Wereldhave

Price

Discussion sur WHA

Postes

19Today I bought NNN Reit

Today I bought $NNN (+0,16 %) reit, 8 shares at an average price of €35,955 each (including transaction costs).

I currently own 48 shares, which currently yields +- €98,99 per year in dividends.

#dividend

#dividends

#dividende

#invest

#investing

#etf

#etfs

$NNN (+0,16 %)

$O (-0,14 %)

$ADC (+0,18 %)

$MAA (+0,13 %)

$WHA (+0,88 %)

$ECMPA (+1,65 %)

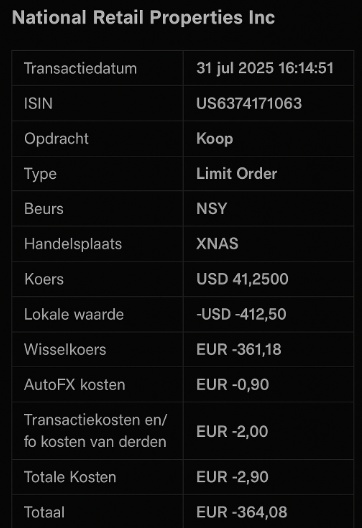

Today I bought NNN reit

Today I bought $NNN reit, 10 shares at an average price of €36,408 each (including transaction costs).

I currently own 40 shares, which currently yields +- €82,492 per year in dividends.

#dividend

#dividends

#dividende

#invest

#investing

#etf

#etfs

#nationalretailproperties

$NNN (+0,16 %)

$O (-0,14 %)

$ADC (+0,18 %)

$MAA (+0,13 %)

$WHA (+0,88 %)

$ECMPA (+1,65 %)

First goal almost reached

Sold $WHA (+0,88 %) and swapped it for $JEGP (+0,14 %) . First goal almost reached: €100 avg div per month

New position opened

$WHA (+0,88 %) is my latest position, I was hesitating about this purchase for a while, especially with the higher share price. It is a wonderful company with great future plans, also they pay a great dividend.

Wereldhave update

$WHA (+0,88 %) has done very nice, it is one that has done like clockwork:

Fundamental has $WHA (+0,88 %) this year changed in a good way in my opinion. If you want to know, I recomand the part over Wereldhave of "De Aandeelhouder" podcast on YouTube https://youtu.be/L11_N9eQ9FE?si=vSIc9e6F_iKeciKr&t=962

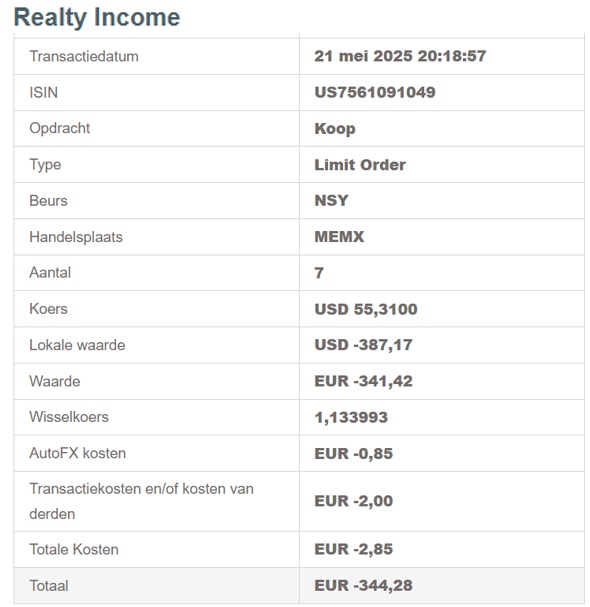

Bought 7 shares of Realty Income today

Bought 7 shares of Realty Income $O (-0,14 %) today at an average price of €49,182 including transaction costs.

I currently own 73 shares.

This gives me an annual dividend of approximately €214 per year.

$O (-0,14 %)

$ADC (+0,18 %)

$NNN (+0,16 %)

$MAA (+0,13 %)

$WHA (+0,88 %)

$ECMPA (+1,65 %)

#dividend

#dividende

#dividends

#invest

#investing

#realestate

Titres populaires

Meilleurs créateurs cette semaine