$KDP (-0,8 %)

$7751 (+1,12 %)

$NXPI (-0,53 %)

$WM (-0,38 %)

$CDNS (+2,6 %)

$BN (-0,69 %)

$SOFI (+2,85 %)

$UNH (+1,21 %)

$AMT (+0,49 %)

$UPS (+0,01 %)

$BNP (-0,15 %)

$NVS (-0,66 %)

$DB1 (+1,44 %)

$MSCI (+0,6 %)

$ENPH (+1,79 %)

$BKNG (+0,72 %)

$LOGN (-0,21 %)

$V (+0,08 %)

$MDLZ (-0,67 %)

$PYPL (+0,12 %)

$000660

$MBG (+0,47 %)

$BAS (-0,06 %)

$UBSG (-0,56 %)

$SAN (-0,23 %)

$CVS (+0,54 %)

$OTLY (+4,46 %)

$GSK (-3,24 %)

$ETSY (+0,17 %)

$CAT (+0,5 %)

$KHC (-0,32 %)

$ADYEN (+0,77 %)

$ADS (-1,01 %)

$AIR (+0,19 %)

$SBUX (+0,83 %)

$CMG (-1,83 %)

$META (+0,46 %)

$KLAC (+1,14 %)

$MELI (+0,32 %)

$WOLF (-1,18 %)

$GOOGL (+1,8 %)

$EQIX (+0,56 %)

$MSFT (+0,63 %)

$CVNA (+3,03 %)

$EBAY (+1,83 %)

$005930

$6752 (+1,71 %)

$KOG (+0,61 %)

$VOW3 (+0,96 %)

$GLE (-0,41 %)

$LHA (-1,03 %)

$STLAM (+1,15 %)

$SPGI (+1,54 %)

$MA (-0,34 %)

$PUM (+0,48 %)

$AIXA (+1,18 %)

$FSLR (+4,46 %)

$AAPL (+1,23 %)

$REDDIT (+2 %)

$AMZN (+1,56 %)

$NET (+0,22 %)

$MSTR (+1,82 %)

$GDDY (-0,88 %)

$TWLO (+1,38 %)

$COIN (+9,84 %)

$066570

$CL (-0,97 %)

$ABBV (-0,1 %)

$XOM (-0,4 %)

Discussion sur V

Postes

365Quarterly figures 27.10-31.10.25

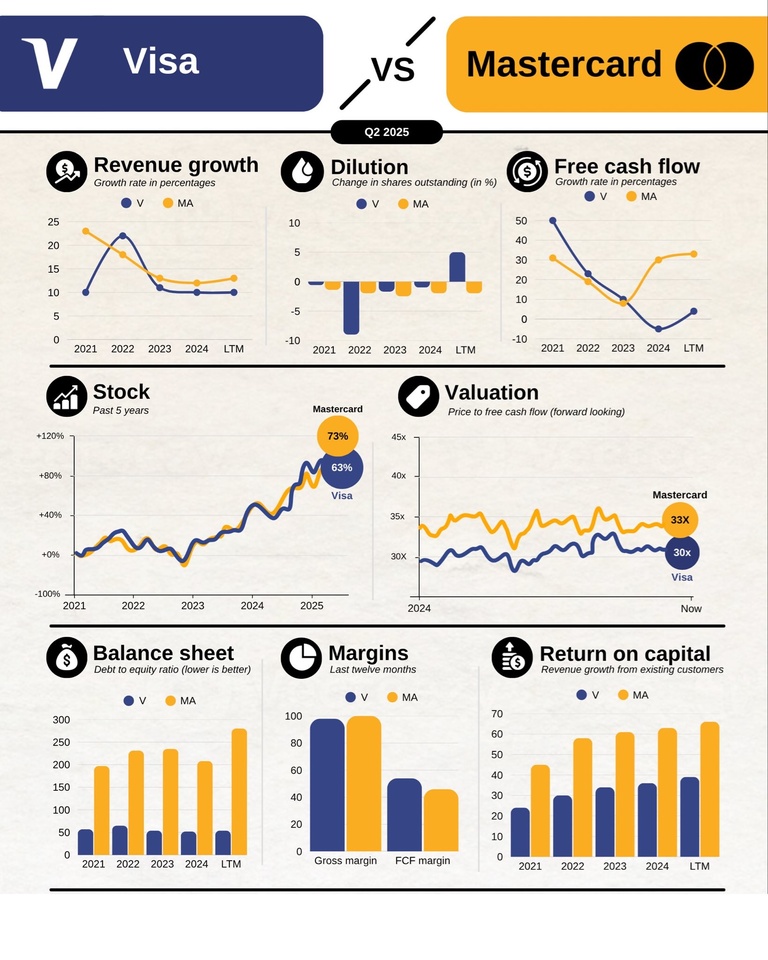

VISA vs MASTERCARD

Both $V (+0,08 %)

visas and $MA (-0,34 %)

