🇯🇵🇯🇵 𝑨𝒌𝒕𝒊𝒆𝒏𝒗𝒐𝒓𝒔𝒕𝒆𝒍𝒍𝒖𝒏𝒈 🇯🇵🇯🇵

Unicharm

JP3951600000

𝖪𝗈𝗇𝗌𝗎𝗆𝗀ü𝗍𝖾𝗋𝗍𝗂𝗍𝖾𝗅 𝖺𝗎𝗌 𝖩𝖺𝗉𝖺𝗇 - 𝖭𝖺𝖼𝗁𝗁𝖺𝗅𝗍𝗂𝗀𝗄𝖾𝗂𝗍 𝗇𝖺𝖼𝗁 𝖽𝖾𝗆 𝖪𝗒𝗈-𝖲𝖾𝗂 🌳

Unicharm engages in the manufacture and sale of baby, feminine, pet, and health care products, and provides industrial and food packaging. The personal care segment includes baby care, feminine care, health care, and clean-and-fresh products. It includes the moony, Natural moony, MamyPoko, Center-in, Kiyora, Sofy, Lifree, Charm Nap and Silcot brands. The Pet Care segment is engaged in the manufacture of pet food and pet toiletries. This includes the Aiken Genki, Neko Genki, Gin no Spoon, Deo-Sheet, Deo-Manner-Wear, Deo-Sand, and Deo-Toilet brands. The Other segment manages commercial products that use nonwovens. [1]

Sales per segment [1]:

Personal Care (body care): 85.86%.

Pet Care (pet care): 13,35%

Other (miscellaneous): 0.79%

Sales per region [2]:

Japan: 37.67%

China: 14.26%

Asia: 32.2%

Others: 15.87%

However, the focus on emerging markets seems to be very important for Unicharm to generate growth in the long term. Specifically, Asia, the Middle East, North Africa and South America are designated focus markets.

"...In those regions, we are setting up our own manufacturing and sales operations and transferring management authority to local subsidiaries, giving us the ability to respond rapidly to changes in local consumer needs. By contrast, in the large but maturing markets of North America and Europe, we are generating stable earnings by minimizing our investment outlay through technology licensing agreements with local partners. In addition, we are rapidly expanding our sales areas overseas by building strong networks with leading wholesalers in local markets and promoting early uptake of our products."

𝑲𝒚𝒐-𝑺𝒆𝒊 𝑨𝒑𝒑𝒓𝒐𝒂𝒄𝒉:

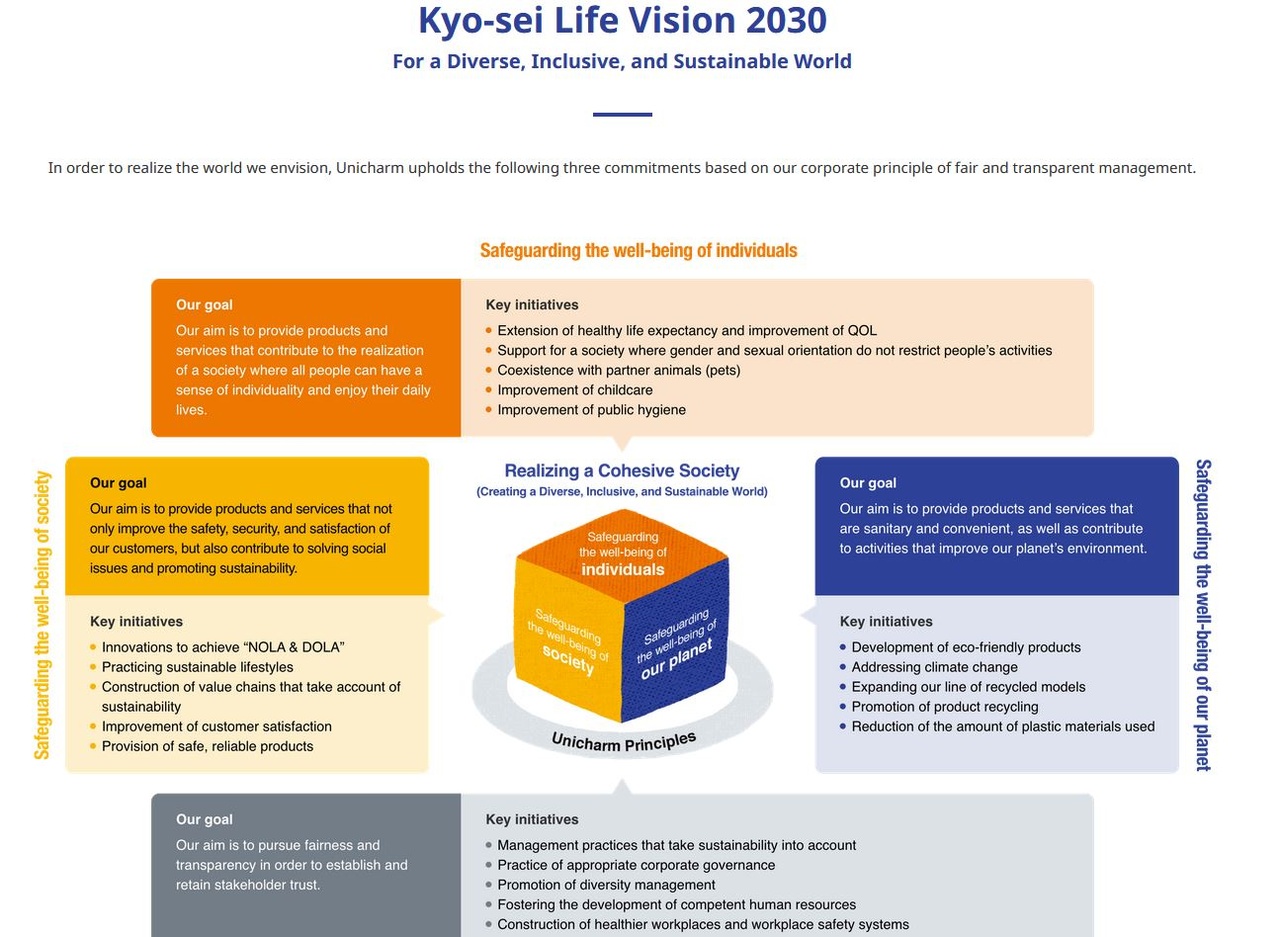

In all of its expansion efforts, Unicharm is pursuing a very particular strategy, that of kyo-sei. Translated into German, Kyosei means "living and working for the common good." The three pillars of Kyo-Sei are to reduce the impact on the climate, create offerings for sustainability, and social participation [4].

Thus, Unicharm has launched a Kyo-Sei Life Vision 2030 [5]:

"At Unicharm, we are committed to helping solve environmental and social issues as we work together to realize a cohesive society. With that in mind, we have put forward Unicharm Group's mid-to-long term environmental, social, and corporate governance (ESG) goals in a document called "Kyo-sei Life Vision 2030 - For a Diverse, Inclusive, and Sustainable World."

We will probably only be able to make a final assessment of Unicharm's Kyo Sei Vision in a few years' time, as it was only launched a year ago. Basically, the approach (see also pictures below the post) seems reasonable to me at first glance. Because Unicharm is sustainable not only since yesterday, what the following news confirm:

"Unicharm selected in stock composites of "SOMPO Sustainability Index", 11 years in a row".

https://www.unicharm.co.jp/en/csr-eco/education.html

In the pictures, I have attached you an overview of the strategy of Kyo Sei of Unicharm.

Strategy according to company homepage [3]

"Unicharm will strive for appropriate collaboration with its stakeholders and aim to be a fair and highly transparent company that is well-regarded and trusted by society. We believe that doing so in an effort to achieve sustainable growth and creation of corporate value over the medium- to long-term will lead to "sound corporate management" through the "pursuit of proper management which collectively accomplishes corporate growth and development, associates' well-being and fulfillment of social responsibilities" as stated in our corporate ideals. In addition, we aim to create an environment in which happiness for each employee can be made a reality through the promotion of diversity management and human resource development."

𝗞𝗲𝗻𝗻𝘇𝗮𝗵𝗹𝗲𝗻 𝗨𝗻𝗶𝗰𝗵𝗮𝗿𝗺[𝟳]*:

-KGV 2021: 41

-KGV 2022e: 36.5

-KGV 2023e: 32.7

-KGV 2024e: 29.9

-PEG 2022e (P/E/growth rate): = 4.86 (rule of thumb: < 1 = very favorable)

-PEG 2023e: = 4.36

-Sales growth: 2022: 8.9%; 2023: 5.8%; 2024: 6.1%

-EBIT growth: 2022: 1.7%; 2023: 10,5%; 2024: 8,4%

-Dividend yield 2021: 0.72%

*As of 07/20/22

𝗞𝗲𝗻𝗻𝘇𝗮𝗵𝗹𝗲𝗻 𝗝𝗮𝗽𝗮𝗻 [𝟴]:

-GDP Japan (excluding banking sector/financials): 14.05

-Growth Japan (excl. banking sector/financials): 7%**

**This is not about Japan's economic/GDP growth but about the growth of Japanese companies, which also generate large growth abroad.

