$PDD (+0 %)

$601318

$EH

$OKTA (+0,56 %)

$MDB (+0,37 %)

$3690 (-0,22 %)

$KSS (+0,32 %)

$ANF

$CRWD (+0,47 %)

$SNOW (+0,78 %)

$HPQ (-0,21 %)

$NTNX (+0,5 %)

$NVDA (+0,1 %)

$DHER (-0,11 %)

$LI (-1,57 %)

$DELL (+0,34 %)

$S (-0,17 %)

$IREN (+4,56 %)

$ULTA (+0,33 %)

$MRVL (+2,54 %)

$AFRM (+0,44 %)

$ADSK (+0,33 %)

$BABA (+0,95 %)

Discussion sur EH

Postes

12Quarterly figures 25.08-29.08.25

Insights from the EHang analyst conference - record sales, positive profitability and ambitious growth plans

As a member of the audience at EHang's analyst conference ($EH ) on the fourth quarter and financial year 2024 and would like to summarize the key findings and discussion points for you today.

It was an exciting conference that highlighted the progress and future ambitions of this pioneer in eVTOL. First, the founder, Chairman and CEO of EHang, Huazhi Hu, presented the highlights of the fourth quarter and the full year 2024. He emphasized that 2024 will be a record year for EHang, exceeding its own forecasts and achieving new highs in deliveries and revenue. In the fourth quarter 78 EH216 series were delivered, which corresponds to sales of 164 million RMB an increase of 239.1% compared to the previous year. For the year as a whole, deliveries amounted to 216 units with a total turnover of 456 million RMBan increase of 288.5% compared to the previous year.

Particularly noteworthy is the fact that in 2024, EHang for the first time achieved positive adjusted net profit and positive operating cash flow for the first time in achieved for the first time. He emphasized that this makes EHang the first eVTOL company in the global Urban Air Mobility (UAM) industry to achieve non-GAAP profitability .

He also addressed the the strategic importance of the low-altitude economy in China which was again emphasized as an important driver for new quality productivity in the "Two Sessions" 2025. The inclusion in the government work report and the establishment of a dedicated department for the development of the low-altitude economy by the NDRC in December 2024 underline the strong government commitment. In addition, over 50 cities in China have presented local development plans for this sector.

For 2025 Hu sees the year of implementation of the low-altitude development. Since receiving the three airworthiness certificates, EHang has accelerated commercial deliveries and operational deployment of the EH216-S . Customers have already completed over 20 eVTOL demonstration sites and e-ports in 16 cities in China. cities in China. The top priority for 2025 is to implementation of operational demonstration projects in key cities to demonstrateto enable the public to experience eVTOL flying first-hand.

EHang is actively driving the process of operator certification for pilotless passenger for pilotless passenger eVTOL aircraft. The Civil Aviation Administration of China (CAAC) has completed the document and on-site inspections for the first two applicants: EHang General Aviation (a wholly-owned subsidiary) and Heyi Aviation (a joint venture in Hefei). The early issuance of these two operator certificates would mark the beginning of the commercial eVTOL era.

Hu also emphasized the importance of AI technology (AI) and EHang's AI+ strategy. EHang integrates AI into the entire eVTOL lifecycle to drive intelligent upgrades and innovative practices in commercial operations. This includes optimizing key technologies such as intelligent flight control algorithms, autonomous detection, flight route planning and the UAV cloud system. In addition, AI will accelerate the development of digital infrastructure for air mobility. EHang is working with universities, government institutions and commercial enterprises to integrate technologies such as 5G, 6G, satellite communications and high-precision navigation to develop an intelligent low-altitude ecosystem ecosystem.

In the product field, EHang is working on the further development of its multi-rotor EVTOL series through strategic collaborations, including cutting-edge solid-state lithium batteries, fast-charging batteries and electric motors. The first eVTOL test flight with solid-state batteries with an impressive flight duration of over 48 minutes was carried out. In the field of flying cars for the mass market a cross-industry strategic partnership was concluded with China Automobile.

COO Zhao Wang then spoke about the strong market strong market demand and growing customer orderswhich led to the record deliveries and sales in 2024. He mentioned significant orders from Shandong and Zhejiang provinces as well as Sunriver. To meet the increasing demand, EHang is focusing on increasing production increasing production efficiency and capacity and plans to expand its production sites. The production principle is "manufacturer-to-order".

