I received a dividend from BlackRock at Scalable today! Strange because I already got my June dividend from BlackRock! Is it possibly a mistake 🤔 Does anyone have similar experiences/problems?

Best regards $BLK (+0,09 %)

Postes

62I received a dividend from BlackRock at Scalable today! Strange because I already got my June dividend from BlackRock! Is it possibly a mistake 🤔 Does anyone have similar experiences/problems?

Best regards $BLK (+0,09 %)

BlackRock achieves record assets despite decline in turnover

BlackRock $BLK (+0,09 %) achieved an impressive record of 12.5 trillion dollars in assets under management in the second quarter of 2023. But behind this glittering figure lies a dark cloud: at 5.42 billion dollars, turnover fell short of analysts' expectations, who had expected 5.44 billion dollars. The reason for this revenue shortfall? An institutional client withdrew a whopping 52 billion dollars from the index funds, which significantly reduced net inflows. In the final hours of trading, the markets reacted sensitively: the shares fell by almost 6% after previously reaching an all-time high. Despite these setbacks, BlackRock has still been able to record an increase of around 3% in equities since the beginning of the year.

In addition to the revenue woes, BlackRock announced that the acquisition of HPS Investment Partners for $12 billion was completed as early as July 1, 2023. This acquisition brings with it not only 165 billion dollars in client assets under management, but also 118 billion dollars in fee-based assets. The question remains as to whether this strategic decision can strengthen the company in the long term or whether the current challenges will overshadow the positive effects.

René Benko faces serious charges

In the world of real estate, René Benko, who was celebrated as the star of the industry, is now facing serious legal difficulties. Prosecutors have brought charges against him based on various allegations, the details of which have not yet been disclosed. According to reports, the investigation includes extensive evidence pointing to a possible legal dismantling of his business. Benko was known for his aggressive acquisition strategies, which brought him both fame and criticism. His current situation not only raises questions about his personal future, but could also have far-reaching implications for his legacy in the real estate world. The industry is watching with interest to see how the situation will develop.

Sources:

https://finance.yahoo.com/news/blackrock-stock-tumbles-revenue-misses-160133670.html

🔹Revenue: $5.42B (Est. $5.46B) 🟡; UP +13% YoY

🔹 Adj EPS: $12.05 (Est. $10.91) 🟢; UP +16% YoY

🔹 AUM: $12.53T; UP +18% YoY

🔹 Total Net Flows: $68B; DOWN -17% YoY

🔹 Long-Term Net Flows: $46B; DOWN -64% YoY

Segment / Revenue Breakdown

🔹 Base Fees: $4.28B; UP +15% YoY

🔹 Securities Lending Revenue: $171M; UP +11% YoY

🔹 Tech Services & Subscription Revenue: $499M; UP +26% YoY

🔹 Performance Fees: $94M; DOWN -43% YoY

🔹 Distribution Fees: $320M; UP +1% YoY

Other Key Q2 Metrics:

🔹 Net Income (Adj.): $1.88B; UP +21% YoY

🔹 Operating Income (Adj.): $2.10B; UP +12% YoY

🔹 Operating Margin (Adj.): 43.3% vs 44.1% YoY

Flows by Product

🔹 iShares ETFs: +$85B

🔹 Active: +$11B

🔹 Digital Assets: +$14B

🔹 Cash Management: +$22B

🔹 Institutional Index: -$48B

Flows by Client Type

🔹 Retail: +$2B

🔹 ETFs: +$85B

🔹 Institutional: -$41B

AUM Composition

🔹 Equity AUM: $6.91T

🔹 Fixed Income AUM: $3.09T

🔹 Multi-Asset AUM: $1.08T

🔹 Alternatives AUM: $302B

🔹 Cash Management AUM: $970B

Operating Metrics

🔹 Dividend: $5.21/share

🔹 Share Repurchase: $375M

🔹 Effective Tax Rate (Adj.): 24.8%

🔹 Diluted Shares Outstanding: 156.3M; UP +4% YoY

CEO Larry Fink Commentary

🔸 “We generated 6% organic base fee growth in Q2 and 7% over the last twelve months.”

🔸 “iShares ETFs had a record first half in flows, and tech ACV growth hit 16%.”

🔸 “We surpassed the fundraising target for GIP’s fifth flagship, raising $25.2B.”

