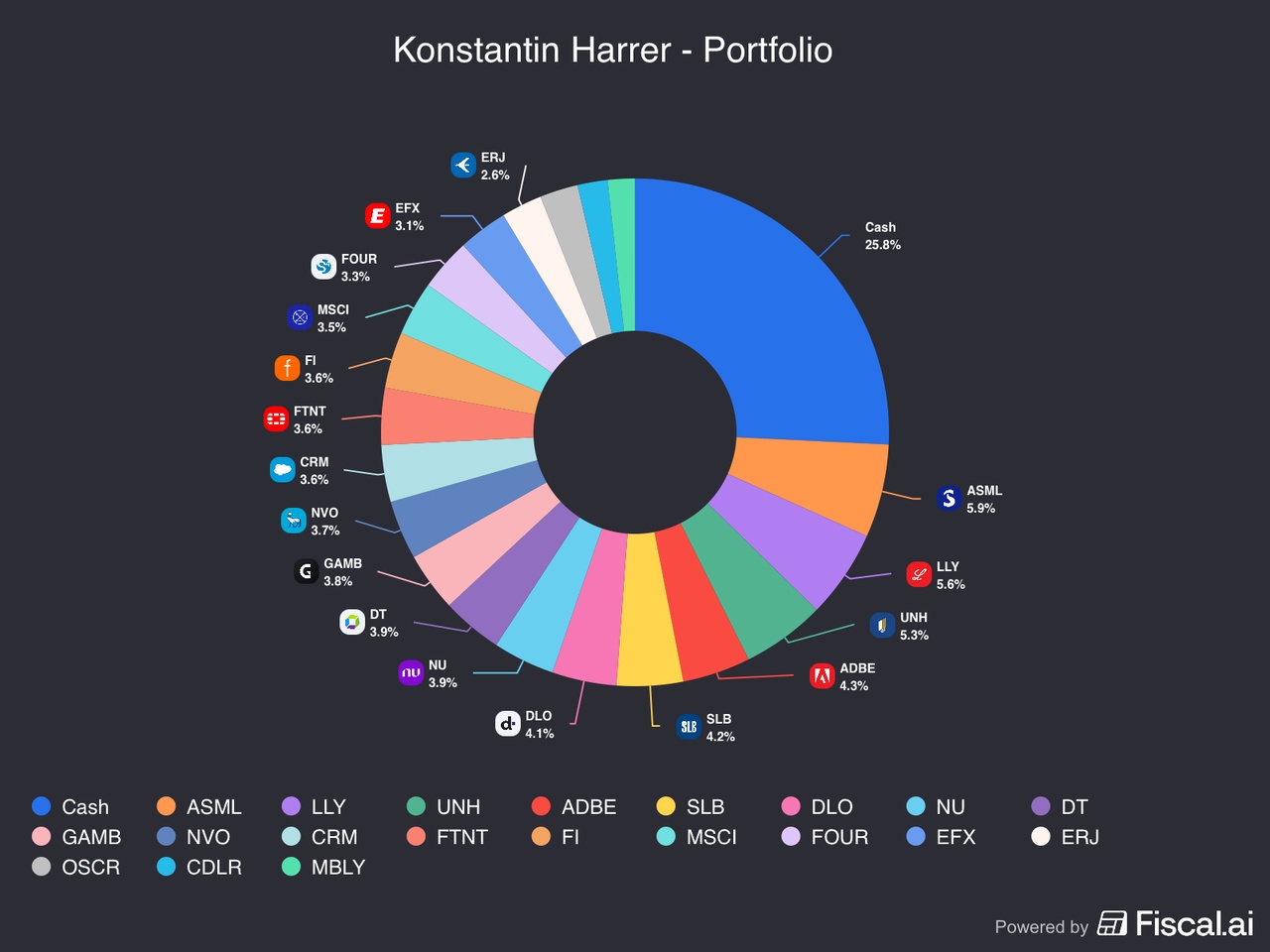

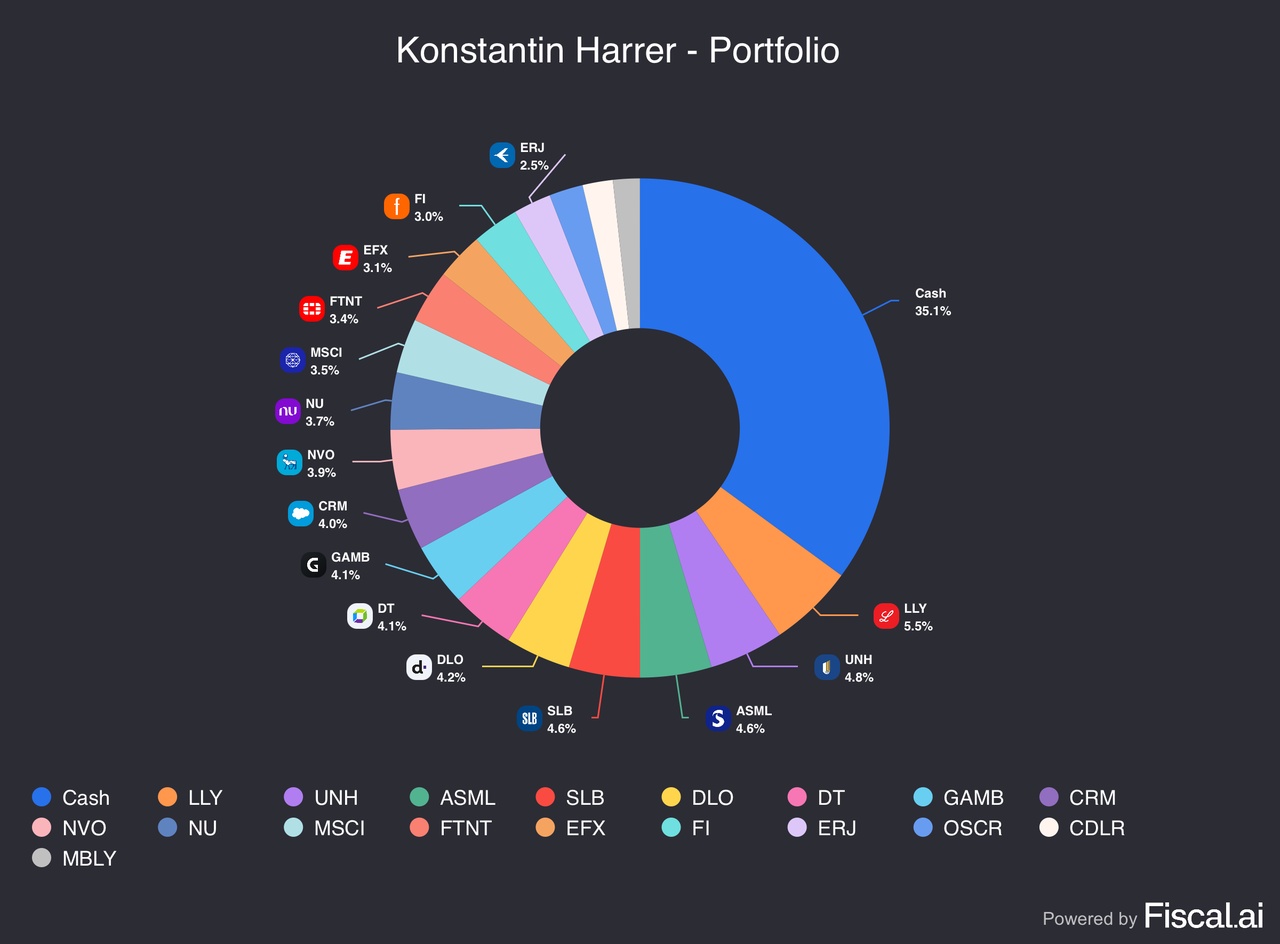

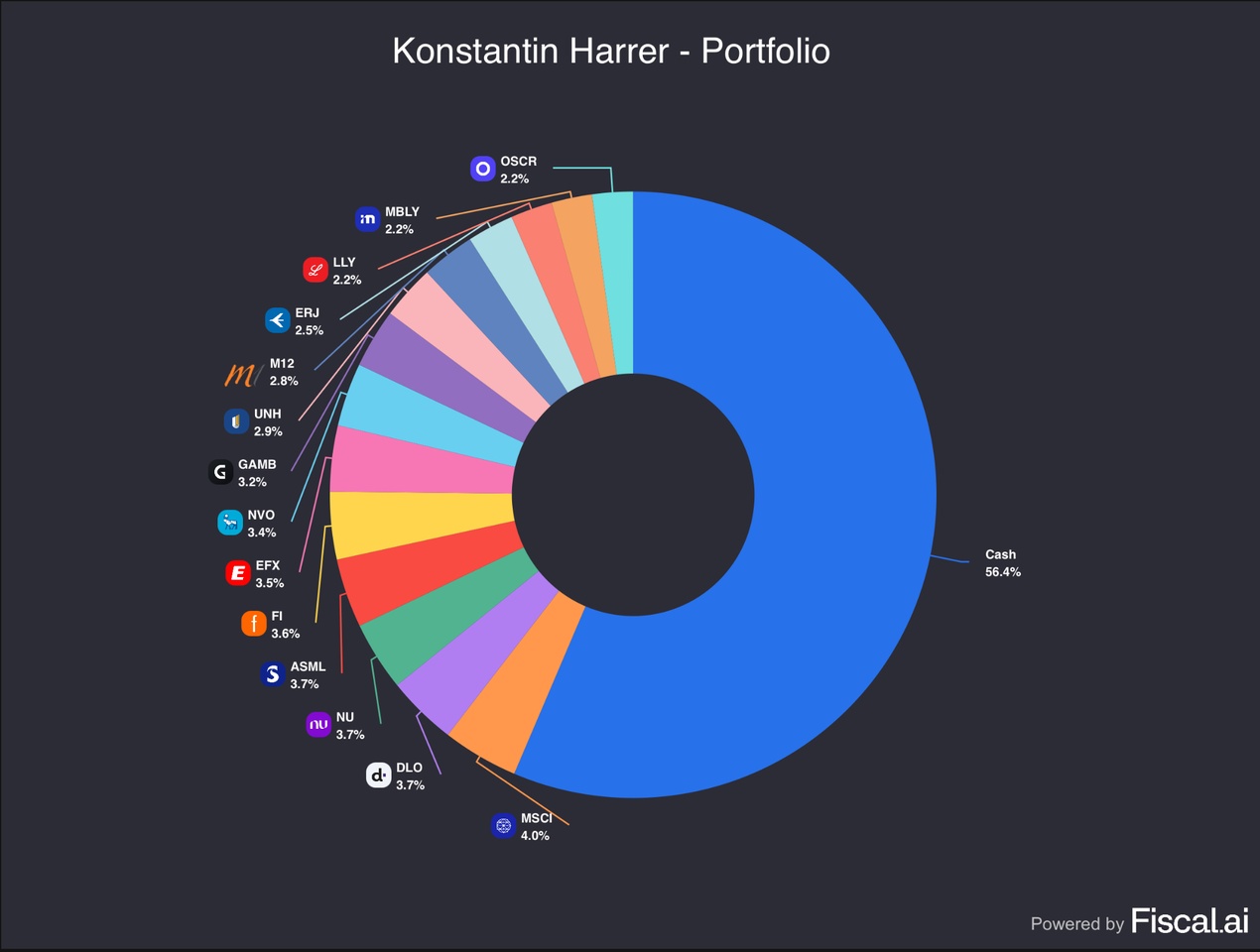

Finally, the move to Bahrain is completed. My Austrian portfolio now is officially dissolved and there is a lot of free capital for the road ahead. Stay with me as I briefly dive into all holdings of my new portfolio. Follow my trades and take a look at my portfolio for yourself.

No matter the broker or location, the goal remains the same: Making money in a predictable and transparent way, based on (as) objective (as possible) metrics.

