🇺🇸 USA

$SPX500 — Futures indicate a decisive surge, with the market attempting to recover losses from last week's banking sell-off.

$DJ30 — Futures in a solid rise, showing generalized risk-on sentiment.

$NSDQ100 — Futures are strongly up, with tech leading the market rebound.

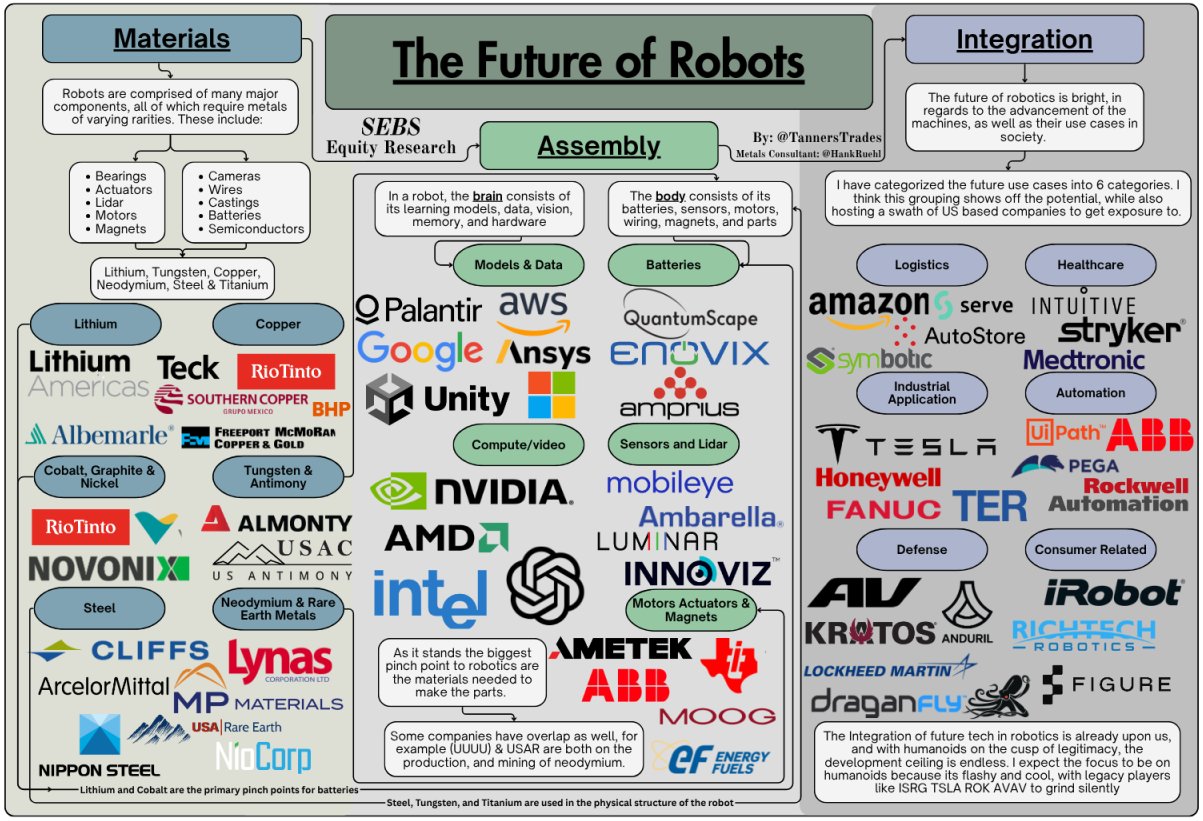

💻 Tech & Growth Snapshot

$NVDA (-0,43 %) — Up (0.55%), the stock is leading the semiconductor sector, confirming strong AI demand.

$GOOGL (+2,53 %) — Up (0.19%), the stock joins the positive Nasdaq trend.

$AVGO (+1,61 %) — Up (0.53%), the semiconductor sector benefits from renewed optimism.

$META (+0,33 %) — Up (0.48%), showing a strong recovery after recent weakness.

$MSFT (+0,77 %) — Up (0.36%), the stock regains momentum with positive sentiment.

$QBTS (-4,87 %) — Strongly up, quantum computing sentiment has turned positive amid the tech rebound.

