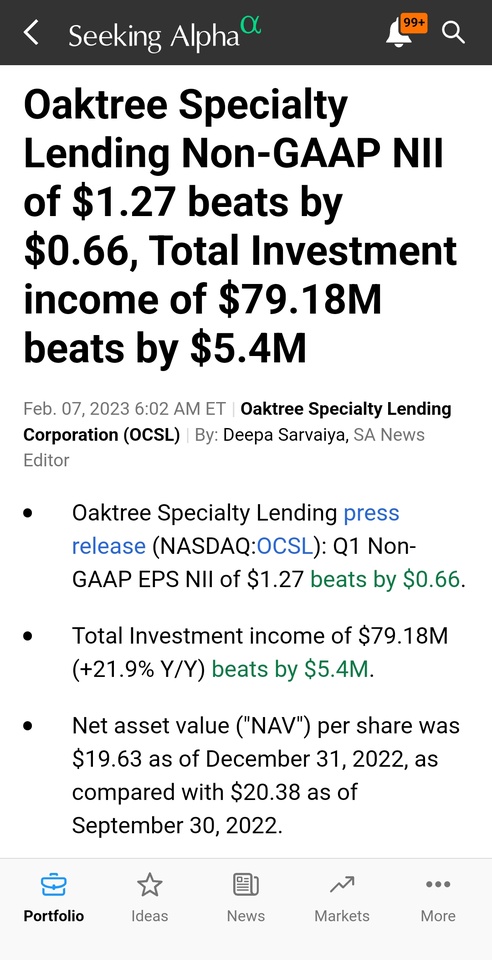

$OCSL with very good figures 🚀

Oaktree Spclty

Price

Discussion sur OCSL

Postes

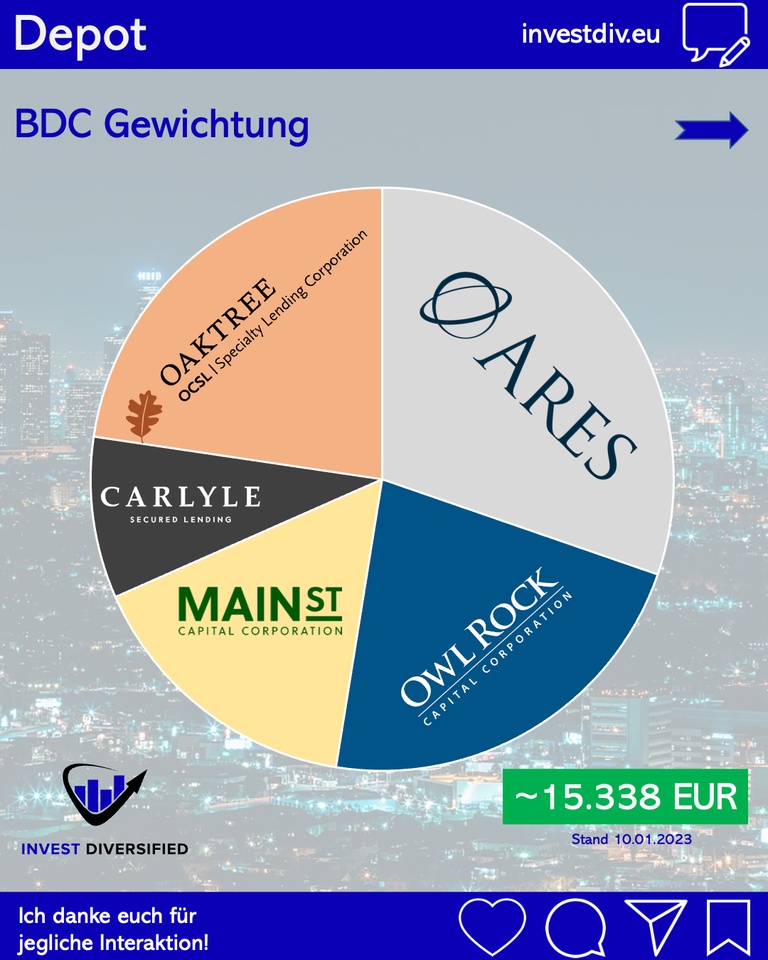

7📈 BDC Depot Update January '23 📈

Hello everyone 🙋♂️. Today we have an update on the Business Development Companies in the depot ($ARCC, (+1,64 %)

$OCSL,

$ORCC, (+1,67 %)

$MAIN, (+1,99 %)

$CGBD (+1,63 %)) and some info about how they performed in 2022.