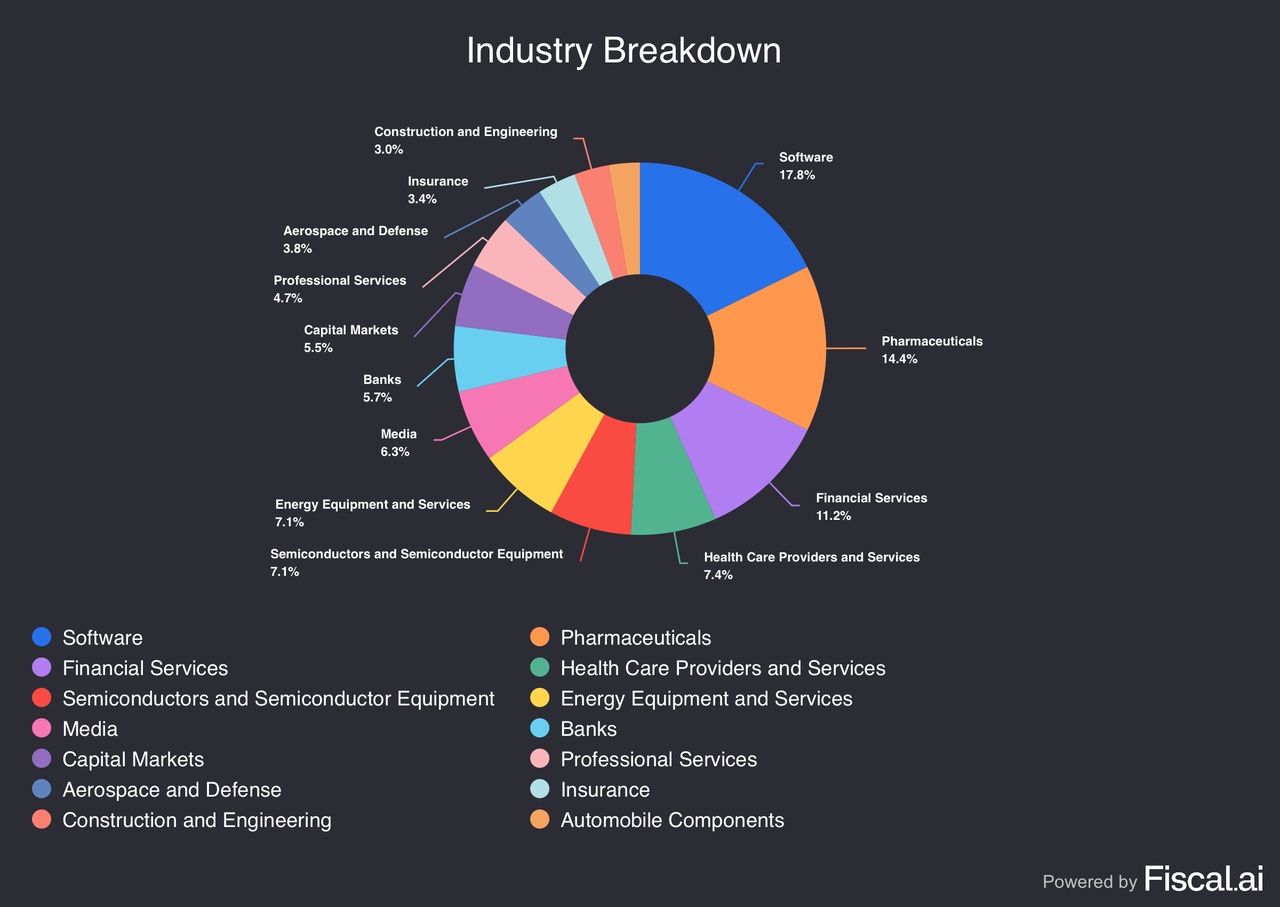

I try to judge companies not by their technicals or hype and would never claim to understand either of them, but rather on their fundamentals: cold, hard numbers. Another crucial attribute of my portfolio is diversification. Ultimately, I aim to hold around 25-30 companies in my portfolio, balancing variation with concentration.

There are two kinds of companies in my portfolio:

· Stable, cash-flow-generating companies with solid growth, preferably a sizeable moat to a low/fair valuation (e.g. $EFX or $MSCI)

· Unique, innovative companies with explosive growth, revolutionizing industries that offer higher rewards, while also bearing more risks (e.g. $OSCR, $DLO or $NU)

Cash – 56%

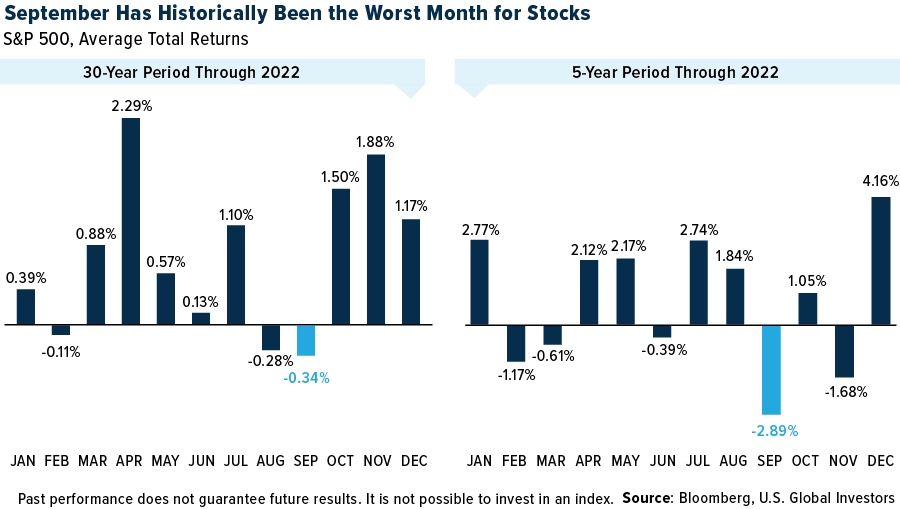

USD currently accounts for the majority of my portfolio. This is due to the fact that I just recently opened the new brokerage account. I plan to reduce my cash position gradually over the following months, although not as aggressively as I might had done a few months ago.

The market has been going through a major recovery since the April lows induced by the “Liberation Day” tariff news. The big catch: In my opinion, the risks paired with high tariff rates have not disappeared, just because the world got a 15% tariff instead of 20% one.

There could still be a bumpy road ahead, since the impact of the tariffs hasn’t fully materialised in companies’ earnings reports yet, which is likely to change in Q3 and Q4. As of now we just saw a demonstration of Trump’s “Art of the Deal” that convinced the stock market that reduced tariff rates, which are still much higher than last year’s btw, now suddenly don’t affect the economy anymore.

