I have sold $DRO (-4,78 %) sold almost half of my position and took profits.

Discussion sur KTOS

Postes

8Cyber security - the armor of the future

Hello dear Getquin Community,

Over the past few days, I have been working intensively on the topic of cyber security and its fundamental importance in various sectors such as healthcare, technology, energy, armaments & defense, e-commerce, software, insurance, industry, utilities, commodities, banks, fintech, holdings, crypto and blockchain. I took a closer look at the big players, the hidden champions and the essential blade manufacturers in the industry. My aim was to gain as comprehensive a picture as possible of the different levels of this industry.

If I have overlooked any important aspects or have not categorized something correctly, I look forward to your comments and interesting additions @Tenbagger2024

@Multibagger

@Simpson

@Vegasrobaina . Together we can understand the topic even better and learn from each other.

Feel free to leave a 👍. I wish you every success with your investments 🚀

At the request of @Multibagger I have subsequently added my personal favorites in each sector. I have an investment horizon of five to ten years. In addition to the quarterly figures, my main focus was on the long-term competitive advantages and the strength of the respective moat.

Contribution:

Cybersecurity is evolving from a peripheral topic to the foundation of global markets. Whether healthcare, banking, utilities, armaments & defense, energy, industry or the digital infrastructure for artificial intelligence and blockchain, the need for protection mechanisms is increasing everywhere. While the big players such as $PANW (-4,92 %) Palo Alto Networks, $CRWD (-4,63 %) CrowdStrike or $ZS (-2,54 %) Zscaler are in the spotlight, more and more specialized providers are emerging that are essential in their niches and often have disproportionately high growth potential. Hidden champions such as $SECT B (-1,37 %) Sectra in the healthcare sector, $NCNO (-2,71 %) nCino in the banking sector or $ESTC (-4,39 %) Elastic in the data center show that cyber security has long been a diversified ecosystem. In addition, we must not overlook the blade manufacturers, i.e. the companies that provide the technological basis. These include chip manufacturers such as $NVDA (-6,14 %) , $INTC (-5,15 %) Intel or $AMD (-10,01 %) AMD, data center operators such as $EQIX (-1,43 %) Equin$DLR (-3,41 %) Digital Realty as well as software and infrastructure providers such as $ESTC (-4,39 %) Elastic, $DDOG (-5,26 %) Datadog or $ANET (-4,24 %) Arista Networks, without whose technology the security providers' solutions would not be scalable. The capital markets are reacting to this with valuation premiums, as the dependence on secure infrastructures is comparable to electrification in the 20th century. Investors are now faced with the question of whether to favor the established market leaders or invest in smaller companies that fly under the radar but could potentially be the real winners of tomorrow.

🔑Takeaway:

Cybersecurity is not an isolated trend, but a key investment factor across all industries from hospitals to data centers from payments to crypto platforms.

Healthcare

Major players:

$PANW (-4,92 %) Palo Alto Networks (PANW), $FTNT (-4,55 %) Fortinet (FTNT), $CHKP (-1,42 %) Check Point (CHKP), $CRWD (-4,63 %) CrowdStrike (CRWD), $S (-4,35 %) SentinelOne (S), $CYBR (-3,24 %) CyberArk (CYBR), $ZS (-2,54 %) Zscaler (ZS), $NET (-4,51 %) Cloudflare (NET), $AKAM (-3,46 %) Akamai Tech. (AKAM)

- Core provider for firewalls, zero trust, endpoint and web security

My top 2 recommendation in this sector are $ZS (-2,54 %) Zscaler global Zero Trust Exchange, huge barrier to entry as infrastructure is built globally and $PANW (-4,92 %) All-in-one platform, extremely high customer retention, hard to replace + acquisition of the company $CYBR (-3,24 %)

Hidden champions:

$SECT B (-1,37 %) Sectra (SECT-B.ST) - secure imaging & healthcare security

$VRNS (-3,95 %) Varonis Systems (VRNS) - protection of sensitive patient data

Imprivata (private, partnerships with listed players) - identity management for clinics

My top recommendation

$SECT B (-1,37 %) Niche leadership in healthcare security & medical technology

Blade manufacturer:

$NVDA (-6,14 %) Nvidia (NVDA), $INTC (-5,15 %) Intel (INTC), $AMD (-10,01 %) AMD (AMD) - Chips & computing power for security appliances

$EQIX (-1,43 %) Equinix (EQIX), $DLR (-3,41 %) Digital Realty (DLR) - Data center infrastructure for clinical data

$ESTC (-4,39 %) Elastic (ESTC), $DDOG (-5,26 %) Datadog (DDOG) - basic software for monitoring & analytics

My top 2 recommendations are $NVDA (-6,14 %) - GPUs, quasi-monopoly in high-end compute and $EQIX (-1,43 %) - largest global colocation provider, enormous switching costs

🔑 Takeaway healthcare

Healthcare data is highly sensitive and clinics are at high risk of ransomware. In addition to large security providers, hidden champions such as Sectra and Varonis are gaining in importance as they secure directly at the interface between patient data and medical devices.

