Discussion sur DOW

Postes

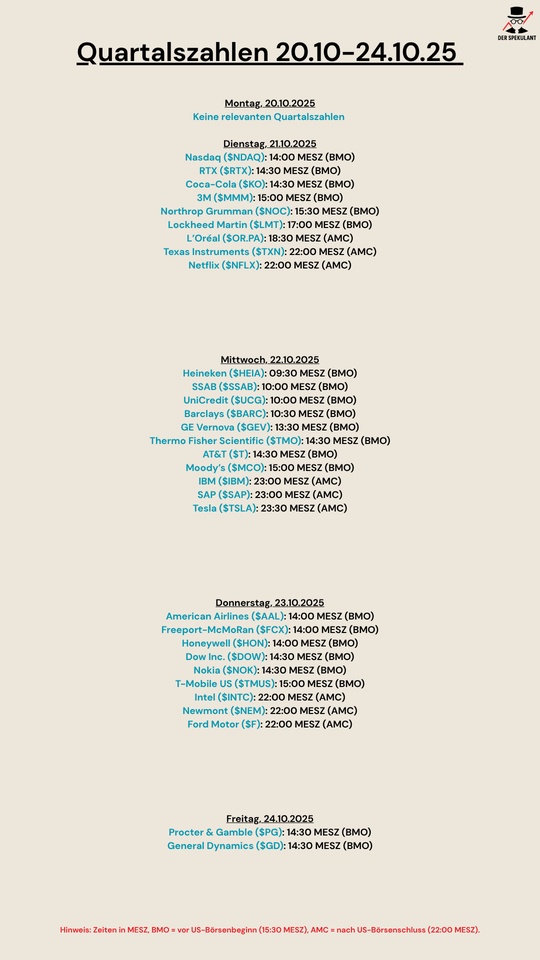

11Quartalsberichte 21.10-24.10.25

$NDAQ (-0,14 %)

$RTX (+0,1 %)

$KO (-0,37 %)

$MMM (-1,74 %)

$NOC (-0,1 %)

$LMTB34

$OR (-0,56 %)

$TXN (-1,56 %)

$NFLX (-1,61 %)

$HEIA (-2,16 %)

$SAAB B (+5,28 %)

$UCG (-2 %)

$BARC (+0,23 %)

$GEV (-1,56 %)

$TMO (+0,74 %)

$T (+2,17 %)

$MCO (+2,02 %)

$IBM (+8,06 %)

$SAP (-3,22 %)

$TSLA (-3,07 %)

$AAL (+8,03 %)

$FCX (+0,06 %)

$HON (-2,23 %)

$DOW (+1,43 %)

$NOKIA (+1,13 %)

$TMUS (-1,05 %)

$INTC (-7,3 %)

$NEM (-4,95 %)

$F (+6,36 %)

$PG (-0,4 %)

$GD (+2,31 %)

DOW down 14%

Dow Inc. shares fell 14% after the chemical producer announced it would cut its quarterly dividend payment by 50%.

The new dividend will be USD 0.35 per share, down from USD 0.70 previously, the company announced.

In a press release, Dow Inc. said: "Today's announcement is designed to maximize long-term shareholder value as we navigate a prolonged industry downturn.

" Prior to the payout cut, Dow Inc. stock had a dividend yield of 9.22% -

one of the highest on Wall Street.

With the new payout, the yield will fall to around 5%.

The new dividend payments will cost the company USD 1 billion annually.

Cash savings Dow Inc. expects to generate free cash flow of USD 500 million this year and USD 600 million in 2026.

This is a significant decrease compared to the years 2020 to 2023, when Dow Inc.'s free cash flow averaged more than USD 5 billion per year.

Management stated that the dividend would be cut to conserve cash. The dividend cut was announced along with Dow Inc.'s second quarter financial results.

The company, which is known for the production of chemicals for plastics and silicones, reported a loss per share (EPS) of USD 0.42 and sales of USD 10.1 billion.