Undoubtedly President Trump’s negotiation tactics seem to pay off, to the better or worse, which is exactly why the entire cash position in my portfolio consists of USD. The Euro is dropping again compared to the Dollar after a new trade deal was announced just last week, in which a toothless, divided European Union had nothing to counter the USA with. I assume the Euro will continue to weaken in the coming quarters and therefore won’t be changing much in my currency allocation.

MSCI Inc. – 4% ($MSCI (+0,36 %) )

I believe $MSCI is an indestructible giant in an industry practically impossible to enter as a newcomer. You can imagine $MSCI as the $SPGI for international markets. $MSCI is a provider of global investment decision tools, including popular indices like the MSCI World, ESG analytics and portfolio risk models mainly serving institutional clients.

The stock is currently trading at a historically low valuation of a 36 P/E ratio, far below competitors like $SPGI. I recently opened a position in the company and subsequently made it my largest position, which constitutes around 4% of my total holdings. Furthermore, I plan to make it a key position of my portfolio for the future, which means I will continue adding to this holding over the few next months, preferably at an even lower valuation.

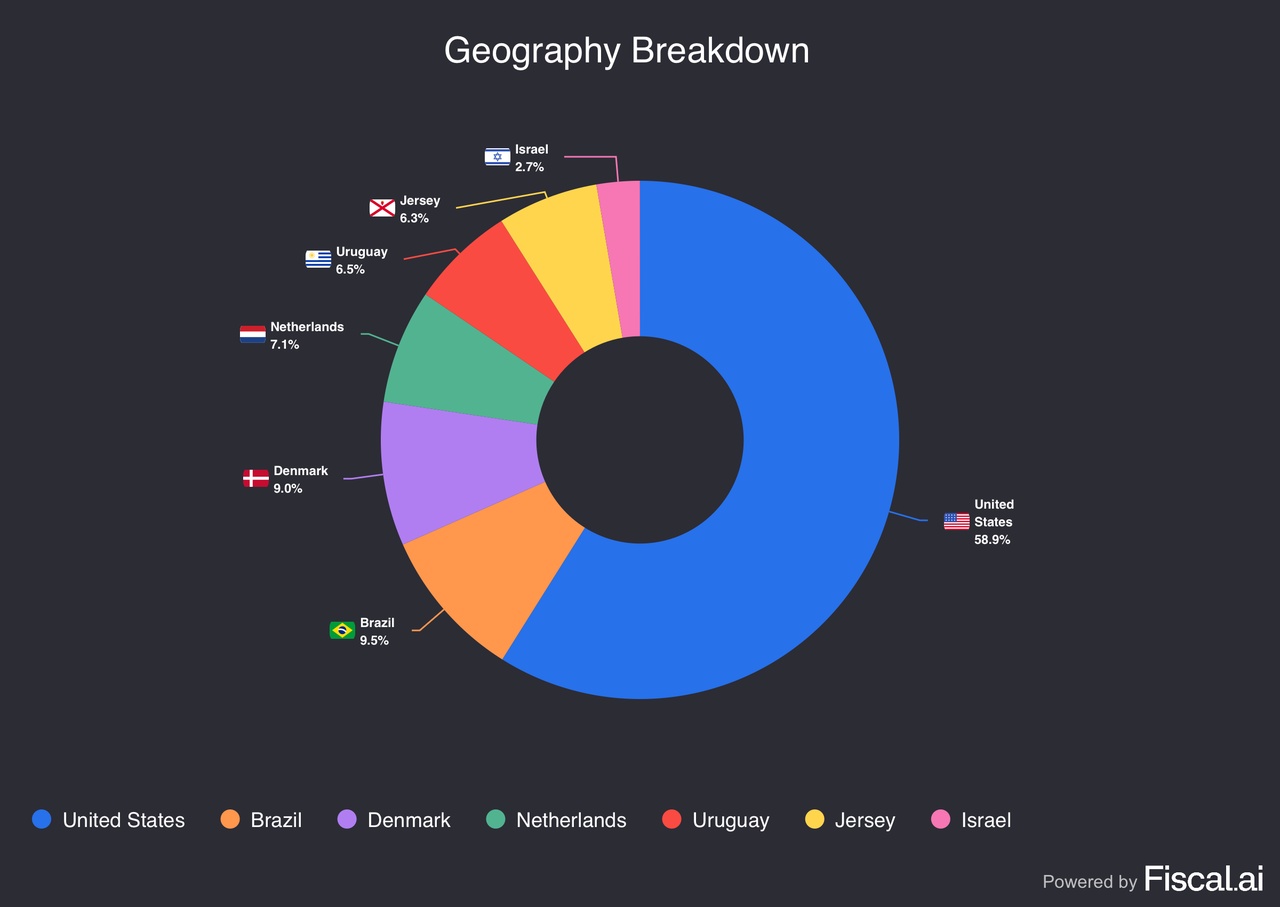

dLocal Ltd. – 3.7% ($DLO )

$DLO is a Uruguayan fintech company, providing major companies like $AMZN or $GOOGL with payment solutions mainly in South America, but also expanding to other emerging markets.

