Hello my dears,

After introducing you to $TDY (-0,93 %) Teledyne and noticed from your comments and likes. You are interested in the blade suppliers, so today I climbed deep into the engine room.

And found for you $LTRX found Lanotronix.

@EpsEra (do you know the company?)

Since Teledyne is a long-term runner that has impressed with its robustness in recent years.

I would like to emphasize that Lanotronix is a rather cyclical stock.

However, the tide could now be turning because Lanotronix products are becoming increasingly important. This is reflected in sales.

As the chart shows, investors also seem to be recognizing this. And that's why, dear readers, I don't want to withhold the company from you.

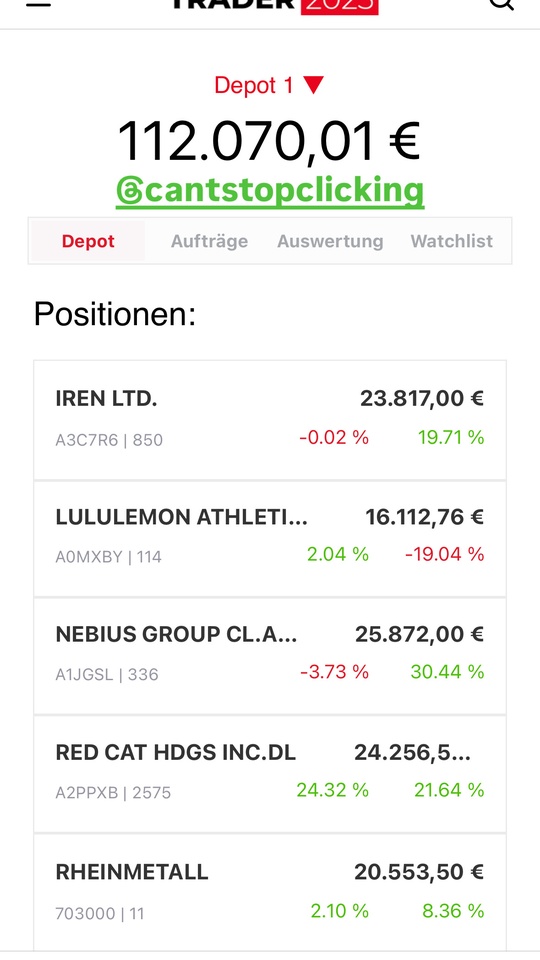

Estimates in millions:

2026 2027

Turnover 126.26 141.28

Profit - 6.24 - 3.46

EBIT 7.26 11.68

KGV -31.3 -57.8

Free cashf 16.95 12.8

(The company is not yet profitable)