-KGV Healthcare products: 34.80

-PEG Healthcare products: 1.18 (growth next 5 years 29.57%)

-P/E ratio household products: 31.49

-PEG Household Products: 2.13 (Growth next 5 years 14.78%)

-Inflation: 2.4% [9]

-Lead interest rate: 0 to -0.1% (since 01/02/2016) [10]

-Government debt: 263% of GDP [11]

-->Growth rate Unicharm:

Based on the Japanese economy and Unicharm's sales, or EBIT forecasts, I assume average growth of 7.5% p.a.

In the feminine hygiene sector, where Unicharm has a strong presence, scientific surveys also assume sales growth of 6.4%, in the Asia Pacific region. [12]

𝗥𝘂𝗯𝗿𝗶𝗸 - 𝗪𝗮𝘀 𝘄ü𝗿𝗱𝗲 𝗕𝘂𝗳𝗳𝗲𝘁 𝘀𝗮𝗴𝗲𝗻 (data from Annual Report 2021 [1]):

Criteria to be read in detail:

https://app.getquin.com/activity/XcuRrJwmyP

Income Statement:

-Net Margin: 2021: 10.68%, 2020: 8.6% -->negative! (Buffet's target: >20%) -Unilever: 12.6%, Johnson & Johnson: 22.26%)

--Gross margin: 2021: 40%, 2020: 40% --> positive! (Buffet's target: min. 40%) - Unilever approx. 42%, Johnson & Johnson approx. 68%)

-Sales/Administration. and other overhead: 24.42% of sales -->positive! (Buffet's target: 30-40% max.)

-Interest expense: 1.2% of operating profit -->positive! (Buffet's target: <15%) -->Debt seems to be very low (see also Balance Sheet)!

Balance Sheet:

-Treasury Shares: Yes! Share buybacks available -->positive!

Debt: < 4xEBIT: Ja! -->very positive!

-Short-term debt to short-term assets ratio: 0.5 -->very positive! Ideally <1 -->The cash position alone covers 68%. One could therefore immediately pay 68% of the current liabilities (including the outstanding receivable <1)!

-EK Quote: 64,33% (2021), 62,97% (2020) -->positive

Key Note Balance: Very low debt with sufficient cash and therefore flexibility with good EK ratio!

Cash Flow Statement:

Overview 2021 in million yen, previous year (2020) in parentheses:

Operating cash flow 139.073 (170.252)

-Cash flow from investing activities -79,837 (-41,698)

=Free cash flow 59,236 (128,554)

-Cash flow from financing activities -45,180 (-35,239) --> Dividends paid, loan repayments, employee stock options

Investments: 95% of net income (Buffet's goal: <50%) -->negative! However, the low debt situation allows for high investments. So I don't see this position quite as negative.

𝗞𝗲𝘆 𝗡𝗼𝘁𝗲:

-->margin analysis!

At Unicharm, I would like to take a closer look at margin. Unlike my last ideas of Maxar (debt) or Alfen (turnover rate), the margin is the sticking point for me here. This is, compared to the competition, still in need of minimal improvement, to then still find the hair in the soup. So how has the margin developed and in which area do we have potential for development?

Margin on operating profit (EBIT) by region [14]:

-Japan: 19.7% -->Volatile, fluctuating in the range of 15.8% to 21.7% since 2016.

-Asia: 14% -->Trending steadily upward (from 11% in 2016 increasing year over year)

-Other: 10.3% -->Trending steadily upward (from 4.6% in 2016 increasing year over year)

The development in Asia, China and "Others" (mainly Middle East, North Africa and South America) is to be seen positively. Thus, Unicharm has increasing margins especially in the selected growth markets. This gives me confidence that Unicharm will show even better margins in the future. Exactly this potential is also reflected in the development of the gross and net margin:

Gross margin (sales less production costs):

-2021: 40,07%

-2020: 40,22%

-2019: 37,35%

Net margin:

-2021: 10,68%

-2020: 8,6%

-2019: 7,37%

The margins show an increasing trend and are mainly driven by the growth markets. For example, Unicharm states the following in its 2021 annual report, which again shows the sustainability mindset:

"In doing so, we will secure a high degree of competitiveness and profitability by

investing management resources in growth markets and businesses. By reinvesting the cash generated through these activities in new growth markets and businesses, we will create a virtuous cycle and enable sustainable growth and high profit."