🔸 “Our comprehensive platform and depth of client relationships set us apart from traditional or private markets firms.”

🔸 “These are just the early days in our next phase of even stronger growth.”

As the earnings season starts again, here is a summary of the most important figures next week.

$JPM (+0,47 %)

$C (+1,33 %)

$WFC (+2,48 %)

$BLK (+0,09 %)

$JNJ (+1,61 %)

$GS (-0,02 %)

$BAC (+2,45 %)

$AA (-0,25 %)

$ASML (+0,88 %)

$PLD (-0,15 %)

$UAL (+1,69 %)

$KMI (+0,15 %)

$PEP (+1,49 %)

$ABT (+2,44 %)

$Netflix

$TSM (-0,72 %)

$USB (+1,18 %)

$IBKR (+2,25 %)

$AXP (+1,41 %)

$MMM (+1,11 %)

Does anyone know what's going on with $BLK (+0,09 %) they are literally going through the roof 🚀🚀 Luckily I got in on time 🙂

Partly due to the following article by @Epi (many thanks for that! 👍🏻) I am considering reducing my US share in my portfolio.

Specifically, I am considering, for example, selling my shares in $BLK (+0,09 %) to sell:

These are close to the all-time high in dollars (which I generally don't think is a bad time to sell), but roughly about 10% lower in EUR. So selling would currently mean giving up about 10% of the return.

The share in my portfolio is 3.5%, I would currently realize a profit of 13% in EUR.

My investment horizon is 15 years+, my US share in the portfolio is approx. 80-85%.

How are you dealing with the current weakness of the dollar? Does it even make sense to react by buying/selling?

Are you currently selling positions in dollars because of the weakness of the dollar (and accepting the loss of return in EUR)?

Or is that precisely why you are not selling, even though you actually want to sell?

Or are you perhaps even building up positions in dollars in order to benefit from an appreciation of the dollar from 2027?

What is it about?

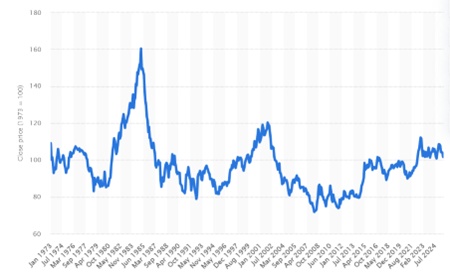

As I wrote in my last post, the USDEUR exchange rate has broken its upward trend, which has been running since 2007, in the last few days.

Why is this a problem for investors?

A falling USD means capital outflows from the US market, which traditionally goes hand in hand with problems in the US and global economy and thus falling equity indices. In addition, a 30% depreciation of the USD means an additional 30% loss for investors in EUR. Ergo: Understanding the USD cycle is very important for your own investment strategy!

In the following article, I will 1. introduce you to the USD cycle, 2. explain which asset classes perform best in which phase of the cycle, 3. what to expect over the next few years from a cycle perspective and 4. how to profit from it.

The USD cycle

Here is the long-term chart of the USD index since the installation of the current international monetary system (Bretton Woods) in 1971:

A certain cyclicality of the USD is noticeable. It can be roughly summarized as follows:

High approx. 120 USD: 1971

Low approx. 80 USD: 1978-80 -30%

High approx. 160 USD: 1985 +100%

Low approx. 80 USD: 1990-95 -50%

High approx. 120 USD: 2000-02 +50%

Low approx. USD 70: 2007-11 -40%

High approx. 115: 2022-2025 +60%

If you look at the highs in 1969, 1985, 2001 and 2017, you can see a relatively stable 16-year cycle. The next high point would be around 2033. There is also a 16-year cycle for the low points: 1978, 1994, 2010. The next one would be around 2026. Roughly speaking, this results in the following cycle: USD falls for 9 years and then rises for 7 years. On average, the USD appreciates by 70% in an upward cycle and depreciates by 40% in a downward cycle (100 +70% -40% = 102). The economic reason for this cycle is probably to be found in the US election periods and the different economic policies.

Each cycle tells its own story:

1969-1978: Oil crisis and stagflation

1979-1984: Reaganomics

1985-1994: Political turnaround and emerging markets boom

1995-2000: Internet boom and emerging markets bust

2001-2010: Internet bust, financial crisis and emerging markets boom

2011-2016: Zero interest rate policy and US tech boom

2017-2026: AI boom/bust and Trump(?)