It connects merchants globally through their simple one stop shop solution and earns money with the accompanying fees. $DLO is led by a stellar leadership: Sebastian Kanovich (founder and brain behind $DLO) and Pedro Arnt (seasoned Latin America veteran who played a key role in $MELI’s success).

Yes, the fintech space is crowded, but the closest competitor to $DLO is $ADYEN, which operates globally, but is less present in emerging markets. And again, $DLO has faced some issues in the past with a fraud investigation, but that’s behind the company now.

$DLO operates in a market with massive growth potential, which the platform already delivers on year over year with revenue growth in the mid to high double digits. I will continue buying this stock, especially while it is trading at a ridiculously low forward P/E ratio of about 19. This is one of my highest conviction plays and I will publish a deeper dive into the company soon.

NU Holdings Ltd. – 3.7% ($NU (+0,9 %) )

I acknowledge that this is already the second fintech company based in Latin America but hear me out and let me explain why it makes sense to own both $DLO and $NU. In contrary to $DLO, $NU is a bank. Not a classic bank like you might think, a highly innovative digital bank revolutionizing the banking industry in Brazil and soon all over South America.

$NU impresses with its dominant market position and rapidly expanding customer base. The platform serves 59% of Brazil’s adult population of which 60% already use it as their primary bank. Undoubtedly, these numbers are highly impressive and reflected by rapid growth in revenue as well as earnings.

Nevertheless, the Brazilian market is conquered and now it is time for the founder-led management to expand to other countries with a similarly successful execution. $NU is currently trading at a P/E ratio of 23, which is elevated compared to other players in South America, but highly warranted for faultless execution, robust growth and great potential, similar to $MELI.

ASML Holding N.V. – 3.7% ($ASML (+0,65 %) )

$ASML is a European semiconductor company that forms the backbone of the entire global chip industry with their highly advanced machines needed to produce the most sophisticated chips.

Nevertheless, the stock has taken a beat over the last few weeks, due to several detrimental factors. Not the least of it is $ASML’s location. The company faced a lot of uncertainty around US-EU trade relations, which has now vanished, although probably not in the way $ASML would have wished.

Another factor that puts pressure on the share price is the lowered forecast $ASML reported in the last earnings report, which still showed impressive double-digit revenue and earnings growth.

However bad all that may sound, it doesn’t change anything in $ASML’s almost monopolistic position within the chip industry. The chip maker has a gigantic moat, probably the largest of any company in my portfolio. China is lacking behind its technology, and American companies are heavily reliant on $ASML’s goods.

Therefore, $ASML is a company I buy to hold. In my opinion, it currently presents a great risk/reward opportunity trading at a historically low P/E ratio of 26, double-digit, organic growth ahead and a moat that is not expected to shrink in, at least, the near future.

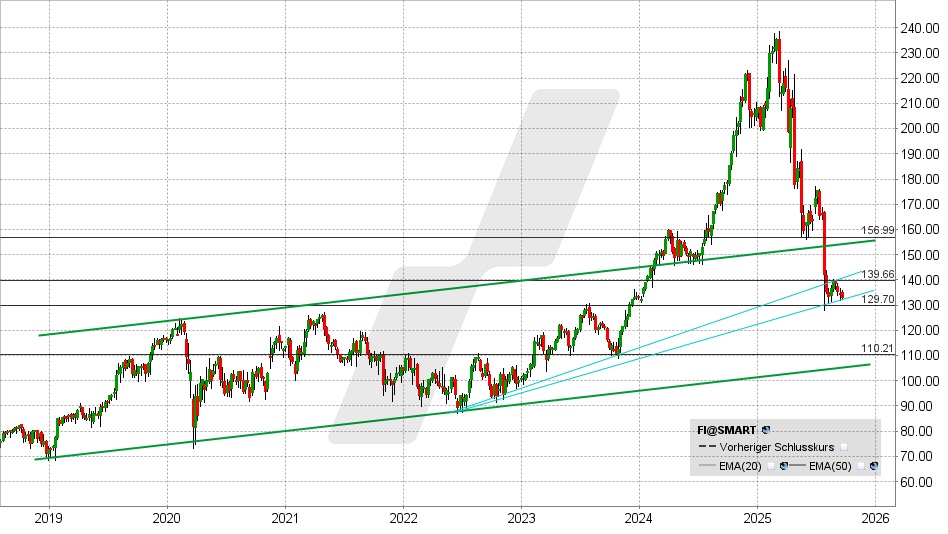

Fiserv Inc. – 3.6% ($FI (+0,51 %) )

I know what you might think: Another fintech company? Firstly, I assure you this is the last one in my portfolio and secondly give me a chance to explain why $FI is different. $FI offers a wide range of financial technology and services across the global financial sector, including banks, credit unions, securities broker dealers and many more.

