Hello community,

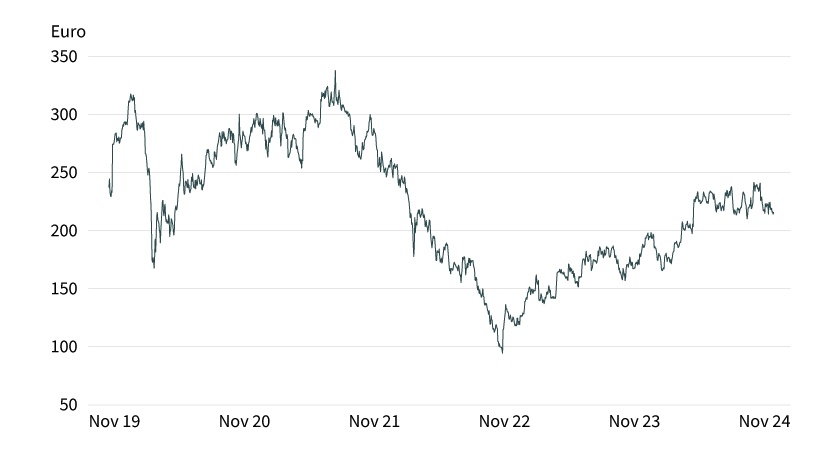

I bought for the first time today. Would buy more if there are further setbacks. What is your assessment of Under Armour in the short to long term?

Thank you and best regards

Postes

12🔹 Adj. EPS: $0.02 (Est. $0.03 🔴)

🔹 Revenue: $1.10B; -4% YoY (Est. $1.13B 🔴)

Q2 Outlook

🔹 Revenue: -6% to -7% YoY (Est. -2.9% 🔴)

🔹 Gross Margin: -340 to -360 bps YoY (tariff/supply chain impact)

🔹 Adj. Operating Income: $30M–$40M

🔹 Adj. EPS: $0.01–$0.02

Segment Performance

🔹 Apparel: $747M; -1% YoY

🔹 Footwear: $266M; -14% YoY

🔹 Accessories: $100M; +8% YoY

🔹 Wholesale: $649M; -5% YoY

🔹 Direct-to-Consumer: $463M; -3% YoY

🔹 Stores: +1% YoY

🔹 eCommerce: -12% YoY (31% of DTC)

Other Key Metrics:

🔹 North America rev: $670M; -5% YoY

🔹 International rev: $467M; -1% YoY

🔹 Gross Margin: 48.2%; +70 bps YoY

🔹 Adj. Operating Income: $24M

🔹 Inventory: $1.1B; +2% YoY

🔹 Cash: $911M (no revolver borrowings)

CEO Commentary

🔸 “Our quarterly results met or exceeded expectations as we drive a bold transformation – sharpening Under Armour into a brand where sports credibility, innovation, and style meet operational discipline.” – Kevin Plank

Subscribe to the podcast so that the bottom is reached soon.

00:00:00 Market environment

00:21:40 Nike, Adidas, Puma, On Holdings, Lululemon, Under Armor

00:35:50 Finding the bottom: Vix, Oil Price, Baltic Dry Index, Gold, Bonds / Bonds, CME FED Watchtool, St. Louis FRED Overnight Reverse Repurchase Agreements, COT

01:18:30 Chevron, Exxon, Occidental Petroleum, BP, Shell

Oil & Gas Exploration & Production A1JKQL

WisdomTree WTI Crude Oil A0KRKU

iShares MSCI World Energy Sector A2PHCF

01:29:35 China shares

01:44:25 Container ship shares

Spotify

https://open.spotify.com/episode/28RlbWBRC6xGUJ8AkHVcFU?si=w1t0GJtDTWOwNuUADqWoPQ

YouTube

Apple Podcast

$ZIM (+2,8 %)

$MAERSK A (-0,62 %)

$SHEL (+0,34 %)

$XOM (-0,87 %)