$RGTI (-8,25 %) — Up sharply (3.08%), the quantum sector actively participates in the risk-on move.

$TSM (-0,39 %) — Up sharply (2.43%), boosted by optimism in the semiconductor sector.

🛍️ Retail & Commerce

$AMZN (-0,92 %) — Up (0.80%), strong pre-market recovery, led by tech.

$BABA (+0,21 %) — Down (-0.57%), counter-trending Western tech, affected by Asian uncertainties.

$CVNA (-1,83 %) — Up (0.57%), the stock gains ground following the broader market trend.

$SHOP (-1,48 %) — Solidly up, retail tech is driven by the general risk-on mood.

⚕️ Health & Pharmaceutical

$LLY (-0,26 %) — Up, tracking the general market rebound.

$HIMS (-0,24 %) — Stable (0.00%), the stock is steady after last week's volatility.

$INSM (-0,35 %) — Stable (0.00%), the biotech sector cautiously joins the rally.

🇪🇺 Europe

STOXX 600 — Opening solidly up, in line with global optimism.

GER40 — Decisively higher, the German market regains momentum.

$LDO (+3,18 %) — Stable (0.00%), the defense sector is neutral in this rebound phase.

$$IBE (-0,57 %) — Stable (0.00%), utilities are static in a risk-on environment.

$OKLO — Up sharply (1.73%), advanced nuclear technology continues its positive trend.

🏦 Banking & Finance

$$UCG (-2,46 %) — Stable (0.00%), Italian banks are trying to establish a base after heavy selling.

$$ISP (-0,45 %) — Stable (0.00%), awaiting clearer signals.

$$BAMI (-1,97 %) , $CE (-0,53 %) , $BPE (-2,69 %) — Stable (0.00%), the financial sector shows caution despite the risk-on trend.

$$BBVA (+0,84 %) — Stable (0.00%), the Spanish stock is leading the European banking recovery.

$AXP (+0,12 %) — Up (0.59%), the payments sector participates in the rebound.

$V (+0,39 %) — Up (0.07%), confirming its positive tone.

🌏 Asia

$JPN225 — Close in a solid rise, led by optimism in tech markets.

$KOSPI — Close up, Korean tech drives the index.

$HK50 — Up, tech stocks recover despite BABA's uncertainties.

$CHINA50 — Up, following positive global sentiment.

💱 Forex

$EURUSD — Up, the Dollar is losing momentum in a risk-on phase.

$GBPUSD — Up, the market positively assesses prospects for a stronger economy.

$USDJPY — Down, the Yen is gaining ground.

$DXY — The Dollar Index is showing clear weakness.

💎 Commodities & Precious Metals

$GLD (-1,92 %) — Down slightly (0.00%), gold consolidates as investors shift to riskier assets.

$CDE (-6,74 %) — Stable (0.00%), tracking the flat movement of gold.

$BRENT — Up, showing signs of demand recovery.

$WTI — Gaining ground, reflecting positive macroeconomic sentiment.

📈 Benchmark ETFs

$VOO (+0,21 %) — Tracking $SPX500$ futures higher.

$VGT (+0,09 %) — Up (0.00%), reflecting the strength of the technology sector.

$$CSNDX (+0,22 %) — Up (0.00%), tracking Nasdaq futures in positive territory.

$BND (+0,2 %) — Down (0.00%), reflecting rising yields.