In South China the Yunfu Phase 2 site is being expanded to achieve an annual capacity of 1,000 units by 2025. In East China an advanced and automated eVTOL production center is being built in Hefei in collaboration with the JAC Group and Hefei Guoxian Holdings. In North China a national headquarters for low-altitude emergency equipment is being built in Beijing Fangshan.

The revenue streams are to be diversifiedwith the initial focus on low-altitude low-altitude tourism as an entry point into urban air mobility. Projects are planned with partners such as China Construction Group and China Communications Construction Company to build over 100 UAM terminals and over 100 tourism terminals in national and scenic areas in the next three years. In addition to the passenger business, the non-passenger business in the areas of firefighting and emergency rescue as well as logistics drones with a long range and low energy consumption.

The global expansion is also progressing, with flight demonstrations in Thailand, Japan, Spain and Mexico. Commercial test operations are planned in Thailand, various use cases were demonstrated in Japan and the first autonomous eVTOL flight in a European city took place in Spain.

In the subsequent Q&A section analysts asked various questions, which were answered in detail by Ehang's management:

Tin Song (Goldman Sachs) asked about the expansion of the production capacity in Hefei for 2025 and 2026 and the expected capacity utilization rate with a total capacity of 1,000 units. Mr. Hu explained that Yunfu Phase 2 will be completed this year and will reach an annual capacity of 1,000 units. Yunfu Phase 1 and 2 will specialize in the production of aviation materials/components and aircraft assembly respectively. The production expansion in Hefei in cooperation with JAC Motors and Hefei Guoxian Holdings is expected to be completed in 1.5 to 2 years according to government planning.

Cindy Huang (Morgan Stanley) inquired about the the exact timetable for operator certification (OC) and the and the expected milestones as well as the the timing of GAAP profitability and the expected CapEx and OpEx for the coming quarters. Hu announced that the CAAC has completed the acceptance and on-site inspection of the two OC applicants and is now awaiting final regulatory approval. Yang answered the question on GAAP profitability and stated that quarterly GAAP profitability is expected in the second half of 2024 and annual GAAP profitability in 2026. CapEx for 2025 is estimated at USD 40 million and OpEx is expected to increase by 40% year-on-year.

Wei Shen (UBS) asked about the outlook for the gross margin and the financing plans for 2025. Mr. Yang explained that the gross margin target of around 60% will be achieved through a more diversified product range and a planned distribution model. In terms of financing, EHang plans to accelerate market expansion and raise additional funds to support technology and product advancement, market expansion, construction of the new headquarters and production site development. He emphasized that the business already has a certain degree of self-sustainability due to the positive cash flow.

Laura Lee (Deutsche Bank) asked about the timetable for the air cab operation and the important milestones until then, given increasing announcements of UAM projects and digital infrastructure construction. Mr. Wang explained that air cab service remains the long-term goal, but safety is the top priority. In the next few years, the focus will initially be on operating in domestic tourism areas to collect data before moving into air cab operations. Implementation also depends on the development of ground infrastructure (vertiports) and digital infrastructure, for which cities in China have concrete plans. EHang is actively involved in policy development and infrastructure planning.

Yiming Wang (China Renaissance) inquired about new orders and the cooperation with the JAC production siteespecially the roles, profit distribution and cost sharing. Hu emphasized the strong domestic demand with current letters of intent for over 1,000 units. The JV partnership with JAC is being established under the support of the Hefei Municipal Government. JAC brings expertise in automotive manufacturing and supply chain management, while EHang is a leader in development, production and OC in the eVTOL sector.

Xuxia Tang (Guosen Securities) asked about the the trend of management and R&D spending for 2025after they increased significantly in the fourth quarter. Yang explained that expenses will increase due to company growth, but the ratio of expenses to revenue is expected to decrease as revenue growth (expected +97%) will exceed cost growth (expected +40% for operating expenses).

EHang's earnings conference painted a very positive picture of the company. The record revenues achieved and the first-time non-GAAP profitability in 2024 are impressive milestones. The strategic focus on active cooperation with the government and the focus on technological innovations, particularly in the field of AI and battery development, underline the growth potential.

The ambitious targets for 2025, including revenue growth of 97% and expected GAAP profitability in the near future, point to a promising development. Even if the development of the air cab business still needs time, EHang is laying important foundations with its focus on tourism and the development of the necessary infrastructure.

