$WH (-0,77 %)

$AXP (+1,18 %)

$AFRM (+0,7 %)

$BFH (-1,22 %)

$DAL (+4,37 %)

BTIG reiterated $SOFI (+3,72 %) Neutral, says "we think $SOFI (+3,72 %) shares being up 5% on this news is fair"

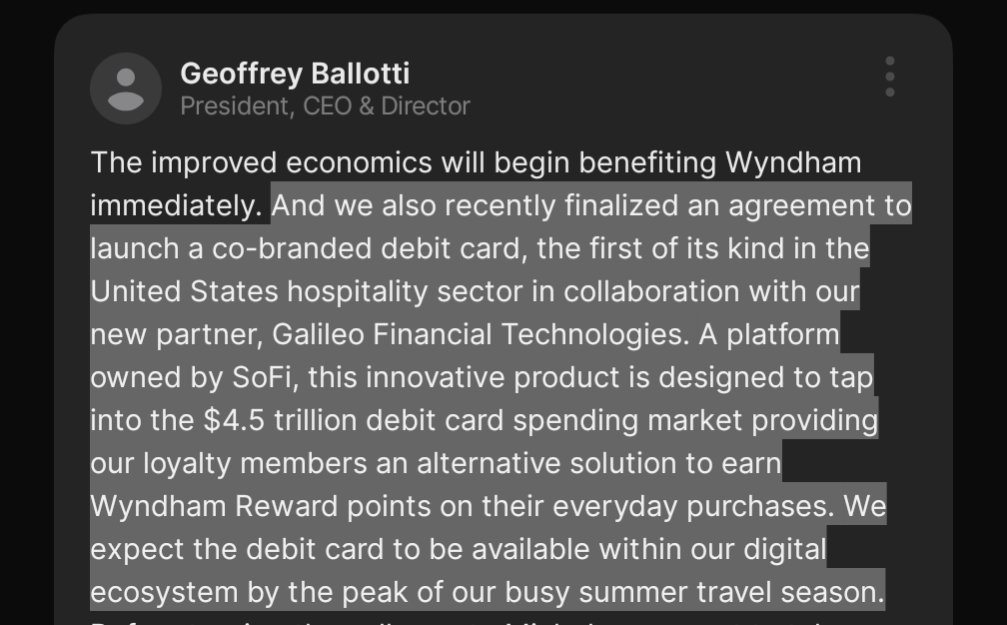

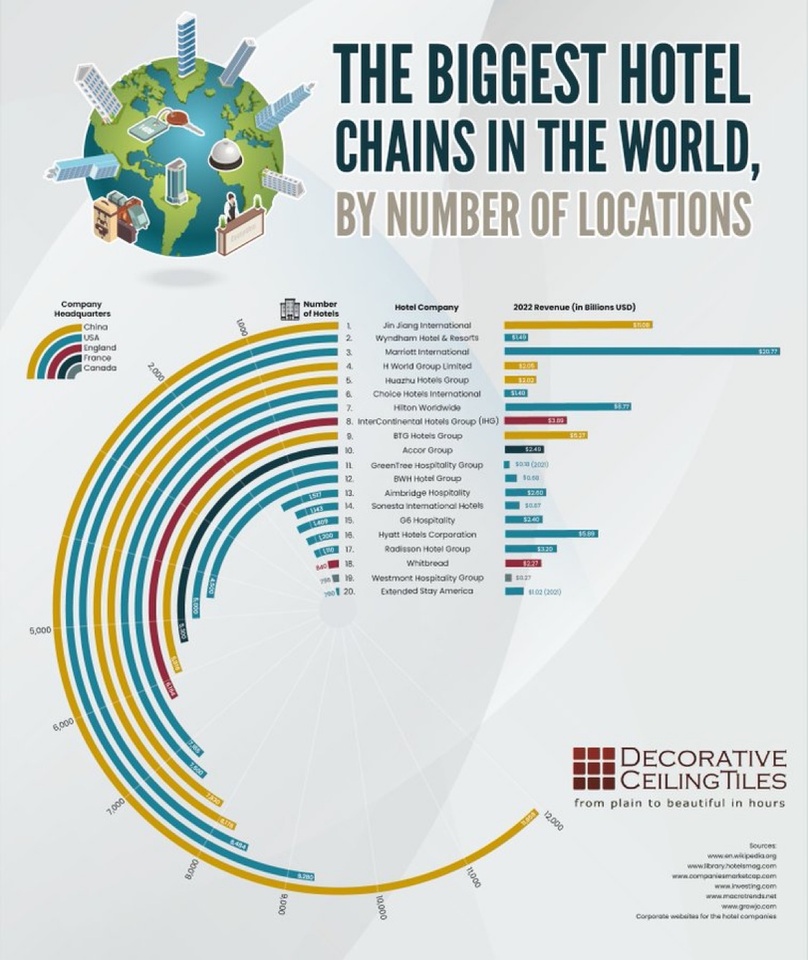

$SOFI (+3,72 %) entrance into the co-brand space is a very interesting development, and winning one of the largest global hotel brand chains hints at what could potentially be a very large market for SoFi's growth.

The debit-card angle is also unique, in our view, with most of the other competitors only offering rewards and loyalty funded via credit card interchange fees.

For the rest of our coverage group, we think $SOFI (+3,72 %) entrance into the space is a negative on $AXP (+1,18 %) (AXP, Sell, $272), $AFRM (+0,7 %) (AFRM, Buy, $81), $BFH (-1,22 %) (BFH, Neutral) and Synchrony (SYF, Neutral).

While we don't think $SOFI (+3,72 %) ’s entrance will have a material near-term impact on these competitors, it does add a potentially sizable player into a market that is already biased toward merchant pricing power.

For instance, we've noted several times in the past that American Express appears to be paying Delta Airlines (DAL, Not Rated) at a faster growth rate compared to the growth of the premium traveler

spend on their co-brand card.

We expect the Wyndham win will be a topic of conversation when we host CEO Anthony Noto for

investor meetings in Boston on February 18."

Who is BTIG and why is SoFi meeting with them on Wednesday?

BTIG is a global financial services firm specializing in investment banking, institutional trading, research, and related brokerage services. According to recent information, SoFi Technologies, Inc. is scheduled to meet with BTIG on February 18, 2025. This meeting could be significant for several reasons:

