---𝐀𝐤𝐭𝐢𝐞𝐧𝐯𝐨𝐫𝐬𝐭𝐞𝐥𝐥𝐮𝐧𝐠---

Neste Corp

FI0009013296

Neste specializes in the production of fuels. To this end, the company relies on its core areas of refining and marketing crude oil. The company operates refineries in Sweden, Finland, the Netherlands, Bahrain and Singapore. [1] The renewable energy sector accounts for a large share of this business. Neste is thus the world's largest producer of renewable diesel and sustainable aviation fuel (SAF) from waste and residue raw materials. Since the beginning of July, for example, the Group has been successfully supplying San Francisco International Airport with sustainably produced fuels by pipeline. The company recently announced that it is putting a billion-dollar investment into a joint venture with Marathon Petroleum, which would make Neste the world's first and only producer of renewable fuels with global capacity. [2]

"About us" as per homepage [3]:

"We are the world's largest producer of renewable jet fuel and renewable diesel, as well as renewable solutions in raw materials for the plastics and chemical industries.We are also driving the development of chemical recycling to address the problem of plastic waste. Our goal is to make our oil refinery in Porvoo, Finland, the most sustainable refinery in Europe by 2030. We rely on renewable and recycled materials, such as liquefied plastic waste, as raw materials for the refinery. The company operates production facilities in Finland, the Netherlands and Singapore. We aim to become the global market leader for renewable and recycled solutions. We are committed to helping our customers reduce their greenhouse gas emissions by at least 20 million tons per year by 2030."

Operating segments:

1) Renewable Products

2) Oil Products

3) Marketing & Services

4) Others

The main component in all segments is Fuels, which are subdivided as follows:

-Light distillates (motor gasoline,gasoline components, biopropane, renewable naphtha, LPG),

-Middle distillates (diesel, jet fuels, low sulphur marine fuels, heating oil, renewable fuels, renewable jet fuels and low carbon fuels)

-heavy fuel oil

The main sales drivers are "Middle distillates" (68%) and "Light distillates" (22%). "Heavy fuel oil now accounts for only a marginal share of sales.

𝘒𝘦𝘯𝘯𝘻𝘢𝘩𝘭𝘦𝘯:

-KGV 2021: 18.9 [4]

-KGV 2022e: 18.2 [4]

-KGV 2023e: 16.9 [4]

-PEG 2022e (P/E/growth rate): 18.2/10%= 1.82 (rule of thumb: < 1 = very favorable).

-PEG 2023e: 16.9/10% = 1.69

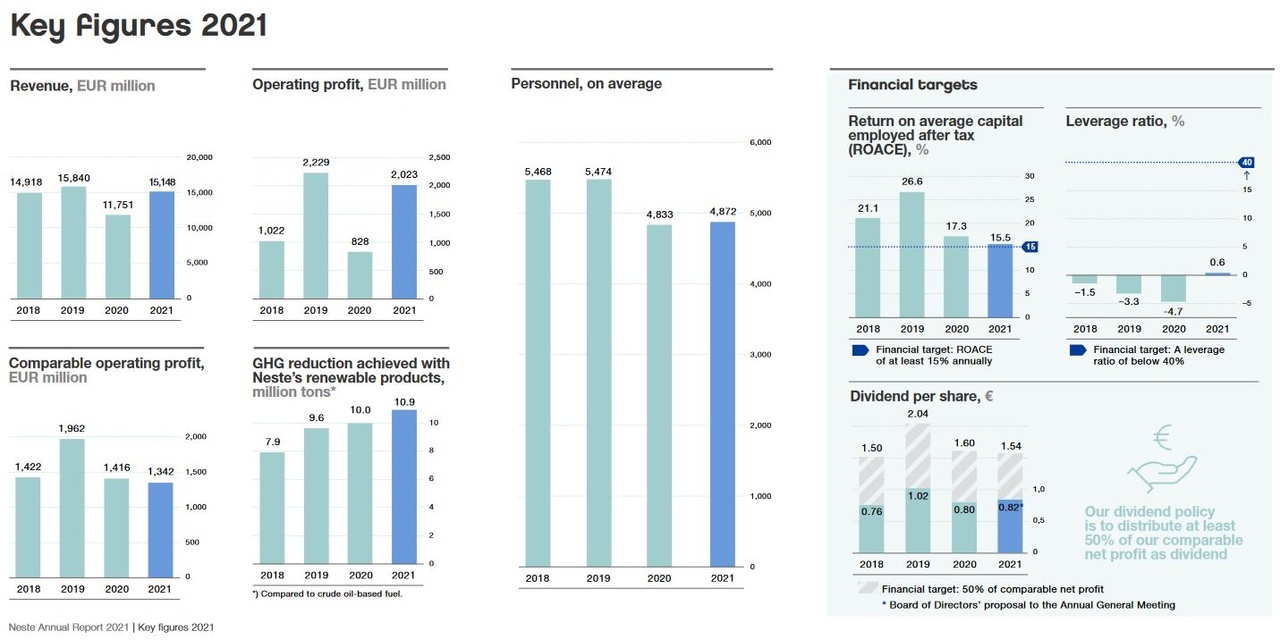

-Revenue growth: 2020 to 2021: 28.9% ; 2021 to 2022: 25.38%; 2022 to 2023: 9.7%; 2023 to 2024: 9.16%