Mastercard will publish their quarterly figures next week - and from a fundamental point of view, the two payment payment giants are still in a really close race.

Visa - strong profits, strong margins

Visa really delivered in the last quarter really delivered:

Sales increased by 14 % to 10.2 billion US dollarsearnings per share rose by as much as 23 % to 2.98 US dollars.

The transaction volume also looks good - up up 8 % worldwidedriven primarily by strong foreign sales.

With a gross margin of almost 98 % and a return on equity of around 52 % Visa is one of the most efficient companies in the fintech sector.

In addition, it has an extremely solid balance sheet - debt-to-equity just 0,07 - and a moderate P/E ratio of around 31.

In short: Visa is operationally well positioned and remains one of the most stable fintech stocks on the market.

Mastercard - solid growth, but more expensive valuation

Mastercard publishes on October 30 analysts expect EPS of 4.30 US dollarsi.e. around +10,5 % compared to the previous year, with sales of 8.5 billion US dollarsalso +14 % YoY.

The free cash flow is with 13.6 billion US dollars in 2024 is also strong.

But - the share is valued significantly higher:

P/E ratio around 40 and a higher debt with a debt-to-equity of 0,34.

Nevertheless, Mastercard scores with global presence in over 210 countries and pure innovation - for example with biometric security and contactless payment.

Many analysts remain bullishwith an average price target of 652 US dollars and a rating of "Strong Buy"

Comparison & Conclusion

Key figure: Visa (V) vs Mastercard (MA) :Sales growth (YoY), FCF (YoY) etc

In a nutshell:

Visa convinces with stability, high profitability and a defensive valuation - ideal for long-term investors.

Mastercard offers slightly more growthbut at a higher price and with slightly higher risk.

Both clearly benefit from the megatrend of digital payments - but in the current environment with high cost pressure and increasing regulation seems Visa is fundamentally somewhat better positioned.

My Youtube channel for more stock analysis: www.youtube.com/@Verstehdieaktie

I'm staying loyal to Visa and plan to place my first tranche this year. Maybe I'll be lucky and get a rate under 280€

Milestone reached: €10,000 in the custody account 🎉

Today, my portfolio broke through the €10,000 mark for the first time.

I've been active on the stock market since the end of 2022, i.e. since the start of my training.

I'm really glad that I started looking into investing back then.

Not only do I enjoy it, but it has also completely changed the way I deal with money and my view of wealth accumulation. 📈

Of course, not everything went perfectly at the beginning.

I often swapped back and forth, sold or bought shares due to short-term fluctuations and sometimes just traded on instinct.

As a result, I also had quite high fees in the first year.

But I learned a lot from that.

I now have a clear strategy that suits me well:

Buy & Hold invest for the long term and give companies time.

Here are two more suitable quotes:

As Buffett said: "Our favorite holding period is forever."

Or as Graham said: "In the short run, the market is a voting machine, but in the long run, it is a weighing machine."

My savings plans:

ETF:

- Vanguard FTSE All-World ($VWRL (+0,41 %) )

- Fidelity Global Quality Income ($FGEQ (+0,75 %) )

- iShares Physical Gold ($IGLN (-0,64 %) )

Equities:

- Microsoft ($MSFT (+0,63 %) )

- Apple ($AAPL (+1,23 %) )

- Visa ($V (+0,08 %) )

- Coca-Cola ($KO (-0,37 %)

Alliance ($ALV (+0,33 %) )- Realty Income ($O (-0,39 %) )

Crypto (small share):

- Bitcoin ($BTC (+0,93 %)

Ethereum ($ETH (+1,78 %) )

I am very happy about this first milestone and will stay on the ball. 🚀

After everything that's happening on the stock market, it's quite possible that my portfolio value will soon fall below €10,000 again. But that's just part of it. 📉

💰Milestone reached: 300k 2,5 years in.

