Fell victim to the fall cleaning of the portfolio. Should actually benefit from the energy/climate transition and the hydrogen/industrial gases growth market and outperform Linde in particular ... but what can I say, no positive share price performance for 5 years. APD has lowered its profit forecast, discontinued major projects and margins are falling ... the share price has developed accordingly.

Discussion sur APD

Postes

45New companies in our sights!

Of course, these are not new companies that have caught my attention, but they are new to my focus. First of all, they are $APD (+0,27 %)

Air Products and Chemicals is far more than just a traditional gas producer - the company is the sleeping giant of the global energy transition. While the market clings to short-term pressures from helium prices and China worries, Air Products is preparing for a new earnings phase: The company is repositioning its margins on the basis of structural cost reductions, the reduction of overcapacities and selective large-scale projects. In the coming year, the operating margin is expected to rise again to 24 percent, while EBITDA will climb from 5.0 to 5.7 billion dollars - well above the analysts' consensus. The company's market leadership in long-term industrial gas contracts with "take or pay" clauses ensures stable, predictable cash flows even in weak economic phases. Over 50 percent of sales are already contractually secured - a moat that only a few competitors can offer. At the same time, mega-projects such as the Blue Hydrogen complex in Louisiana or the NEOM project in Saudi Arabia offer considerable potential for future valuation premiums, even though they have not yet been factored into current estimates. Despite higher debt and a historically high valuation, Air Products delivers strong dividend stability (43 consecutive years of increases!) and a conservative re-margining roadmap. Those willing to see through the temporary valuation thicket will recognize that this is the world's strongest gas company for the green energy era. Investors who buy today will secure a rare combination of defensive cash flow stability and explosive hydrogen fantasy.

CHART PHOTO SHARE The Air Products share has been oscillating in a broad trading range between 215 and 338 dollars for five years now. However, this sideways trend could now come to an abrupt end. Since the April low of 248 dollars, the share has gained momentum and last week broke above the GD200 on a sustained basis. At the same time, it is showing increasing relative strength compared to the market as a whole. Particularly interesting: In the near future, the GD50 should cross the GD200 from bottom to top, generating a golden cross - a classic technical buy signal. This would clear the way to the all-time high of 338 dollars.

Peer group in percent 6 % better than Al The chart comparison of the four industrial gases groups shows high volatility over the past twelve months, particularly in the case of Air Products. While the share price slipped into negative territory at times during the April correction - as was also the case with its competitors - all the shares have now managed to return to positive territory. Air Products in particular has stood out over the past two weeks with its increasing upward momentum. At the same time, the fundamental outlook has brightened considerably. Although a decline in profits of around 30% is expected for the 2025 financial year, analysts are forecasting double-digit profit growth again from the following year. This positive outlook is also reflected in the share price targets: at its peak, the experts see a potential of over 30 percent - up to 394 dollars!

And of course, as usual, there is a suitable derivative that I might invest in. I have chosen VG0L32. If the share rises to the old ATH, the bond will make just under 400%.

RBC rates Air Products and Linde as "Outperform" due to earnings recovery

RBC Capital Markets initiated coverage of Air Products and Chemicals (NYSE: APD ) and Linde (NYSE: LIN ) with Outperform ratings, saying both industrial gases companies are well positioned to deliver steady earnings growth and improved returns.

Air Products was described as a turnaround story. RBC said a recent decline in the shares presents a buying opportunity.

With new leadership, the company is distancing itself from riskier growth projects and refocusing on its traditional industrial gases activities.

The bank sees potential for a recovery in the shares after a decline of around 10% since March and set a price target of 355 dollars.

It expects most of the gains to come from better operating performance and investor confidence in the company's simplified strategy.

Air Products plans to reduce capital spending by $2.5 billion by 2030, scale back underperforming initiatives and cut nearly 4,500 jobs by 2028.

Linde is sticking to its proven formula of steady price increases and disciplined project spending.

Despite weaker industrial demand, the company was able to further increase its profit margins and return capital to shareholders through share buybacks and dividends.