-EBIT growth: 2020 to 2021 -5.3%; 2021 to 2022: 16.99% ; 2022 to 2023: 31.85% ; 2023 to 2024: 15.94%.

-EBIT growth on a 10-year average according to Traderfox: 21.87% [5]

-Dividend yield 2020: 1.81% [1]

Market Averages (EU - as of 05/01/2022):

-Aver. P/E Power: 16.99 [9]

-Aver. PEG Power: 1.71 [9]

-Aver. KGV Oil & Gas: 18.09 [9]

-Aver. PEG Oil & Gas: 0.25 [9] -->Assumption for strong growth!

DCF calculation (conservative)= €26.09

-Parameters: Free cash flow from GB; WACC 8%, Growth 10%, Perpetual Growth 4%.

DCF calculation (realistic)= € 32.95

-parameters: Free cash flow from GB; WACC 7.5%, Growth 12%, Perpetual Growth 4%

Current share price: €40.25

-->Neste seems slightly overvalued based on the DCF calculation and the industry standard P/E/PEGs. A price from about 35€ seems to me interesting again for a long-term entry.

𝘙𝘶𝘣𝘳𝘪𝘬 - 𝘞𝘢𝘴 𝘸ü𝘳𝘥𝘦 𝘉𝘶𝘧𝘧𝘦𝘵 𝘴𝘢𝘨𝘦𝘯 (data from Annual Report 2021 [6]):

Criteria to be read in detail: https://app.getquin.com/activity/XcuRrJwmyP

Income Statement:

-Sales/Administration. and other overhead: 2.6% of sales -->very positive!

-Gross margin: 18.57% -->negative! (Buffet's target: min. 40%)

-Net margin: 11.7% in 2021 (6% in 2020) -->negative! (Buffet's target: >20%)

-Interest expense: 2.7% of operating profit -->extremely positive, thus hardly any credit debt! (Buffet's target: <15%)

Balance Sheet:

-Treasury Shares: 1,242 shares (no significant share buyback programs).

-Debt < 4xEBIT: 0,18 Mrd. EUR; EBIT = 2,01 Mrd. EUR -->very positive!

-Goodwill: Intangible assets represent only a small portion of 4.15% of total assets. Goodwill is therefore negligible (very positive).

Goodwill contribution to further understanding: https://app.getquin.com/activity/ymidZwhlTk

Cash Flow Statement:

Investments: 83.59% of net income (Buffet's target: <50%) -->negative!

𝘒𝘦𝘺 𝘕𝘰𝘵𝘦𝘴:

Neste is very asset-intensive, which is why property, plant & equipment account for 41.5% of total assets. However, this is not particularly exceptional. At Neste, these are oil refineries, storage tanks and production facilities. For asset-intensive and project-driven companies, I therefore like to look at the development of inventories, in conjunction with sales. Both items should ideally grow together and continuously, which can indicate a good order situation. It should be mentioned, however, that due to the cyclical nature of the business, Corona had a significant impact on 2020 and 2021 sales. In addition, raw material prices can fluctuate strongly.

However, from 2017 to 2019, Neste had a very constant and positive development. However, 2020 was strongly influenced by Corona. In 2021, the market situation was able to relax again and so were Neste's sales. If they can continue the development from before 2020, I am very positive.

Turnover rate 2021: 6.81 (15,148/2,223.50)

Turnover rate 2020: 6.7 (11,751/1,753.50)

Inventory turnover rate 2019: 10.07 (15,840/ 1,572.50)

Turnover rate 2018: 9.84 (14,918/1,515)

Briefly on the inventory turnover rate: the inventory turnover rate (sales/average inventory level) tells us how often the company "turns over" its inventories within a year, or how often the inventory warehouse is "emptied", so to speak, in a year (even though in practice, of course, this happens on a rolling basis and the warehouse is never completely empty - hopefully).