Technology, Data centers & AI, Telecommunications

Major players:

$ZS (-2,54 %) Zscaler (ZS), $S (-4,35 %) SentinelOne (S), $CHKP (-1,42 %) Check Point (CHKP)

- Protection for cloud and AI environments

My top recommendation $ZS (-2,54 %) - Global Zero Trust Exchange, almost impossible to copy

Hidden champions:

$ESTC (-4,39 %) Elastic (ESTC) - Security-Analytics

$ANET (-4,24 %) Arista Networks (ANET)

- Network switches for data centers

My top recommendation $ANET (-4,24 %) - High-end switches, hyperscaler customers

Shovel manufacturer:

$EQIX (-1,43 %) Equinix (EQIX), $DLR (-3,41 %) Digital Realty (DLR)

- Data center infrastructure

$NVDA (-6,14 %) Nvidia (NVDA), $INTC (-5,15 %) Intel (INTC), $MRVL (-5,93 %) Marvell Tech. (MRVL)

- Chips & computing power for AI and security

My top 2 recommendation $NVDA (-6,14 %) - GPUs, quasi-monopoly in high-end compute and $EQIX (-1,43 %) - largest global colocation provider, enormous switching costs

Special players Telecommunications

$AKAM (-3,46 %) Akamai Tech. (AKAM) & Cloudflare (NET) - secure traffic and mobile data

$RDWR (-4,29 %) Radware (RDWR) - DDoS protection for telcos

$CSCO (-3,83 %) Cisco (CSCO) - network security for carriers

$CLAV (+1,23 %) Clavister Holding AB (CLAV) - through SD-WAN and carrier security

My top recommendation $AKAM (-3,46 %) - Established CDN + Security

🔑 Takeaway technology, data centers & AI

Data centers and AI platforms are the backbone of the digital economy. Zero Trust and cloud security from Zscaler or SentinelOne meet shovel manufacturers such as Equinix or Nvidia, who are indispensable with infrastructure and chips.

Energy

Major players:

$FTNT (-4,55 %) Fortinet (FTNT, NASDAQ) - OT/ICS security for power grids and power plants

$PANW (-4,92 %) Palo Alto Networks (PANW, NASDAQ) - Zero Trust & network protection for energy suppliers

$CHKP (-1,42 %) Check Point (CHKP, NASDAQ) - Critical infrastructure protection, gas and oil industry

My top recommendation $FTNT (-4,55 %) - ASIC hardware + software, cost advantage

Hidden champions:

Dragos (private, IPO candidate) - leader in OT security, specialized in energy infrastructures

$RDWR (-4,29 %) Radware (RDWR, NASDAQ) - DDoS defense for energy networks

$NCC (-0,3 %) NCC Group (NCC.L, London) - penetration tests & audits for utilities

$CLAV (+1,23 %) Clavister Holding AB (CLAV) - OT/ICS and infrastructure security

My top recommendation $CLAV (+1,23 %) - small niche player (carrier security)

Shovel manufacturer:

$SBGSY (-2,31 %) Schneider Electric (SBGSY, OTC) - OT/ICS hardware with security components

$ENR (-3,54 %) Siemens Energy (ENR, Frankfurt) - Energy infrastructure with embedded security solutions

$AVGO (-7,17 %) Broadcom (AVGO, NASDAQ) - Security chips for networks in energy environments

My top recommendation $AVGO (-7,17 %) - Chip giant + Symantec Enterprise Security

E-Commerce

Major players:

$NET (-4,51 %) Cloudflare (NET, NYSE) - DDoS and API protection for online stores & payment platforms

$AKAM (-3,46 %) Akamai (AKAM, NASDAQ) - Application security & bot management in e-commerce

$FFIV (-3,6 %) F5 Networks (FFIV, NASDAQ) - API & payment security for digital platforms

My top recommendation $NET (-4,51 %) - worldwide network for DDoS/API, network effects

Hidden Champions:

$RSKD (-3,72 %) Riskified (RSKD, NYSE) - Fraud prevention in online trading

$VRNS (-3,95 %) Varonis Systems (VRNS, NASDAQ) - Protection of customer data

$CYBR (-3,24 %) CyberArk (CYBR, NASDAQ) - Identity & access protection for payment processes

My top recommendation $CYBR (-3,24 %) - Standard for Privileged Access

Shovel manufacturer:

$V (-2,33 %) Visa (V, NYSE) & $MA (-2,02 %) Mastercard (MA, NYSE) - not classic cybersecurity, but operators of secure payment networks

$ESTC (-4,39 %) Elastic (ESTC, NYSE) - fraud analytics for e-commerce platforms

$DDOG (-5,26 %) Datadog (DDOG, NASDAQ) - monitoring & security analytics for retail infrastructure

My top recommendation $V (-2,33 %) - Global payment network, enormous network effect

🔑 Takeaway:

Energy is particularly vulnerable due to OT/ICS systems, specialists such as Dragos are emerging here.

E-commerce needs fraud prevention in addition to traditional web security, which is why players such as Riskified are occupying a niche.

