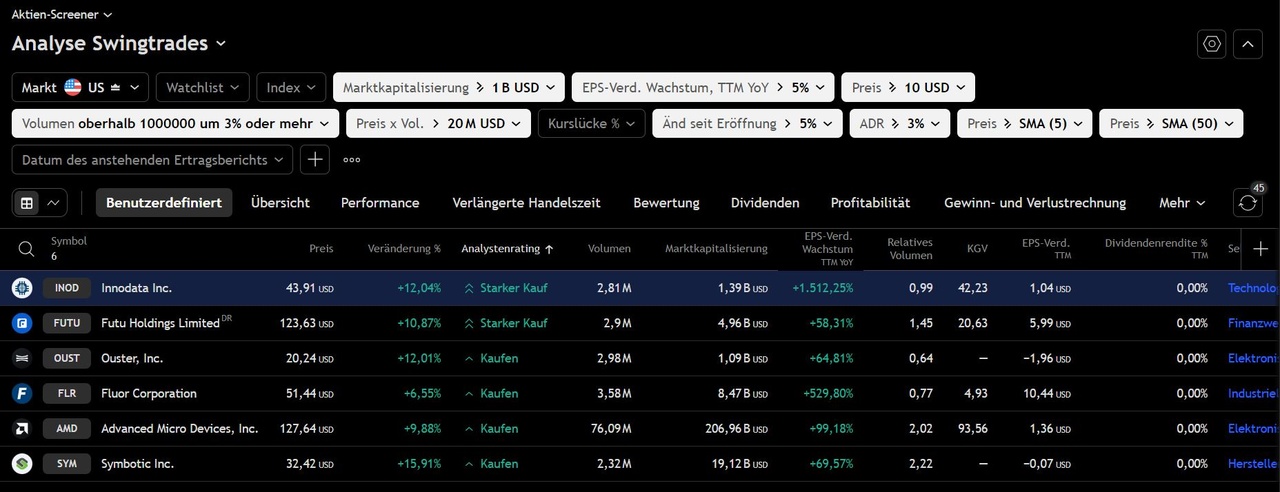

$INOD (-11,68 %)

https://www.tradingview.com/x/JRtOq7mU/

$FUTU (-11,96 %)

