My dears,

I hope some of you have also bought it after my presentation.

Postes

4My dears,

I hope some of you have also bought it after my presentation.

Hello my dears,

due to the fact that dear @Dividendenopi wants to launch a Tenbagger 2026 ETF. I'm under a bit of pressure to find a growth stock in which the dear one can invest with a clear conscience.

Once again I have found one in Sweden, and what can I tell you, I really like the business model and the fundamental figures.

My dears, what do you think of the share? And do you think it has the potential to be included in Opi's ETF?

Tobii Dynavox history

It started with two pioneers in assistive technology: Tobii Technology, based in Sweden, and DynaVox, based in the USA. In 2014, the companies joined forces to give a voice to people with disabilities worldwide.

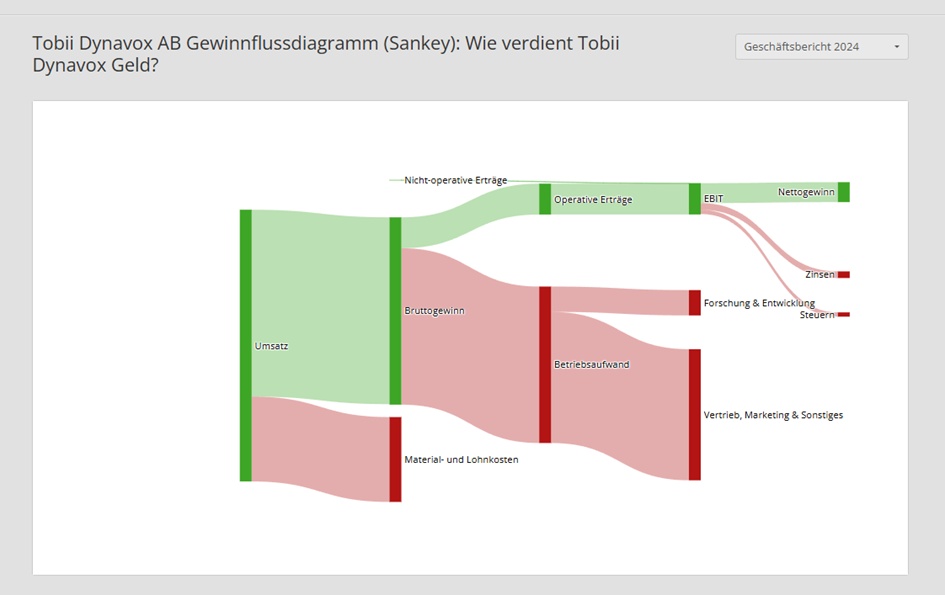

Tobii Dynavox AB

Tobii Dynavox AB is a Sweden-based company engaged in the development and distribution of assistive technologies for communication. The company's products enable its users to improve their quality of life and live more independently. The technology offers a range of solutions, including specially designed communication devices controlled by eye movements or touchscreens, as well as a variety of software applications for communication and special education. Tobii Dynavox offers solutions that, in addition to software and communication devices, include supporting prescribers with user testing, assisting users with reimbursement and providing assistance to enable users to utilize the solutions. The company operates worldwide.

Number of employees: 1,005

Global presence Sales breakdown by region¹ - North America 77 % - Europe 18 % - Other countries 5 %

Why invest in the Dynavox Group?

Ein einzigartiger Investitionsfall – Dynavox Group

RehaMedia joins Dynavox Group to increase customer value

01,09,2025

Tobii Dynavox, the world's leading provider of assistive communication solutions owned by Dynavox Group, and RehaMedia have been working closely together for many years. Both organizations have local teams that work closely together to serve the German market. As we share the same passion for providing high quality solutions for people who need the UK, there is a strong sense of common purpose between our two organizations.

RehaMedia schließt sich Dynavox Group an, um den Kundennutzen zu steigern

Tobii Dynavox share: Growth rockets ignited!

Explosive growth in the third quarter

The third quarter of 2025 brought Tobii Dynavox a spectacular 35% jump in sales to 606 million Swedish kronor. Even more impressive: 33 percent of this was organic growth. The gross margin climbed to 70 percent - a clear sign of efficient operations and healthy pricing in the communication solutions niche.