Armaments & Defense

Major players:

$NOC (-2,31 %) Northrop Grumman (NOC, NYSE) - leader in cyberdefense for military & intelligence agencies, also developing offensive cyber capabilities

$BAESY (+1,65 %) BAE Systems (BAESY, OTC) - strong cyber intelligence division, protects critical military and government networks

$RTX (-3,57 %) Raytheon Technologies (RTX, NYSE) - defense company with growing cybersecurity portfolio for military communications & satellites

My top recommendation $NOC (-2,31 %) - Top defense contractor with cyber dominance

Hidden champions:

$PLTR (-7,09 %) Palantir Technologies (PLTR, NYSE) - Data and analytics platform with strong cybersecurity component, often for defense contractors

$CACI (-2,05 %) CACI International (CACI, NYSE) - specializes in cyber intelligence, network protection and military IT services

$LDOS (-3,56 %) Leidos Holdings (LDOS, NYSE) - IT and cybersecurity service provider for US defense and NATO

$CLAV (+1,23 %) Clavister Holding AB (CLAV) - used by government and military organizations

$ADVE Advenica (ADVE) - Specialized security, relevant for government agencies and national infrastructure

My top recommendation $CACI (-2,05 %) - Cyber intelligence, deep roots in the defense sector

Shovel manufacturer:

$LHX (-2,48 %) L3Harris Technologies (LHX, NYSE) - provides communications and cyber hardware for military networks

$GD (-3,41 %) General Dynamics (GD, NYSE) - with its IT division GDIT also a provider of cyber defense infrastructure

$KTOS (-4,85 %) Kratos Defense (KTOS, NASDAQ) - specializes in drones, satellite systems and cyber hardening of defense communications

My top recommendation $GD (-3,41 %) - strong role in defense cyber with GDIT

🔑 Takeaway:

In the defence sector, the boundaries between traditional defense and cybersecurity are becoming blurred. Alongside the large defense contractors, hidden champions such as Palantir, CACI and Leidos are emerging to provide pure cyber and data expertise. Shovel manufacturers such as L3Harris and Kratos secure the technical infrastructure.

Software & insurance

Big players:

$OKTA (-5,44 %) Okta (OKTA), $CYBR (-3,24 %) CyberArk (CYBR), $CRWD (-4,63 %) CrowdStrike (CRWD)

- Identity, endpoint and cloud security

My top recommendation $CRWD (-4,63 %) - Network effect through Falcon & Threat Graph

Hidden champions:

$VRNS (-3,95 %) Varonis (VRNS) - Data Security

SailPoint (private, formerly NYSE) - Identity Governance

$FROG (-0 %) JFrog (FROG) - DevSecOps & Supply-Chain-Security

$CYBE (+0 %) CyberCatch Holdings, Inc (CYBE) - Provides AI-based cybersecurity SaaS

$GEN (-1,72 %) Gen Digital (GEN) - one of the largest consumer cybersecurity providers worldwide (Norton, Avast, LifeLock), strong in identity protection and data protection for consumers & small businesses

$RBRK (-4,71 %) Rubrik (RBRK) - data compliance and security in the area of cloud data security

My top recommendation $GEN (-1,72 %) - Consumer security giant (Norton, Avast, LifeLock), strong brand power

Shovel manufacturer:

$MSFT (-3,3 %) (MSFT), $GOOG (-3,33 %) Alphabet (GOOGL), $AMZN (-5,92 %) Amazon (AMZN)

- Cloud security base

$FFIV (-3,6 %) F5 Networks (FFIV) - API protection for SaaS & insurance platforms

My top recommendation $GOOG (-3,33 %) - global cloud security + Mandiant, strong moat through infrastructure & Threat Intel

🔑 Takeaway Software & Insurance

Data and identity protection take center stage. Major players such as Okta and CyberArk secure access, while hidden champions such as Varonis and JFrog provide specialist solutions. Cloud providers such as Microsoft and Amazon are both platform operators and security suppliers.

Industry, supply & raw materials

Major players:

$FTNT (-4,55 %) Fortinet (FTNT), $CSCO (-3,83 %) Cisco (CSCO), $PANW (-4,92 %) Palo Alto Networks (PANW)

- Network protection for critical infrastructures

My top recommendation $FTNT (-4,55 %) - ASIC hardware + software, cost advantage

Hidden champions:

$RDWR (-4,29 %) Radware (RDWR) - DDoS protection

$NCC (-0,3 %) NCC Group (NCC.L) - OT-Security & Penetration Tests

$SECT B (-1,37 %) Sectra (SECT-B.ST) - secure infrastructure in the OT/healthcare intersection

$CLAV (+1,23 %) Holding AB CLAV) - OT/ICS and infrastructure security

$ADVE Advenica (ADVE) - Specialized security, relevant for public authorities and national infrastructure

My top recommendation $ADVE - Specialized Crypto/OT-Security for public authorities

Shovel manufacturer:

$AVGO (-7,17 %) Broadcom (AVGO) - security chips

Juniper Networks (JNPR) - network backbones

$ANET (-4,24 %) Arista Networks (ANET) - high-end switches

My top recommendation $AVGO (-7,17 %) - Chip-Giant + Symantec Enterprise Security

🔑 Takeaway Industry, Utilities & Commodities

OT/ICS systems in production, energy and raw materials are attractive targets. Fortinet and Palo Alto dominate, but hidden champions such as Radware and the NCC Group offer special expertise for attacks on industrial control systems.

