+++Investing in the future: How India will dominate the global economy in 10 years! +++

India is emerging as one of the most exciting investment destinations in the world, with the potential to not only match but exceed the performance of the MSCI World Index. The country is on track to become the third largest economy by 2027, driven by robust economic growth, a young population and a business-friendly environment. With a current GDP of USD 3.417 trillion and an average population age of just 27 years, India's economy offers a fertile field for investors looking for long-term growth and diversification.

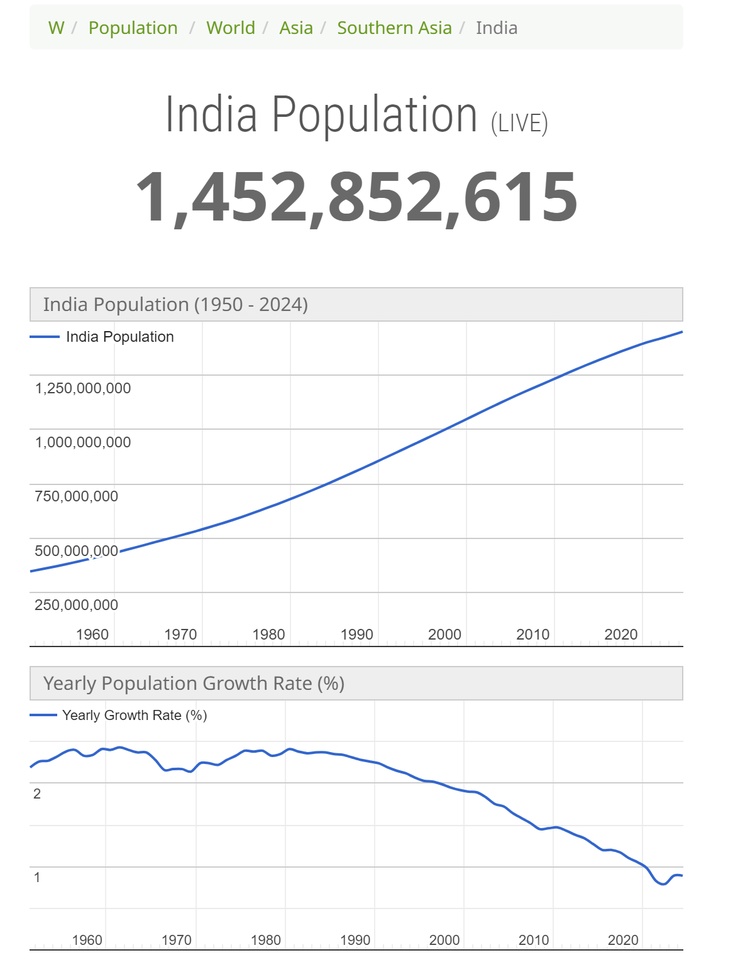

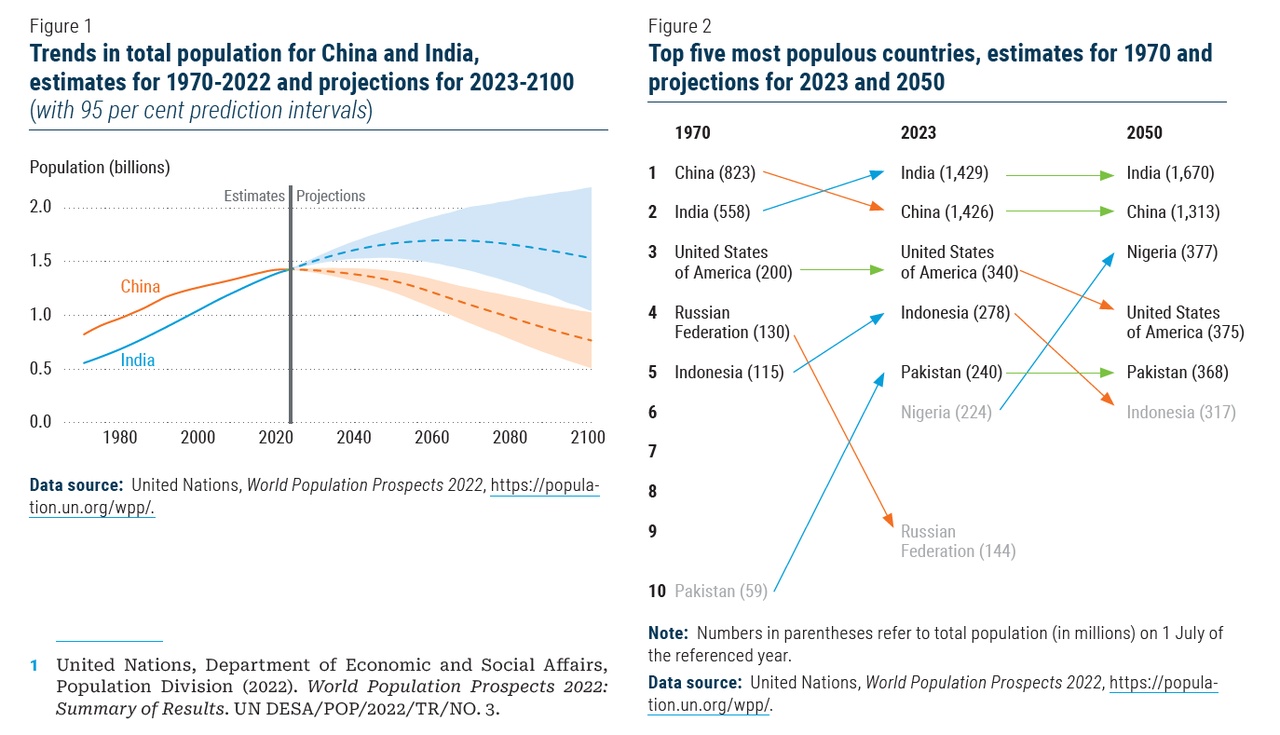

India's young population One of India's biggest advantages is its demographic profile. The country is home to approximately 1.452 billion people with an annual growth rate of 0.89%. By 2025, the population is expected to reach 1.67 billion, cementing India's position as the most populous country in the world. Of particular note is the young median age of 27, which will be a driver of the country's economic growth in the coming decades.