RBC set a price target of USD 576 for Linde, citing the company's track record of stable growth and a number of major projects that are expected to contribute positively to earnings in the coming years.

The firm said that both companies offered relative safety at a time of greater uncertainty in industrial markets, with Linde seen as the more stable operator and Air Products offering greater recovery potential.

My favorites in the basic materials sector ⛰️⛏️

Air Products & Chemicals $APD (+0,27 %)

Ecolab $ECL (+0,44 %)

CRH $CRH (+0,22 %)

Linde $LIN (-0,08 %)

Sherwin-Williams $SHW (+0,36 %)

Rio Tinto (With $RIO (+1,18 %) I am more interested in the attractive valuation, dividend and investments in future areas such as copper/lithium)

In the basic materials sector, stock selection was not easy for me. I had to adjust my usual quality standards somewhat and in some cases also make compromises (see above 🤓). The sector is very cyclical, which makes it more difficult to find companies with consistently stable performance. Many key figures are heavily distorted by fluctuations in commodity prices, economic influences or geopolitical factors. At the same time, however, it also offers interesting opportunities for long-term investors, especially if an anti-cyclical entry is successful 🫣.

Which companies do you see as particularly promising for a long-term investment?

----------------------------------------------------------------------------------------------------------

I am also fascinated by the idea of profiting from gold actively and with dividends. That's why I've been looking at gold stocks and have my eye on Franco-Nevada and Agnico Eagle in particular. Neither of them made it into the selection above, but I wanted to mention them anyway. Even though I am not yet invested, I will definitely continue to monitor both stocks.

$FNV (-4,11 %) Franco Nevada is a royalty company with low operating risk but high gold price leverage.

$AEM (-5,88 %) Agnico Eagle is a classic mining company with a good balance sheet and a decent dividend history.

----------------------------------------------------------------------------------------------------------

Air Products Trade

$APD (+0,27 %) also looks nice.

CRV of 2

There was only one bill with KO at 298$

I am also in here.

Buy will be posted when getquin allows it again.

Air Prdocuts & Chemicals still too cheap?

$APD (+0,27 %) is currently in the process of generating new record highs - business is still booming - which is good news for me!

What are your thoughts on the company?

Click here for a brief analysis:

Pinned post, Close Watch:

$BATS (+0,62 %)

https://www.tradingview.com/x/z3rRyfl7

Current trades:

20.06 $NOC (-1,34 %)

https://www.tradingview.com/x/kYA61TYh

Closed trades:

08.01 $AD (-0,54 %)

https://www.tradingview.com/x/jWgHkMO8 🟢

$NOVO B (-0,89 %) Yolo trade 20.01 / closed 22.01 🟢+47%

31.1 $COST (-0,67 %)

https://www.tradingview.com/x/rjRs5UU0 +175%🟢

$NU (+0,04 %) +85% 🟢 https://www.tradingview.com/x/m1Vq6dAQ

$APD (+0,27 %)

https://www.tradingview.com/x/omJ97Qwm

Closed 25.01 with +5%🟡 Market is too sensitive for me.

14.02 $CPRT (-1,21 %) closed due to the quarterly figures on 19.02 / +20%🟢https://www.tradingview.com/x/k5xe1w71

24.02 $GOOGL (+3,03 %) -90% SL 🔴

From sand to chip: how is a modern semiconductor made?

Reading time: approx. 10min

1) INTRODUCTION

Since 2023 at the latest and the rapid rise of Nvidia $NVDA (+1,98 %) semiconductors and "AI chips" in particular have been the talk of the town. Since then, investors have been chasing after almost every company that has something to do with the manufacture of chips, driving share prices to unimagined heights. However, hardly any investors really know how complex the value chain is within the production of modern chips.

In this article, I will give you an overview of the entire manufacturing process and the companies involved. Even if many of you have a vague idea that the production of modern chips is complex, you will certainly be surprised by how complex it really is in reality.

