SELLING:

$500 (+0,34 %) S&P500 ETF - selling at +15,06%🟢

$UST (+0,17 %) NASDAQ100 ETF - selling at 18,63%🟢

$MFC (+0,2 %) Manulife Financial - selling at -7,12%🔴

$CS (+0,24 %) AXA - selling at +30,34%🟢

$ADC (-0,49 %) Agree Realty - selling at -8,68%🔴

Reasons:

• I’m out of the ETFs, I stopped adding to them months ago but now I’ve decided to kill my positions, as I think we’re in a phase where a very short list of names are moving them, and since that is the case I prefer to choose exactly what companies I want to be invested in.

•Exiting Manulife as it has lost momentum and has been trading sideways for a year, earnings estimates for the following years are ok but not amazing and I wanted to focus my investments on insurers with $ALV (+0 %) that has been performing better. Also exiting $CS (+0,24 %) even though I like its valuation. Again I want to focus in just 1 insurer and I prefer not to be particularly exposed to France.

•Sold $ADC (-0,49 %) as again I want to focus on 1 name on the REITT sector, and that is $O (-0,06 %) . The biggest, still growing, strong, and reliable. I do think REITTS will perform better in the coming months once interest cuts start materializing. Realty Income’s yields are higher than usual and I don’t see the stock going down, with potential for appreciation and nice monthly dividend.

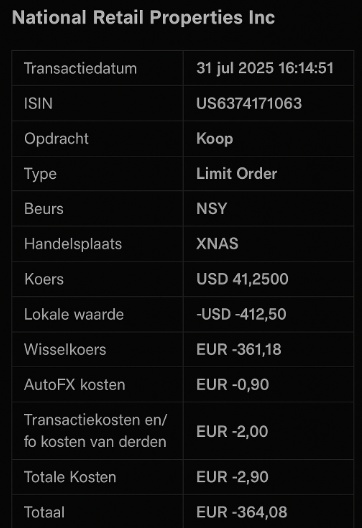

BUYING:

$DELL (+1,05 %) adding more to my position

$ALV (+0 %) Allianz adding more to my position

$GRF (-3,5 %) Grifols adding more to my position

$PUIG (+0,81 %) adding more to my position

$SSRM (-9,34 %) SSR Mining new addition to my portfolio

$GSL (+0 %) Global Ship Lease new addition to my portfolio.

$9999 (-0,38 %) NetEase (ADR) new addition to my portfolio.

Ressons:

•I’m growing the positions I’m confident in, and I belive that Puig, Grifols and Dell are undervalued, all of them are growing strong, with Puig having lost half of its market cap since IPO but growing net income, revenue, and maintaining good revenue forecasts (7-8% annual). Grifols has been performing well, but it is far away from its all time highs and I think that their dominant position, their US exposure (with plasma centers built in the country) and their growing market, are all combined with operational and financial improvements, factors that should help the stock run higher sooner than later… and Dell… probably the only AI player with a P/E close to 20.

•My new additions follow my usual logic for picking… good momentum, good growth prospects, and correct valuation.

Global Ship Lease has a ridiculously low P/E, high dividend with low payout, nice balance sheet that has improved a lot in recent years (deleveraging) and well the macro is not amazing for them (trade wars, end of Gaza war…) but they have a very nice backlog for the next 2 years.

SSR Mining is a gold miner with no debt, long term cost effective gold mines, nice production growth prospects and an amazing momentum linked to golds nice performance. Even if gold price went down a but, I see it as a good investment. I took the oportunity to buy today as it was falling 10% after news of a possible meeting Trump-Putin that affected gold price.

Finally NetEase, mobile gaming Chinese company with low valuation, nice growth projected, zero debt, cash, and a growing market and macro improvement in Chinese regulation. I wanted some exposure to China and I got it with NetEase.