The operating result (EBIT) reached 64 million crowns with a margin of 10.6 percent. Earnings per share (EPS) amounted to 0.36 crowns. These figures prove it: The company is actually turning sales growth into profit.

Convincing cash flow and strategy

Tobii Dynavox Aktie: Wachstumsraketen gezündet! () | aktiencheck.de

Dynavox Group AB: Dynavox Group erwirbt SR Labs Healthcare in Italien

23,12,2025

Dynavox Group AB (publ), the parent company of Tobii Dynavox and global leader in assistive communication, has entered into an agreement to acquire all shares of its Italian reseller SR Labs Healthcare. This strategic move will strengthen Tobii Dynavox's presence in Southern Europe and strengthen its ability to support people with communication disabilities. The transaction is expected to close in the first half of 2026.

June 02, 2025

Die Dynavox Group hat die Übernahme von Cenomy abgeschlossen

May 22, 2025

DG_Earnings_Call_Presentation_Q3_2025_EN.pdf

SEK in millions

Estimates

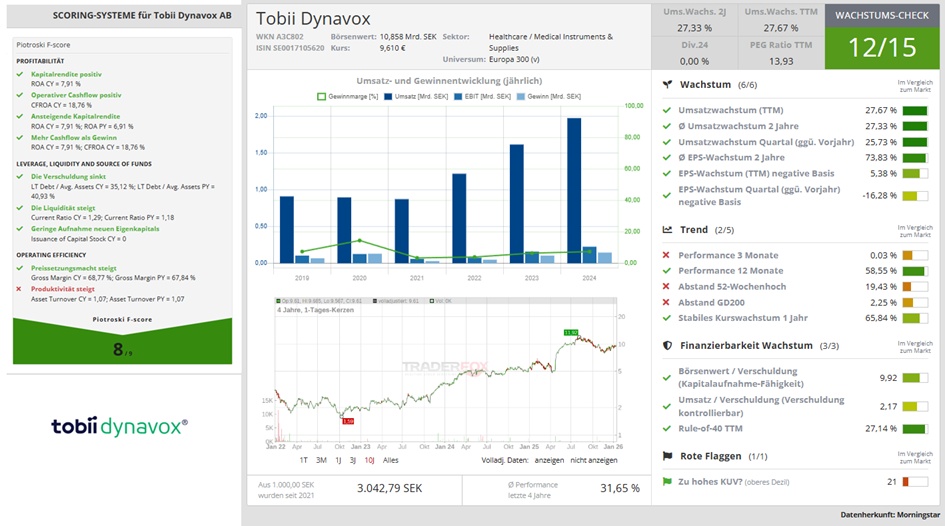

Year Sales Change

2024 1.972 22,26 %

2025 2.480 25,78 %

2026 2.874 15,86 %

2027 3.334 16,01 %

Year EBIT Change

2024 229 47,74 %

2025 281,2 22,79 %

2026 457,1 62,55 %

2027 595,7 30,32 %

Year Net result Change

2024 146 40,38 %

2025 151,1 3,52 %

2026 331,9 119,63 %

2027 443,3 33,55 %

Year Net debt CAPEX

2024 657 62

2025 728 154,5

2026 419 163,5

2027 79,4 183,5

Net debt decreases despite rising capex 👍

And free cash flow is also increasing 👍

Year Free cash flow change

2024 99 -30,28 %

2025 38,4 -61,21 %

2026 367 855,73 %

2027 510 38,96 %

Year EBIT margin ROE

2024 11,61 % 38,83 %

2025 11,34 % 34,6 %

2026 15,91 % 38,8 %

2027 17,87 % 38 %

I like the increase in the EBIT margin 👍

Year Dividend p share Yield

2024 0 0

2025 0,26 0,25 %

2026 0,665 0,65 %

2027 1,745 1,69 %

Year Earnings per share Change

2024 1,37 38,38 %

2025 1,437 4,87 %

2026 3,12 117,17 %

2027 4,197 34,51 %

Number of shares (in thousands) 106,880

Date of publication 05.02.25

Market value 11,019

Year P/E ratio PEG

2024 45.7x 1.2x

2025 71.8x 14.75x

2026 33x 0x

2027 24.6x 0.7x

Our goal As a global leader in the field of assistive communication, we will drive the market forward while addressing a previously underserved global target group.