$CVX (-0,58 %)

$BP. (+1,22 %)

$OXY (+0,27 %)

$ADS (+1,58 %)

$NKE (+0,16 %)

$PUM (-1,42 %)

$UAA (+2,43 %)

$LULU (+3,86 %)

$WTI

$1BRN

$SPOT (+4,57 %)

$AAPL (-0,14 %)

$GOOG (+0,56 %)

$GOOGL (+0,52 %)

$BABA (-1,99 %)

$700 (-2,87 %)

$BYD (+1,05 %)

#china

#zoll

#podcast

A few individual purchases are on the agenda this week.

The first share will be $MC (+1,62 %) . I have had it on my watchlist for some time and now I see a good entry point.

In addition $ASML (+6,93 %) will also be topped up.

And I have added to the watchlist $UAA (+2,43 %) let's see what they will do in the near future...

Hopefully a good start to the week :)

Sales of selected competitors of Nike $NKE (+0,16 %) :

Nike(USA): $49.0 billion, -8% in the last quarter compared to the previous year, $NKE (+0,16 %)

Adidas*(Germany): $24.6 billion, +7%, $ADS (+1,58 %)

Lululemon**(USA): $10.2 billion, +9%, $LULU (+3,86 %)

VF Corporation**(USA): $9.9 billion, +2%, $VFC (+4,34 %)

Anta Sports*(China): $9.7 billion, +14%, $2020 (-2,12 %)

Puma*(Germany): $9.3 billion, +0%, $PUM (-1,42 %)

Skechers**(USA): $8.7 billion, +13%, $SKX (+0 %)

New Balance*(USA): $7.8 bn, unlisted

Under Armour*(USA): $5.4 billion, -6%, $UAA (+2,43 %)

Deckers Brands**(USA): $4.6 billion, +17%, $DECK (+0,73 %)

ASICS*(Japan): $4.1 billion , +16%, $7936 (+1,06 %)

Li Ning*(China): $3.9 bn, +2%, $2331 (-2,22 %)

On Holding**(Switzerland): $2.5 billion, +32%, $ONON (+3,51 %)

Despite all its problems, Nike is still twice as big as Adidas and somewhat as big as its four main competitors (Adidas, Anta Sports, Puma, New Balance) combined. together.

The Nike share is currently in a 60% drawdown (the worst in 25 years) and is roughly at the level of the COVID-19 low in March 2020.

Attractive risk-reward ratio?

Is Nike a buy, hold or sell for you?

*Main competitor

**Competitor in certain segments

🔹 Revenue: $1.40B (Est. $1.34B) 🟢; DOWN -6% YoY

🔹 EPS: $0.08 (Est. $0.03) 🟢; BEAT by $0.04

🔹 Gross Margin: 47.5% (Est. 46.83%) 🟢; UP +240bps

🔹 Net Income: $1M (Est. $19.84M) 🔴

Guidance:

🔸Q1'25 EPS: $0.28 - $0.30 (Est. $0.29) 🟡

🔸FY25 Revenue Decline: ~10%

Segment Revenue:

🔹 North America: $844M; DOWN -8% YoY

🔹 International: $558M; DOWN -1% YoY

🔹 Wholesale: $705M; DOWN -1% YoY

🔹 DTC: $673M; DOWN -9% YoY

Product Sales:

🔹 Apparel: $966M; DOWN -5% YoY

🔹 Footwear: $301M; DOWN -9% YoY

🔹 Accessories: $110M; UP +6% YoY

Operational Metrics:

🔹 SG&A: $638M; UP +6%

🔹 Operating Income: $14M; DOWN -80%

🔹 Adj. Operating Income: $60M; DOWN -65%

Key Updates:

🔸 Restructuring Plan: Anticipated charges $140M - $160M, with $75M cash-related & $85M non-cash.

🔸 Distribution Center Closure: Rialto, California site shutdown.

🔸 Marketing Initiative: Multi-year brand storytelling & influencer strategy launched.