1. **Investment and Analysis**: BTIG is known for its research and analysis capabilities. They have previously initiated coverage on SoFi with a Buy rating, which suggests they see potential in SoFi's growth or strategic direction. This meeting could involve discussions about SoFi's performance, future plans, or specific investment opportunities.

2. **Strategic Guidance**: Investment banks like BTIG often provide strategic advice to companies like SoFi. They might be discussing potential mergers, acquisitions, or strategic partnerships that could enhance SoFi's market position or expand its service offerings.

3. **Capital Markets Activities**: SoFi could be exploring capital raising activities, like issuing new equity or debt, where BTIG could assist in underwriting or advising on the structure and timing of such transactions, especially considering SoFi's growth trajectory and its need for capital to fund expansion.

4. **Market Sentiment and Positioning**: The meeting might also aim at understanding current market sentiment towards SoFi, especially given BTIG's previous positive outlook on the company. This could help SoFi in fine-tuning its investor relations strategy or preparing for upcoming financial disclosures or events.

5. **Networking and Relationships**: Given that BTIG is partially owned by Goldman Sachs, and considering past connections like SoFi's CEO Anthony Noto's history with Goldman, the meeting could also reinforce business relationships or explore new avenues for collaboration or investment.

In summary, SoFi's meeting with BTIG likely focuses on strategic discussions, investment opportunities, market positioning, and strengthening business relationships, all of which are crucial for a company looking to navigate the financial markets effectively.