Banks, Fintech & Holdings

Big players:

$CRWD (-4,63 %) CrowdStrike (CRWD), $PANW (-4,92 %) Palo Alto Networks (PANW), $ZS (-2,54 %) Zscaler (ZS)

- Core protection for banks & digital platforms

My top recommendation $ZS (-2,54 %) - Global Zero Trust Exchange, almost impossible to copy

Hidden champions:

$NCNO (-2,71 %) nCino (NCNO) - Cloud Banking Security

$NCC (-0,3 %) NCC Group (NCC.L) - Audits & Compliance

$CYBE (+0 %) CyberCatch Holdings, Inc (CYBE) - Provides AI-based cybersecurity SaaS

$GEN (-1,72 %) Gen Digital (GEN) - through fraud prevention and identity topics

My top recommendation $GEN (-1,72 %) - Consumer security giant (Norton, Avast, LifeLock), strong brand power

Shovel manufacturer:

$FFIV (-3,6 %) F5 Networks (FFIV) - API security for payments

$AKAM (-3,46 %) Akamai Tech. (AKAM) - Web & Payment Security

$ESTC (-4,39 %) Elastic (ESTC) - Fraud Analytics

My top recommendation $FFIV (-3,6 %) - Leader in Application & API Security

🔑 Takeaway Banks, Fintech & Holdings

High regulatory pressure makes cybersecurity a mandatory field. In addition to established providers, banks are relying on hidden champions such as nCino or Darktrace for cloud banking and anomaly detection. Shovel manufacturers such as F5 or Akamai secure payment APIs and banking portals.

Crypto & blockchain

Big players:

$PANW (-4,92 %) Palo Alto Networks (PANW), $FTNT (-4,55 %) Fortinet (FTNT), $CRWD (-4,63 %) CrowdStrike (CRWD)

- Core protection for exchanges, wallets and blockchain infrastructure

My top recommendation $FTNT (-4,55 %) - ASIC hardware + software, cost advantage

Hidden champions:

$BBAI (-4,05 %) BigBear.ai (BBAI) - Blockchain Fraud Detection

$RIOT (-7,91 %) Riot Platforms (RIOT) - Mining with a focus on security

$CHKP (-1,42 %) Check Point - the new blockchain firewall initiative (Web3)

My top recommendation $CHKP (-1,42 %) - Strong brand & existing customers, but limited innovative strength

Shovel manufacturer:

$NVDA (-6,14 %) Nvidia (NVDA), AMD (AMD) - chips & mining hardware

$NET (-4,51 %) Cloudflare (NET), $AKAM (-3,46 %) Akamai Tech. (AKAM)

- Network protection for wallets & exchanges

My top recommendation $NVDA (-6,14 %) - GPUs, quasi-monopoly in high-end compute

🔑 Takeaway crypto & blockchain

Crypto ecosystems are heavily affected by attacks on exchanges, wallets and smart contracts. While traditional security players provide protection, niche providers such as BigBear.ai and Riskified are emerging that specialize specifically in fraud and blockchain risks.

Source: Own analysis, image material: schwarz-digits

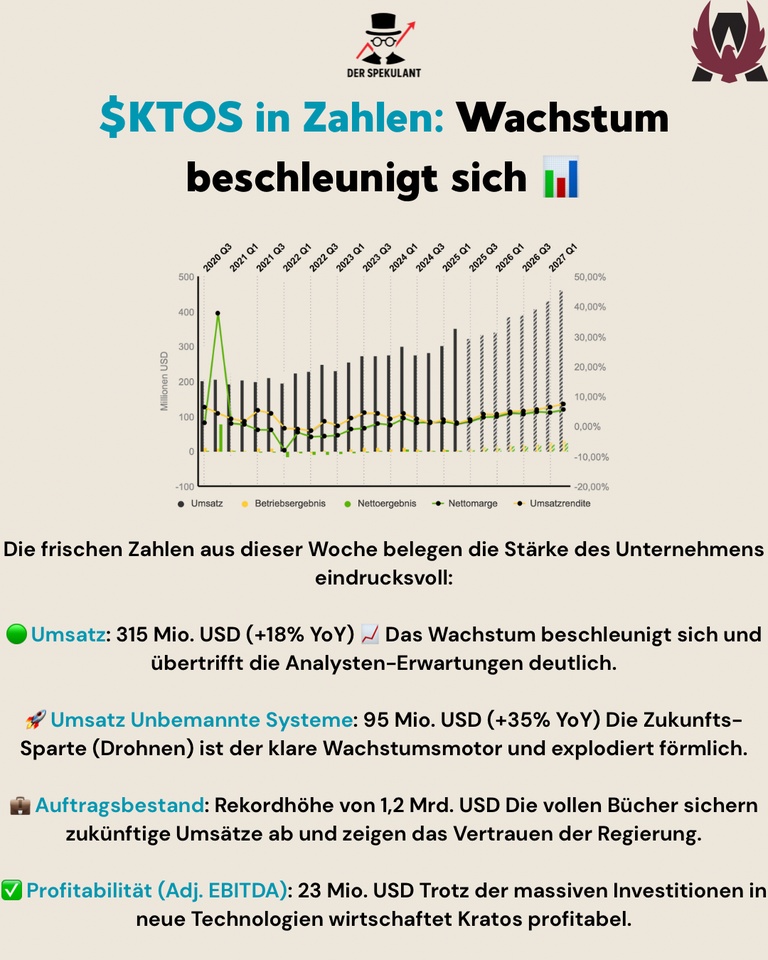

Deep Dive: Kratos Defense ($KTOS) - More than drones, a bet on autonomous war 🛰️

Hello Community,

After this week's red-hot quarterly results, it's time for a detailed deep dive into a company that works at the intersection of technology and defense and has the potential to redefine the rules of modern warfare: Kratos Defense $KTOS (-4,85 %)

). Many people only know the company as "the one with the drones", but this description falls far short.