https://www.tradingview.com/x/FK6cnkiF/

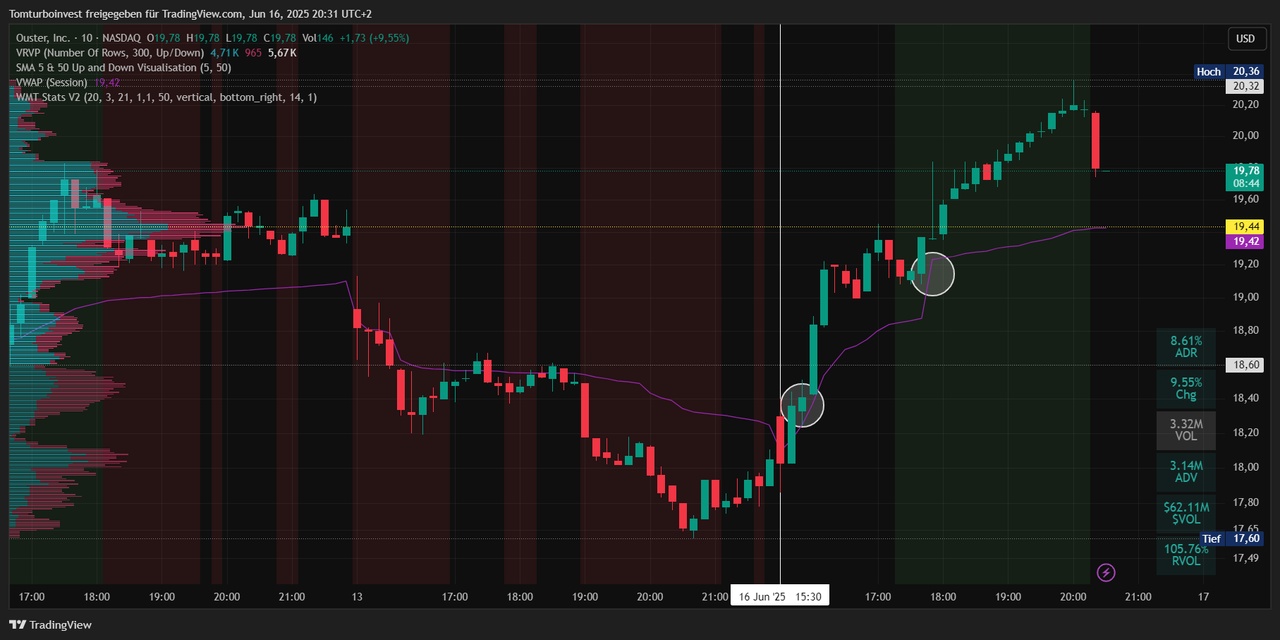

$OUST

https://www.tradingview.com/x/E2g8XCaV/

$FLR (+0,58 %)

https://www.tradingview.com/x/mz4FKsAX/

$AMD (-10,01 %)

https://www.tradingview.com/x/pW1E7zgH/

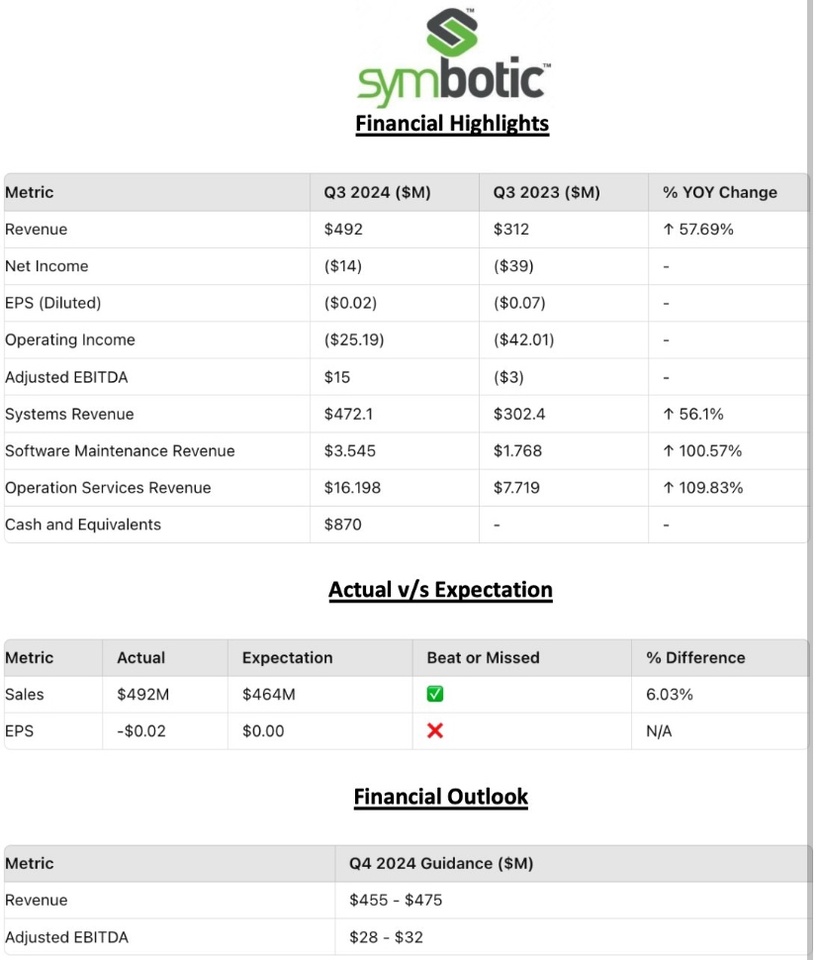

$SYM

https://www.tradingview.com/x/RkUvCPtq/

Entries and exits according to the VWAP of the session. As always for those interested in trading - otherwise keep scrolling 😅

Ex. $SYM I only enter when the price is at the VWAP (purple), either I catch the momentum at the start of trading, or I wait for the consolidation, which should be at least 30 minutes, and then enter if the structure is appropriate.

Example. $OUST