Servus,

Since my little one is sleeping now, I'm going to throw out the next post right away. In my last post I have already presented my strategy.

Strategy itself very boring. Short version dividend stocks.

Only how do I choose the right stocks?

- Dividend should be solid

- the business model should have long term potential and

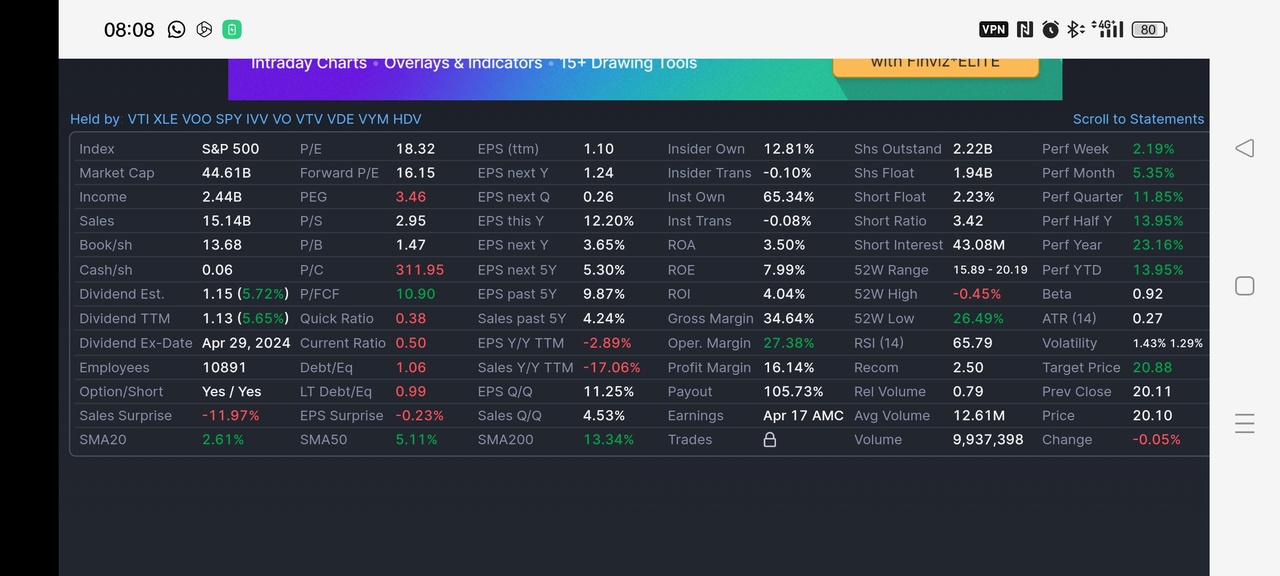

- of course the numbers should be right

- The share price is secondary for the time being.

Today I will start with a share that is not currently in the portfolio but could be interesting in a few years.

The company.

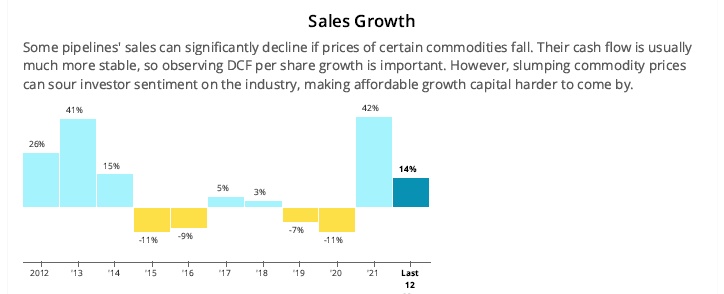

Kinder Morgan was founded in 1997 and is one of North America's largest infrastructure companies, providing gathering, storage, transportation and processing services to the oil and gas industry. In total, they operate 135,000 km of natural gas and crude oil pipelines and have 180 tank farms. Kinder Morgan's pipelines, storage facilities and terminals are integrated with nearly all areas of the U.S. energy industry, including all major gas and oil shale formations and export markets along the Gulf Coast. The company generates most of its cash flow from natural gas pipelines, with the remainder split between refined products and oil pipelines, storage and the sale of carbon dioxide used in tertiary oil production.