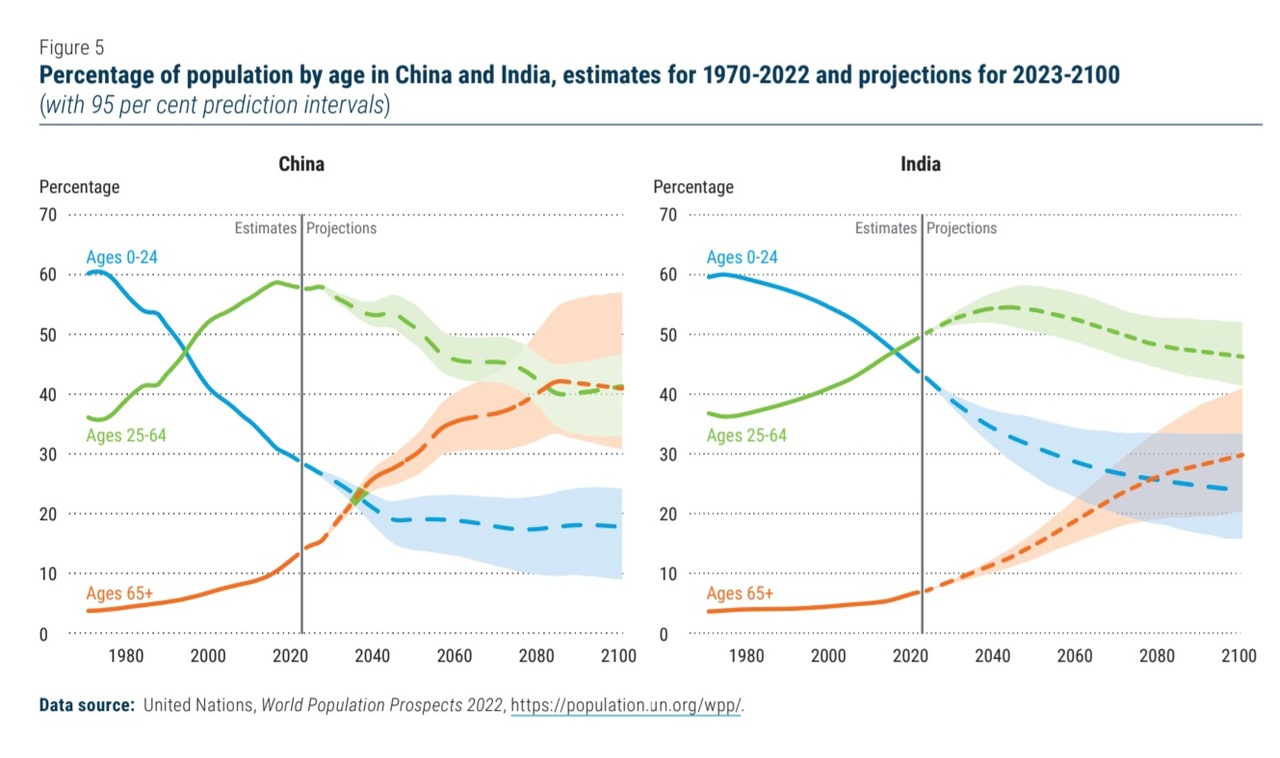

Unlike many developed countries where ageing populations pose a threat to economic sustainability, India's demographic bonus promises to boost economic development. As the working population expands, so does consumer demand in various sectors. A young workforce also means that the labor market remains dynamic and adaptable, providing the skills to sustain India's growth. By 2050, the expansion of the labor force is expected to mitigate potential social security burdens so that economic gains are not impacted by an aging population.

In addition, India's large population provides a significant domestic market that reduces the country's dependence on exports and protects it from global economic uncertainties. This internal consumption power makes India less vulnerable to external shocks in today's volatile global economy.

A bright future India's economic future looks promising, with major financial institutions forecasting unprecedented growth. Morgan Stanley predicts that India will overtake Japan and Germany to become the world's third largest economy by 2027, with GDP set to rise to USD 7.5 trillion. This transformation is not speculative, but based on solid economic fundamentals, government reforms and increasing investment in key sectors such as IT/ Infratstukur....

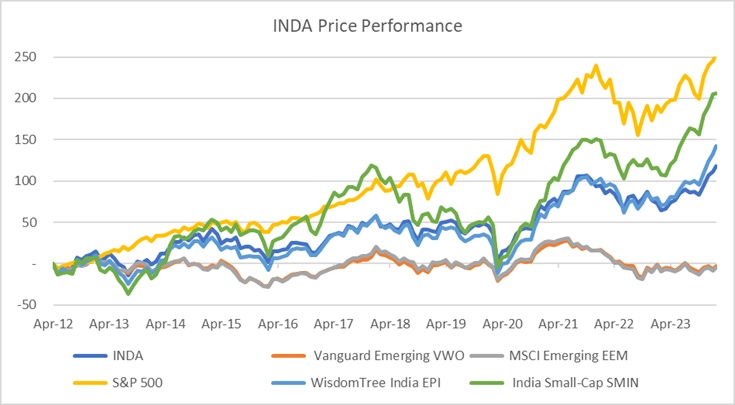

The Indian stock market is expected to reflect this economic growth, with annual returns of around 11% forecast. This strong growth potential, coupled with a relatively stable and transparent market environment, makes India a compelling destination for global investors. Growth is supported by favorable government policies, including tax reforms, labor market reforms and business improvement initiatives, all of which contribute to a more investor-friendly environment.

India's unique positioning Several strategic factors differentiate India from other emerging markets, particularly its regional neighbor China. While China dominated the emerging market for years, India is increasingly seen as an attractive alternative, offering a blend of economic growth and political stability that is hard to beat.