I started out testing a lot of different strategies, but about 1.5 years ago I decided to fully commit to dividend growth investing — and it’s been the best decision so far.

Sticking to quality companies, buying the dips when others sold out, and focusing on long-term compounding really paid off earlier this year 💪🏻

The journey continues — slow, steady, and growing every month 📈

Right now focus is on : $HSY (-1,22 %) , $NOVO B (+0,13 %)

$UNH (+1,21 %) to get yield in a good range.

I am Considering buying more of $V (+0,08 %)

📊 Market Update (October 21, 2025)

🇺🇸 USA

$SPX500 — Futures indicate a slight decline, showing loss of momentum after yesterday's rally, driven by negative tech futures.

$DJ30 — Down slightly, affected by the cautious sentiment and renewed Dollar strength.

$NSDQ100 — Under pressure, the tech rally has faded, leading to pre-market weakness.

💻 Tech & Growth Snapshot

$NVDA (+2,31 %) — Down slightly (-0.10%), the chipmaker stock is struggling to hold onto yesterday's gains.

$GOOGL (+1,8 %) — Down (-0.44%), aligning with the cautious sentiment in the tech sector.

$AVGO (+1,78 %) — Up slightly (0.09%), showing resilience in the semiconductor space.

$META (+0,46 %) — Down slightly (-0.02%), the Communication Services sector is mixed.

$MSFT (+0,63 %) — Up slightly (0.02%), the stock is essentially flat.

$QBTS (+3,39 %) — Down (-0.53%), the quantum sector is actively correcting.

$RGTI (+3,78 %) — Down (-0.51%), in line with the broader *new techcorrection.

$TSM (+1,4 %) — Up (0.80%), showing strong resilience and helping to support the chip sector.

$RR. (+1,01 %) — Down slightly (-0.06%), the Industrial/Aerospace stock is mixed.

🛍️ Retail & Commerce

$AMZN (+1,56 %) — Up slightly (0.06%), essentially flat, following the mixed tech trend.

$BABA (+1,49 %) — Down (-1.99%), experiencing a clear drop, reflecting heavy selling in Chinese stocks.

$CVNA (+3,03 %) — Down slightly (-0.06%), losing ground.

$SHOP (+3,64 %) — Down (-0.64%), retail tech is under pressure.

⚕️ Health & Pharmaceutical

$LLY (+0,54 %) — Up slightly (0.01%), holding up better than the general market.

$HIMS (+1,27 %) — Stable (0.00%), in line with the cautious mood.

$INSM (-0,36 %) — Stable (0.00%), the biotech sector is mixed.

🇪🇺 Europe & Industrials

STOXX 600 — Opening solidly up, exceeding initial caution (resilience driven by defensive sectors).

GER40 — Up, showing resilience.

$LDO (-0,99 %) — Up slightly (0.38%), the defense sector is stable.

$IBE (+0,41 %) — Up (0.53%), the utilities sector is in the green, showing defensive appeal.

$OKLO — Down (-0.56%), the new tech stock is experiencing profit-taking.

🏦 Banking & Finance

$UCG (-2 %) — Up slightly (0.13%), Italian banks are mixed.

$ISP (-0,36 %) — Up slightly (0.16%), showing a modest gain.

$BAMI (+0 %)

$CE (-0,45 %) , $BPE (+1,74 %) — BPER Banca ($BPE.MI$) is in a massive rally (6.55%), strongly counter-trending the sector; $CE.MI$ is up $1.36\%$.

$BBVA (-0,12 %) — Down (-0.81%), showing clear pressure and vulnerability today.

$AXP (+0,56 %) — Down (-0.26%), ahead of today's earnings report.

$V (+0,08 %) — Down (-0.19%), following cautious sentiment in the payments sector.

$CS (+0,17 %) — Up slightly (0.15%), the financial services sector is mixed.

🌏 Asia

$JPN225 — Close in a solid gain, with the Nikkei hitting $50,000$.

$KOSPI — Close mixed/stable, Korean tech holds up.

$HK50 — Up, the index is recovering.

$CHINA50 — Up, tracking positive global sentiment.

