My conviction in LVMH is strong; I believe it will deliver surprises in 2025. I expect a slow but steady recovery from China $MC (+1,23 %)

$BABA (-2,2 %)

Alibaba ADR

Price

Discussion sur BABA

Postes

265

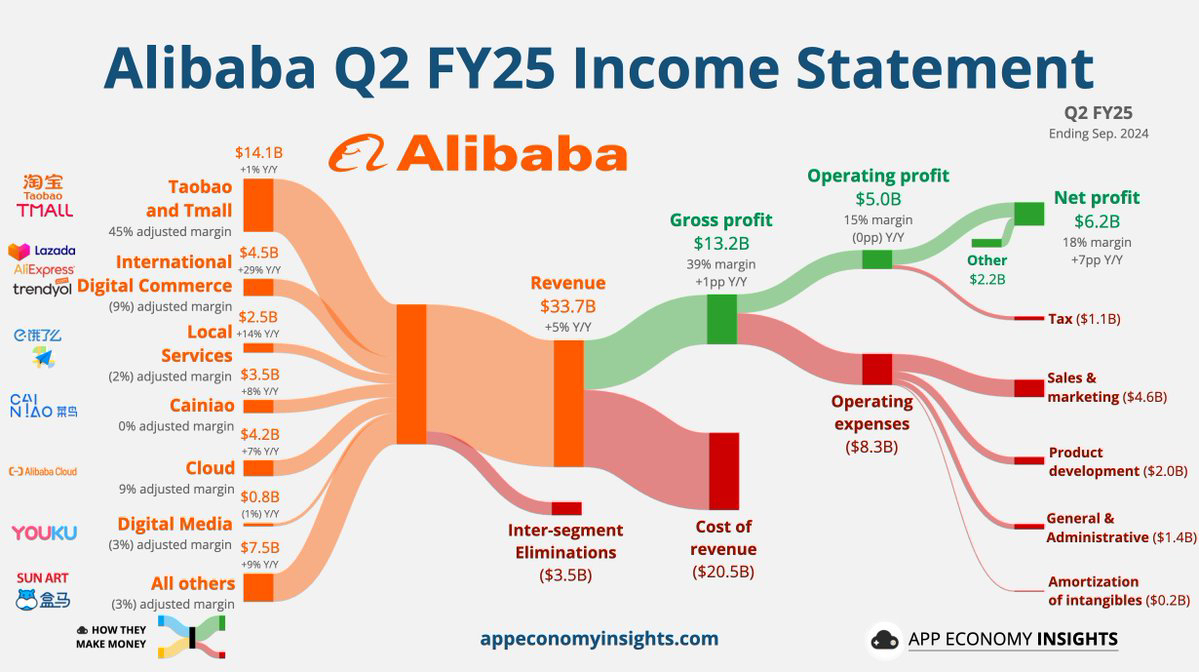

Alibaba Income Statement | $BABA (-2,2 %)

$BABA (-2,2 %)

| Alibaba Q3 FY24 Earnings Highlights

🔹 EPS: 🟢15.06 (Est. 🟢14.79) 🟢

🔹 Total Revenue: ¥236.50B (Est. ¥239.45B) 🔴; UP +5% YoY

🔹 Gross Margin: 39.1% (Est. 38.1%) 🟢

Q3 SEGMENTS:

Taobao and Tmall Group

🔸 Revenue: ¥98.99B (Est. ¥98.22B) 🟡; UP +1% YoY

🔹 Adjusted EBITA: ¥44.59B (Est. ¥45.62B) 🔴; DOWN -5% YoY

China Commerce Retail Revenue:

🔹 Customer Management: ¥70.36B; UP +2% YoY

🔹 Direct Sales and Others: ¥22.64B; DOWN -5% YoY

Alibaba International Digital Commerce Group

🔸 Revenue: ¥31.67B (Est. ¥30.92B) 🟢; UP +29% YoY

🔹 Adjusted EBITA: -¥2.91B (Est. -¥3.67B) 🟢; WIDENED LOSS YoY

🔹 International Commerce Retail Revenue: ¥25.62B; UP +35% YoY

🔹 International Commerce Wholesale Revenue: ¥6.05B; UP +9% YoY

Cloud Intelligence Group

🔸 Revenue: ¥29.61B (Est. ¥29.52B) 🟡; UP +7% YoY

🔹 Driven by double-digit growth in public cloud products and triple-digit growth in AI-related products

