a bit of fiat at Michael Segler for some short-term fun? $MSTR (+4,84 %)

Discussion sur MSTR

Postes

266Strategy

Where are you $MSTR (+4,84 %) end of the year?

Thanks and greetings

Bitcoin ATHs and why Metaplanet is the way to go now

Metaplanet $3350 (-3,45 %) is currently considered one of the most exciting companies in Japan, as it has focused its strategy strongly on Bitcoin and is thus positioning itself as a kind of Asian "MicroStrategy". A possible inclusion of the share in a major New York index could give the share price a significant boost. The reason for this is the increasing demand from ETFs and funds, which would be forced to buy Metaplanet shares as soon as they become part of the index. At the same time, the international visibility and confidence of institutional investors would increase, which often leads to a short-term rise in the share price. The share's liquidity and trading volume would also increase, making Metaplanet more attractive to new investors. Historically, an inclusion in an index usually results in an "inclusion effect", i.e. a price boost in the run-up to and shortly after inclusion. In the long term, however, success remains dependent on the further development of the Bitcoin price and the company's ability to scale its business model in a stable manner.

By reaching another ATH this morning, my first play on Monday is a juicy entry into the stock.

What do you think? Do you prefer $MSTR (+4,84 %)

$3350 (-3,45 %) or rather directly $BTC (+0,65 %) ?

Metaplanet: Continues to fall

$3350 (-3,45 %) fell -10% in Japanese trading this morning. The mNAV is therefore at 1.11

It is important to pay attention to the next transactions after the BTC yield has $MSTR (+4,84 %) has dropped for the first time.

If Bitcoin were to slip into a bear market, the mNAV could also go towards 0.8x in my opinion. Metaplanet remains exciting, but is also a very risky asset!

Oops - broken promise?🙃

Strategy $MSTR (+4,84 %) bought 196 $BTC (+0,65 %) last week. This was mainly financed by "printing" ordinary shares (and a few prefs).

However, for the first time, Saylor was apparently unable to keep his promise to only buy Bitcoin if it caused BTC/share to rise. This fell slightly with the last purchase.

The reason for this is apparently the dividends the prefs have to pay. They were therefore only able to use part of the new capital to buy Bitcoin.

It will be interesting to see how this develops. If this happens more often, it could turn into a negative cycle. Investors could lose confidence, the mNav would fall further and Strategy would no longer be able to print its own shares as easily. Nevertheless, the dividends of the prefs must be paid werden🤷♂️

The question is of course whether they have really done themselves a favor with the prefs and the high dividends they pay.

https://www.blocktrainer.de/blog/strategy-kauft-196-bitcoin-und-die-btc-yield-sinkt

The downward cycle has begun. 😈

Dividend vs. Covered Calls

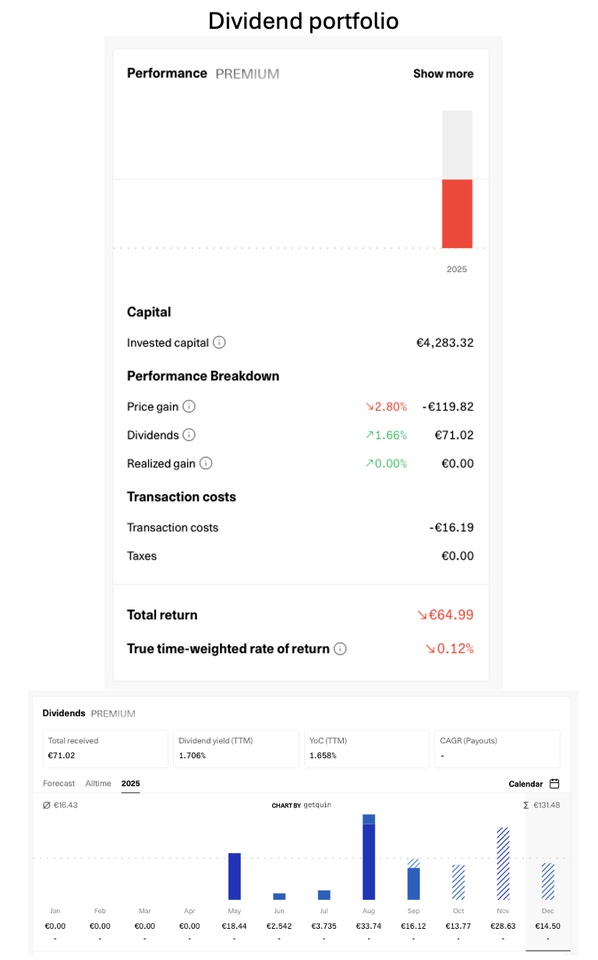

I’m running a small investing experiment to see which approach can generate steadier monthly cash flow: dividend investing or selling covered calls.