💰 Crypto

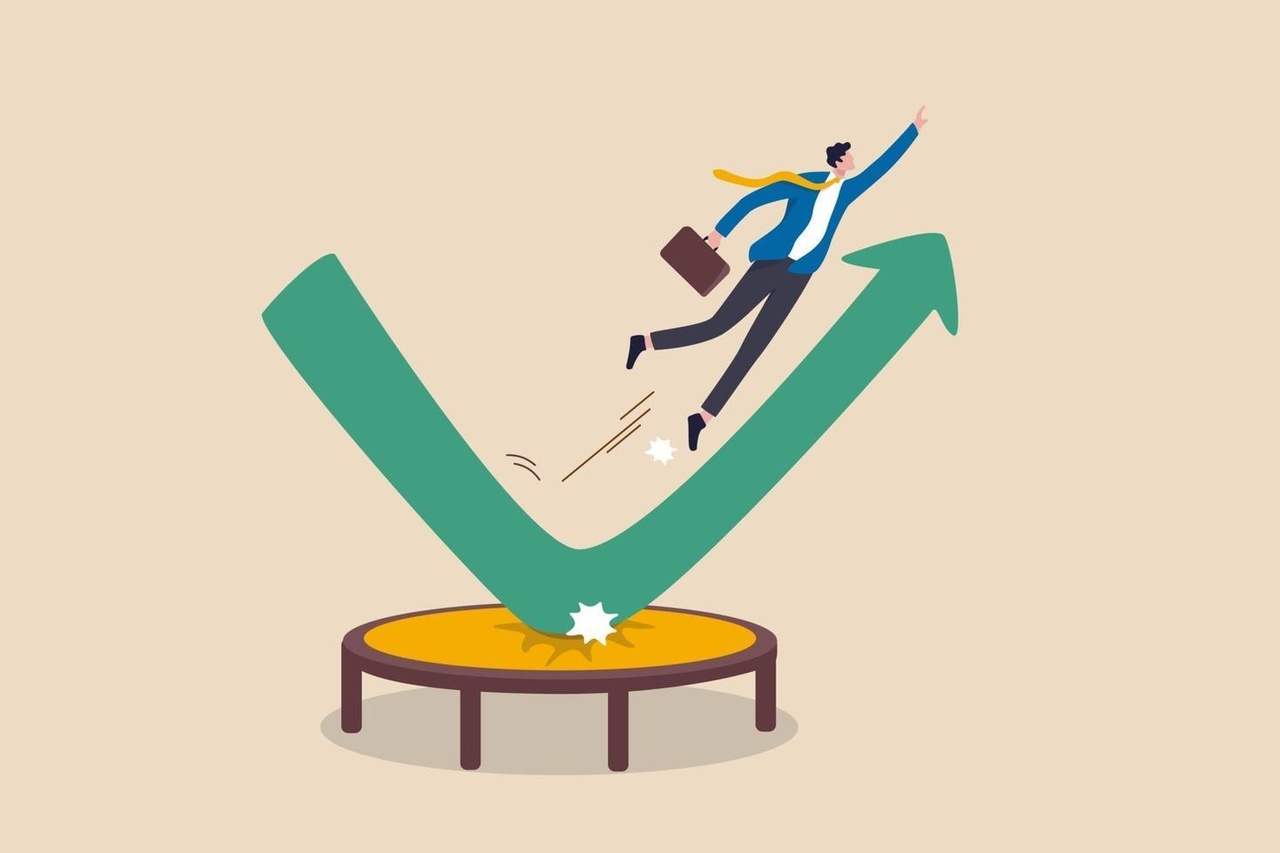

$BTC (-2,31 %) — Strong recovery, the crypto sector bounces off the bottom and gains ground.

$ETH (-2,38 %) — Solidly up, following Bitcoin.

$TRX (-1,13 %) — Up (0.00%), the altcoin sector participates in the rally.

$CRO (-3,53 %) — Up, in line with overall positive sentiment.

🚀 Space & New Tech

$RKLB (-1,78 %) — Up, sentiment for growth stocks suggests a rebound.

🔎 Deep Dive: The Return of Risk-On

The week opens with a decisive "Risk-On" mood. Markets are clearly shrugging off (for now) last week's banking tensions, focusing instead on tech-led growth ($NVDA, $TSM$) and hopes for monetary easing. The strong rally in cryptocurrencies ($BTC, $ETH$) and the weakness of the Dollar ($DXY$) are clear indicators that liquidity is flowing back into riskier assets. European banks ($BBVA.MC$) and the semiconductor sector show unexpected strength, while gold ($GLD$) pauses, confirming the shift in focus from systemic risk to growth opportunities.

For daily real-time market insights, deep dives, and trading discussions, follow me on X: https://x.com/ThomasVioli

To copy my portfolio, strategies, and complete trade insights, you can follow me on eToro: https://www.etoro.com/people/farlys

⚠️ Disclaimer: Past performance is not indicative of future results. Investing involves risks, including the loss of capital.