Technological advances and innovation India's strong economic growth is largely driven by its young population, which is driving technological innovation in various sectors. The country is making rapid progress in areas such as information technology, biotechnology and renewable energy. The Indian government is also focusing on building a digital economy to drive growth. Initiatives such as 'Digital India' aim to transform India into a digitally empowered society and create a favorable environment for technology startups.

India's thriving technology ecosystem is supported by a growing pool of skilled professionals. The country has a large pool of engineers, scientists and IT professionals who are making significant contributions to global technology companies. This talent pool is not just limited to the technology sector, but is also driving growth in other industries such as pharmaceuticals, automotive and manufacturing, making India a hub for innovation and technology.

Another crucial factor in India's growth story is the massive infrastructure development that is currently underway. The Indian government has launched an ambitious plan to modernize the country's infrastructure, including roads, railroads, ports and airports. This development is crucial to support industrial growth and ensure that the country can keep pace with its economic ambitions.

Infrastructure development is also crucial to India's urbanization process. As more and more people move to cities in search of better opportunities, the need for improved urban infrastructure increases. This includes not only physical infrastructure such as housing and transportation, but also digital infrastructure such as broadband connectivity and smart city technologies. The focus on infrastructure is expected to create millions of jobs, further fueling economic growth and making India an even more attractive destination for investors.

India's political stability and democratic governance are other key advantages for investors. Unlike China, which operates under an authoritarian regime, India is the world's largest democracy. This democratic system provides a level of transparency and stability that is often lacking in other emerging markets. Investors can rest assured that India has a long history of stable governments and peaceful transitions of power, which reduces the risk of sudden political changes that could negatively impact investments.

In addition, India's commitment to the rule of law and property rights further enhances its attractiveness as an investment destination. The country has a well-established legal system that protects the rights of investors and ensures that their investments are safe.

Decoupling from China In recent years, India has strategically positioned itself as a key player in the global economy and has increasingly decoupled itself from China. This decoupling is reflected in the significant relocation of global supply chains, with many companies moving their production facilities from China to India. The ongoing trade tensions between the US and China have accelerated this trend, with India emerging as the preferred destination for companies looking to diversify their supply chains.

India's attractiveness as a manufacturing hub is bolstered by its competitive labor costs, improving infrastructure and favorable government policies. The government has introduced several initiatives to attract foreign investment in the manufacturing sector, including the 'Make in India' campaign, which aims to make India a global manufacturing hub. These efforts are already beginning to bear fruit as several global giants, including Apple and Samsung, are expanding their manufacturing operations in India.