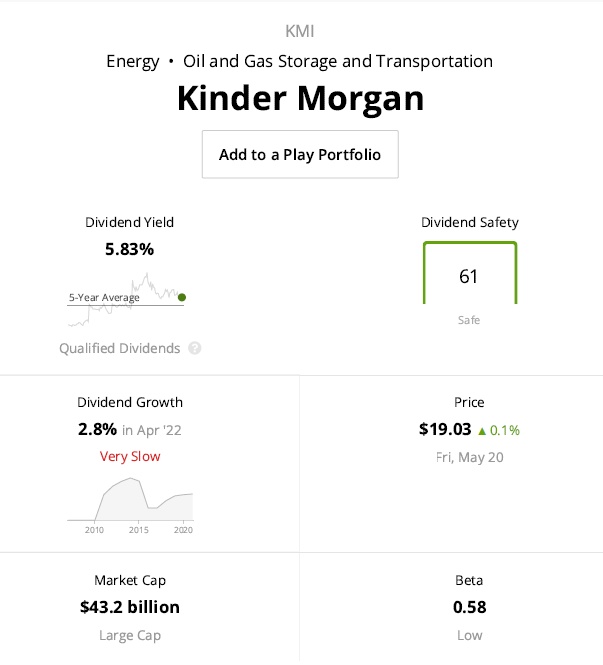

Kinder Morgan's infrastructure provides important services to the energy industry, but the company's long-term track record is clouded by a 75% dividend cut in 2015. The cut took place to further fund expansion plans without jeopardizing its investment-grade rating.

Since then, the company has adopted a self-funding business model (eliminating the need to issue equity), scaled back its growth ambitions, significantly reduced its leverage and improved its credit rating by one notch to BBB.

In addition to these factors, Kinder Morgan's dividend is supported by the company's recurring cash flow. Approximately two-thirds of the company's cash flow is generated under fee-based contracts of up to 20 or more years, which operate on a "take or pay" basis.

This reduces Kinder Morgan's direct exposure to commodity prices, although the company is not immune to volatility in the energy sector. Thus, another 25% of Kinder Morgan's cash flow is also fee-based, but not hedged by minimum volume provisions.

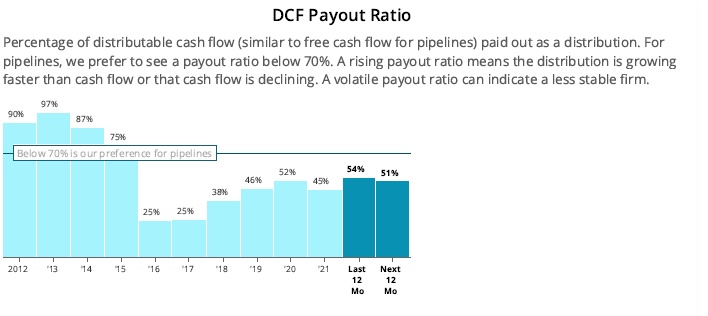

Overall, Kinder Morgan has come a long way since its infamous dividend cut in 2015. The company's balance sheet is in better shape, its dividend is better covered by cash flow, capital spending is more disciplined, and growth is largely self-funded. However, too much is being paid out and total capital is shrinking.

Conclusion.

The business model is certainly relevant for the next 20-25 years and the company is now well positioned. The dividend is bombastic (6%), but not secure. The business figures do not convince me personally at the moment. Thus, Kinder Morgan is currently not yet on the depot list, but will continue to be observed and my attitude may still change.

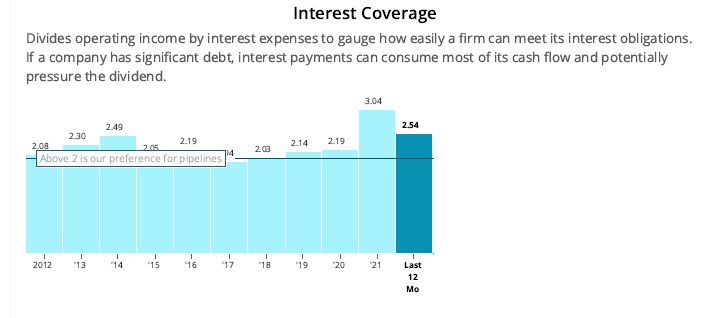

By the way, the charts are from simplysafedividends.com.

In my next post I will introduce a stock that for me will def. still be added this year. Here I will also go into more detail about the key figures. (was a little too much work for me today and for a stock that has not yet made it into the depot or will make it)

as always only my opinion and no investment advice