My portfolio is relatively small, so I don’t mind taking a bit more risk if it means I might learn something new.

Disclosure: I used ChatGPT to clean up my phrasing and typos, but I asked it to keep things simple and stay true to my own words.

Why I’m Doing This

I currently invest through my company, which gives me a great tax advantage.

- I don’t pay tax on realized capital gains because my company is under Hungary’s KIVA system. Under KIVA you don’t pay corporate tax on profits or investment income; instead, you pay a flat 10 % on the total gross salaries you pay out each year. So if you have many employees—or pay yourself a generous salary—you effectively pay tax through that payroll base rather than on the gains themselves.

- I don’t pay the usual 15 % Hungarian dividend tax because I invest through my company under the KIVA system, where the same 10 % salary-based rule applies. Some countries still withhold tax at the source—for example, U.S. dividends now get a 30 % haircut since the Hungary-U.S. tax treaty was dropped, while the U.K. doesn’t withhold anything extra.

- Option premiums are also untaxed, so I keep 100 % of those.

Running a company teaches you that strong cash flow is everything. So I thought: why not try to create reliable cash flow from investments too? Monthly-paying dividends are one way. Another is selling covered calls, which can provide instant income.

Quick Covered-Call Primer

A covered call means you own at least 100 shares of a stock and sell a call option giving someone else the right to buy those shares at a set price by a set date.

Because you already own the shares, the call is “covered.” The buyer pays you a premium up front.

Your obligation: if the option is exercised, you must deliver those shares or buy back the contract (often at a higher price).

If you’re curious, watch a few good YouTube explainers—it’s easier to grasp from a video than from my summary.

My Two Test Portfolios

Dividend Portfolio

Contains $JEGP (+1,34 %) , $UKW (+1,99 %) , $MCSTP —each paying around 8–10 % annually.

- JEGP and UKW dividends are tax-free for me.

- MCSTP is taxed at 30 %, but I’m testing how this new product of $MSTR (+4,84 %) works long term.

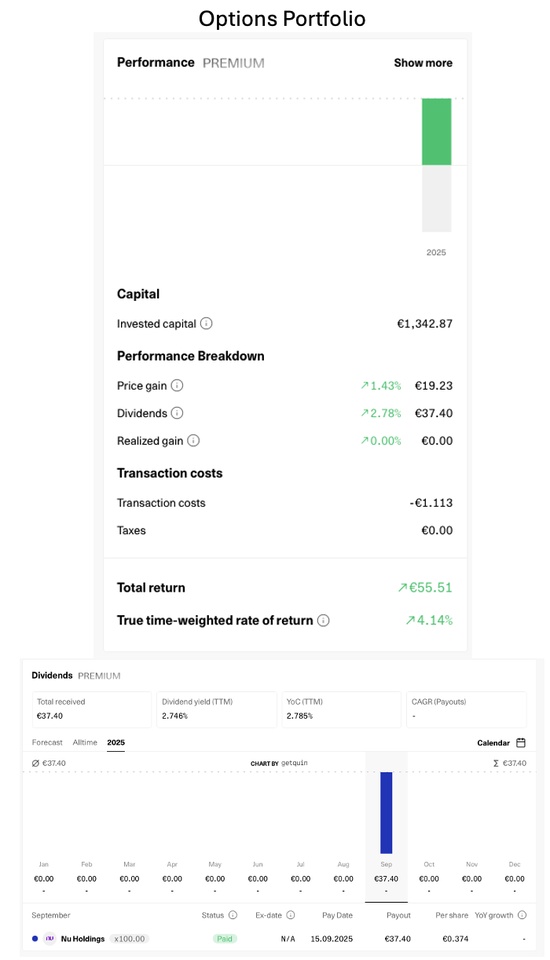

Options Portfolio

Currently just $NU (+0,81 %) . I like the stock, it’s easy to buy 100-share lots, and it’s great for covered calls.

Yes, if NU “goes to the moon” my call might get exercised and I’d have to sell—but I’d still keep the premium. You can roll options to capture extra upside, but that usually means choosing a later expiration date (moving from monthly to perhaps yearly).

Bought 100 shares for $1,580, sold an Oct 24 call at $16.50, and pocketed a $44 premium.

Early Results & Thoughts

- Dividend side: Launched in April. Prices have dipped, so even with dividends I’m slightly negative—mainly due to $UKW (+1,99 %) . I’m okay with small paper losses since I’m here for cash flow.

- Options side: Less than a month old. $NU (+0,81 %) ’s price moves more, which suits me. If I get called away, I’ll just rebuy 100 shares next month and sell another covered call.