The ecosystem: a diversified tech company ⚙️

Kratos is not a simple defense contractor. It is a self-reinforcing ecosystem of highly specialized technology divisions, all focused on the future of US defense:

➡️ Unmanned systems (drones) 🛸:

This is the well-known flagship and growth engine. This includes the profitable target drones (target drones) for exercises and the future-oriented tactical drones(Tactical Drones) such as the revolutionary XQ-58A Valkyrie.

➡️ Space travel & satellite communication 📡: An often overlooked but extremely important area. Kratos is a leading provider of ground stations and satellite control. At a time when space is being militarized, this is a huge growth area.

➡️ Hypersonic & missile systems

hypersonic_sound:: Kratos develops hypersonic systems (weapons that travel at more than five times the speed of sound) and missile defense. This is absolutely cutting-edge technology in which the Pentagon is investing heavily.

➡️ Engines & Electronics ⚙️:

The company is building the next generation of small, efficient jet engines for its drones and missiles. This demonstrates a high level of technological depth and reduces dependence on suppliers.

The hard facts (Q2 2025): Growth driver drones 📊

This week's figures were further proof of the strength of this model:

✅ Total sales:

Exploded to USD 351.5 million (+17% year-on-year), significantly exceeding expectations.

✅ Growth Unmanned Systems:

The future-oriented division is growing exponentially at +35% compared to the previous year. This is where the future money will be earned.

✅ Orders on hand:

Reaches a record level of USD 1.2 billion. This secures sales for the coming quarters and shows the Pentagon's confidence.

✅ Profitability:

Despite massive investments in research & development, the company remains highly profitable with adjusted earnings per share of USD 0.11 (expected: USD 0.09) and is even raising its forecast for the year as a whole.

$KTOS has managed to establish itself as an agile and innovative partner to the US military. The different business areas are mutually beneficial: the engines flow into the drones, the satellite communication controls them. This is a strong technological moat.

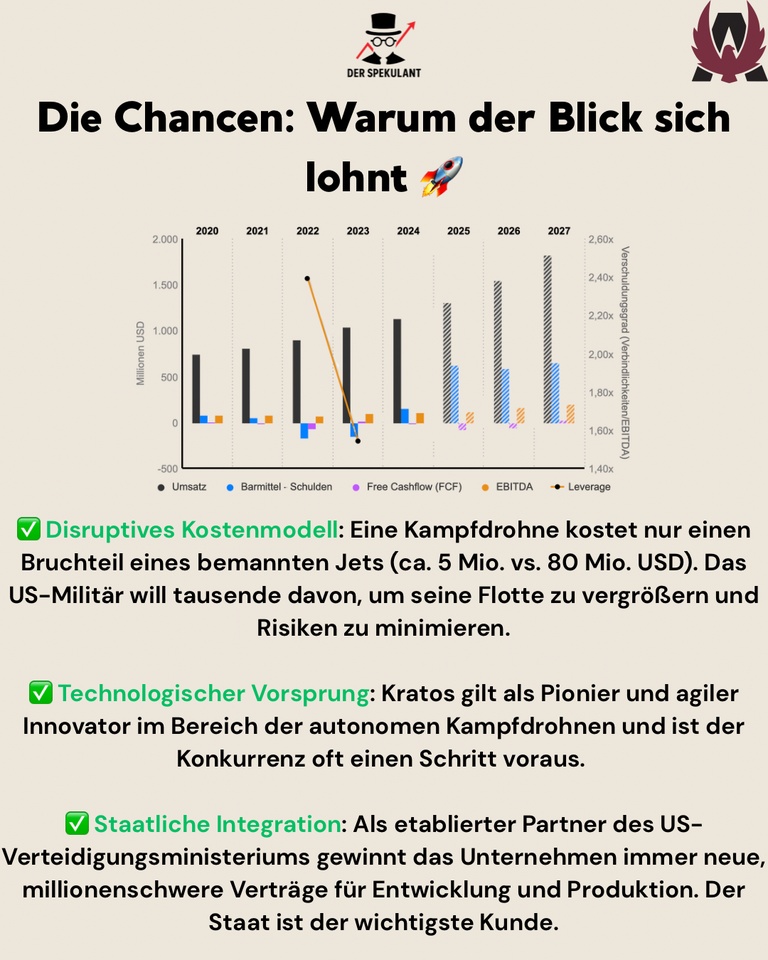

The opportunities 🚀📈

🟢 Disruptive cost model:

In a world where manned combat aircraft cost over $80 million each, Kratos offers an alternative for about $5 million. The US military can build a much larger and more flexible fleet for the same money while minimizing the risk to its pilots.