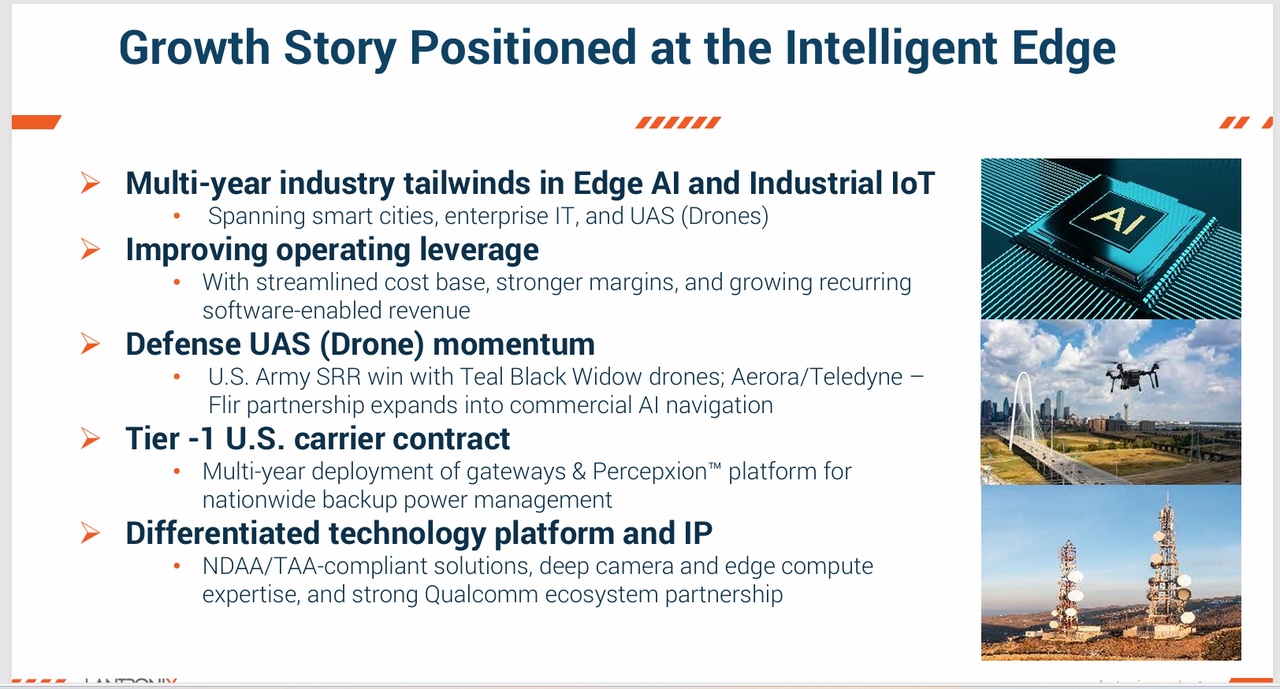

Lantronix Inc (NASDAQ: LTRX) is a leading global provider of compute and connectivity solutions for IoT solutions that enable AI edge intelligence

Lantronix Inc (Nasdaq: LTRX) is a global leader in edge AI and industrial IoT solutions, providing intelligent computing, secure connectivity and remote management for mission-critical applications. Serving high-growth markets including smart cities, enterprise IT, and unmanned systems for commerce and defense, Lantronix enables customers to optimize operations and accelerate digital transformation. The comprehensive portfolio of hardware, software and services supports applications ranging from secure video surveillance and intelligent utility infrastructure to fail-safe out-of-band network management. By delivering intelligence at the network edge, Lantronix helps organizations achieve efficiency, security and a competitive advantage in today's AI-driven world.

Lantronix wins the IoT Evolution Asset Tracking Award 2025

Tier 1 mobile operator in the U.S. selects Lantronix to digitally monitor 50,000+ cellular generators with FOX Series telematics edge gateways

IRVINE, California, October 7, 2025 - Lantronix Inc. (NASDAQ: LTRX), a leading global provider of computing and connectivity IoT solutions for edge AI applications, today announced that its Gateways der FOX-Serie received the IoT Evolution Asset Tracking Award 2025 from IoT Evolution Magazine, the leading publication for the Internet of Things. A key player in the digital transformation of remote assets, Lantronix industrial IoT edge telematics gateways are the choice of a Tier 1 U.S. cellular operator for monitoring its 50,000+ cellular generators.

Lantronix gewinnt den IoT Evolution Asset Tracking Award 2025

Lantronix launches no-code AI platform EdgeFabric.ai for edge computing/n

strategic collaboration positions Lantronix for long-term, high-margin growth in the defense and commercial drone markets, expected to reach $57.8 billion by 2030*

Lantronix launches no-code AI platform EdgeFabric.ai for edge computing/n

Lantronix lanciert No-Code-KI-Plattform EdgeFabric.ai für Edge Computing/n Von Investing.com

Lantronix share: Breakthrough in the drone market!

A new major order could be the turning point for Lantronix: The IoT specialist has beaten off the competition and been selected as a technology partner by Gremsy, a leading manufacturer of camera stabilizers for drones. The news has already caused the share price to jump by over 86% in the past six months.

The cooperation is based on Lantronix' Open-Q 5165RB System-on-Module, which is based on the Qualcomm Dragonwing processor. This solution powers Gremsy's new drone platform and Lynx ISR payload, which is seamlessly integrated with Teledyne FLIR's Hadron 640R dual thermal imaging camera. Notably, the technology is already in production and generating initial sales.

Why Lantronix was awarded the contract

"We chose Lantronix because the company is the trusted world market leader in the global drone industry," says Nguyen Van Chu from Gremsy, explaining the decision. Another decisive factor was the long-standing partnership with $QCOM (-0,49 %) Qualcomm and the ability to deliver NDAA and TAA compliant solutions - a key advantage for government and defense applications.

The integrated solution scores with its energy efficiency and enables longer flight times with lower power consumption. Edge-based AI processing for object detection, real-time analytics and advanced connectivity with Wi-Fi 6 complete the package. The robust design works even in extreme temperatures from -25°C to +85°C.