🔹 Adjusted EBITA: ¥2.66B (Est. ¥2.21B) 🟢; UP +89% YoY

Cainiao Smart Logistics Network Limited

🔸 Revenue: ¥24.65B (Est. ¥26.85B) 🔴; UP +8% YoY

🔹 Adjusted EBITA: ¥55M (Est. ¥240.4M) 🔴; DOWN -94% YoY

Local Services Group

🔸 Revenue: ¥17.73B (Est. ¥17.37B) 🟡; UP +14% YoY

🔹 Adjusted EBITA: -¥391M (Est. -¥821.8M) 🟢; LOSS NARROWED YoY

Digital Media and Entertainment Group

🔸 Revenue: ¥5.69B (Est. ¥6.21B) 🔴; DOWN -1% YoY

🔹 Adjusted EBITA: -¥178M (Est. -¥268.9M) 🟢; LOSS NARROWED YoY

All Others Segment

🔸 Revenue: ¥52.18B (Est. ¥48.06B) 🟢; UP +9% YoY

🔹 Adjusted EBITA: -¥1.58B (Est. -¥1.58B) 🟡

Profitability

🔹 Income from Operations: ¥35.25B; UP +5% YoY

🔹 Adjusted EBITDA: ¥47.33B (Est. ¥47.37B) 🟡; DOWN -4% YoY

🔹 Adjusted EBITA: ¥40.56B (Est. ¥40.48B) 🟡; DOWN -5% YoY

🔹 Non-GAAP Net Income: ¥36.52B; DOWN -9% YoY

🔹 Non-GAAP Diluted EPADS: ¥15.06 (Est. ¥14.82) 🟢; DOWN -4% YoY

Key Operational Metrics

🔹 Free Cash Flow: ¥13.74B; DOWN -70% YoY

🔹 Net Cash Provided by Operating Activities: ¥31.44B; DOWN -36% YoY

Share Repurchases

🔹 Repurchased 414M shares (52M ADSs) worth US$4.1B

🔹 Total shares outstanding reduced by 2.1% QoQ

E-commerce Initiatives:

🔸 Implemented GMV-based service fees on Taobao/Tmall; annual service fee for Tmall merchants canceled

🔸 AI-powered marketing tool, Quanzhantui, saw increased adoption

Cloud Intelligence:

🔸 Strong growth in AI-related products with triple-digit YoY increases

🔸 Recognized as a Leader in public cloud and AI services in China

International Commerce:

🔸 Strengthened AliExpress with localized fulfillment solutions and improved logistics

🔸 Trendyol and AliExpress Choice driving revenue growth

Cainiao Logistics:

🔸 Expanded cross-border fulfillment capabilities

🔸 Cainiao Express launched logistics services on external e-commerce platforms

CEO Commentary

🔸 "Growth in our Cloud business accelerated, with AI products delivering triple-digit growth. We remain confident in our core businesses and are committed to long-term investments." – Eddie Wu, CEO

CFO Commentary

🔸 "We repurchased US$4.1 billion in shares, achieving earnings accretion and reducing total shares outstanding by 2.1% since June." – Toby Xu, CFO

Earnings next week (11.11 - 15.11)

Hi, I currently have 3 positions at $BABA (-2,2 %) Buy In at 95€.

Do you think I should increase my positions before the financial release?