💱 Forex

$EURUSD — Down, the Euro loses ground as the Dollar recovers.

$GBPUSD — Down, the Pound is under pressure.

$USDJPY — Solidly up, the Yen is falling as the Dollar makes a strong recovery.

$DXY — The Dollar Index is moving sharply higher, breaking the risk-on sentiment.

💎 Commodities & Precious Metals

$GLD (-0,34 %) — Stable (0.00%), gold is pausing after yesterday's correction.

$CDE (-1,6 %) — Stable (0.00%), following the gold correction.

$BRENT — Down slightly, oil drops to a 5-month low.

$WTI — Losing ground, in line with Brent.

💰 Crypto

$BTC (+0,93 %) — Down, crypto is undergoing a significant correction.

$ETH (+1,78 %) — Down, following Bitcoin.

$TRX (-1,64 %) — Down, the altcoin sector is negative.

$CRO (+1,07 %) — Down, in line with overall negative sentiment.

🚀 Space & New Tech

$RKLB (+1,36 %) — Up (2.75%), strong counter-trend move in high-beta growth stocks.

🔎 Deep Dive: The Market Divergence

The key theme today is divergence. US indices futures are soft, but specific European stocks are surging (BPER Banca is up over $6\%$) in a massive counter-trend move, highlighting local corporate strength despite global caution. The New Tech sector is mixed: $TSM$ is surprisingly up, while $NVDA$ is slightly down. The Dollar ($DXY$) continues its strength, penalizing risk assets like Bitcoin ($BTC$), while Utilities ($IBE.MC$) and specific banks demonstrate insulation. Today is a major test with $NFLX and $LMT reporting.

For daily real-time market insights, *deep dives*, and trading discussions, follow me on X: https://x.com/ThomasVioli

To copy my portfolio, strategies, and complete trade insights, you can follow me on eToro: https://www.etoro.com/people/farlys

⚠️ Disclaimer: Past performance is not indicative of future results. Investing involves risks, including the loss of capital.

📊 Market Update (October 20, 2025)

🇺🇸 USA

$SPX500 — Futures indicate a decisive surge, with the market attempting to recover losses from last week's banking sell-off.

$DJ30 — Futures in a solid rise, showing generalized risk-on sentiment.

$NSDQ100 — Futures are strongly up, with tech leading the market rebound.

💻 Tech & Growth Snapshot

$NVDA (+2,31 %) — Up (0.55%), the stock is leading the semiconductor sector, confirming strong AI demand.

$GOOGL (+1,8 %) — Up (0.19%), the stock joins the positive Nasdaq trend.

$AVGO (+1,78 %) — Up (0.53%), the semiconductor sector benefits from renewed optimism.

$META (+0,46 %) — Up (0.48%), showing a strong recovery after recent weakness.

$MSFT (+0,63 %) — Up (0.36%), the stock regains momentum with positive sentiment.

$QBTS (+3,39 %) — Strongly up, quantum computing sentiment has turned positive amid the tech rebound.

$RGTI (+3,78 %) — Up sharply (3.08%), the quantum sector actively participates in the risk-on move.

$TSM (+1,4 %) — Up sharply (2.43%), boosted by optimism in the semiconductor sector.

🛍️ Retail & Commerce

$AMZN (+1,56 %) — Up (0.80%), strong pre-market recovery, led by tech.

$BABA (+1,49 %) — Down (-0.57%), counter-trending Western tech, affected by Asian uncertainties.

$CVNA (+3,03 %) — Up (0.57%), the stock gains ground following the broader market trend.

$SHOP (+3,64 %) — Solidly up, retail tech is driven by the general risk-on mood.

⚕️ Health & Pharmaceutical

$LLY (+0,54 %) — Up, tracking the general market rebound.

$HIMS (+1,27 %) — Stable (0.00%), the stock is steady after last week's volatility.

$INSM (-0,36 %) — Stable (0.00%), the biotech sector cautiously joins the rally.

🇪🇺 Europe

STOXX 600 — Opening solidly up, in line with global optimism.

GER40 — Decisively higher, the German market regains momentum.

$LDO (-0,99 %) — Stable (0.00%), the defense sector is neutral in this rebound phase.

$$IBE (+0,41 %) — Stable (0.00%), utilities are static in a risk-on environment.