2) BASIC

The starting point for every chip are so-called wafers [1] - i.e. thin wafers, which usually consist of so-called high-purity monocrystalline silicon. In the field of power semiconductors, which primarily comprises chips for applications with higher currents and voltages, silicon carbide (SiC) or galium nitride (GaN) has recently also been used as the base material for the wafers.

In the so-called front end the actual core components of the chips - the so-called dies - are created and applied to the wafers. The dies are rectangular structures that contain the actual functionality of the later chip. The finished dies are then tested for their functionality and electrical properties. Each die that is found to be good is then integrated into the so-called backend where the individual dies are separated on the wafer. This is followed by the so-called packaging. The individual dies from the front end are then electrically contacted and integrated into a protective housing. In the end, this housing with the contacted die is what is usually called a chip chip.

Now that we have a rough overview of the overall process, let's take a closer look at the individual processes involved in producing the dies on the wafer. This is the area in which most highly complex machines are used and which is usually the most sensitive.

3) FROM SAND TO WAFER

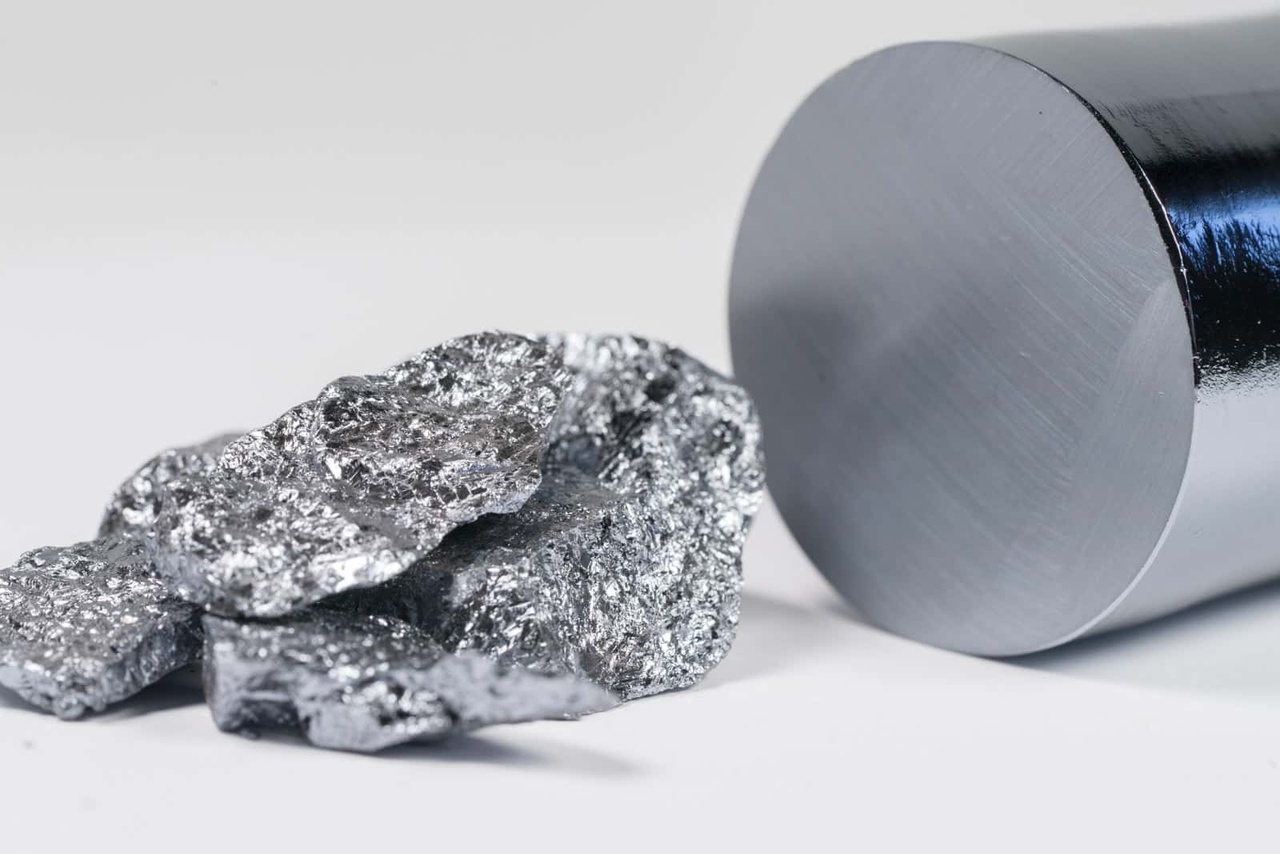

Before wafers made of high-purity silicon can even be produced and the actual process for manufacturing dies can begin, the actual wafer must first be manufactured in almost perfect quality. To do this, quartz sand, which consists largely of silicon dioxide, is reduced with carbon at high temperatures. This produces so-called raw siliconwhich, with a purity of around 96%, is not yet anywhere near the quality required for the production of wafers.