- 50 million people who are currently unable to communicate effectively without communication aids

- 2 million people diagnosed with a need for communication aids each year

- 2 % Percentage of people diagnosed each year who receive communication aids

Meeting a need in a growing market

The AAC market remains critically underserved and offers significant growth potential. Around 50 million people worldwide are unable to communicate without augmentative communication solutions. Every year, around 2 million people are diagnosed with a need for communication aids. Yet only around 2% of these are actually supported, due to low awareness, poor implementation support and a lack of funding infrastructure. We work tirelessly to raise awareness by educating and training thousands of prescribers and healthcare professionals every year to support more people with disabilities

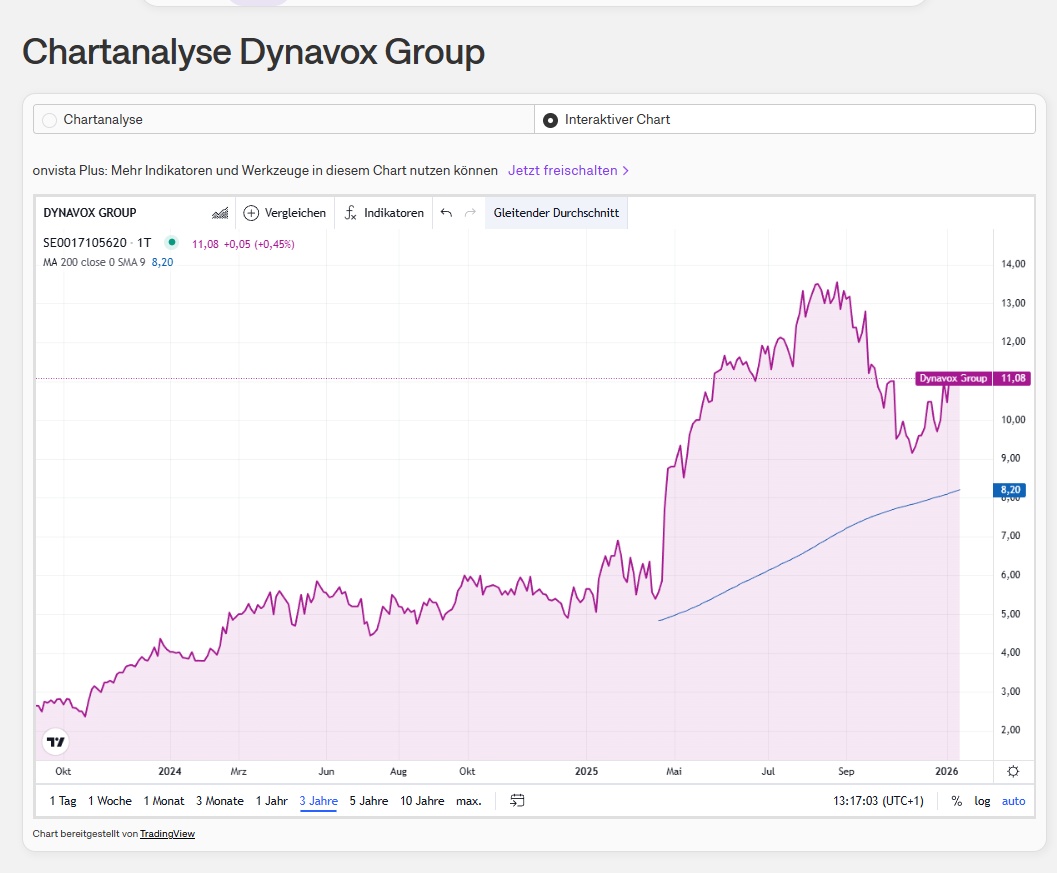

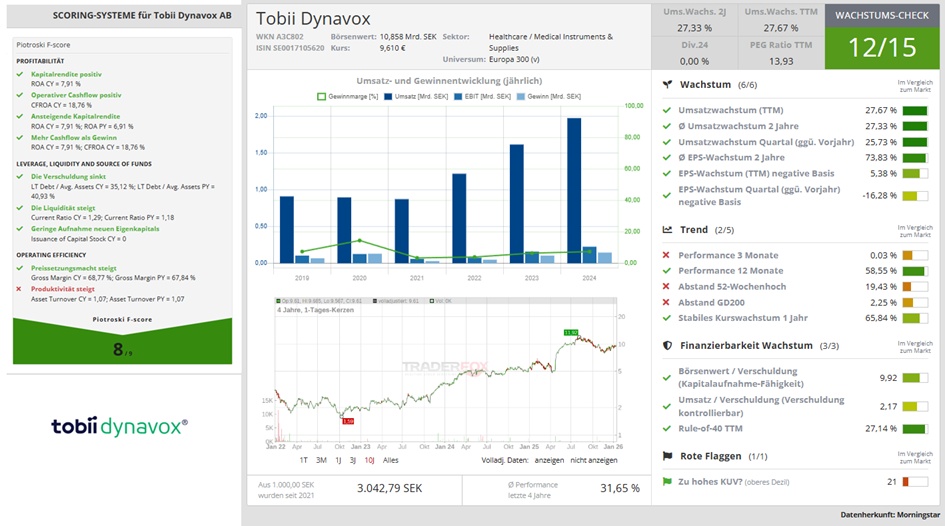

Performance

5 years. +204,48 %

1 year. +25,16 %

Current year. +1,56 %

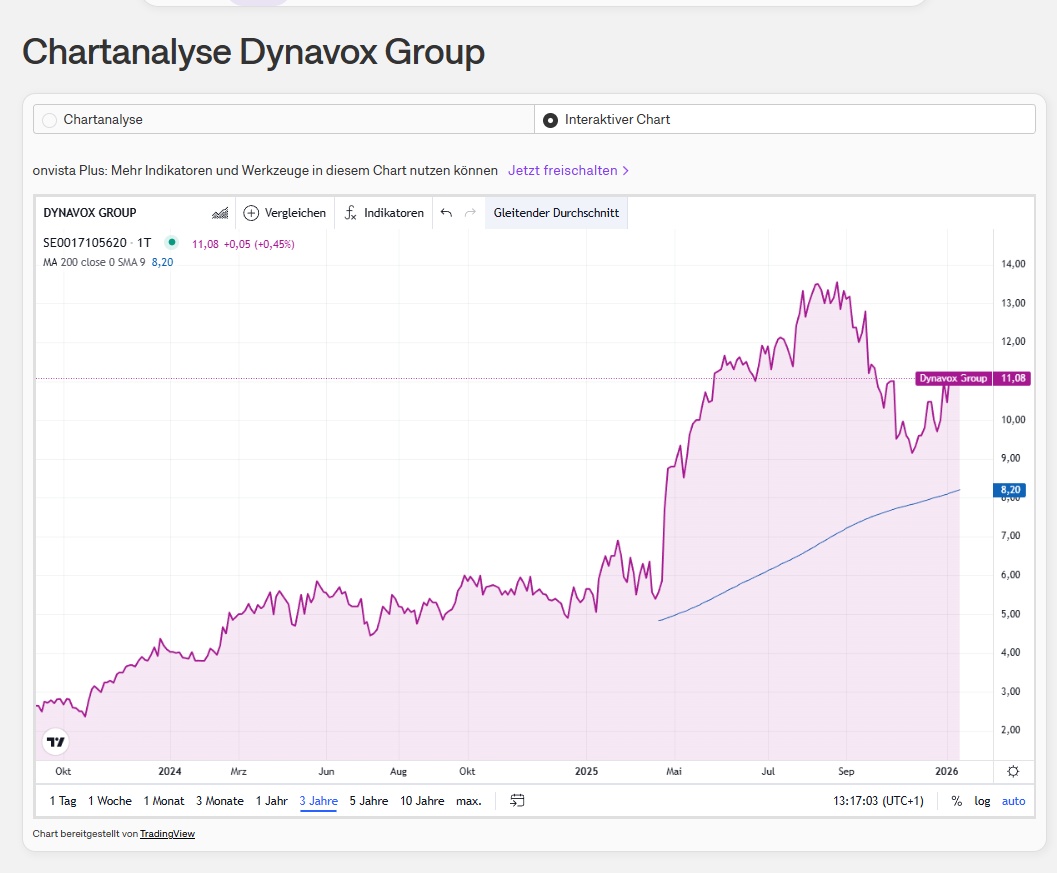

📊 Chart analysis: Dynavox Group (DYVOX / H3Q)

Data source: Onvista chart page

🧭 1. current price & setup

The share price is currently above the middle of the 52 W rangebut below the high for the year. This suggests a share that has already had a strong run, but has recently been consolidating.