🟢 Technological edge:

Kratos is considered a pioneer and agile innovator in the field of autonomous combat drones. In areas such as the "Loyal Wingmen", they are often a decisive step ahead of the sluggish armaments giants.

🟢 Political tailwind:

The US has clearly defined that the future of warfare lies in unmanned, networked systems ("Collaborative Combat Aircraft" program). Kratos is perfectly positioned to be one of the biggest beneficiaries of this billion-euro strategic realignment.

The risks ‼️

🔴 Dependence on government contracts: Political decisions, changes of government or cuts in the defense budget in Washington are and remain the biggest external risk.

🔴 Long development cycles:

It can take many years from a prototype to full mass production. The really big profits are still in the future, and delays are normal in this industry.

🔴 Strong competition:

The big defence giants (Boeing, Northrop, Lockheed) have recognized the potential and are now also investing massively in this future market. They have deeper pockets and better access to politics.

The investment thesis: Why you should know the share 💡

An investment in Kratos is a bet on the disruption of military technology. It's a bet that future conflicts will be decided largely by AI-controlled, networked drone swarms and not just traditional manned jets.

Conclusion & outlook 🧠

Kratos Defense is one of the purest and most exciting stocks to participate in the autonomous warfare revolution. The company has a clear vision, leading technology, diversified business areas and the most important customer in the world: the US military. The key question for investors is whether they have the patience and risk tolerance to wait for this enormous potential to be fully realized.

+ 3

That's exciting

I find the share of $KTOS (-4,85 %) quite interesting. It has only taken just under 20 years to complete the saucer formation since the issue and finally rise above the issue price again. Should you get in now or wait for a setback?

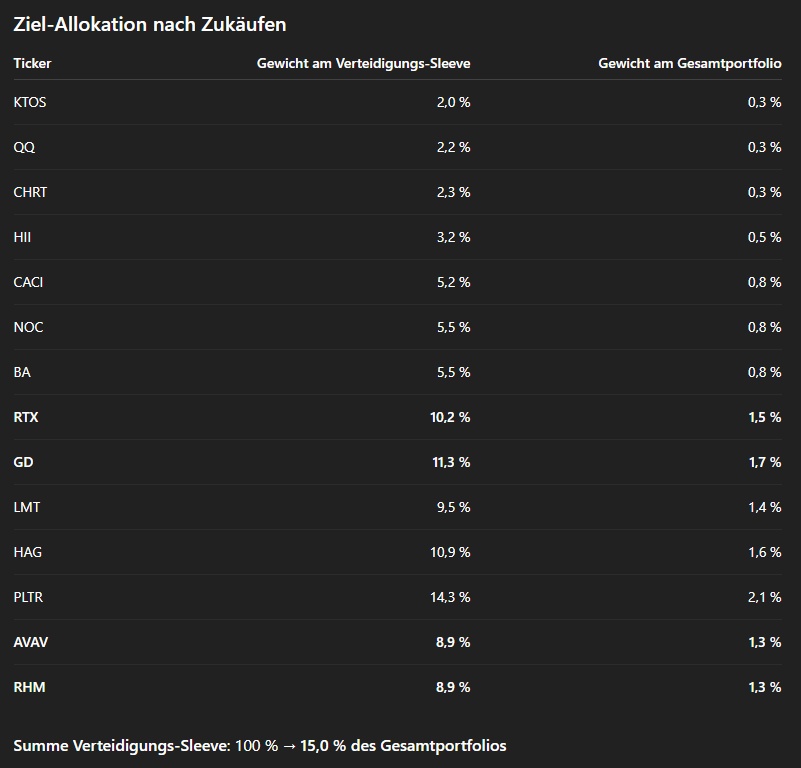

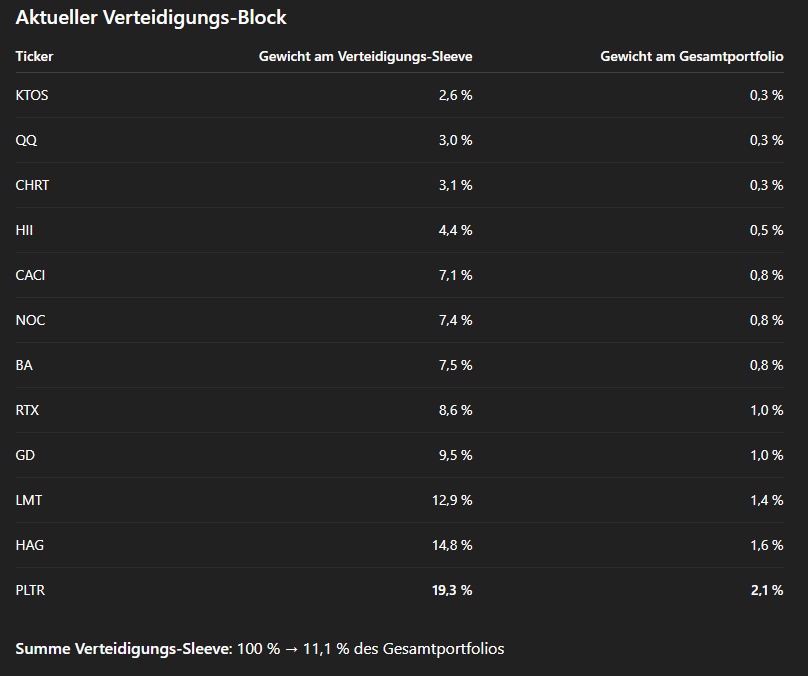

Defense Portfolio Update

I wanted to give you a little update on my current defense portfolio and the planned changes.