𝗨𝗻𝘁𝗲𝗿𝗻𝗲𝗵𝗺𝗲𝗻𝘀𝗲𝗶𝗻𝗼𝗿𝗱𝗻𝘂𝗻𝗴 𝗻𝗮𝗰𝗵 𝗣𝗲𝘁𝗲𝗿 𝗟𝘆𝗻𝗰𝗵 [𝟭𝟮]:

-->moderate growth (>5%, max. 12%) -->classic consumer goods stock. Growth comparable to Unilever (7-12%), Johnson & Johnson, P&G, etc.

𝗣𝗲𝗲𝗿 𝗚𝗿𝗼𝘂𝗽/𝗞𝗼𝗻𝗸𝘂𝗿𝗿𝗲𝗻𝘇 [𝟲]:

-Unilever (GB) - mainly due to focus on emerging markets.

P/E RATIO: 19.57

-Johnson & Johnson (USA)

P/E RATIO: 21.91

-Essity AB (Sweden)

P/E RATIO: 21.97

-Kimberly-Clark

P/E RATIO: 24.70

-VVF:

Sales $901 million

-Natura Brazil:

Sales $1 bn.

-Bidco Africa:

Sales $848 mn

𝗪𝗲𝘁𝘁𝗯𝗲𝘄𝗲𝗿𝗯𝘀𝘃𝗼𝗿𝘁𝗲𝗶𝗹:

I don't see a direct competitive advantage. The competition is far too big for that. However, due to the financial situation and strategic orientation in the Asian region, I definitely see a pricing power and cultural advantages over the Western competition.

𝗥𝗶𝘀𝗶𝗸𝗲𝗻:

1) I see a similar risk in Unicharm as in Unilever. The focus on the growth markets of Asia, Middle East, North Africa and South America creates a currency risk that could weigh on margins. This is exactly the "problem" Unilever also has. I think the focus on these markets is good, but it goes hand in hand with the currency risk. Growth, in particular of the net margin, which I already explained in the key note, could falter as a result.

2) China represents around 14% of total sales. There is also a certain risk here in the field of political tension between China and Japan.

𝗙𝗮𝘇𝗶𝘁:

Unicharm is a very interesting stock from Japan. So thank you first of all to @Divmann for the suggestion. For those who want to invest in the Japanese market, Unicharm offers a solid alternative to the well-known players from the US and Europe (Unilever, Johnson & Johnson, Essity AB, Kimberly-Clark). Unicharm is deeply anchored in the Asian market. Nevertheless, they will have to compete against the aforementioned Western competitors, who will also share in the growth forecasts (see above) in the Asian region. Financially, the company is in a very good position and does not have to hide at all. However, the gross and net margins are in need of minimal improvement, but are within the range of the peer group. Whoever wants to invest in Unicharm can do so, in my opinion, with a first, small tranche. However, the price is still a bit too expensive for a larger position (as of 22.07.22).

Also exciting is the Kyo-Sei approach, which stands for sustainable management. This seems to me to be in line with the Japanese culture, as I have come to know it. Perhaps Unicharm thus also offers a sympathetic side effect and causes less stomach ache for some than with the well-known "villains" of the industry (Nestle..cough..).

What I also particularly like is the very clear and transparent annual report, with lots of graphics. Since I have already seen a lot of reports, also from the Asian region, this was still worth a mention to me :)

I hope you enjoyed it! In this sense, I would like to conclude with a Japanese proverb from the Sumarais:

"𝓓𝓮𝓷𝓴𝓮 𝓼𝓬𝓱𝓪𝓻𝓯 𝓷𝓪𝓬𝓱 𝓾𝓷𝓭 𝓮𝓷𝓽𝓼𝓬𝓱𝓮𝓲𝓭𝓮 𝓲𝓷𝓷𝓮𝓻𝓱𝓪𝓵𝓫 𝓿𝓸𝓷 𝓼𝓲𝓮𝓫𝓮𝓷 𝓐𝓽𝓮𝓶𝔃ü𝓰𝓮𝓷."

But I hope your purchase decision will take a little longer ;)

A sake on that for now, Kanpai 乾杯!

As always, no investment advice!