📈 2. trend analysis

🔹 Long-term trend (12-24 months)

🔹 Medium-term trend (3-6 months)

🔹 Short-term trend (1-4 weeks)

🧱 3. supports & resistances

Level Meaning

USD 10.50 Strong support, defended several times

11.00 USD Current equilibrium price

12.50 USD Short-term resistance

13.55 USD Annual high & main resistance

🔮 5. scenarios

🟢 Bullish

🔴 Bearish

🧠 6. overall conclusion

Dynavox Group is currently in a quiet consolidation phase after a strong rise. The long-term trend remains bullishbut in the short term the share price is trapped in a narrow range.

For traders: → Breakout strategy makes sense (above USD 12.50 or below USD 10.50)

For investors: → Solid but illiquid share. Setbacks towards USD 10.50 would be attractive.

+ 2

Revenue & Profitability

🟢 Revenue: SEK 677M (Prior: 585M) +16% YoY

🟢 Currency-adjusted growth: +31% YoY

🔴 Gross Margin: 69% (Prior: 70%) -1.1 pts YoY

🟢 EBIT: SEK 103M (Prior: 83M)

🟢 EBIT Margin: 15.2% (Prior: 14.2%)

🟢 EPS (basic): SEK 0.72 (Prior: 0.51)

Operating Performance

🟢 Growth across all regions, led by North America and Europe

🟢 Strong demand in touch-based solutions for autism segment

🟢 Encouraging traction in eye-gaze solutions (complex needs)

🔴 Operating expenses: +17% organically (investment-heavy year)

