A Niche but Growing Play

Insurance isn’t exactly the most exciting industry. Most people hate it, and most companies in it act like it’s still the 20th century. No innovation, no enthusiasm, with rigid old structures. This, unfortunately, leads many investors to look past value opportunities like UnitedHealth or, as I’ll discuss in this post, disruptors. Names like Oscar and Lemonade caught my eye a long time ago. Root, however, I just discovered fairly recently, and I’ve been nothing but impressed ever since. They’re small, scrappy, and trying to do something very few incumbents even attempt: drag insurance into the 21st century. The investment case for these insurers is very different from my UnitedHealth approach. While Oscar and Root might also be cheap on a P/E level, with these disruptors I’m not betting on valuation or negative sentiment – I’m betting on future domination.

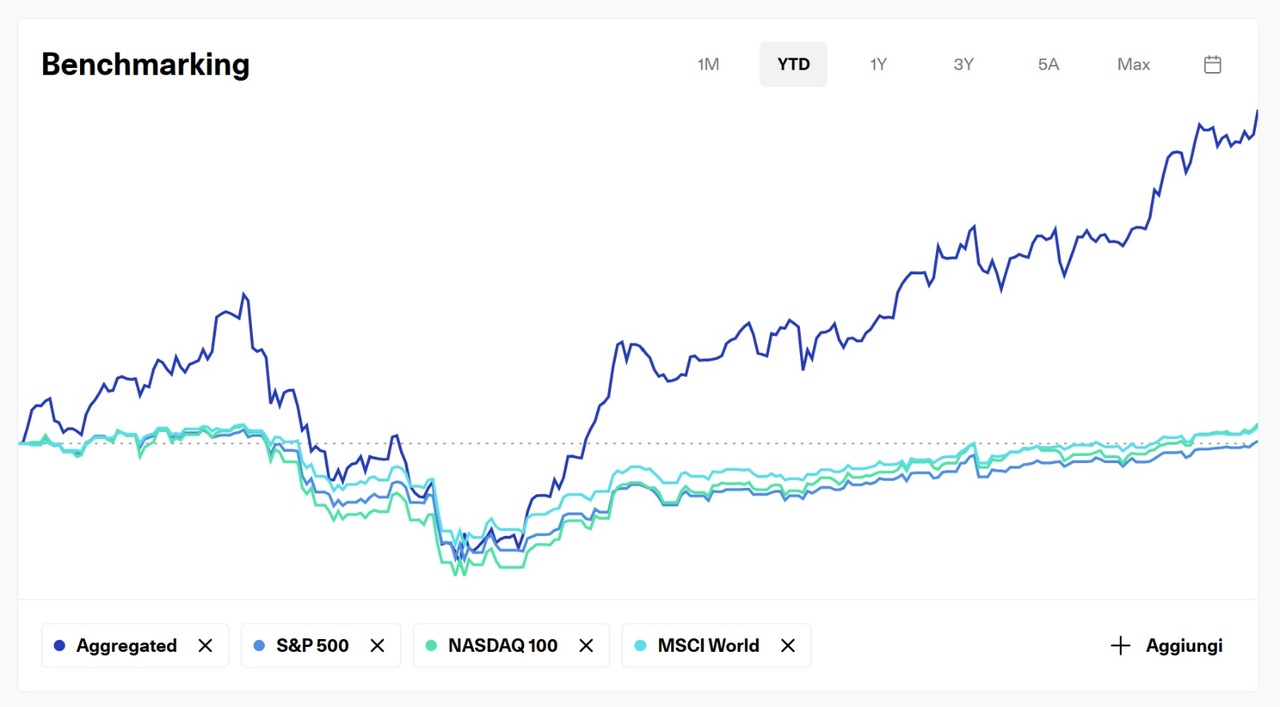

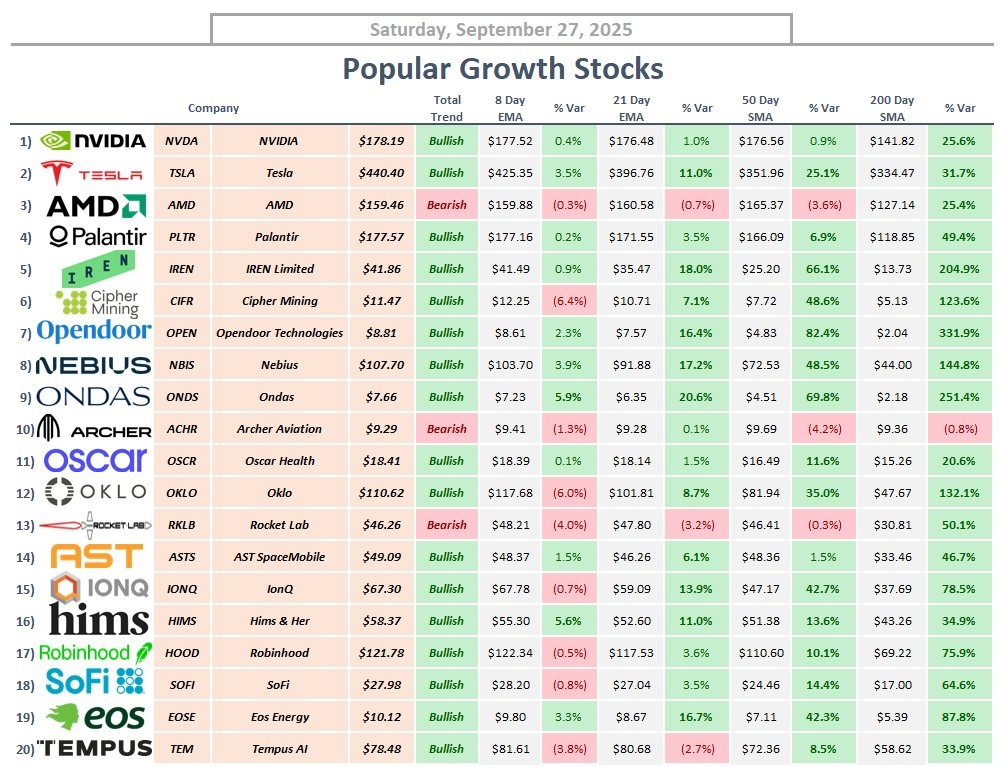

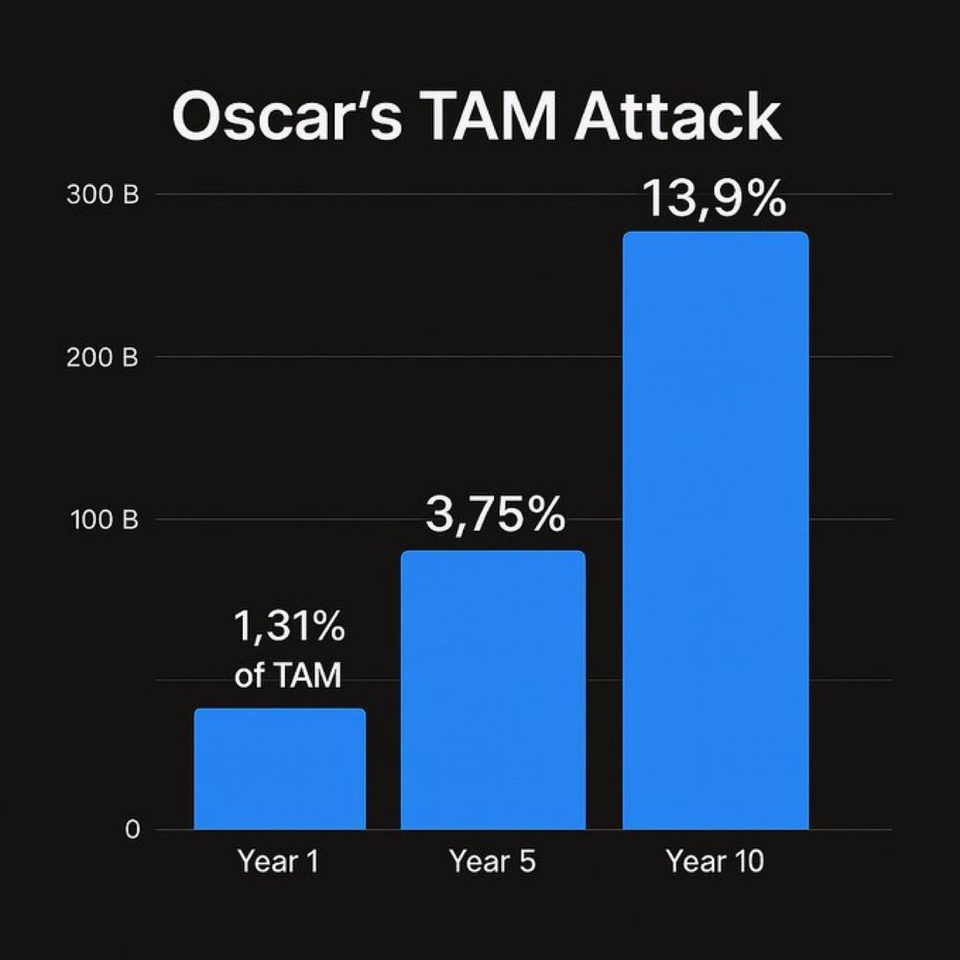

Oscar is the one I actually hold – one of my smallest positions, but still. Their approach to health insurance can’t be compared to legacy competitors, with its tech-driven, user-focused approach. It’s not without risks (regulation, competition, thin margins), but they’ve shown real growth and are slowly proving skeptics wrong. The stock has been beaten down in the past, but that’s what makes it interesting: there’s still huge upside if they keep executing. Another thing that makes me believe in the company is its visionary CEO. I’ve listened to calls and interviews with Mark Bertolini, and trust me when I say he is the embodiment of excitement and confidence in Oscar.

Root, on the other hand, is only on my watchlist for now. Auto insurance is a brutal space, but Root’s data-driven, app-based model is exactly the kind of disruption the sector needs. What I like about the business: it’s not hard to understand. They offer car insurance based on driving behavior. That’s as ingenious as it is simple.

Both are risky, no doubt. These are not “buy and forget” blue chips, and they won’t become core holdings of my portfolio, but rather satellite bets with strong management and enormous potential. In an industry this outdated, the upside for true disruptors is enormous. That’s why I like keeping some exposure, even if only small. Incumbents like UnitedHealth will never roll over, but Root and Oscar represent the kind of innovation that could carve out real market share over time, as long as execution is strong.

For now, I’m keeping Oscar as a small holding and Root on the watchlist. Insurance will probably never be exciting, but the companies reinventing it just might be. I’ll be watching closely, as I firmly believe that both of them deserve some attention for what they could become in the future.

$ROOT

$OSCR (-4,92 %)

$LMND (-10,89 %)

$UNH (-5,78 %)