CEO:

🔸 "We’re improving margins, optimizing costs, and driving long-term brand strength."

Detailed Adidas share analysis $ADS (+1,58 %)

Company portrait

Long-term growth profile

Performance

Ukraine war

The economy

China

Yeezy / Kanye West

Management and strategy

Valuation & recovery

Quarterly figures & forecast

Analsyst updates, 08.11.

⬆️⬆️⬆️

- GOLDMAN upgrades BIONTECH from Neutral to Buy and raises price target from USD 90 to USD 137. $BNTX (-0,18 %)

- BOFA raises target price for UNDER ARMOUR from USD 9 to USD 13. Neutral. $UAA (+2,43 %)

- DEUTSCHE BANK RESEARCH raises the price target for DELIVERY HERO from EUR 29 to EUR 35. Hold. $DHE

- DEUTSCHE BANK RESEARCH raises the price target for SIEMENS from EUR 197 to EUR 200. Buy. $SIE (+1 %)

- JEFFERIES raises the price target for HOCHTIEF from EUR 135 to EUR 138. Buy. $HOT (+2,59 %)

- DEUTSCHE BANK RESEARCH raises the price target for SIEMENS HEALTHINEERS from EUR 60 to EUR 62. Buy. $SHL (+0,46 %)

- DEUTSCHE BANK RESEARCH raises the price target for NORDEX from EUR 18 to EUR 19. Buy. $NDX1 (+0 %)

- DEUTSCHE BANK RESEARCH raises the price target for RATIONAL from 832 EUR to 841 EUR. Hold. $RAA (-1,02 %)

- DEUTSCHE BANK RESEARCH raises the target price for AXA from 37 EUR to 39 EUR. Buy. $CS (-0,35 %)

- WARBURG RESEARCH raises the price target for BASTEI LÜBBE from EUR 11.70 to EUR 12.20. Buy. $BST (-3,73 %)

- DEUTSCHE BANK RESEARCH raises the price target for ARCELORMITTAL from EUR 28 to EUR 29. Buy. $MT (+1,92 %)

- DZ BANK raises the price target for SWISS RE from CHF 130 to CHF 140. Buy. $SREN (-0,75 %)

- ODDO BHF raises the price target for HEIDELBERG MATERIALS from EUR 99 to EUR 110. Neutral. $HEI (+1,52 %)

- KEPLER CHEUVREUX raises the price target for DAIMLER TRUCK from EUR 35 to EUR 41. Hold. $DTG (+1,86 %)

- KEPLER CHEUVREUX upgrades REDCARE PHARMACY from Reduce to Hold. $RDC (+2,11 %)

- ODDO BHF raises the price target for HENKEL from EUR 67 to EUR 73. Neutral. $HEN (-1,18 %)

- ODDO BHF raises the price target for FREENET from EUR 27 to EUR 28. Neutral. $FNTN (+0,04 %)

- BARCLAYS raises the target price for ABOUT YOU from EUR 3.10 to EUR 3.40. Underweight. $YOU (-0,22 %)

- BARCLAYS raises the target price for NEMETSCHEK from EUR 108 to EUR 125. Overweight. $NEM (+4,18 %)

⬇️⬇️⬇️

- BOFA lowers the price target for PINTEREST from USD 45 to USD 39. Buy. $PINS

- WARBURG RESEARCH lowers the price target for DAIMLER TRUCK from EUR 56 to EUR 55. Buy. $DTG (+1,86 %)

- UBS lowers the price target for JCDECAUX from EUR 21.60 to EUR 18.50. Neutral. $DEC (+0,26 %)

- WARBURG RESEARCH lowers the price target for ADTRAN HOLDING from EUR 9.70 to EUR 9.30. Buy. $ADTN (+5,83 %)

- ODDO BHF lowers the price target for NORDEX from EUR 18 to EUR 17. Outperform. $NDX1 (+0 %)