$OKLO — Up sharply (1.73%), advanced nuclear technology continues its positive trend.

🏦 Banking & Finance

$$UCG (-2 %) — Stable (0.00%), Italian banks are trying to establish a base after heavy selling.

$$ISP (-0,36 %) — Stable (0.00%), awaiting clearer signals.

$$BAMI (+0 %) , $CE (-0,45 %) , $BPE (+1,74 %) — Stable (0.00%), the financial sector shows caution despite the risk-on trend.

$$BBVA (-0,12 %) — Stable (0.00%), the Spanish stock is leading the European banking recovery.

$AXP (+0,56 %) — Up (0.59%), the payments sector participates in the rebound.

$V (+0,08 %) — Up (0.07%), confirming its positive tone.

🌏 Asia

$JPN225 — Close in a solid rise, led by optimism in tech markets.

$KOSPI — Close up, Korean tech drives the index.

$HK50 — Up, tech stocks recover despite BABA's uncertainties.

$CHINA50 — Up, following positive global sentiment.

💱 Forex

$EURUSD — Up, the Dollar is losing momentum in a risk-on phase.

$GBPUSD — Up, the market positively assesses prospects for a stronger economy.

$USDJPY — Down, the Yen is gaining ground.

$DXY — The Dollar Index is showing clear weakness.

💎 Commodities & Precious Metals

$GLD (-0,34 %) — Down slightly (0.00%), gold consolidates as investors shift to riskier assets.

$CDE (-1,6 %) — Stable (0.00%), tracking the flat movement of gold.

$BRENT — Up, showing signs of demand recovery.

$WTI — Gaining ground, reflecting positive macroeconomic sentiment.

📈 Benchmark ETFs

$VOO (+0,68 %) — Tracking $SPX500$ futures higher.

$VGT (+1,34 %) — Up (0.00%), reflecting the strength of the technology sector.

$$CSNDX (+0,82 %) — Up (0.00%), tracking Nasdaq futures in positive territory.

$BND (-0,02 %) — Down (0.00%), reflecting rising yields.

💰 Crypto

$BTC (+0,93 %) — Strong recovery, the crypto sector bounces off the bottom and gains ground.

$ETH (+1,78 %) — Solidly up, following Bitcoin.

$TRX (+0,33 %) — Up (0.00%), the altcoin sector participates in the rally.

$CRO (+1,07 %) — Up, in line with overall positive sentiment.

🚀 Space & New Tech

$RKLB (+1,36 %) — Up, sentiment for growth stocks suggests a rebound.

🔎 Deep Dive: The Return of Risk-On

The week opens with a decisive "Risk-On" mood. Markets are clearly shrugging off (for now) last week's banking tensions, focusing instead on tech-led growth ($NVDA, $TSM$) and hopes for monetary easing. The strong rally in cryptocurrencies ($BTC, $ETH$) and the weakness of the Dollar ($DXY$) are clear indicators that liquidity is flowing back into riskier assets. European banks ($BBVA.MC$) and the semiconductor sector show unexpected strength, while gold ($GLD$) pauses, confirming the shift in focus from systemic risk to growth opportunities.

For daily real-time market insights, deep dives, and trading discussions, follow me on X: https://x.com/ThomasVioli

To copy my portfolio, strategies, and complete trade insights, you can follow me on eToro: https://www.etoro.com/people/farlys

⚠️ Disclaimer: Past performance is not indicative of future results. Investing involves risks, including the loss of capital.

📊 Market Update (October 17, 2025)

🇺🇸 USA

$SPX500 — Futures are moving in a decisive drop, indicating a strong negative open due to renewed regional bank stress.

$DJ30 — Futures in a sharp decline, dragged down by financial and cyclical stocks.

$NSDQ100 — Futures are markedly lower, with weakness in tech stocks solidifying.

💻 Tech & Growth Snapshot

$NVDA (+2,31 %) — Up in pre-market, holding strong against the general weakness thanks to robust AI demand.

$GOOGL (+1,83 %) — Under strong pressure, aligned with the overall Nasdaq decline.

$AVGO (+1,78 %) — Aggressive profit-taking in the semiconductor sector.

$META (+0,46 %) — Stable in pre-market, showing relative strength against its peers.

$MSFT (+0,63 %) — Slight dip, following the market's bearish trend.

