Oh Oh... I just read the news that the NASDQ 100 is to be rebalanced because the "Magnificent Seven", ie. $MSFT (+1,29 %), $AAPL (-0,52 %), $NVDA (+0,44 %), $AMZN (+0,27 %), $TSLA (-0,12 %), $META (-0,22 %) and $GOOGL (+0,23 %) currently account for over 50% of the NASDAQ 100.

The 7 largest companies in the NASDAQ 100 have had really impressive earnings this year, resulting in overrepresentation in the index. To adjust this, a special rebalancing will be made, which has only happened twice in the history of the NASDAQ 100.

The rebalancing is scheduled to take place on July 24. It will likely result in the weighting of the 5 largest companies by market capitalization (i.e. Microsoft, Apple, NVIDIA, Google, Amazon and) being reduced from 46.7% to 38.5%.

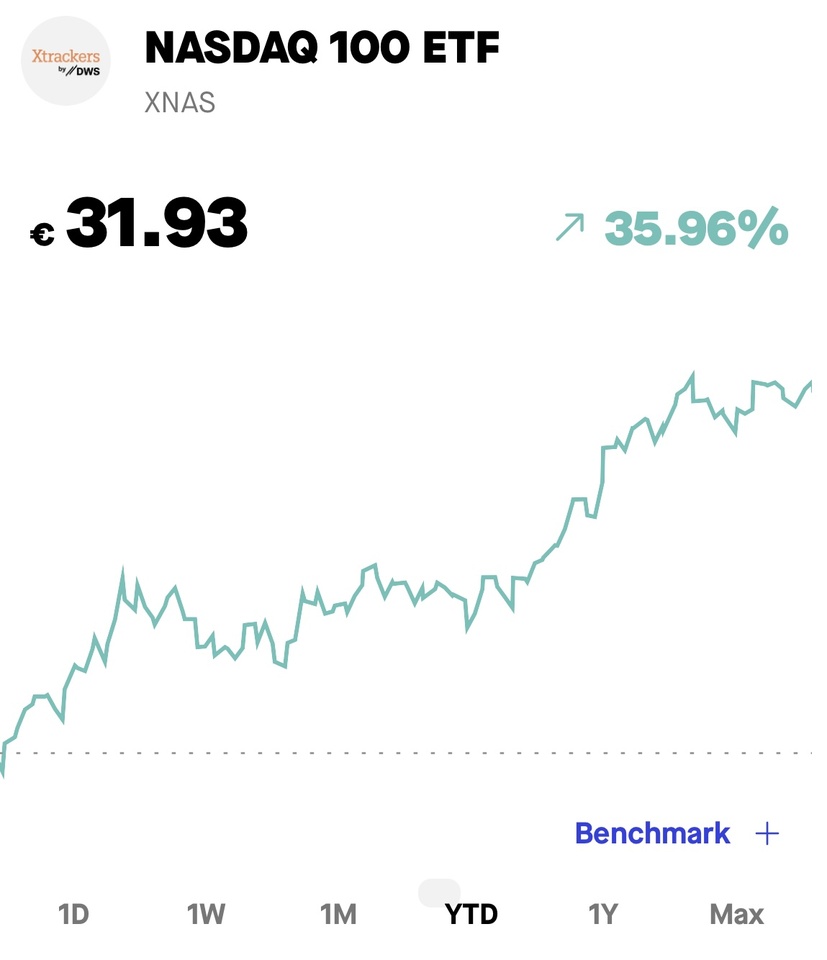

I invested in the NASDAQ 100 late last year and have been very pleased with its performance so far. Since the beginning of the year: +36%! 📈🎉 However, I must admit that I am a bit worried that the upcoming rebalancing might affect my performance. On the other hand, of course I understand why the index should be reweighted. Currently, the first 7 positions in the index already account for 51.56 percent. That is quite a statement.

Have you invested in the $XNAS (+0,12 %) and what do you think about the planned rebalancing of the index? Do you think that this will influence the performance of the index?