Unlike $NU and $DLO, I don’t consider $FI an explosive growth revolutionary, but rather a company, boasting organic revenue growth around 8% YoY, while optimising profitability rapidly, with a large customer base across the world, that has been beaten up by the stock market due to trivialities. Let me be clear: $FI is a value play.

$FI stock is trading at a forward P/E of 13, which is a bargain, considering $FI’s position in the market, solid growth and institutional customer base that values consistency, reliability and a proven track record. Thus, $FI is a buy for my portfolio, and I will add to my position if the opportunities arise.

Equifax Inc. – 3.5 % ($EFX (+0,25 %) )

$EFX is a perfect example for company that doesn’t look very exciting on the outside, but has a lot to offer once you take a closer look. But what do they actually do? You can split $EFX’s revenue in different segments. In my short thesis I’ll focus on the two most important and exciting parts of the business.

$EFX is a credit bureau, which inherently function as oligopolies, while organically growing along with the economy. The credit ratings business is virtually impossible to enter and $EFX shares this space with only very few others in the US. Furthermore, it’s an industry that is never going to disappear, but rather strengthen over time. A huge catalyst for this part of the business is lower interest rates, which are likely to be seen in the coming months.

However, the even more interesting segment of $EFX’s business is their workforce solutions: Basically, a work verification tool offered to the government and private institutions which can be used to prove the income people have. It’s crucial to lenders to know who they are giving out credits to and whether they have the means to repay them. That is a highly versatile, rapidly growing business and accountable for the lion’s share of $EFX’s revenue.

Consequently, a forward P/E ratio of 30 is highly justifiable and seems to be on the cheap side, considering $EFX is operating in a high-margin industry with very few competitors. I will be buying the dips in this stock over the next months.

Novo Nordisk A/S – 3.4% ($NOVO B (+0,07 %) )

$NVO is the most recent addition to my portfolio, after using the slaughter of the company’s stock yesterday after disappointing earnings as a buying opportunity. $NVO’s stock was temporarily down almost 25%, after slashing their guidance for the full year on both the revenue and the earnings front.

Nevertheless, one of my favourite quotes about the stock market comes from Baron Rothschild and reads as follows: “Buy when there’s blood in the streets even if the blood is your own.” Still, I don’t want to downplay the horrible numbers presented during the earnings report paired with the introduction of a new CEO.

However, I base my investment on two key assumptions. Firstly, I think the new CEO set the bar for the full year results deliberately low and hasn’t even mentioned promising new medications with one word, which could change in the following months. And my second reason is a macro trend: Obesity rates are climbing worldwide and while $NVO is struggling in the US, partly due to the strong EUR (already reversing right now), the new CEO emphasized in the earnings call that global growth remains strong.

As a result, I believe that the recent sell-off is massively overblown and the stock will recover from these levels fairly quickly and rise to new heights in a few years. The stock is trading at a forward P/E of 12 while maintaining a competitive position in a high-margin, fast growing market with a long runway ahead worldwide.

Gambling.com Group Ltd. – 3.2% ($GAMB (+1,14 %) )

The stock is trading like a sin, while boasting numbers like a saint. Online gambling, especially sports betting is prevalent in our society and growing fast. $GAMB operates as a performance marketing company for the online gaming industry globally.

There is not much to say other than that the numbers are fabulous, the growth is exceptional (>20% CAGR in revenue and net income) and the industry is booming right now. The stock is trading at a 11 forward P/E ratio and the company is estimating continuing double-digit revenue and EPS growth for the next years, which makes it a solid pick for me right now.

UnitedHealth Group Inc. – 2.9% ($UNH (+0,31 %) )

Many high-quality companies enter a phase where they encounter short-term obstacles and subsequently get their stock price killed. We saw that with $NFLX and $META in 2022 when both these giants lost clients temporarily. But what happened since then? Right, they recovered and rose to new heights.

$UNH is the largest health insurance provider and after all the 9th largest employer in the US. The company is troubled by rising healthcare costs and a recent change in leadership. Although all that may sound scary, in my opinion, these are short-term concerns, and we are likely to have reached the bottom of the stock decline and will see a steady rise from now forward.

Therefore, I am doubling down on my position and continue adding more shares, especially while the stock is trading at a forward P/E ratio of 12.