What does this mean for the next few years? The current phase did not look like a devaluation phase for a long time. We are still only 10% below the peak of the last appreciation phase 2011-16/17. The current depreciation phase ends in 2026/27. For the cycle of the last 60 years to be maintained, there would have to be a significant USD depreciation of 30-40% in the next 1-2 years.

Ergo: If the cycle remains intact, we are on the verge of a true USD crash! Of course, it will hit everyone unexpectedly, especially our political economists - but not you! You now know the cyclicality. How can you profit from it now?

2. the performance of asset classes in the cycle phases

Here you can see the real return (performance minus inflation) of the most important markets S&P500, emerging markets, gold and commodities in the individual phases of the cycle in USD (I have left out bonds):

S&P 500

Period Real (p.a.)

1969-1978 -0,5 %

1979-1984 4,4 %

1985-1994 10,9 %

1995-2000 17,5 %

2001-2010 0,0 %

2011-2016 10,3 %

2017- 2025 7,5%

MSCI Emerging Markets Index

Period Real (p.a.)

1969-1978 -

1979-1984 -

1985-1994 12,0 %

1995-2000 2,0 %

2001-2010 9,4 %

2011-2016 -3,4 %

2017- 2025 2,1%

Gold (USD per ounce)

Period Real (p.a.)

1969-1978 23,8 %

1979-1984 2,5 %

1985-1994 -4,9 %

1995-2000 -5,5 %

2001-2010 14,7 %

2011-2016 -5,0 %

2017- 2025 9,2%

Commodities (CRB/BBG Commodity Index)

Period Real (p.a.)

1969-1978 5,0 %

1979-1984 -2,1 %

1985-1994 -4,2 %

1995-2000 -0,4 %

2001-2010 5,0 %

2011-2016 -10,4 %

2017- 2025 -0.7%

If we select the top performer for each period, the following picture emerges:

Period 1st place (real return p.a.)

1969-1978 Gold +23.8 %

1979-1984 S&P 500 +4.4 %

1985-1994 EM +12.0 %

1995-2000 S&P 500 +17.5 %

2001-2010 gold +14.7

2011-2016 S&P 500 +10.3 %

(2017-2025 gold +9.2 %)

The result is quite clear: the S&P 500 performs best in the USD appreciation phases. Gold and, to a lesser extent, emerging markets perform best in depreciation phases. There is also an economic logic to this: when the US economy is booming, international capital flows into the US market, which strengthens the USD and causes prices to rise. Gold is traded in USD and becomes cheaper for ex-US investors when the USD falls and more attractive for US investors when share prices fall. Emerging market companies and governments are often indebted in USD, which lowers the debt burden when the USD falls.

3. cyclical forecast for 2026/27

a) The USD is likely to reach its cyclical low in 2026. As it is still close to the high of the last cycle, it should depreciate by approx. 30-40% over the next 1-2 years.

b) The S&P500 has gained an average of approx. 3.5%pa (real) during the devaluation phases. From a level of 2400 points in 2017, this would be approx. 4500 points at the end of 2026 with approx. 3% inflation, i.e. approx. 15% lower than today (5300 points).

c) Gold has gained an average of approx. 11.2%pa (real) during the devaluation phases. From a level of USD 1300 in 2017, 3% inflation at the end of 2026 results in a gold price of approx. USD 4900, i.e. around 50% higher than today (USD 3300).

d) For euro investors, the depreciation of the USD must also be taken into account. This means that an unhedged S&P500 ETF would be approx. 45-55% lower in 2026 than today according to the cycle and unhedged gold would be approx. 10-20% higher than today.

e) From 2027, the USD should bottom out and then rise again until 2032. This would then also be the performance phase for the S&P500.

4. strategies and investments

a) Passive B&H savings plan investors (S&P500/ MSCI World/ ACWI)

B&H investors remain consistently invested and continue to save in their ETFs. However, they should be prepared for a massive test of their strategy and nerves. The drawdown could be massive (approx. -50%) due to the falling USD and falling equity markets. Those who have added emerging markets should be less affected by a falling USD.