🟢 R&D leverage improving, net R&D costs down YoY

Full Year 2025 Highlights

🟢 Revenue: SEK 2,467M (Prior: 1,972M) +25% YoY

🟢 Currency-adjusted growth: +34% YoY

🟢 EBIT: SEK 254M (Prior: 229M)

🔴 EBIT Margin: 10.3% (Prior: 11.6%)

🟢 EPS (basic): SEK 1.57 (Prior: 1.39) +13% YoY

Cash Flow & Balance Sheet

🟢 Operating Cash Flow (Q4): SEK +46M

🟢 Cash Position: SEK 195M (Prior: 133M)

🔴 Net Debt (incl. IFRS 16): SEK 909M

🔴 Net Debt / LTM EBITDA: 1.9x (Prior: 1.5x)

Strategic Actions

🟢 ERP implementation completed in North America

🟢 Relocation to new Pittsburgh facility completed

🟢 Acquisition signed: SR Labs Healthcare (Italy)

🟡 Acquisition closing pending (expected H1 2026)

🟢 Expanded direct European presence strengthens moat

Outlook & Capital Return

🟢 Revenue growth target: ~20% CAGR (currency-adjusted, incl. M&A)

🟢 Mid-term EBIT margin target: ≥15%

🟢 Dividend proposed: SEK 0.50 per share

🟢 Limited tariff exposure (medical device exemption)

Professional Assessment

Dynavox delivered a high-quality quarter, with exceptional organic growth (+31%), improving EBIT margins at the quarterly level and strong EPS expansion. The few red flags (margin compression FY, higher leverage) are intentional and temporary, driven by scaling investments rather than structural weakness.