- BARCLAYS lowers the target price for VESTAS from DKK 99 to DKK 80. Underweight. $VWS (-0,24 %)

- KEPLER CHEUVREUX lowers the price target for FRAPORT from EUR 62 to EUR 59. Buy. $FRA (+0,54 %)

- BARCLAYS lowers the target price for GSK from GBP 15.50 to GBP 14.50. Equal-Weight. $GSK

- BERENBERG lowers the price target for COMPUGROUP from EUR 23 to EUR 21. Buy. $COP (-0,46 %)

- BERENBERG lowers the price target for JUNGHEINRICH from EUR 41 to EUR 39. Buy. $JUN3 (+0,63 %)

- JEFFERIES lowers the target price for SUSS MICROTEC from EUR 87 to EUR 75. Buy. $SMHN (+5,33 %)

$UA (+1,85 %)

$UAA (+2,43 %) | Under Armour Q3 '24 Earnings Highlights:

🔹 Adj EPS: $0.30 (Est. $0.19) 🟢

🔹 Revenue: $1.4B (Est. $1.38B) 🟢; DOWN -11% YoY

🔹 Gross Margin: 49.8%, UP 200 bps YoY

🔹 Adj Operating Income: $166M (excluding one-time items)

🔹 Inventory: DOWN -3% YoY to $1.1B

Raised FY25 Outlook:

🔹 Adj EPS: $0.24-$0.27 (Prev. $0.19-$0.21) 🟢

🔹 Adj Operating Income: $165M-$185M (Prev. $140M-$160M) 🟢

🔹 Revenue: Expected to decline at a low double-digit percentage

🔹 North America: -14% to -16%

🔹 International: Low single-digit percent decline

🔹 Gross Margin: Expected to increase by 125-150 bps

🔹 Adjusted SG&A Expenses: Expected to decrease low-to-mid single digits (excluding litigation and transformation expenses)

🔹 Capital Expenditures: $190M-$210M

Q3 Demography Revenue:

🔹 North America: $863M; DOWN -13% YoY

🔹 International: $538M; DOWN -6% YoY

🔹 EMEA: DOWN -1%

🔹 Asia-Pacific: DOWN -11%

🔹 Latin America: DOWN -13%

Revenue Channels:

🔹 Wholesale Revenue: $826M; DOWN -12% YoY

🔹 Direct-to-Consumer (DTC) Revenue: $550M; DOWN -8% YoY

🔹 eCommerce Revenue: DOWN -21%; accounts for 30% of DTC

Product Categories:

🔹 Apparel: $947M; DOWN -12% YoY

🔹 Footwear: $313M; DOWN -11% YoY

🔹 Accessories: $116M; UP +2% YoY

CEO Kevin Plank's Commentary:

🔸 "Our strategy to elevate Under Armour’s brand positioning is gaining traction, as evidenced by better-than-expected profitability, allowing us to raise our full-year outlook while increasing brand investment for long-term growth."

Fiscal 2025 Restructuring Plan:

🔹 Total estimated charges of $140M-$160M, with up to $75M in cash-related expenses

Quarterly figures on 03.11.2022...

Feel free to leave a follow, because...⤵️

...at 5,000 followers there will be together with getquin, a small thank you for the community. But this post could already be created tomorrow. I look forward to it! On to today's quarterly numbers. In this post that I post every morning, I had announced what was happening today:

https://app.getquin.com/activity/ydggsOLkpb?lang=de&utm_source=sharing

$SBUX (+0,15 %)

Starbucks:

Beat analyst estimates of $0.73 in the fourth quarter with earnings per share of $0.81. Revenue of $8.4 billion beat expectations of $8.33 billion.

$PYPL (+0,91 %)

PayPal:

Beats analyst estimates of $0.96 in the third quarter with earnings per share of $1.08. Revenue of $6.85 billion beats expectations of $6.82 billion.