Wall Street had expected a loss of 0.17 US dollars and sales of 10.2 billion US dollars.

Management said it was struggling with a global oversupply of chemicals in the market, which was squeezing profit margins and forcing the company to control costs, including dividends.

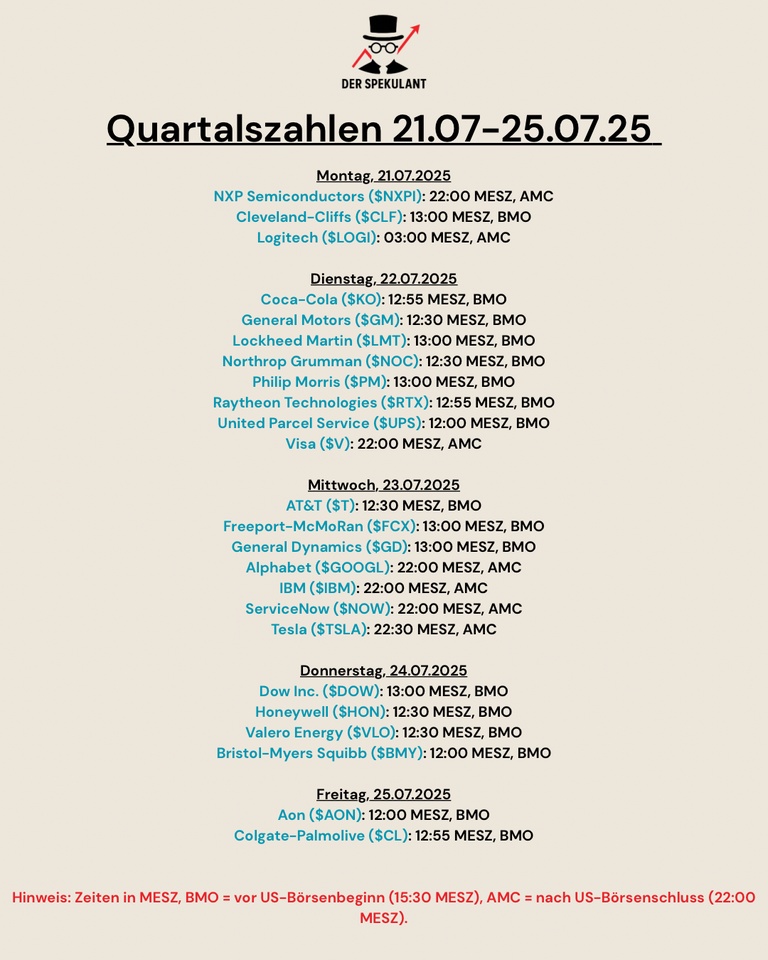

Quarterly figures 21.07-25.07.25

Here is a clear overview of the quarterly figures due next week.

$NXPI (-0,53 %)

$CLF (-0,62 %)

$LOGN (-0,21 %)

$KO (-0,37 %)

$GM (+3,46 %)

$LMT (-0,76 %)

$NOC (-0,1 %)

$PM (+0,09 %)

$RYTT34

$UPS (+0,01 %)

$V (+0,08 %)

$T (+2,17 %)

$FCX (+0,06 %)

$GD (+2,31 %)

$GOOGL (+1,8 %)

$IBM (+8,06 %)

$NOW (-0,5 %)

$TSLA (-3,07 %)

$DOW (+1,43 %)

$HON (-2,23 %)

$VLO (-1,25 %)

$BMY (-0,97 %)

$AON (-1,12 %)

$CL (-0,97 %)

🚀 **Market Recap: January 28, 2025** 📊

Today was another rollercoaster in the financial markets as investors grappled with the aftermath of the DeepSeek AI shockwave and awaited key earnings reports from tech giants. Here’s the breakdown:

📉 **Tech Sector Volatility**: The Nasdaq clawed back some losses, gaining 1% after Monday’s steep 3.5% drop, driven by a sell-off in AI-related stocks. $NVDA (+2,31 %) , the AI bellwether, rebounded 3% but remains under pressure after losing nearly $600 billion in market value earlier this week.