Those who have the opportunity can consider at least hedging the depreciation of the USD. A factor certificate or ETC is most suitable for this. If you reserve 10% of your portfolio volume for a factor 10 short USDEUR, you can at least cushion a good part of the USD depreciation.

An alternative would be to pause the savings plan for the equity ETF and instead invest in a currency-hedged gold ETC or simply a money market ETF.

Another option is to switch to currency-hedged ETFs or redirect the savings plan to them. Such ETFs are available cheaply for the S&P500, MSCI World and ACWI.

b) Active investors (market timing, trading, stock picking)

Friends of sophisticated, strategic market timing have a few more options.

They can either switch immediately into a currency-hedged gold ETC or wait for a correction and invest in gold near the SMA100 via a factor ETC, for example.

Or you can bet directly on a falling USD with a low-cost factor ETC/certificate (see above)

In addition to gold mines, equity fans can also target emerging market companies with high USD debt, as these benefit particularly from a falling USD. This can quickly add up to several 100% gains.

Finally, connoisseurs can bet on falling prices on the US markets with inverse index ETFs. However, due to the asymmetrical volatility, a good strategy and disciplined implementation are a must here.

What other ideas do you have for profiting from a USD devaluation?

5. summary

The USD cycle has been very reliable over the last 60 years. Knowing it helps to better understand the major movements in the financial markets. The current break in the USD trend could be followed by a rapid and sharp depreciation of the USD in the next 1-2 years with serious consequences for the financial markets, especially for German investors with USD investments. Those who know the cycle can protect themselves against it or even profit from it.

I have hereby warned you.

And now on with the business!

Your Epi

Hello getquin community,

here at getquin I can see that my BlackRock dividend was paid out on June 20, but when I checked today I realized that Scalable has not yet transferred it! Have you already received your BlackRock dividend from Scalable?

Best regards 🫡 $BLK (+0,09 %)

✅ BlackRock (BLK) increases turnover in the 1st quarter by 12 % to USD 5.3 billionearnings per share increase by 15 % to USD 11.30 .

📈 Growth driver:

✅ Net inflows in Q1 at an impressive 84 billion USD.

💎 Bitcoin ETF IBIT at record pace

✅ The iShares Bitcoin Trust ETF (IBIT) is one of the first physical Bitcoin ETFs in the USA (since January 2024).

⚡ After only 211 days: Market capitalization at 40 billion USD - faster than any comparable ETF before.

✅ Current market capitalization: around 72.5 billion USD.

📈 Bitcoin rose sharply on June 25 - additional price driver for BlackRock.

📊 Chart breakout for BlackRock

✅ Share breaks through resistance at 1,003 USD.

🚀 Follow-up buying likely, technical target: 1,050-1,100 USD.

⚠️ Next support zone remains at approx. 970 USD.

This is my first post, so please don't hate. 🙂

I've been using the dividend strategy for a year now because it motivates me to stick with it. The simple one-ETF solution is too boring for me in the long run - I have more fun following individual stocks from time to time.

So far, I've mainly invested in dividend ETFs, and I want to keep it that way. However, I would like to add a few individual stocks to my portfolio to make it more interesting.

My goal is a maximum of 10 individual stocks so that I don't lose track. Here are the stocks I'm currently looking at:

My questions for you:

👉 Are these stocks generally suitable for a dividend strategy?

👉 Is there potential for improvement in terms of sector and country allocation?

👉 Is there a stock that you think should definitely not be missing?

Looking forward to your opinions and tips!

Another small moment for the long-term strategy today:

📥 €41.68 dividend from BlackRock Funding Inc. on 8 shares

I know - for some people that's a joke. For me, it's exactly the opposite:

➡️ It's visible progress.

➡️ It is income from patience.

➡️ It's passive income that works while I sleep, work or play with my daughter.

With just under €5,000 invested, I don't want "to the moon" - I want reliability.

And BlackRock delivers.

The goal? 💡 Not to get rich overnight.

But a system that brings me financial independence bit by bit.

With quality. With a plan. With peace of mind.

How many of you also hold BlackRock in your portfolio?

And what do you think of individual shares with a solid dividend policy?

#DividendenDienstag

#BlackRock

#PassivesEinkommen

#FinanzielleFreiheit

#Cashflow

#Langfristdepot

#InvestorMindset

#DividendenRegen

#Vermögensaufbau

Meilleurs créateurs cette semaine