$DBX (-1,55 %)

Dropbox:

Beat analyst estimates of $0.38 in the third quarter with earnings per share of $0.43. Revenue of $591 million exceeded expectations of $586.15 million.

$DASH (+3,21 %)

DoorDash:

Missed analyst estimates of -$0.55 in the third quarter with earnings per share of -$0.77. Revenue of $1.7 billion exceeded expectations of $1.62 billion.

$GPRO (+9,95 %)

GoPro:

Beat analyst estimates of $0.17 in the third quarter with earnings per share of $0.19. Revenue of $305 million exceeded expectations of $298.85 million.

$MSI (-0,38 %)

Motorola Solutions:

Beats third-quarter analyst estimates of $2.88 with earnings per share of $3.00. Revenue of $2.37 billion beats expectations of $2.31 billion.

$HOT (+2,59 %)

Hochtief:

Reached sales of 7.18 billion euros in the third quarter, up from 5.32 billion a year earlier, and earned 115 million euros on the bottom line, up from 99.8 million a year earlier. Order intake on a comparable basis was 6.5 billion (prior year 7.5 billion).

$K (+0,65 %)

Kellogg Co:

Surpassed analysts' estimates of $0.97 in the third quarter with earnings per share of $1.01. Sales of $3.95 billion exceeded expectations of $3.77 billion.

$RCL (+1 %)

Royal Caribbean Cruises Ltd:

Beat analyst estimates of $0.19 in the third quarter with earnings per share of $0.26. Revenue of $3 billion exceeded expectations of $2.99 billion.

$UAA (+2,43 %)

Under Armour Inc:

Second-quarter earnings per share of $0.20 beat analyst estimates of $0.10. Revenue of $1.57 billion exceeded expectations of $1.42 billion.

$W (+2,3 %)

Wayfair Inc:

Missed analyst estimates of -$2.05 in the third quarter with earnings per share of -$2.11. Revenue of $2.8 billion below expectations of $2.82 billion.

$PTON (-0,67 %)

Peloton Interactive Inc:

Missed analyst estimates of -$0.64 with first-quarter earnings per share of -$1.20. Revenue of $616.5 million below expectations of $637.07 million.

$DDOG (+2 %)

Datadog Inc:

Third-quarter earnings per share of $0.23 beat analyst estimates of $0.16. Revenue of $437 million exceeded expectations of $415.07 million.

$MRNA (+2,4 %)

Moderna Inc:

Missed analyst estimates of $4.81 in the third quarter with earnings per share of $2.53. Revenue of $3.36 billion below expectations of $4.63 billion.

$CROX (+0,12 %)

Crocs Inc:

Missed analyst estimates of $2.62 in the third quarter with earnings per share of $2.50. Revenue of $985.1 million exceeded expectations of $942.52 million.

$IRM (+0,21 %)

Iron Mountain Inc:

Third-quarter earnings per share of $0.48 beat analyst estimates of $0.44. Sales of $1.29 billion below expectations of $1.31 billion.

$SBS (+2,91 %)

STRATEC:

Posts Q1-3 sales of €207.7 million (preliminary: €207.7 million), adjusted EBIT margin of 18.3% (preliminary: 18.3%), and net income (adjusted) of €29.5 million (PY: €40.6 million). Outlook confirmed.

$BOSS (-0,25 %)

HUGO BOSS:

Achieves Q3 sales of €933 million (PY: €755, analyst forecast: €903.4 million), EBIT of €92 million (PY: €85 million, forecast: €88.1 million) and net income of €58 million (PY: €53 million, forecast: €56.6 million). In the outlook for 2022, the company now expects sales of €3.5 to €3.6 billion (previous: €3.3 to €3.5 billion) and EBIT of €310 to €330 million (previous: €285 to €310 million).

$SGL (+0,44 %)

SGL CARBON:

Achieves Q1-3 sales of €853.9 million (previous year: €743.5 million), Ebitda (adjusted) of €136.1 million (previous year: €108.5 million) and net income after minorities of €70.6 million (previous year: €42.6 million). Forecast confirmed.