💡 **DeepSeek Impact**: The Chinese AI startup continues to rattle markets with its claims of building efficient AI models at a fraction of the cost. This has sparked fears of overvaluation in the U.S. tech sector, particularly for companies like $MSFT (+0,63 %) and $GOOG (+1,83 %) , which are heavily invested in AI infrastructure.

📈 **Defensive Plays Shine**: While tech struggled, defensive sectors like healthcare and consumer staples saw inflows. The $DOW (+1,43 %) edged up 0.1%, supported by gains in $JNJ (-0,96 %) and $PG (-0,4 %)

🔍 **Earnings in Focus**: All eyes are on the "Magnificent Seven" this week, with $META (+0,46 %) , Microsoft, $TSLA (-3,07 %) , and $AAPL (+1,23 %) set to report. Investors are keen to see how these companies address the AI competition and whether they can maintain their growth trajectories.

💼 **Fed Watch**: The Federal Reserve’s policy meeting tomorrow is another key event. While no rate cuts are expected, Jerome Powell’s commentary on inflation and future rate trajectories will be critical for market sentiment.

🌍 **Global Ripples**: The DeepSeek saga isn’t just a U.S. story. European and Asian markets also felt the tremors, with chipmakers like $ASML (-0,02 %) and TSMC facing sell-offs. Meanwhile, oil prices dipped 2% amid concerns over global demand and tariff tensions.

🔮 **What’s Next?**: The market remains in a state of flux, balancing AI-driven growth optimism with valuation concerns. As earnings and Fed decisions unfold, expect more volatility—but also potential opportunities for savvy investors.

📌 **Key Takeaways**:

- Tech rebounds but remains fragile.

- Defensive sectors offer stability.

- Earnings and Fed decisions will set the tone.

#MarketUpdate #Investing #AI #TechStocks #FedWatch #EarningsSeason #DeepSeek #Nvidia #DefensiveStocks #Volatility

Let’s navigate these waves together! 🌊💼

Hello everyone,

I'm 20 and I started investing 400 euros a month in February this year.

I'm currently investing regularly this 400 euros in an accumulation plan divided like this:

100euros each on $CSPX (+0,63 %) and $IWRD (+0,44 %)

Then 50euros each on $XAIX (+1,07 %) and $EIMI (+0,31 %)

and then 20euros each on $XOM (-0,4 %)

$MO (+0,05 %)

$MCD (-0,54 %)

$DOW (+1,43 %) and $CUBE (+0,28 %)

at the same time I'm also reinvesting my dividends.

I'm looking to diversificate more my portfolio since most of the stocks I have are based in the North America zone and mostly in the tech industry and I was hoping for some advice on how to have a better diversification and some advice about dividend growth.

DOW $DOW (+1,43 %)

Subsequent purchase of the US company

Solid value, good dividend and profiteer from EU prices in chemical production.

Perhaps upside potential in the US election year

Do you have DOW or what do you think of the company?

Spin the speculation carousel. 💸

It looks very gloomy above the clouds of the energy-intensive industry in Germany, but with exactly one value within the sector, the decline really annoys me the most. Therefore, I think that these could soon be taken over due to their now low stock market value.

I would like to present a few plausible reasons why I think this and why I may also speak of a significant undervaluation in general.

The stocks in question are Lanxess $LXS (+1,93 %) .

Lanxess was the spin-off of the plastics division of the Bayer Group. It has been independently active on the stock market since 2005.

It has developed from a sad subsidiary into a successful and highly competitive company with still enormous group potential.

Here are some reasons why the share is clearly undervalued.

1. the market segment

Lanxess is primarily based in the chemical industry, but there are equally high-margin segments in this industry that Lanxess fills.