In several chemical processes, which are carried out by Wacker Chemie

$WCH (-0,69 %) or Siltronic

$WAF (-0,72 %) are used to turn the "impure" silicon into so-called polycrystalline silicon with a purity of 99.9999999%. For every billion silicon atoms, there is then only one foreign atom in the silicon. However, this pure polycrystalline silicon is still not suitable for the production of wafers, as the crystal structure in the silicon is not uniform enough. In order to create the right crystal structure, the polycrystalline silicon is then melted again and a so-called ingotwhich is made from monocrystalline silicon is produced. A comparison between raw silicon and the ingot can be found in the following image [3]:

This ingot is then sawn into thin slices, which are then the final wafers for semiconductor production. The best-known wafer producers are Shin Etsu

$4063, (-3,96 %)

Siltronic or GlobalWafers

$6488.

4) FROM THE WAFER TO THE DIE

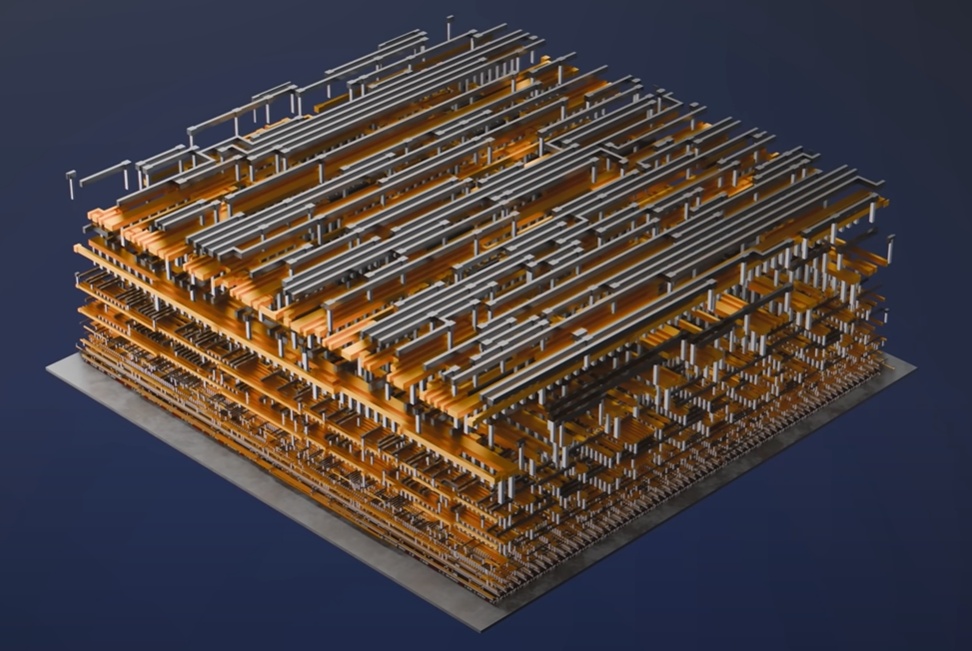

The wafers described in the previous section can now be used to produce dies. The overall process for producing dies basically consists of applying a large number of layers using various chemical, mechanical and physical processes. The overall process (depending on the product) takes approx. 80 different layers on the wafer, requiring almost 1000 different process steps and 3 months

non-stop production are required [4].