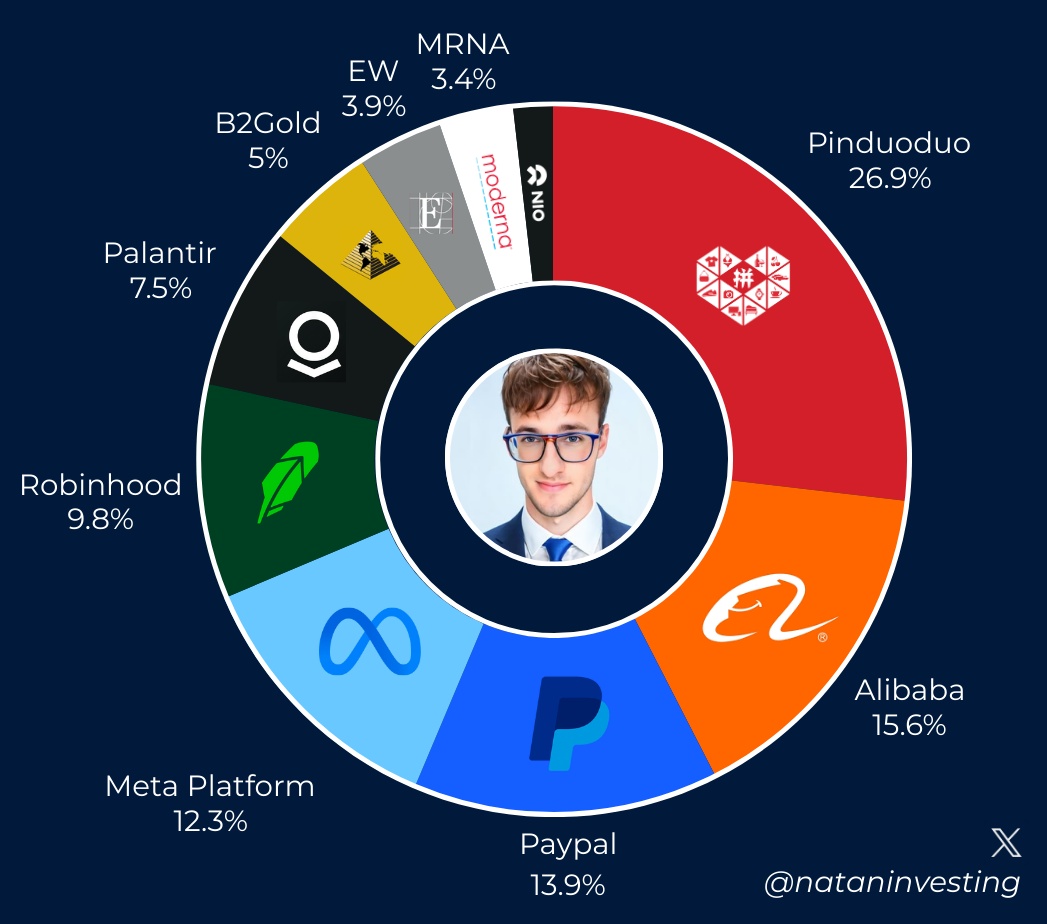

What do you think about my portfolio allocation? $PDD (-3,8 %)

$BABA (-2,2 %)

$PYPL (+2,78 %)

$META (+0,07 %)

$HOOD (+4,27 %)

$PLTR (+5,14 %)

$BTO (+2,6 %)

$EW (+0,51 %)

$MRNA (+8,29 %)

$9866 (+4,34 %)

$BABA (-2,2 %) Average price is 69$, should i sell?

I just love the stock , it was one of the first stocks that i bought, but china stock just give me anxiety.

I also own $1211 (-0,37 %)

Week in review 28.09.

New all-time highs for DAX, Dow Jones, S&P 500, Gold, GE Vernova, Meta, Netflix, SAP, Vistra Corp, Walmart 👑🥇 $LYY7 (+1,03 %)

$CSPX (+0,99 %)

$ABX (+1,16 %)

$GEV (+2,77 %)

$META (+0,07 %)

$NFLX (+0,78 %)

$SAP (+0,74 %)

$VST (-1,06 %)

$WMT (+3,08 %)

New 52-week highs for 3M, Air Products, Alibaba, Arista Networks, Barrick Gold, Bank of Nova Scotia, BlackRock, Caterpillar, Constellation Energy, DuPont, HSBC, Infosys, Live Nation, McDonald's, Palantir, PayPal, Public Storage, Royal Bank of Canada, Royal Caribbean, Sea Ltd, Spotify, Tangier 💵📈 $PLTR (+5,14 %)

$9988 (-2,28 %)

$BABA (-2,2 %)

$BLK

$CAT (+2,69 %)

$BNS (+0,58 %)

$STZ (+0,09 %)

$DD (+1,26 %)

$HSBA (+0,78 %)

$HSBC (+0,91 %)

$INFY

$LYV (+1,16 %)

$MCD (+1,28 %)$PUB

$PUB

$RCL (+2,48 %)

$SEA (-0 %)

$SKT (+0,06 %)

Bitcoin with new 1-month high, +22% in three weeks since the low on 07.09. from 52k$ to 66k$, +150% in 12 months📉📈 $BTC (+1,24 %)