One supplies the important segments of:

- High-Performance Materials, including synthetic rubber and intermediates (Advanced Intermediates)

- Specialty Additives

- Consumer Products

The fact is that you come into contact with products from the Lanxess brand portfolio every day.

Here are a few examples:

- Kalaguard - preservatives for hygiene products and cosmetics.

- Lewatit - exchange resins for water treatment in small and large applications (such resins are normally found in every household appliance that runs on water, such as the dishwasher)

- Mesamoll - a plasticizer for plastics. Found mainly in stable application areas, such as waterbeds, and therefore high-margin or "expensive" for the consumer.

- Saltidin - the active ingredient par excellence for "mosquito or tick sprays

- Oxone - the chlorine-free pool cleaner for your home swimming pool.

Net margins of ~15% are not rare here, but rather average.

2. competition

Lanxess is the market leader in most areas of its chemical products and clearly competes with the top dog BASF in its areas. $BAS (-0,06 %) and is challenging the Ludwigshafen-based company right down to its very substance.

3. production sites

Lanxess is also globally diversified in its choice of locations and thus linked to different markets in terms of cost balance. A decline of the German production sites would be devastating, roughly speaking, but not the end of the company.

It must be admitted, however, that most of the sites in Germany have definitely already been paid off and therefore represent the Group's cash cow. In the current situation, too much is coming together.

- The loss of consumption among the population

- High costs and, in some cases, insolvencies of downstream manufacturers

- Competitive pressure

- Flooding of the European market with Asian products

4. management

The management of Lanxess under Matthias Zachert is definitely a role model for the German industrial landscape. They recognize sensible market opportunities at an early stage and steer the Group specifically into high-margin niches, while at the same time maintaining the limit for expenditures within the framework.

It is not without reason that Buffet also holds a 5% stake in the company.

5. takeover theory

The following is of course only my thoughts and therefore pure speculation.

Since the downfall of the stock exchanges in 2022, German industrial stocks have not caught on. The current economic environment is too bad. The political support impulses are completely missing. Various industry associations are increasingly criticizing the economic competence behavior of the federal government, whereas the state governments have already recognized the seriousness of the situation and are assuring the companies of binding support.

Even with the Covestro offer, one could assume that foreign investors were keeping a closer eye on German industry in order to take advantage of the favorable prices.

Another likely example due to its unique brand portfolio may be Lanxess.

The enterprise value is likely to be slightly below €5 billion in 2023, whereas the sales outlook continues to be upward. The market value, on the other hand, is only put at just under €2 billion. However, a takeover bid of around €5 billion is estimated to be acceptable. The second factor, on the other hand, will be the management, but with the right sum one may certainly not deny.

But who would be interested in this?

It would be reasonable to assume that other Oriental emirates and funds would launch a capital attack on Europe and especially Germany in order to expand their economic and political influence here and accelerate the move away from oil. With a sustainable portfolio, such as Lanxess has, this would be an ideal complement.

But also US corporations, such as Dow $DOW (+1,43 %) or DuPont $DD (-0,71 %) could give a boost to their dominance of the plastics markets and absorb the innovative power of the German chemical industry. Difficult, however, would be antitrust concerns by the competition. But here, too, detours could be found through shareholdings or concessions to the competition, similar to the Linde $LIN (-0,16 %) -Praxair merger.

What do you think about this?

Was Interesting written, even if it's really not my subject area, it makes me very happy to see such contributions here, at such we grow and such also attracts like-minded. 👍 Thanks for your effort! 🥃

Opinion about $DOW (+1,43 %)

Say, have you guys looked into DOW in your search for good dividend stocks?

Seems pretty attractive to me. It's a global chemical company based in the US. The dividend yield is already at 6% now. Unfortunately can't say much about the increase as the company has only been around in this form since 2019. However, their payout ratio is just 30%. So there's still a lot of room for improvement. And 30% sounds like future increases to me.

I'm not quite done with my analysis yet, but so far everything seems great sein🙌🏽 what do you think?

Titres populaires

Meilleurs créateurs cette semaine