A macroscopic analogy is useful here, which I have also taken from [4]. You can compare the overall process for producing dies with baking a large multi-layer cake. This cake has 80 layers and the recipe for baking consists of 1000 steps. It takes 3 months to make the cake and if even one layer of the cake deviates from the recipe by more than 1%, the whole cake collapses and has to be thrown away.

In the first process steps, the wafer is covered with billions tiny little transistors are created on the wafer, which are then all individually electrically contacted in the following steps. The final steps consist of electrically connecting the transistors to each other, resulting in a complete electrical circuit [4]:

Each individual layer of the approximately 80 layers in the die requires highly specialized processes, which can be roughly summarized as:

- Applying masks: Photolithography, photoresist coating (applying photoresist)

- Apply material: Chemical Vapor Deposition (CVD), Physical Vapor Deposition (PVD), Atomic Layer Deposition

- Remove material: Plasma annealing, Wet annealing, Chemical Mechanical Planarization (CMP)

- Modify material: Ion Implanting, Annealing

- Material cleaning

- Inspecting the layers: Optical, Microscopical, Focused Ion Beam, Defect Inspection

Apply masks

Ultimately, a mask can be thought of as an enlarged copy of the structure of a special layer in the die. These so-called photomasks are then scanned using so-called scanners or steppers "copied" in reduced size onto the wafer. The best-known manufacturer of such lithography systems is ASML

$ASML (+1,93 %). It is currently the only producer of lithography systems that make it possible to produce structures smaller than 10 nanometers on the wafer. In today's powerful and modern chips, such as those found in smartphones, AI chips and processors, the smallest structures are around 3 nanometers in size. Other manufacturers of lithography systems for larger structures (10nm and larger) are Canon Electronics

$7739 or Nikon $7731 (-0,78 %) .

The photomasks - i.e. the enlarged "copies" of the structures - are produced by companies such as Toppan $7911 (+0 %) , Dai Nippon Printing

$7912 (+0 %) or Hoya $7741 (+4,98 %) manufactured. Systems for cleaning the photomasks or for applying the photoresist are produced, for example, by Suss Microtec

$SMHN (-19,99 %) for example.

Apply/remove/modify/clean material

As can be seen in the overview above, there are a variety of methods and processes for modifying the material of a particular layer. As a result, there is a lot of different equipment that can handle a process very well with incredible specialization. The best-known and most successful equipment manufacturers include Applied Materials $AMAT (+0,95 %), LAM Research

$LRCX (+3,24 %), Tokyo Electron (TEL)

$8035, (-0,2 %)

Suss Mictrotec, Entegris

$ENTG (+1,46 %) and Axcelis $ACLS (-0,32 %).

The material - for example, highly specialized chemicals - is of course also required for production. Companies such as Linde

$LIN (-0,08 %), Air Liquide

$AI (+0,32 %), Air Products

$APD (+0,27 %) and Nippon Sanso

$4091 (-0,73 %) are major manufacturers of process gases such as nitrogen, hydrogen and argon.

Inspect

As mentioned, every single layer in the manufacturing process of a die must be perfect in order to obtain a functional die at the end. Any small deviation or foreign particles can impair the functionality of the die. As the function of the die can only be checked precisely on the finished die, it is advantageous to inspect the individual layers for defects and deviations during production. Special machines are required for this, which must be able to do different things depending on the layer. Manufacturers of such machines include KLA

$KLAC (+3 %) or Onto Innovation

$ONTO (-0,87 %).

The following applies to almost all of the companies mentioned in this section: the companies are highly specialized and have quasi-monopolies on the machines for certain process steps. quasi-monopolies. Suitable equipment therefore usually costs several million dollars. In addition, some of the systems are so complex that they can only be serviced by the manufacturer's own service staff, which results in recurring service revenues for every machine sold. As a rule, each machine requires several highly specialized engineers to ensure long-term stable operation.