Sources:

[1]

https://aktienfinder.net/dividenden-profil/Unicharm-Dividende

[2]

https://diyinvestor.de/peter-lynch-6-kategorien-fuer-die-einordnung-von-unternehmen/

[3]

https://www.unicharm.co.jp/en/csr-eco/special04.html

[4]

https://www.crevelt.de/2021/09/02/kyosei-leben-und-arbeiten-fuer-das-allgemeinwohl/

[5]

[6]

https://www.zoominfo.com/c/unicharm-corporation/347154294

[7]

https://de.marketscreener.com/kurs/aktie/UNICHARM-CORPORATION-115884907/fundamentals/

[8]

https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datacurrent.html

[9]

https://www.global-rates.com/de/wirtschaftsstatistiken/inflation/inflation.aspx

[10]

https://www.finanzen.net/zinsen/leitzins/japan

[11]

[12]

https://diyinvestor.de/peter-lynch-6-kategorien-fuer-die-einordnung-von-unternehmen/

[13]

[14]

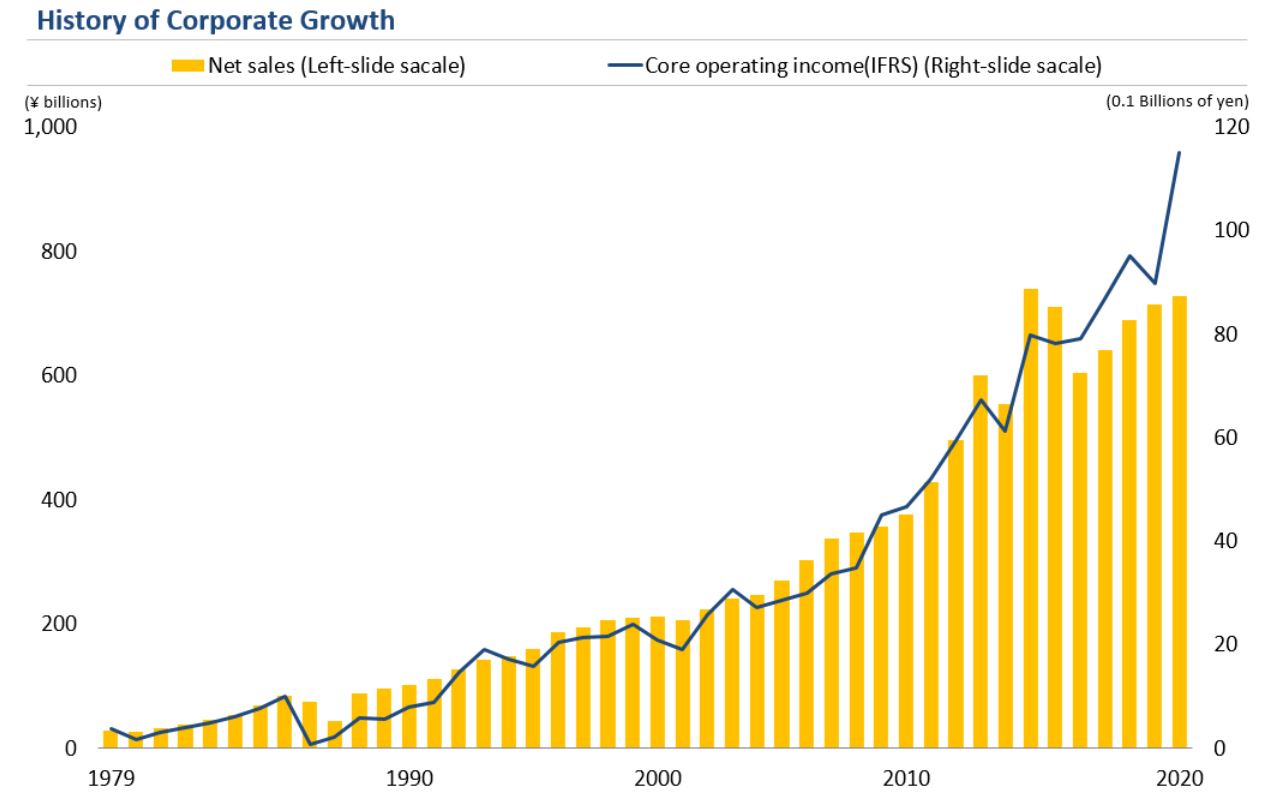

Graphic:

history of corporate growth:

https://www.unicharm.co.jp/en/ir/financial/growth.html

Company homepage:

https://www.unicharm.co.jp/en/home.html