📍Status Quo:

📍Capability areas and benefits for the portfolio:

Air & missile defense

$RTX (-3,57 %) ,$LMT (-1,11 %)

Patriot, PAC-3, THAAD - core systems for the protection of cities, bases and fleets

Combat aircraft & air dominance

$LMT (-1,11 %) , $BA. (-2,69 %)

F-35 program (LMT), Eurofighter Typhoon, future Tempest/FCAS

Maritime strike capability

$HII (-2,12 %) , $GD (-3,41 %) , $BA. (-2,69 %)

Nuclear submarines (Virginia, Astute), Type-26 frigates, combat systems

Sensors & electronic reconnaissance

$HAG (-4,62 %) , $QQ. (-2,53 %) , $CHRT (-3,22 %) , $BA. (-2,69 %)

AESA radars, ESM/ECM, BAE Raven ES-05 radar

Autonomous systems & drones

Almost all companies play me here. $KTOS (-4,85 %) as the only drone pure play.

Unmanned jets (XQ-58) and tactical UAS - rapidly growing budget item

Cyber / AI & data fusion

$PLTR (-7,09 %) ,$CACI (-2,05 %)

AI-supported command and control systems (PLTR Gotham/Apollo) and US government IT services

Ground-based large-scale systems

$GD (-3,41 %) ,$NOC (-2,31 %) , $BA. (-2,69 %)

Abrams modernizations, artillery rockets and ground-based sensors, CV90-IFV, M109 howitzers

Multidomain space flight

US nuclear deterrence - from delivery systems to warning and command and control networks

💰Realized partial sales at $HAG and $PLTR

I had already reduced $HAG and $PLTR by 50% each this year with large gains (+651% and +346%):

The valuations of both companies are currently extremely sporty.

PLTR

Trailing P/E ratio (TTM): 580 - 590x

Forward P/E ratio: ~240x

Price-to-sales: >100x

HAG

Trailing P/E ratio (TTM): 120 - 130x

Forward P/E ratio: ~80x

Price-to-sales: >5x

I will nevertheless remain invested in both positions for the time being. Mainly because I currently see no significant change in the underlying investment story.

Position sizes are relativized by new planned purchases and the concentration risk falls from 34% → 25% of the sleeve.

📊Planned adjustments:

❓Why these changes?

New position$AVAV (-2,23 %)

(drones/loitering ammunition):

Covers the fastest growing budget line (attritable UAS), which was previously barely represented.

New position $RHM (-2,26 %)

(Ammunition & Platforms)

Adds the "155 mm grenades" bottleneck and European land systems to the portfolio; beneficiary of EU armament.

Increase $RTX (-3,57 %)

Most favorable US prime (forward P/E ≈ 25), high visibility in air/missile defense systems.

Top-up $GD (-3,41 %)

Diversified towards submarines, ground vehicles and ammunition; reliable free cash flow.

📉Planned, staggered entries:

$AVAV: $220 - $185

$RHM: €1550 - €1450

$RTX: $125 - $120

$GD: $285 - $270

🤔 What does your portfolio look like?

Which defense stocks do you hold and why?

Or smaller companies like $MILDEF.

I myself am also in $AVAV

But then also more with suppliers and companies that only partly cover armaments.

Such as $KIT as a drone contract manufacturer and supplier for Rheinmetall, Kongsberg, Safran etc..

Or $MTX in the consortium for the Eurofighter and maintenance company for the German Armed Forces.

Then $ERJ supplies transport aircraft for NATO countries. And smaller combat aircraft.

$PNG supplies the navy.

$TDG is also a supplier.

$IVG I also have the defense division for sale.

My new addition is $GILT. They have now also entered the defense sector.

Share presentation

While everyone is staring at the big armor values such as Lockheed & Co. $KTOS (-4,85 %) is still flying under the radar - but they are right in the middle of things when it comes to the future of defense:

✅ Focus on drones, unmanned systems & space technology

✅ Supplier for the Pentagon, NATO & SpaceX partner

✅ Drones such as the XQ-58A Valkyrie are seen as game changers for the military

✅ Sales are growing, order backlog is steadily increasing

💡 Market environment speaks for itself: global defense spending at record levels, drone technology is becoming standard - and Kratos is at the forefront of technology

Currently still below USD 3 billion market capitalization - small cap with real 10x potential if drone programs are successful.