PayPal's own stablecoin PYUSD (crypto) is growing strongly and is now one of the top 100 cryptos by market capitalization at 95th place 💰 $PYPL (+2,78 %)

Palantir with inclusion in the S&P 500 on Monday #PLTRgang 🤜🤛👊✊ $PLTR (+5,14 %)

Uber is working with Google's Waymo (Alphabet) and wants to offer robotaxis for a surcharge 🚗🤖 $UBER (+3,46 %)

$GOOGL (-0,02 %)

$GOOG (-0,06 %)

After the ECB and FED, China has also turned on the money printer *brrr brrr*, plus a big economic stimulus program, China stocks therefore have their best week in 10 years, car and luxury stocks with Chinese business are therefore rising 🖨🇨🇳 $MC (+1,23 %)

$P911 (+0,84 %)

$BMW (+0,04 %)

$MBG (+1 %)

AMD CEO and Nvidia CEO confirm continued high demand for AI chips 🧠🤖, Nvidia CEO does not want to sell any more of his own shares for the time being. $AMD (+1,2 %)

$NVDA (-2,44 %)

Upcoming Playstation 6 with AMD chip again, but AMD will leave the high-end graphics card market for PC gamers and try to scale more strongly in the mid and lower segments. Nvidia would then have a monopoly 🎮 $SONY (+0,82 %)

$6758 (+0,41 %)

Super Micro suspected of accounting fraud. US justice is apparently already investigating according to an insider, -62% share price in three months 🔍👮 $SMCI

AI needs a lot of electricity and nuclear power plants are being reactivated in the USA. In Germany, it's the other way around due to the world's stupidest energy policy. US electricity provider shares, uranium mines - shares and ETFs are rising. ⚛️⚡️ (see podcast episode 57 "Buy High. Sell Low." pinned to my profile at the top) $URNM

$URA (+0,63 %)

$UEC (+1,45 %)

Micron with good quarterly figures and +13% share price, semiconductor stocks rally 💻📈 $MU (+0,26 %)

Costco - quarterly figures mixed, EPS exceeds estimates but sales worse than expected, share price falls slightly 🛒 $COST (+1,65 %)

McDonald's increases quarterly dividend by 6% to 1.77$. Since the first dividend payment in 1976, the payout has been increased 48 years in a row. 🍟🍔 $MCD (+1,28 %)

Investigation initiated against Visa 💳 and SAP 💻 in the USA for illegal price fixing $V (+0,73 %)

$SAP (+0,74 %)

Oil price falls again, Shell & Co. on the way to 1-year low 🛢⛽️ $SHEL (+0,58 %)

$GB00B03MM408

$RDS.A

Meta releases VR glasses Quest 3s for €330 from 15.10.24 📱👓

Intel launches AI accelerator "Gaudi 3" as an alternative to Nvidia's H100. IBM, Google & Dell as first customers. 🧠 $INTC (+1,08 %)

US debt level climbs above 35 trillion dollars for the first time 🖨💵

Ubisoft share price collapses due to postponement of "Assassin's Creed: Shadows", -70% 1-year performance 🎮📉 $UBI (+1,45 %)

DHL raises outlook / growth forecast until 2030 and increases letter postage by 10.5% in Germany from 2025 📦✉️📯 $DHL (+1,27 %)

BASF struggles with high energy prices and weak demand, threat of plant closure and dividend cut 🇩🇪📉 $BAS (+1,14 %)

Adidas (+28%) significantly better than Nike (-18%) since the beginning of the year ⚽️🏀👟 $ADS (+1,49 %)

$NKE (+3,31 %)

Takeover poker at Commerzbank by Ital. Unicredit continues 🏦🇮🇹🇩🇪 $CBK (-1,98 %)

$UCG (-2,27 %)

Jefferies issued a buy recommendation for BioNTech and sees the antibody BNT327 against cancer as a potential massive sales driver. 👨⚕️⚕️💊 $DE000A0V9BC4

Mutares -14% because shortseller Gotham City raises serious allegations against the SDAX member: Ponzi scheme, false accounting and circular business model 🔍👮 $MUX (+2,78 %)

>> If you want to read a review like this every week, leave a like & subscribe. What important news have I forgotten? 👍❤️

+ 6

Titres populaires

Meilleurs créateurs cette semaine