M1 Kliniken AG – 2.8% ($M12 (-1,31 %) )

I know this might seem like a very unique and unusual pick. A German small-cap company running beauty clinics, but you might reconsider after diving further into the company’s fundamentals and some statistics.

The European aesthetic medicine market is forecast to reach $86.9 billion by 2030, growing at a CAGR of ~15%. Germany represents nearly 25% of the European market share and the market for medical aesthetics is expected to climb at a CAGR of ~18% until 2030.

I am bullish on $M12, due to their positioning in the market and capitalization on the beauty trend, exacerbated by social media and foreigners laying their trust in German hands.

Analysts’ estimates suggest 10% growth annually in $M12’s revenue over the next years, which seem to be more on the conservative side. The stock is trading at a 15 forward P/E ratio and a solid pick if you are aiming for diversification.

Embraer S.A. – 2.5% ($EMBR3 )

$ERJ is a Brazilian aircraft manufacturer, operating in commercial, private, and military aviation.

The manufacturer is third after $AIR and $BO in commercial aviation, but impresses with a backlog of $13.1 billion, up 16% YoY, and a book-to-bill ratio of ~1.8x, almost twice that of $AIR and $BO.

While Commercial Aviation still leads in a direct segment comparison within the company, Executive Aviation is catching up rapidly with a backlog surge of 62% YoY to $7.4 billion and Defense even doubled to $4.3 billion.

Momentum is a big driver of this stock: $ERJ increased deliveries over 30% from Q2 2024 and has secured multiple high-value contracts. The macro environment also plays $ERJ in the cards massively: Regional jet demand is rising globally, business aviation grows faster than ever before, while Defense spending reaches record highs.

Therefore, I believe $ERJ is a great investment to diversify into the aerospace sector, with superior book-to-bill ratio and strong diversification to competitors. Rapid double-digit growth, forecast as well as achieved, and strong momentum justify a forward P/E ratio of 20, even though I would have a better feeling adding to my position if the stock climbed down a bit more.

Eli Lilly & Company – 2.2% ($LLY (+0,13 %) )

$LLY is operating in the same field as the prior discussed $NVO, although experiencing fewer headwinds. Similarly to $NVO the same statistics apply: Obesity rates are expected to rise rapidly and affect more than 3 billion people globally by 2030.

Specifically tailored to $LLY, I think the company is in a strong position to dominate the US market, while $NVO might shift its focus more on international opportunities, probably exacerbated by a Trump’s “Made in America” approach. $NVO’s weakness is likely to boost $LLY’s sales and dominance in the US.

The fundamentals of $LLY speak for themselves with high double-digit growth all across the board and a justifiable forward P/E of 30. Considering the growth and quality of this business, a P/E of 40 would still be highly competitive. I am adding to my position right now, even though I consider $NVO the better buy, if you are willing to accept slightly more risk.

Mobileye Global Inc. – 2.2% ($MBLY )

Now we get to a company that could really be a key driver in revolutionizing a sector. $MBLY engages in the development and deployment of advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide. $MBLY is a compelling buy right now, after the management raised the guidance for 2025 and commented positively on a bright future.

Commercial development of autonomous vehicles is starting. The ADAS industry is booming and $MBLY commands over 50% of the global market share. Many regions are mandating safety technologies like those $MBLY is offering. The robotaxi market is poised to grow massively in the next years and $MBLY is at the heart of it.

Consequently, I will be buying more of this stock, always considering the risk of the industry not yet being fully developed and uncertainty around who will eventually be the market leader, though I think $MBLY is in a good position to strike partnerships with major long-established car makers no matter who wins the race.

Oscar Health Inc. – 2.2% ($OSCR (+6,05 %) )

$OSCR is another revolutionary, this time in the space of health insurance, providing a cloud-native insurance platform. This enables a range of options for the user; from mobile signup to claims analysis and provider navigation. $OSCR poses a major threat to traditional carriers at least in the long run.

Though prospect isn’t the only thing $OSCR can score with. Major catalysts for the company are its strong numbers and experienced, professional management. Mark Bertolini (former CEO of Aetna) took over in 2023, bringing decades of expertise in the insurance sector to the table. He immediately set clear financial goals like 20% revenue CAGR by 2027 and is confident about achieving them.

$OSCR is hitting its targets and growing rapidly, that combined with a management that has a straightforward vision convinced me to open a position, which I will build up in the future.

Conclusion

With this portfolio I am trying to strike a balance between stable giants and innovative disruptors, with a mainly fundamentals-driven approach without disregarding diversification or the macro picture. My aim is to reflect both high-conviction plays and undervalued value gems.

Ultimately, while I will reduce my cash position over the next months, I will do it strategically and opportunistically, while staying cautious amid tariff impact uncertainty and possible market volatility.