In my opinion, Ehang is currently the leading manufacturer in the eVTOL sector and is definitely on my watch list.

EHang Holdings Earnings

$EH

EHang Holdings Q4 2024

GAAP EPADS $(0.07), Inline

Sales $22.50M Miss $23.37M Estimate

I have been involved in the EVTOL sector for some time now and find it very promising for the future.

There are a large number of companies that want to develop EVTOL aircraft (electrically powered vertical take-off and landing aircraft) in the future, some of which are already in promising test phases. In addition, some of the most promising companies are already listed on the stock exchange. The following EVTOL manufacturers are listed on the stock exchange:

- Archer ($ACHR )

- Joby Aviation ($JOBY )

- Lilium ($LILM (+43,75 %) )

- Vertical Aerospace ($EVTL )

- Ehang ($EH )

- Horizon Aircraft ($HOR )

- Airbus ($AIR (+0,02 %)

However, there are other promising developers that are not currently listed on the stock exchange, so direct investments in these companies are not possible. Here is an overview of the unlisted companies:

- Volocopter

- Xpeng Aeroht

- Wisk

- Supernal

- Eve Air Mobility

- AIR VEV

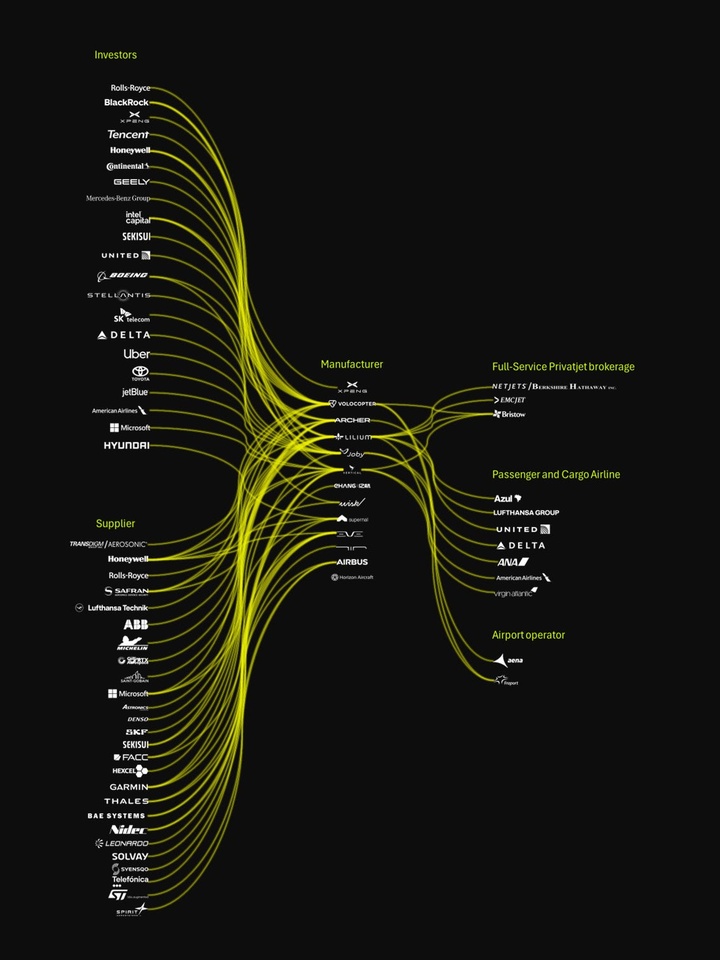

I asked myself how the industry is structured and whether it is possible to invest in the industry through indirect investments. And I will say this much: yes, you can.

Here is an overview of the value chain:

$ERJ

https://www.airliners.de/blade-embraer-flugtaxis-europa-einsetzen/69361

As every Sunday, the most important news of the last week and the dates of the coming week, also as video:

https://youtube.com/shorts/s9icpY6A1oo?si=QsXp6ZlISFxhfKGA

Monday:

Industrial production continued to fall in August. This was announced by the Federal Statistical Office. Compared with the previous month, production fell by 0.2%.

Tuesday:

$KBC2 Kontron receives two major orders from the aviation industry worth EUR 100 million.