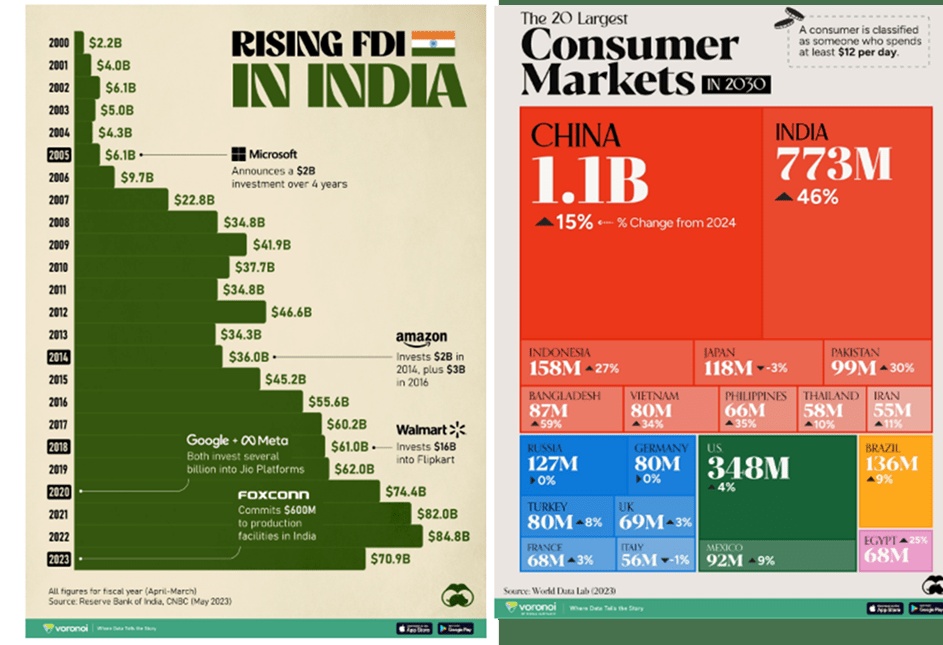

Foreign Direct Investment (FDI): Capital inflow Foreign Direct Investment (FDI) is a key driver of India's economic growth. Over the last two decades, India has witnessed a significant increase in FDI inflows, rising from USD 2.2 billion in 2000 to an impressive USD 70.9 billion in 2023. This increase in FDI is a testament to the growing confidence of global investors in India's economic prospects.

The technology sector has been a major beneficiary of this capital inflow as global technology giants have outsourced their operations to India and invested heavily in the country's technology ecosystem. The Indian government's proactive approach to creating an enabling environment for foreign investment, including the relaxation of FDI regulations in key sectors such as defense, retail and insurance, has contributed to this growth.

In addition, India's consumer market is also experiencing rapid growth, driven by rising incomes and a growing middle class. The consumer electronics market in particular is expanding faster than in China, making it an attractive destination for consumer-oriented investments. This growth is not limited to traditional sectors; emerging sectors such as e-commerce, fintech and renewable energy are also attracting significant FDI.

One notable aspect of India's global influence is the presence of its talent in leadership positions at some of the world's most prominent technology companies. Two of the largest and most influential companies, Microsoft and Alphabet, are currently led by Indian CEOs: Satya Nadella at Microsoft and Sundar Pichai at Alphabet (Google).

These leaders are examples of the immense technical expertise and management skills that have come from India. Their successful careers and leadership of such tech giants underline the quality of education and talent development in India. This shows how India is playing an important role in the technology industry not only nationally but also at a global level.

ETFs as a gateway For investors looking to participate in India's growth story, exchange-traded funds (ETFs) offer an accessible and diversified option. One of the most compelling India-focused ETFs is the Franklin FTSE India UCITS ETF. This ETF stands out for its low expense ratio of 0.19%, its sizable fund size of over USD 1 billion and a portfolio that reflects the broad spectrum of the Indian economy. $FLXI (-1,21 %)

The Franklin FTSE India UCITS ETF invests in key sectors that are essential to India's economic development, including banking, technology and infrastructure. Here are some of the key companies included in the ETF:

Reliance Industries: one of India's largest conglomerates with diversified interests in energy, petrochemicals, textiles, retail and telecom. Reliance Industries is a major player in the Indian economy and a pioneer in several sectors, including the digital economy through its subsidiary Jio Platforms. HDFC Bank: A leading private sector bank in India offering a wide range of banking and financial services. It is known for its strong financial performance, extensive branch network and innovative digital banking solutions. Infosys: A global leader in consulting, technology and outsourcing. Infosys is one of India's largest IT companies and plays a crucial role in promoting the country's IT and software exports. Tata Consultancy Services (TCS): TCS is a leading provider of IT services, consulting and business solutions. It is part of the Tata Group, one of India's largest and most respected conglomerates, and is a major contributor to the country's IT sector. Bharti Airtel: A telecom company offering mobile, broadband and enterprise services. Bharti Airtel is a major player in the Indian telecom industry and is present in several other countries in Asia and Africa.

A critical point of the ETF is the current TD of 3%, which is still negligible due to the duration of the fund!

I am invested in India by currently investing 1/3 of my savings plan amount in the Indian market (this amount will be reduced to 1/6 at a certain point)

What do you think of the Indian market?

👍 = Thanks for the post, but I'm not investing for now!

❤️ = Thanks for the post, I am or will be investing in India, or taking a closer look at India!

You can check out my YouTube video for more input/ and a soundtrack where I take a closer look at the Indian market : )

https://www.youtube.com/watch?v=qQl10uYNhgo&feature=youtu.be