The +12.6% share price reaction is justified: the market is re-rating certainty, not speculation. Dynavox is transitioning from a niche growth story into a scaled, mission-critical med-tech compounder with strong pricing power and recurring demand.

Key takeaway:

Fundamentals are clearly stronger than the headline margins suggest. Growth visibility is high, the market remains underpenetrated, and strategic investments are setting the base for margin expansion from 2026 onward.

Note: This datas are directly taken from the Q4 Earnings Call and all the valuations are made by my own criteria. Not an investment advice.

Hello my dears,

due to the fact that dear @Dividendenopi wants to launch a Tenbagger 2026 ETF. I'm under a bit of pressure to find a growth stock in which the dear one can invest with a clear conscience.

Once again I have found one in Sweden, and what can I tell you, I really like the business model and the fundamental figures.

My dears, what do you think of the share? And do you think it has the potential to be included in Opi's ETF?

Tobii Dynavox history

It started with two pioneers in assistive technology: Tobii Technology, based in Sweden, and DynaVox, based in the USA. In 2014, the companies joined forces to give a voice to people with disabilities worldwide.

Tobii Dynavox AB

Tobii Dynavox AB is a Sweden-based company engaged in the development and distribution of assistive technologies for communication. The company's products enable its users to improve their quality of life and live more independently. The technology offers a range of solutions, including specially designed communication devices controlled by eye movements or touchscreens, as well as a variety of software applications for communication and special education. Tobii Dynavox offers solutions that, in addition to software and communication devices, include supporting prescribers with user testing, assisting users with reimbursement and providing assistance to enable users to utilize the solutions. The company operates worldwide.

Number of employees: 1,005

Global presence Sales breakdown by region¹ - North America 77 % - Europe 18 % - Other countries 5 %

Why invest in the Dynavox Group?

Ein einzigartiger Investitionsfall – Dynavox Group

RehaMedia joins Dynavox Group to increase customer value

01,09,2025

Tobii Dynavox, the world's leading provider of assistive communication solutions owned by Dynavox Group, and RehaMedia have been working closely together for many years. Both organizations have local teams that work closely together to serve the German market. As we share the same passion for providing high quality solutions for people who need the UK, there is a strong sense of common purpose between our two organizations.

RehaMedia schließt sich Dynavox Group an, um den Kundennutzen zu steigern

Tobii Dynavox share: Growth rockets ignited!

Explosive growth in the third quarter

The third quarter of 2025 brought Tobii Dynavox a spectacular 35% jump in sales to 606 million Swedish kronor. Even more impressive: 33 percent of this was organic growth. The gross margin climbed to 70 percent - a clear sign of efficient operations and healthy pricing in the communication solutions niche.

The operating result (EBIT) reached 64 million crowns with a margin of 10.6 percent. Earnings per share (EPS) amounted to 0.36 crowns. These figures prove it: The company is actually turning sales growth into profit.

Convincing cash flow and strategy

Tobii Dynavox Aktie: Wachstumsraketen gezündet! () | aktiencheck.de

Dynavox Group AB: Dynavox Group erwirbt SR Labs Healthcare in Italien

23,12,2025

Dynavox Group AB (publ), the parent company of Tobii Dynavox and global leader in assistive communication, has entered into an agreement to acquire all shares of its Italian reseller SR Labs Healthcare. This strategic move will strengthen Tobii Dynavox's presence in Southern Europe and strengthen its ability to support people with communication disabilities. The transaction is expected to close in the first half of 2026.