$QBTS (+3,39 %) — Down again, volatility remains extreme in this sector.

$RGTI (+3,78 %) — Down, the quantum computing sector is highly sensitive to the risk-off mood.

🛍️ Retail & Commerce

$AMZN (+1,56 %) — Down in pre-market, negative sentiment weighs on consumer confidence.

$BABA (+1,49 %) — Stable, counter-trending thanks to Asian positive sentiment.

$CVNA (+3,03 %) — Down, the stock struggles to find a stable support base.

$SHOP (+3,64 %) — Correcting some of its recent gains.

⚕️ Health & Pharmaceutical

$LLY (+0,54 %) — Stable/Up slightly, the defensive sector offers timid refuge.

$HIMS (+1,27 %) — Profit-taking in pre-market despite recent catalysts.

$INSM (-0,36 %) — Mixed, the biotech sector moves disconnectedly, but with caution.

🇪🇺 Europe

STOXX 600 — Opening solidly up, boosted by defensive sectors and positive earnings reports.

GER40 — Up slightly, showing resilience despite US banking worries.

$LDO.MI — Up, the defense sector continues to outperform.

$IBE.MC — Stable, utilities confirm their defensive asset status.

$OKLO — Stable, the nuclear tech stock awaits concrete catalysts.

🏦 Banking & Finance

$$UCG (-2 %) — Under strong pressure, the financial sector is generally affected by contagion fears.

$$ISP (-0,36 %) — Markedly lower, negative sentiment dominates.

$$BAMI (+0 %)

$CE (-0,45 %) , $BPE (+1,74 %) — Widespread selling on Italian banks.

$$BBVA (-0,12 %) — In strong increase, counter-trending the sector due to positive corporate news or insulation from US regional bank stress.

$AXP (+0,56 %) — Down in pre-market, facing consumer slowdown concerns.

$V (+0,08 %) — Essentially flat, confirms its more defensive status.

🌏 Asia

$JPN225 — Close down, weighed by Wall Street losses and trade uncertainty.

$KOSPI — Close flat/slightly down, the market remains in a holding pattern.

$HK50 — Sharp fall, due to regional bank pressures and China's plenum anticipation.

$CHINA50 — Weak, caution dominates.

💱 Forex

$EURUSD — Down, the Euro loses ground against the haven Dollar.

$GBPUSD — Down, the Pound is under pressure.

$USDJPY — Falling sharply, the Yen is rallying as the Dollar loses momentum on Fed rate-cut hopes.

$DXY — The Dollar Index is showing strength, acting as a safe haven.

💎 Commodities & Precious Metals

$GLD (-0,34 %) — Strong rally, gold hits new record highs on strong safe-haven demand.

$CDE (-1,6 %) — Up sharply, following the explosive trend of gold.

$BRENT — Down slightly, global demand fears persist.

$WTI — Losing ground, affected by negative macroeconomic sentiment.

📈 Benchmark ETFs

$VOO (+0,68 %) — Tracks the negative S&P 500 futures.

$VGT (+1,34 %) — Down, reflecting weakness in the technology sector.

$CSNDX (+0,82 %) — Tracks Nasdaq futures in negative territory.

$VWCE (+0,39 %) — Stable/Down, reflects the mixed global trend.

$BND (-0,02 %) — Up, as bond yields fall due to safe-haven demand.

💰 Crypto

$BTC (+0,93 %) — Down slightly, aligned with the general risk-off mood.

$ETH (+1,78 %) — Following Bitcoin, showing broad weakness.

$CRO (+1,07 %) — Flat/Down slightly, in line with the rest of the market.

$TRX (-1,64 %) — Down slightly, the sector struggles to find significant support.

🚀 Space & New Tech

$RKLB (+1,36 %) — Weak in pre-market, aligning with other growth stocks.

🔎 Deep Dive: Gold & Banking Stress

The day is polarized: the strong safe-haven demand for Gold ($GLD) is the dominant theme, hitting new all-time highs due to persistent US regional bank stress. While European markets, specifically $BBVA.MC, show resilience and an isolated uptrend, the US futures and Italian financial stocks are struggling. The overall takeaway is a heightened sense of systemic risk, forcing investors into traditional havens while penalizing US high-beta stocks. The strength of $NVDA remains a key structural theme resisting the general decline.

