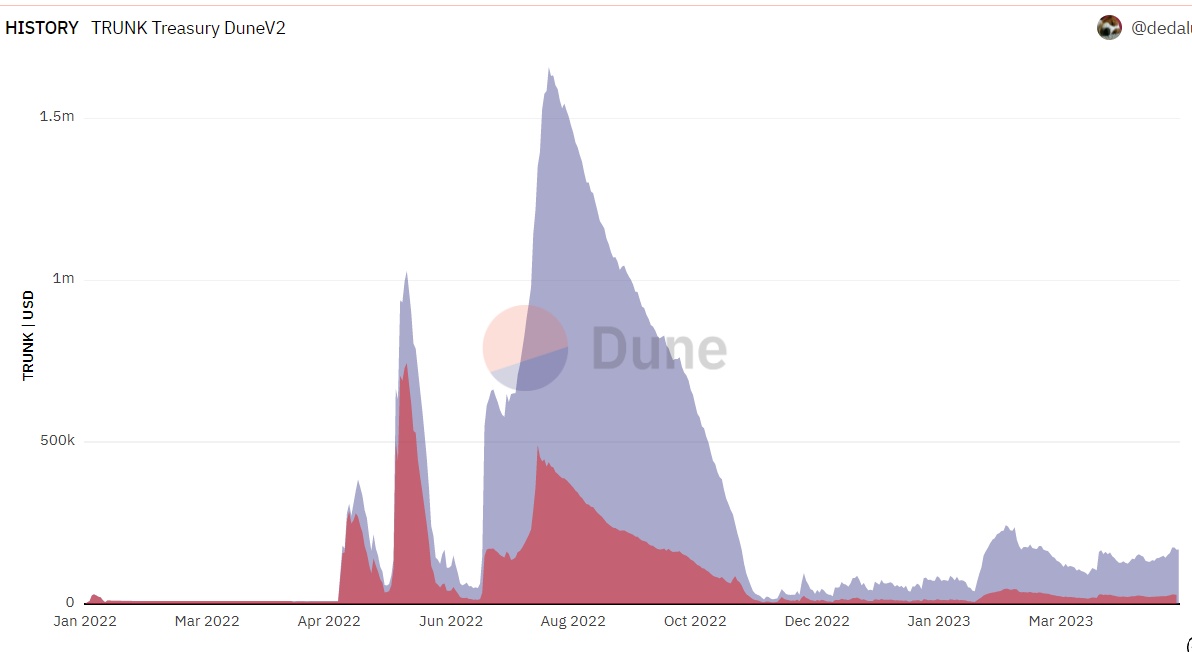

The total "Queue Value" so what is in the queue - has since 07.2022 from 1.3 million to about 1.7 million to date steadily increased. Also the wallets from 2300 to about 2700. You can see here quite clearly something is not running smoothly here in any case.

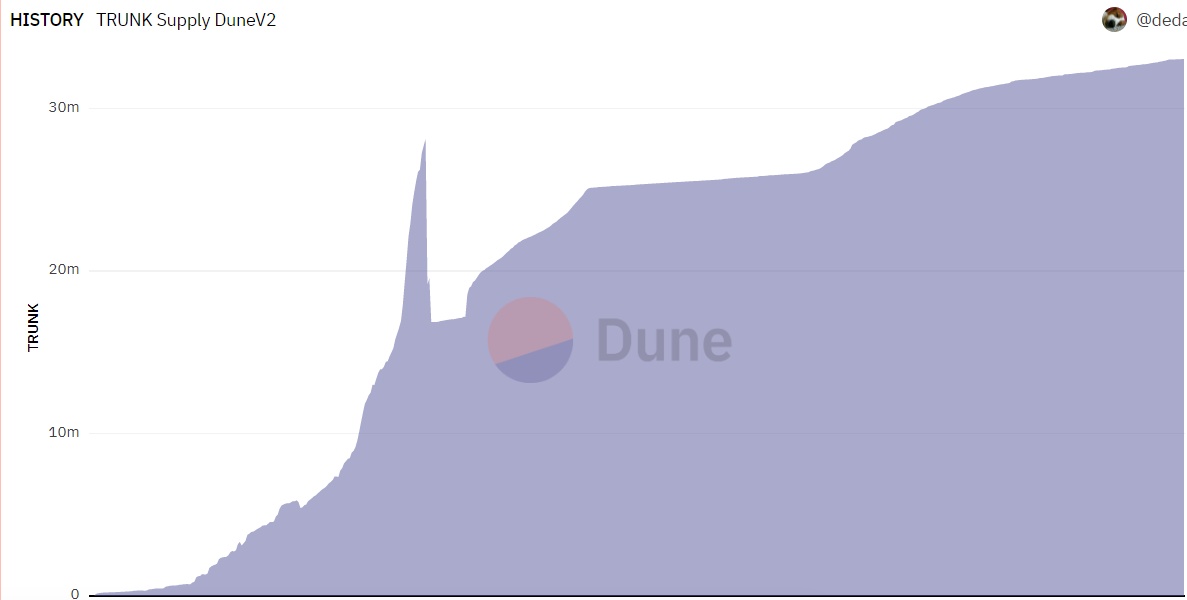

One must say that originally one could $Trunk also still for abnormally high APYs Staken that was abolished meanwhile. That means you have to pay out your $Trunk either in the queue or you do it on the public market on Pancake Swap and get meanwhile still fabulous 0.16$ per 1$ you originally paid.

The BUSD used to mine Trunk is in turn used to buy the protocol's own token "Elephant" again.

I think slowly there is a system here :) And now everyone should start to realize that here with endless back and forth movement of assets is trying to keep a bubble going to somehow get people to buy so that the bubble is running longer. I think we all know what this is for a system and I do not need to say it ;)

I could talk more about original uses of Trunk but they have been mostly discontinued. Probably because it just didn't work in the long run and only causes losses to the protocol.

Stampede

I don't feel like explaining this in detail but basically I pay $Trunk to get $Trunk. Currently about 31% APR which is of course again abnormally high and only ensures that more trunks are thrown into circulation and on the one hand the price on the public market drops and the redemption queue gets bigger.

So Conclusion -> Dirt

So then there is EMF:

Elephant Money Farms

In the farms you can again throw Trunk + AssetX (BNB,XRP,BTC,CAKE, etc.) into a pool and you can guess it slowly I think -> you get $Trunk for it. Currently APRs are around 20% p.a. and that too at something like USDT/Trunk. Now you can try to explain to me how/where the protocol with the USDT received here should generate the 20%. As far as I know there is no liquidity pool on Curve or elsewhere where you can get even close to 20% with very good borrow/lend/liquidity providing techniques in 3way stable pools. Therefore more trunk -> lower price -> higher queue.

Then there are Airdrops and Raffles. I deliberately leave them out because they are only there to keep people in the system as long as possible.

Attached are some screenshots of some stats.

Now again to you @ActionChris you can try to explain me in the comments how this prokoll should survive in the long run. I'll take it in advance that you can not, the APRs and everything that pays the protocol are so abnormally high that this simply can not work.

I find it an impertinence how you can promote such a project which is obviously more or less already almost faked here on Getquin.

Please inform first before you post something like this.

So if I am completely wrong here I am sorry and I apologize for my way of speaking. I have read through the whitepaper and looked a bit in the blockchain data more not because for me the project is already crap at first glance.

+ 1