$PFV (-0,13 %)

Pfeiffer Vacuum:

Achieves Q1-3 order intake of €866.5 million (preliminary: €866.5 million), sales of €668.7 million (preliminary: €668.7 million), EBIT of €94 million (preliminary: €94 million) and net income of €66.6 million (PY: €52.1 million). October 17 forecast for revenue and Ebit margin confirmed.

$HNR1 (+0,62 %)

Hannover Re:

Achieves 3. Gross premiums written of €8.91 billion (PY: €7.15 billion, analyst forecast: €8.02 billion), combined ratio of 99.6% (PY: 101.5%, forecast: 99.6%), investment result of €400.3 million (PY: €491.1 million), an Ebit of €408.9 million (PY: €324.5 million, forecast: €399 million) and a net profit of €221.9 million (PY: €185.4 million, forecast: €311 million). In the outlook for 2022, the company sees net income in the lower range of €1.4 billion to €1.5 billion, profit target for 2022 remains achievable.

$UN01

Uniper:

Achieves 1st to 3rd. Quarter net result of -€40 billion (PY: -€4.8 billion), net loss includes €10 billion realized costs for replacement volumes; economic net debt at €10.91 billion (PY: €0.324 billion), net loss includes €31 billion expected losses and provisions; adjusted net loss of -€3.22 billion (preliminary: -€3.2 billion, prior year: +€0.487 billion), adjusted EBIT of -€4.75 billion (preliminary: -€4.8 billion, prior year: +€0.614 billion). Concrete earnings forecast currently impossible for the time being.

$O2D (+0,49 %)

Telefonica Germany:

Achieves Q3 sales of €2.085 billion (PY: €1.967 billion, analyst forecast: €2.030 billion), service sales of €1.47 billion (PY: €1.42 billion), adjusted OIBDA of €642 million (PY: €613 million, forecast: €640.5 million). In the outlook for 2022, sales and OIBDA are now expected to be in the "lower mid-single-digit percentage range" compared to the previous year (previously: in the "low mid-single-digit percentage range").

$BMW (+0,25 %)

BMW:

Reports Q3 sales of €37.18 billion (PY: €27.47 billion, analysts' forecast: €35.53 billion), EBIT of €3.68 billion (PY: €2.88 billion, forecast: €3.5 billion), EBT of €4.1 billion (PY: €3.42 billion) and net income of €3.18 billion (PY: €2.58 billion). Outlook confirmed.

$ZAL (+5,41 %)

Zalando:

Achieves Q3 revenues of €2.34 billion (PY: €2.28 billion), Ebit (adjusted) of €13.5 million (PY: €9.8 million) and net result of -€35.4 million (PY: -€8.4 million); number of active customers grows by 8% and exceeds 50 million for the first time. Outlook confirmed.

$COP (-0,46 %)

CompuGroup:

Posts Q1-3 revenue of €802 million (preliminary: €802 million), Ebitda of €166 million (preliminary: €166 million) and net income of €59.8 million (PY: 56.6 million). Outlook confirmed.

$RAA (-1,02 %)

RATIONAL:

Achieves Q3 sales of €274.2 million (PY: €207 million, analyst forecast: €270 million), Ebit of €70.3 million (PY: €49.7 million, forecast: €64.4 million), Ebit margin of 25.6% (PY: 24.0%) and net income of €53.8 million (PY: €37.8 million). Forecast confirmed.

$KCO (-0,36 %)

Klöckner & Co:

Achieves 3rd quarter sales of €2.37 billion (PY: €2.0 billion), Ebitda (adjusted) of €16 million (PY: €277 million) and net result of -€22 million (PY: +€185 million). Outlook confirmed.

#quartalszahlen

#boerse

#börse

#aktien

#paypal

#starbucks

#sandp500

#communityfeedback

#community

Meilleurs créateurs cette semaine