Market potential makes investors prick up their ears

The figures speak for themselves: the drone market for defense and commercial applications is expected to grow to 57.8 billion dollars by 2030. Lantronix is cleverly positioning itself in this growth market with its high-margin solution, serving mission-critical applications in the government, energy, agriculture and infrastructure sectors.

CEO Saleel Awsare emphasizes the strategic importance: "With an increasing number of high-profile global drone customers, Lantronix is a key enabler for secure, high-performance drone platforms." The partnership with Gremsy demonstrates the scalability of the technology and opens the door for further collaborations with drone manufacturers worldwide.

Analysts are optimistic and see price targets of between 5 and 8 dollars per share. With a market capitalization of 180 million dollars, the drone division could become an important growth driver - especially if further design wins follow.

Lantronix Aktie: Durchbruch im Drohnenmarkt! () | aktiencheck.de

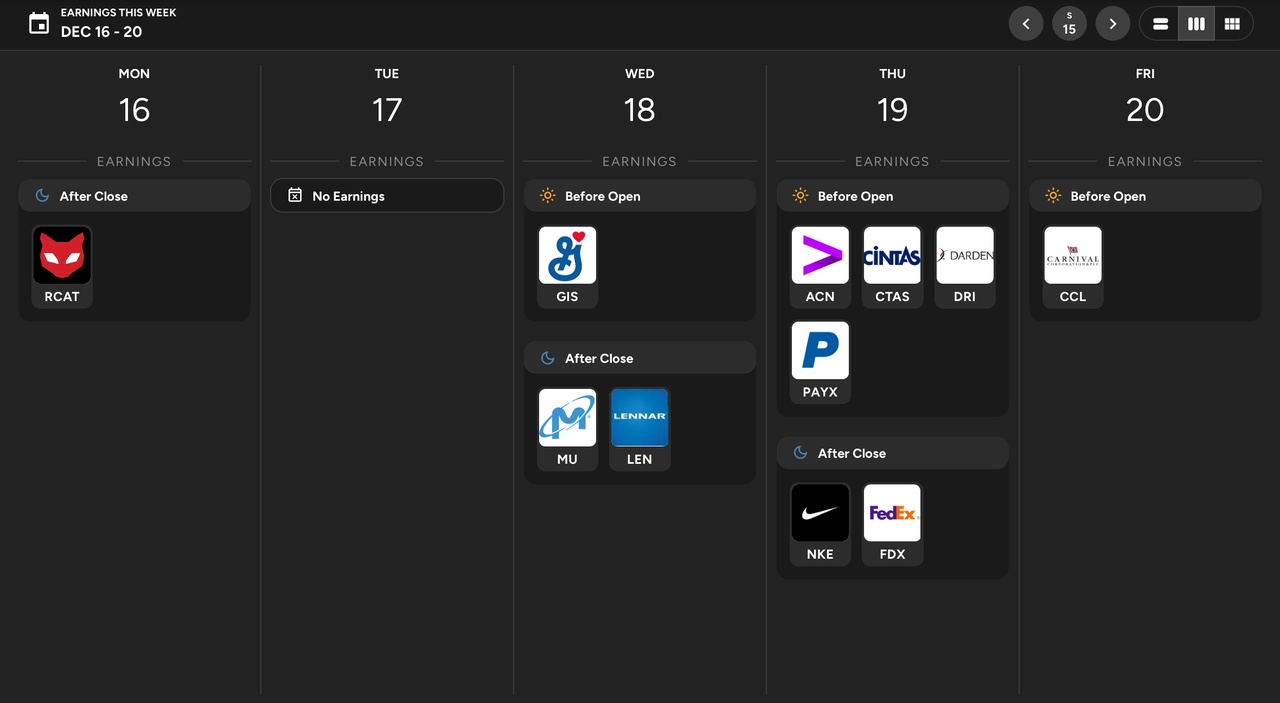

Lantronix solution supports US Army-certified Teal Drones, a Red Cat Holdings company, and unlocks growth opportunities for secure edge AI. $RCAT (+9,45 %) Red Cat Holdings, and unlocks growth opportunities for secure edge AI

Lantronix Enables TAA and NDAA Compliant Edge AI Solution, Supports Sensitive U.S. Government Missions and Expands Long-Term Positioning in Defense Market

Lantronix-Lösung unterstützt die von der US-Armee