Figures in EUR million

Sales 2021: 15,148

Sales 2020: 11,751

Sales 2019: 15,840

Sales 2018: 14,918

Sales 2017: 13,217

Inventories 2021: 2,618

Inventories 2020: 1,829

Inventories 2019: 1,678

Inventories 2018: 1,467

Inventories 2017: 1,563

𝘉𝘶𝘳𝘨𝘨𝘳𝘢𝘣𝘦𝘯:

The moat is difficult to interpret. As the world's first and only producer of renewable fuels with global capacity, one certainly has a certain market and power position. In addition, one is very broadly positioned with the markets of Scandinavia as well as Bahrain, Singapore and, in the future, the USA. The financial situation allows for further expansion and borrowing. Not surprising is the low margin for investment-intensive companies, so I am less concerned here, even if Buffet would like to have more ;).

𝘜𝘯𝘵𝘦𝘳𝘯𝘦𝘩𝘮𝘦𝘯𝘴𝘦𝘪𝘯𝘰𝘳𝘥𝘯𝘶𝘯𝘨 𝘯𝘢𝘤𝘩 𝘗𝘦𝘵𝘦𝘳 𝘓𝘺𝘯𝘤𝘩 [7]:

This is where I have a very hard time. Historically, I have used 10% growth to calculate the PEG ratio. This is also justified by the fact that we had two positive spikes in 2019 and 2021, which drive the average growth up but were just spikes. 2020 was an extraordinary year, which also negatively impacted Neste through Corona. I am therefore a bit more conservative and place them in the Stalwart ("Steady" -average growth of 10-12% ) and Cyclical range, as they are dependent on commodity prices.

𝘗𝘦𝘦𝘳 𝘎𝘳𝘰𝘶𝘱/𝘒𝘰𝘯𝘬𝘶𝘳𝘳𝘦𝘯𝘻:

Verbio -->see also my brief stock introduction: https://app.getquin.com/activity/dkMFQUVGgg?lang=de&utm_source=sharing

Key Facts about Verbio:

-Gross margin ca 25% (better than Neste).

-Nettomarge ca. 10,6% (similar, in the range of Verbio)

-Debt (no winner, both are hardly indebted)

-Sales/EBIT growth (EBIT 30.71% p.a. in the last 10 years; sales growth 3.13% p.a. in the last 10 years) -->comparison difficult. However, it should be mentioned that Verbio is less cyclical and more continuous in its development.

-KGV 2022e: 23.4

-KGV 2023e: 28.4

Market situation Verbio: Verbio suffered heavy share price losses in recent days. This is mainly due to the planned limitation of biofuel by the German government. Due to the focus on the German market, this has a particular impact on Verbio.

In addition to Verbio, there are a number of companies in the oil and gas business. However, Verbio in particular has taken up the renewable energy sector in a comparable way. Ultimately, however, the competition could be expanded at will. Classic commodity stocks such as Shell or BP should also be mentioned.

BP, for example, wants to cut its oil and gas production by 40 percent by 2030 (measured against the level of 2019) and at the same time expand its business with renewable energies. Increased "low-carbon" investments are planned, such as in electric vehicle charging stations, hydrogen, and bioenergy, including biofuels, biogas, and sustainable aviation fuel. [8] This would make it a direct competitor of Neste!

𝘍𝘢𝘻𝘪𝘵:

Neste is a very exciting company with interesting business areas. Verbio, as the German counterpart, is in my opinion slightly better positioned financially. However, Verbio serves only part of Neste's segments. Neste is thus more broadly diversified and a somewhat bigger "fish." Especially the market of biofuels for airlines is exciting for me and allows growth fantasies. However, one should take into account that well-known oil and gas giants invest in similar business areas in the long term. The advantage of Neste, however, is that they do not have to invest first but are already fully in the business and did not have to expand this industry out of pure diversification or public pressure. Perhaps this will result in interesting M&A transactions in the long run. Valuation-wise, I see Neste a bit too expensive right now. A price <35€ seems interesting to me for an entry, with a long-term strategy.

As usual, you can also find my collected analyses under the following link:

https://app.getquin.com/activity/YyIXcpDduz?lang=de&utm_source=sharing

As always, no investment advice!

Sources:

[1] https://traderfox.de/aktien/1753682-neste-corp

[2] https://aktien-mag.de/aktien/FI0009013296/neste-corp/seite-1/

[3] https://www.neste.de/ueber-neste/wer-wir-sind/unternehmenszweck

[4] https://de.marketscreener.com/kurs/aktie/NESTE-OYJ-1412495/fundamentals/

[5] https://aktie.traderfox.com/visualizations/FI0009013296/EI/neste-corp

[6]https://www.neste.com/sites/neste.com/files/attachments/corporate/investors/corporate_governance/neste_annual_report_2021.pdf

[7] https://diyinvestor.de/peter-lynch-6-kategorien-fuer-die-einordnung-von-unternehmen/

[9] https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datacurrent.html

[10] https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/Betas.html

[11] https://ycharts.com/indicators/10_year_treasury_rate

Graphs Source:

Company homepage:

Share presentation at the request of @HB