The trade balance of Japan shows that Japan continues to achieve an export surplus. The surplus tripled in August to more than $15 billion. One of the main reasons are falling prices for imported goods.

https://www.japantimes.co.jp/business/2023/10/10/economy/japan-current-account-surplus/

$1211 (-0,39 %) BYD is on the verge of $TSLA (-0,07 %) replacing Tesla as the world's largest e-car manufacturer.

https://teslamag.de/news/byd-keine-marktfuehrer-konkurrenz-tesla-keine-angst-eu-verfahren-61724/amp

$EH Ehang, a stock in our Growth Depot, is requesting a trading halt. The request is probably related to an extraordinary announcement.

https://www.instagram.com/p/CyOFeDrOhkY/?igshid=MWZjMTM2ODFkZg==

Wednesday:

$NOVO B Novo Nordisk is seeing positive results with its antidiabetic in chronic kidney patients. This puts a strain on dialysis speci $FME (-0,26 %) Fresenius Medical Care and also $FRE (-0,09 %) Fresenius. The study could be terminated due to proven efficacy. Fresenius Medical Care is thus likely to lose further patients; it already lost many during the corona pandemic due to excess mortality.

$BIRK (+0,68 %) Birkenstock comes to the stock exchange with a price of EUR 46. The company was made fit for the stock exchange by Bernard Arnault and ends up there with a sporting valuation of USD 8.6 billion.

Producer prices in the USA rise more strongly than expected. They rose by 2.2% compared with the same month a year ago. The expectation was for around 1.6%. Producer prices are a leading indicator for inflation, so this is bad news.

https://www.handelsblatt.com/dpa/usa-erzeugerpreise-steigen-staerker-als-erwartet/29440252.html

Thursday:

The war of Isreal and Hamas now has a concrete impact on an asset class: cryptocurrencies. Apparently, cryptocurrencies in particular have been used to finance terror. Israeli police now froze all crypto accounts used to publicly solicit donations. Most of the accounts were held at Binance. Binance confirms cooperation with Isreal. However, the SEC is also suing Binance, so in the US the events also have possible consequences for the world's largest crypto exchange. $BTC (+1,28 %)

Inflation data from the US is not coming in well. The inflation rate remains at 3.7%. A decline was expected.

Friday:

Still virtually no inflation in China. Consumer prices stagnated again, a slight increase was expected. China's foreign trade also continues to shrink. Exports and imports each fell by 6.2% compared to the same period last year. Experts see a slow, temporary recovery of the economy at the end of 2023.

Also $VOW3 (+0,53 %) VW also seems to be slowly stabilizing in China. In September, 0.9% fewer vehicles were sold than in the previous month. Worldwide, however, VW delivered 2.3 million vehicles in Q3, which is 7.4% more than in the same period last year. VW is able to make up for the problems in China with significant increases in North America and Europe. This is a healthy development, as it reduces dependence on China. Electric cars already accounted for 7.9% of total sales so far in 2023, or about 530,000 cars. By comparison, Tesla sold only 1.3 million vehicles in the same period.

$EH Ehang gets mega-approval in China. China's civil aviation authority has approved EH216-S. This is an unmanned drone with autopilot. It is the first approval of its kind in the world, making it a real milestone. The approval process went 2 years with countless tests. Shortly, trading in the stock will start again.

Monday: 11:00 Trade Balance (EuroZone)

Tuesday: 11:00 ZEW survey (DE)

Wednesday: 04:00 GDP figures (China)

Thursday: 14:30 Unemployment Claims (USA)

Friday: 08:00 Producer Prices (DE)

At last 🥳🥳 I hope the stock $EH now learns to fly again 🚀

I recently posted this video and shared that I was thinking about doing a little re-buying. Now I have made a little play money by selling a lever on Alphabet.

Since I believe that such drones can be used in a useful way (among other things, as seen in the video, to bring medical products quickly from A to B) and I have future fantasies in the direction of air cabs or Amazon's "last mile", I have added a little bit. My purchase price is now € 22.50.

My purchase is probably not justifiable with figures at the moment, it is a gut decision and I have invested play money.

https://www.youtube.com/watch?v=F06rqz1g2yQ&t=41s

Ehang transports ten blood units in a self-flying drone. I have 8 shares at € 35 (March 2021) in my depot...such news is worthwhile to lower the cost price

Your worst stock in the portfolio?

I throw Ehang $EH with currently -88% in the ring 😂

I am curious!

Titres populaires

Meilleurs créateurs cette semaine