5) FROM THE DIE TO THE FINISHED CHIP

Once the wafer has been processed, the dies on the wafer are checked for functionality. There is highly specialized equipment for this, so-called probers. These probers test each individual chip several times, if necessary, to check the functionality implemented in the design. Manufacturers of such probers include Teradyne $TER (+1,93 %), Keysight Technologies

$KEYS (-0,91 %), Onto Innovation or Tokyo Electron. These probers have to control each individual die, some of which are only a few square millimetres in size, and contact the corresponding much smaller test structures with tiny needles. The testing process is sometimes outsourced to entire companies that offer die testing as a complete package. One example of such providers is Amkor Technology

$AMKR (+0,44 %).

The processed and tested wafer is now sawn to obtain individual dies. The dies that are found to be good are then integrated into a protective housing in the backend. The dies that have not passed the functionality test are either sorted out or (depending on the error pattern) processed as a variant with reduced functionality similar to those with full functionality. After a final functional test in the package, the chip is ready for use.

6) FOUNDRIES, FABLESS & SOFTWARE

Now that we have an overview of the complex process of manufacturing a chip, let's zoom out a little further to understand which companies perform which tasks in the semiconductor industry.

It's funny that not once in the manufacturing process has the name Nvidia $NVDA (+1,98 %) or Apple $AAPL (+1,58 %) has been mentioned? Yet they have the most advanced chips, don't they?

The pure production of the chips is done by other companies - so-called foundries. Companies like Nvidia and even AMD $AMD (+1,74 %) are in fact fablessThis means that they do not have their own production facilities but only supply the chip design and let the foundries manufacture the actual chip according to their design.

The design of a chip is like the blueprint for production - the foundries then take over the recipe creation and the actual production. There is special software for designing chips. Companies known for this software include Cadance Design

$CDNS (+1,17 %) and Synopsys $SNPS (-0,67 %). But also the industrial giant Siemens

$SIE (+1,5 %) now also supplies software for designing integrated circuits. Synopsys also offers other software for data analysis within foundry production.

Speaking of foundries; the best known foundry is probably TSMC

$TSM, (+0,79 %) which is the global market leader in foundries. TSMC designs itself no chips itself and specializes exclusively in the production of the most advanced generations of chips. Another major player that also masters the most advanced structure sizes is Samsung $005930. In contrast to TSMC manufactures Samsung also produces its own designs. Other large foundries are Global Foundries

$GFS, (-1,17 %) which was originally a spin-off from AMD and the Taiwanese company United Micro Electronics

$UMC. (+0 %)

The best-known fabless companies - i.e. companies without their own chip production - are Nvidia, Apple, AMD, ARM Holdings

$ARM, (+3,68 %)

Broadcom $AVGO (+1,7 %), MediaTek $2454 and Qualcomm $QCOM. (+10,67 %) In the meantime Alphabet $GOOGL, (+3,03 %)

Microsoft $MSFT, (+1,42 %)

Amazon $AMZN (+1,16 %) and Meta $META (+1,5 %) have designed their own chips for certain functionalities and then have them manufactured in foundries.

In addition to foundries and fabless companies, there are of course also hybrid models, i.e. companies that take on both production and design. The best-known examples of this are, of course, companies such as Intel

$INTC (+3,13 %) and Samsung. There is also a whole range of so-called Integrated Device Manufacturer (IDM)which for the most part only manufacture their own designed chips and do not accept customer orders for production. Well-known companies such as Texas Instruments

$TXN, (-0,1 %)

SK Hynix

$000660,

STMicroelectronics

$STMPA, (+1,75 %)

NXP Semiconductors

$NXPI, (+0,66 %)

Infineon $IFX (+2,17 %) and Renesas $6723 (+1,37 %) are among the IDMs.

FINAL WORD

The aim of this article was to provide an overview of the complexity of the semiconductor industry. I do not, of course no claim to be complete, as there are of course many other companies that are part of this value chain. As Getquin thrives on active exchange, I'll give you some food for thought to discuss in the comments below the article:

- feel free to link any other companies in the comments if you think I've forgotten any relevant ones

- what was the most surprising new information for you from the article?