In October I need to decide whether to add another 100 NU shares or introduce a second stock. On my watchlist: $WT (+1,11 %) and $INFY (+1,22 %) . My screening process still needs fine-tuning.

I also figured out how to track option income in Getquin: just add a manual “dividend” to NU so the dividend features capture the premiums. Works nicely for performance tracking.

See the attached picture for results. Feel free to follow if you’re curious how this experiment unfolds.

I don’t post often, so you won’t get spammed—just occasional updates on new moves and my thinking.

I’m far from a pro, so don’t expect sophisticated analysis!

Cheers!

Dividend Portfolio

Options Portfolio

$MTPLF (Metaplanet) | New Buy rating + price target 🚀

What happened?

- Investment bank Chardan starts coverage with buy recommendation and Price target $9.90 (~¥1,455).

- Metaplanet $3350 (-3,45 %) now holds 20,136 BTC in the treasury.

- Japan-Close:

¥608 (+14,72%). ADR MTPLF last at $3,94.

Additional triggers

- New subsidiaries (Metaplanet Income Corp., Bitcoin Japan Inc., Bitcoin Japan Co., Ltd.) are to scale BTC income models.

- Short overhang: including large houses with prominent positions. Sounds like... Drift. 💥

macro

- Bitcoin prints direction $116k; 24h volume declining. Correlation remains high.

Why relevant

- Narrative "Japan's $MSTR (+4,84 %)" remains intact: Equity wrappers as high-beta BTC exposure plus potential yield strategies.

Key figures at a glance

- BTC holdings: 20.136

- Price target (Chardan): $9,90 (~¥1.455)

- JPN Close: ¥608 (+14,72%)

- ADR (previous day): $3,94

- Short overhang: increases the squeeze optionality ✨

My takeaways (not investment advice):

Positive catalyst through fresh analyst cover - sentiment boost possible.

Double-edged: High short float = chance of short squeeze

and more volatile drawdowns.

BTC beta rules: $MTPLF remains an indirect bet on the BTC trend.

Watchlist

- Delivery on the yield models of the new subs (not just announcements).

- Funding requirements/dilution vs. further BTC purchases.

- Further analyst coverage & index flows.

😏🎉

Imagine the shorties building a ladder only for the price to push them off the high. Pure charity - towards longs. Thank you for your service to volatility. 🫶📈

Sources:

The Coin Republic (09/19/2025): "Breakthrough: Metaplanet (MTPLF) stock gets a buy recommendation and this price target"

CoinDesk (30.06.2025) - Coverage/Peers

MarketScreener - Consensus/Overview

MSTR

$MSTR (+4,84 %) before the US interest rate cut? What do you think?

Asymmetric potential

$3350 (-3,45 %) And the next installment. Congratulations to everyone who waited until here - it could have turned earlier. Personally, I already liked the share at the same price in February, when it was fundamentally even "worse". My first purchases were the equivalent of less than €1 last year.

The private international share offering will end soon, after which the interests of many current "shorties" and existing shareholders are likely to be aligned. This is likely to raise over a billion USD, around 10,000 BTC. A potential 50% increase in the treasury.

Current mNAV at 1.3, below the slow giant strategy. Fully diluted mNAV not much higher. BTC holdings 73x (!) as high as current debt. Have fun waiting for BTC to fall that low.

With Japan an incredibly yield-hungry environment that is likely to scramble for more products similar to Strategy.

The prerequisites: People are convinced of BTC itself and see no risk in the management team. Especially compared to Strategy, the latter is actually an advantage for me.

What do you think of the share? Have you already bought it or are you staying away from the dirt? :D

The choice between crypto and the expensive S&P500

Investors today face a striking dilemma. The S&P500, once the epitome of broad diversification, is now dominated by a small number of AI tech giants. Their share prices have risen so much that the index has almost become a mirror image of a handful of expensive companies. The risk of that is clear: if one of those giants stumbles, the whole market feels the blow. In contrast is the largest cryptocurrency.

Despite fluctuations, it offers momentum that is less dependent on a single cluster of companies.

Whereas the S&P500 floats on overconcentrated and pricey expectations, crypto actually seems to promise more room for new capital flows and growth. For those looking ahead, that's a compelling argument.

$VOO (+0,04 %)

$VUSA (+2,42 %)

$BTC (+0,65 %)

$XRP (+3,44 %)

$ETH (+2,87 %)

$SOL (+5,96 %)

$MSTR (+4,84 %)

$BMNR (+5,45 %)

$MARA (+12,02 %)

$IBIT

$IB1T (+1,66 %)

$ETHA

Titres populaires

Meilleurs créateurs cette semaine