Conclusion: If you don't want to miss out on the future of AI and defense, you should put KTOS on your watchlist now - before the mainstream discovers it. ⚡

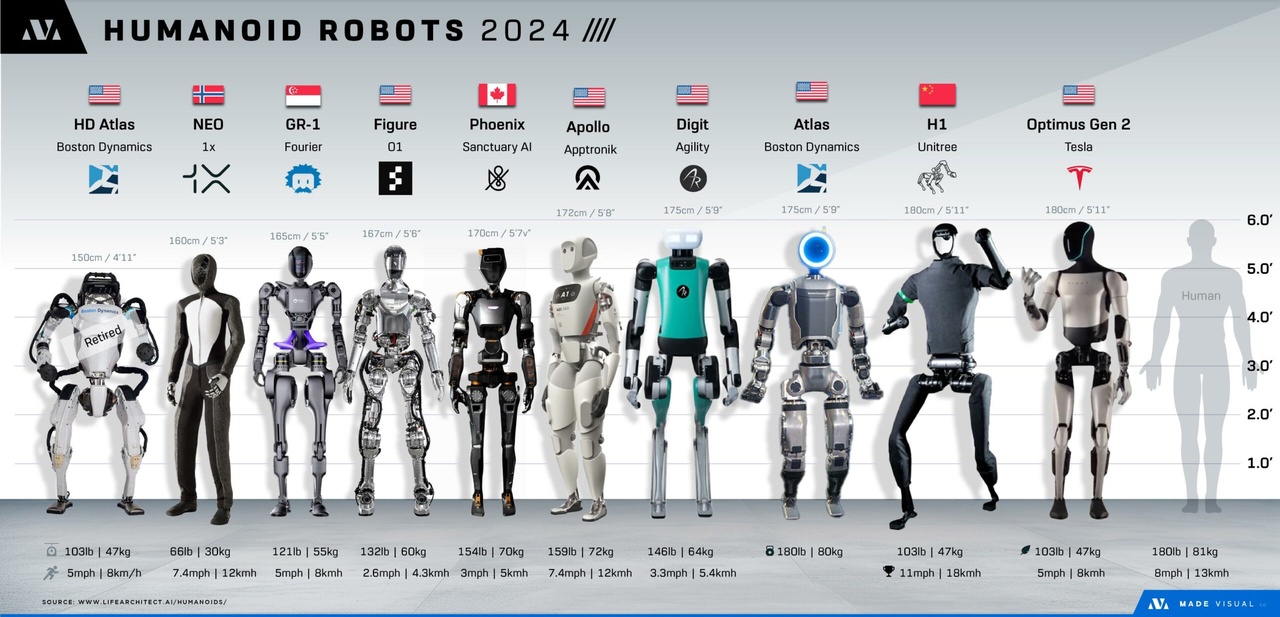

The Age of Robots is Here:

Humanoids

$TSLA (-6,86 %)

Tesla

$XPEV (-7,58 %)

Xpeng

$1810 (-5,32 %)

Xiaomi

$HYUD

Hyundai

Logistics

$SERV

Serve Robotics

$AMZN (-5,92 %)

Amazon

$SYM

Symbotic

$AUTO (-6,3 %)

AutoStore

Robotics Software

$NVDA (-6,14 %)

NVIDIA

$PTC (-2,88 %)

PTC

Sensors

$OUST

Ouster

Healthcare Robotics

$ISRG (-4,16 %)

Intuitive Surgical

$SYK (-2,46 %)

Stryker

$MDT (-1,23 %)

Medtronic

$ARAY (-1,88 %)

Accuray

Industrial Robotics

$HON (-2,58 %)

Honeywell

$TER (-9,45 %)

Teradyne

$LECO (-3,2 %)

Lincoln Electric

Robotics Automation

$ROK (-3,15 %)

Rockwell Automation

$ABBN (-0,59 %)

ABB

$ZBRA (-9,21 %)

Zebra Technologies

$CGNX (-13,21 %)

Cognex

$PATH (-10,71 %)

UiPath

$PEGA (-3,09 %)

Pegasystems

Defense Robotics

$AVAV (-2,23 %)

AeroVironment

$KTOS (-4,85 %)

Kratos

$LMT (-1,11 %)

Lockheed Martin

$NOC (-2,31 %)

Northrop Grumman

$BA (-3,43 %)

Boeing

$GD (-3,41 %)

General Dynamics

Consumer & B2B Robotics

$IRBT (-7,91 %)

iRobot

$1810 (-5,32 %)

Xiaomi

$RR

RichTech Robotics

Specialized Robotics

$OII (-5,91 %)

Oceaneering

$FARO

FARO Technologies

Defence ETF 2025 switch

I just closed my entire $DFEN (-4,18 %) position after a very good ride last year, switching it with the new $IVDF (-4,37 %) because the VanEck ETF is currently too exposed to $PLTR (-7,09 %) and with this structure it does not help me in my portfolio diversification (that is mainly tech, but I also believe that Palantir may not offer good earnings in 2025), while the new Invesco $IVDF (-4,37 %) has a very cool and balanced composition ($RKLB (-6,93 %)

$KTOS (-4,85 %)

$AVAV (-2,23 %)

$LDOS (-3,56 %) to name few) and also a much lower TER.

From my point of view this is the best ETF for anyone looking to invest in the Defence sector at the moment (and I also had been invested on $ASWC (-6,68 %) last year, then I decided to go completely on $DFEN (-4,18 %) until today).

NOT FINANCIAL ADVICE!!! 👀

Titres populaires

Meilleurs créateurs cette semaine