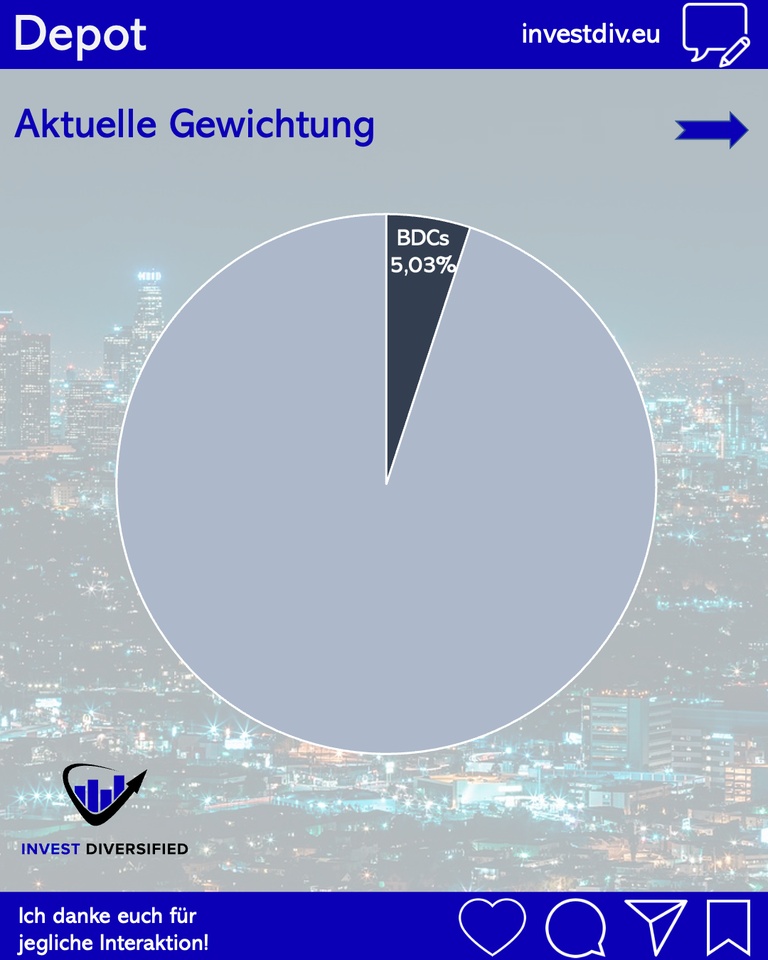

➡️ In total the five BDCs have a market value of ~15,338 EUR and therefore a weighting of 5.03% in the overall portfolio 👍.

➡️ In terms of share price, not much has happened with the BDCs since the last time, but there have been plenty of dividends. 2022 I have a total of 1,174.35 EUR cash flow through BDCs.

➡️ Last year I had to leave the depot with $FSK (+0,78 %) one BDC had to leave the depot, but this was replaced by various additional purchases.

➡️ With +2,7% the S&P 500 and the NASDAQ100 were clearly outperformed.

➡️ For 2023, I will certainly make strategic additional purchases, I also have 1-2 more BDCs on the watchlist. Overall, however, a weighting should be a maximum of 10%.

Do you have BDCs in your portfolio❓?

Quarterly dividend and a special announced for December.

https://investors.oaktreespecialtylending.com/dividends

🇺🇸 Post-purchase No. 3 in October '22 🇺🇸

Moin friends 🙋♂️. In addition to Main Street Capital, I added another BDC at the beginning of October!