⚠️ Disclaimer: Past performance is not indicative of future results. Investing involves risks, including the loss of capital.

Inspiration needed

Hello everyone,

I have cleaned up my portfolio a bit and trimmed it to 30 positions (please ignore the very small positions, it is more expensive to sell them than to keep them). The different ETFs on msci, msci em, dax and NASDAQ are due to historical reasons (sub. Deposits, change from synth. To physical replication, too many taxes with complete change). At the end of the year I will sell the 2 DWS old funds and then have the tax refunded promptly --> grandfathering. I just don't know where to switch to.

I am currently saving:

$TDIV (+0,07 %) 250/m

$IWDA (+0,51 %) 600/m

$IEMA (+0,51 %) 250/m

$EQAC (+0,87 %) 250/m

$ALV (+0,33 %) 50/w

$KO (-0,37 %) 50/w

$PEP (+0,08 %) 50/w

$UNH (+1,21 %) 50/w

$V (+0,08 %) 50/w

$ULVR (-0,04 %) 50/w

And I reinvest the dividends from $O (-0,39 %) and $MAIN (-0,58 %) monthly

I try to have all positions that I want to hold long-term at 2-4 percent (exceptions: ETFs, $EWG2 (+0,43 %) and $BRK.B (+0,27 %) )

At the moment semiconductors ($AMD (+6,32 %)

$PLTR (+2,29 %)

$MU (+5,61 %) and $MPWR (+0,3 %) ) are my "yield positions", which I would like to sell if the price continues to rise.

But at the moment I'm lacking inspiration. What is my portfolio missing in the long term? Which themes could I "play" to achieve short-term returns. Or just leave everything as it is.

I would be grateful for any opinions.

Greetings 👋

Oct 8 / Visa & Mastercard — The Quiet Kings of Stability and Upside

No Sub-Heading Needed

Here are arguably the two stocks you can sleep well owning and forget about, whatever happens: Visa and Mastercard. Two names that rarely make headlines (unless there’s a scandal, which doesn’t really happen) but quietly compound through cycles. I’m talking about an investment foundation – if you need a stable giant while chasing high-flying satellite positions, the two payment processors are the go-to solution.

Visa and Mastercard aren’t super high-growth FinTech hype plays, but they offer a different angle: stability. They are payment rails – the pipes that almost every transaction in the world runs through. No matter how crazy consumer sentiment gets, people still swipe, tap, and click. That gives them durability many others lack. In contrast to other FinTechs, both payment processors are so deeply embedded into the economy that their moat seems almost insurmountable. Even American Express, the third wheel, can’t get close to cracking their moat.

Yet that doesn’t mean no upside. Because at the heart of them lies earnings expansion and steady revenue growth (both around 10% p.a. projected until 2027). As e-commerce adoption expands globally, as consumers borrow more, and as digital payments replace cash, Visa and Mastercard ride the tide. Their margins are already absurdly high (we’re talking FCF margins north of 55%) and they profit from every transaction, no matter how ridiculously small. The business is omnipresent in every aspect of life. For most people, hardly a day goes by without relying on Visa or Mastercard. Their revenue base is sticky – switching costs are high for merchants, infrastructure is entrenched, and network effects are built in.

On valuation, these aren’t screaming bargains either. Why would they be? They’re both trading in the mid-30s forward P/E range. But they’re safer long-term bets than most growth names you see floating around. They’re not going to triple overnight, but they’re also not going to crash 50% on a disappointing quarter.

I don’t own either right now because they don’t fit into my strategy, but, similar to my space stocks post, that’s not to say they are in any way bad investments. Visa and Mastercard are excellent, pretty much flawless companies dominating their respective industries.

SHOULD YOU OWN VISA IN 2025?

Visa ($V (+0,08 %) ) had a great performance in the last 12 months. It up almost 20%. 📈🚀

https://youtube.com/shorts/aBDFXEQzL-8?feature=share

With the current dividend yield of 0,7%, you wont get that much dividends in the first couple years. BUT the dividend growth with over 20% in the last 3 years and a low payout ratio of under 25% indicates a solid LONG TERM dividend growth stock.💸

Are you guys holding $V (+0,08 %) ?🤔

Titres populaires

Meilleurs créateurs cette semaine