June 02, 2025

Die Dynavox Group hat die Übernahme von Cenomy abgeschlossen

May 22, 2025

DG_Earnings_Call_Presentation_Q3_2025_EN.pdf

SEK in millions

Estimates

Year Sales Change

2024 1.972 22,26 %

2025 2.480 25,78 %

2026 2.874 15,86 %

2027 3.334 16,01 %

Year EBIT Change

2024 229 47,74 %

2025 281,2 22,79 %

2026 457,1 62,55 %

2027 595,7 30,32 %

Year Net result Change

2024 146 40,38 %

2025 151,1 3,52 %

2026 331,9 119,63 %

2027 443,3 33,55 %

Year Net debt CAPEX

2024 657 62

2025 728 154,5

2026 419 163,5

2027 79,4 183,5

Net debt decreases despite rising capex 👍

And free cash flow is also increasing 👍

Year Free cash flow change

2024 99 -30,28 %

2025 38,4 -61,21 %

2026 367 855,73 %

2027 510 38,96 %

Year EBIT margin ROE

2024 11,61 % 38,83 %

2025 11,34 % 34,6 %

2026 15,91 % 38,8 %

2027 17,87 % 38 %

I like the increase in the EBIT margin 👍

Year Dividend p share Yield

2024 0 0

2025 0,26 0,25 %

2026 0,665 0,65 %

2027 1,745 1,69 %

Year Earnings per share Change

2024 1,37 38,38 %

2025 1,437 4,87 %

2026 3,12 117,17 %

2027 4,197 34,51 %

Number of shares (in thousands) 106,880

Date of publication 05.02.25

Market value 11,019

Year P/E ratio PEG

2024 45.7x 1.2x

2025 71.8x 14.75x

2026 33x 0x

2027 24.6x 0.7x

Our goal As a global leader in the field of assistive communication, we will drive the market forward while addressing a previously underserved global target group.

- 50 million people who are currently unable to communicate effectively without communication aids

- 2 million people diagnosed with a need for communication aids each year

- 2 % Percentage of people diagnosed each year who receive communication aids

Meeting a need in a growing market

The AAC market remains critically underserved and offers significant growth potential. Around 50 million people worldwide are unable to communicate without augmentative communication solutions. Every year, around 2 million people are diagnosed with a need for communication aids. Yet only around 2% of these are actually supported, due to low awareness, poor implementation support and a lack of funding infrastructure. We work tirelessly to raise awareness by educating and training thousands of prescribers and healthcare professionals every year to support more people with disabilities

Performance

5 years. +204,48 %

1 year. +25,16 %

Current year. +1,56 %

📊 Chart analysis: Dynavox Group (DYVOX / H3Q)

Data source: Onvista chart page

🧭 1. current price & setup

The share price is currently above the middle of the 52 W rangebut below the high for the year. This suggests a share that has already had a strong run, but has recently been consolidating.

📈 2. trend analysis

🔹 Long-term trend (12-24 months)

🔹 Medium-term trend (3-6 months)

🔹 Short-term trend (1-4 weeks)

🧱 3. supports & resistances

Level Meaning

USD 10.50 Strong support, defended several times

11.00 USD Current equilibrium price

12.50 USD Short-term resistance

13.55 USD Annual high & main resistance

🔮 5. scenarios

🟢 Bullish

🔴 Bearish

🧠 6. overall conclusion

Dynavox Group is currently in a quiet consolidation phase after a strong rise. The long-term trend remains bullishbut in the short term the share price is trapped in a narrow range.

For traders: → Breakout strategy makes sense (above USD 12.50 or below USD 10.50)

For investors: → Solid but illiquid share. Setbacks towards USD 10.50 would be attractive.

+ 2

You see portfolios with NVIDIA, AMD, Palantir, Coca Cola, Allianz etc. often enough here. Is there anyone who is particularly active in the small-cap sector and interested in networking? Perhaps someone has a few nice, undiscovered treasures in their portfolio?

Sweden in particular seems to have a lot of interesting companies (apart from some strange stocks, of course).

$TDVOX (+1,67 %) For example: (largest position by now) serves a special niche of assistance communication for people with limited mobility (ALS e.g.) or autism. Tablets with eye control like Stephen Hawking's are certainly still on most people's minds. The market for this is largely untapped because many people, but above all prescribers and doctors, know nothing about it. According to the company, it currently only covers around 2% of the market. The target figures are growth of 20% p.a. (which has always been exceeded in recent years) and a 15% net margin (they are crawling closer every year). There is practically no competition; the company is the clear market leader.

Especially in the DACH region, I often only read about the same DAX stocks or hype names or speculative bullshit coins. Is there a community here with exciting exotics? I would love to read your ideas! :)

Meilleurs créateurs cette semaine