➡️ 100 shares of Oaktree Specialty Lending ($OCSL) have been added to the portfolio at 6.3493 USD per share. There were already 600 shares there, and I now hold a total of 700 shares.

➡️ Due to the increase of the key interest rate by the FED and the very likely longer stay at the increased interest rate level, higher quality makes sense in order to increase the cash flow. Also because credit spreads are likely to increase due to the coming recession.

➡️ In the BDC sector, I have therefore continued to add to my position in Oaktree Specialty Lending. BDC currently has a moderate discount of 8%. The dividend was recently increased by 3%.

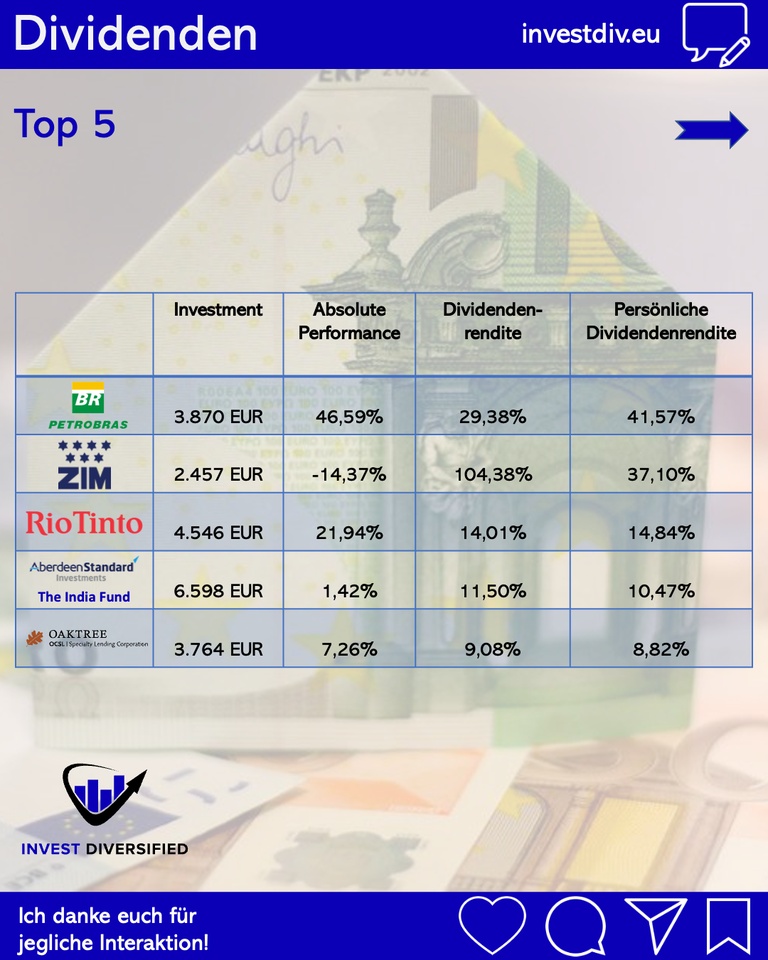

💸 2,632€ Dividends in September '22 💸

Hi there zusammen🙋♂️. To kick off the long weekend, here's a cash flow highlight today.

➡️ With 2.632,15€ I have reached an ATH in terms of dividends on a monthly basis in September. A total of 48 companies (or ETF/CEF) have transferred something to me.

➡️ For a better classification there is info in the 3rd Sreenshos about how the current market value of the top 5 stocks ($PBR (+5,78 %) , $ZIM (-0,98 %) , $RIO (+0,07 %) , $IFN (+1,67 %) , $OCSL ) is. In addition, I have given the absolute performance (i.e. including dividends) as well as the current and personal dividend yield. Here it can certainly come to deviations, depending on which data are used.

Titres populaires

Meilleurs créateurs cette semaine