- which companies from the article have you never heard of?

- before reading the article, did you know approximately how a modern chip is produced and what steps are necessary for this?

In general, I can recommend the 20-minute YouTube video at [4] to any interested reader. It provides an excellent animated overview of the manufacturing process of modern chips.

Stay tuned,

Yours Nico Uhlig (aka RealMichaelScott)

SOURCES:

[1] Wikipedia: https://de.wikipedia.org/wiki/Wafer

[2] https://www.halbleiter.org/waferherstellung/einkristall/

[3] https://solarmuseum.org/wp-content/uploads/2019/05/solarmuseum_org-07917.jpg

[4] Branch Education on YouTube: "How are Microchips Made?" https://youtu.be/dX9CGRZwD-w?si=xeV0TYgJ2iwNOKyO

Analyst updates, 18.11.

⬆️⬆️⬆️

- MORGAN STANLEY raises the price target for SIEMENS from EUR 212 to EUR 220. Overweight. $SIE (+1,5 %)

- HSBC raises the target price for RHEINMETALL from EUR 660 to EUR 700. Buy. $RHM (-1,84 %)

- HSBC raises the target price for DEUTSCHE TELEKOM from EUR 33.50 to EUR 34. Buy. $DTE (+1,19 %)

- DEUTSCHE BANK RESEARCH raises the price target for ALLIANZ SE from EUR 275 to EUR 310. Buy. $ALV (+1,08 %)

- DEUTSCHE BANK RESEARCH raises the price target for SIEMENS ENERGY from EUR 52 to EUR 57. Buy. $ENR (-0,82 %)

- UBS upgrades AIR PRODUCTS & CHEMICALS from Neutral to Buy and raises target price from USD 338 to USD 375. $APD (+0,27 %)

- ODDO BHF raises the price target for SWISS RE from CHF 127 to CHF 138. Outperform. $SREN (+0,2 %)

- BARCLAYS raises the price target for MUNICH RE from EUR 523 to EUR 551. Overweight. $MUV2 (+0,62 %)

- BARCLAYS raises the target price for HANNOVER RÜCK from EUR 206 to EUR 217. Underweight. $HNR1 (+0,35 %)

⬇️⬇️⬇️

- MORGAN STANLEY lowers the target price for BAYER from EUR 35 to EUR 30. Equal-Weight. $BAYN (-0,5 %)

- KEPLER CHEUVREUX lowers the target price for SIEMENS HEALTHINEERS from EUR 60.50 to EUR 59. Buy. $SHL (-0,18 %)

- KEPLER CHEUVREUX downgrades KNAUS TABBERT to Hold. Target price EUR 15. $KTA (-0,25 %)

- DEUTSCHE BANK RESEARCH lowers the price target for SGL CARBON from EUR 10.60 to EUR 9. Buy. $SGL (-1,63 %)

- DEUTSCHE BANK RESEARCH lowers the price target for PVA TEPLA from EUR 18 to EUR 14.50. Hold. $TPE (-0,39 %)

- DEUTSCHE BANK RESEARCH lowers the price target for KERING from EUR 340 to EUR 320. Buy. $KER (-1,46 %)

- ODDO BHF downgrades BECHTLE to Neutral. Target price 37 EUR. $BC8 (-0,44 %)

- BARCLAYS lowers the price target for UNITED INTERNET from EUR 27 to EUR 23. Equal-Weight. $UTDI (+0,11 %)

- BARCLAYS lowers the price target for 1&1 from EUR 19 to EUR 17. Equal-Weight. $1U1 (-0,58 %)

- BERENBERG lowers the target price for AIR LIQUIDE from EUR 195 to EUR 190. Buy. $AI (+0,32 %)

- HSBC downgrades PORSCHE SE from Hold to Reduce and lowers target price from EUR 36 to EUR 26. $PAH3 (+1,44 %)

Titres populaires

Meilleurs créateurs cette semaine