The venture play of Sino AG. The investment in the self-proclaimed "European Charles Schwab" as well as Rest & ah and Getquin are also still there.

My small contribution to everything $XTP (+0,44 %)

Since the core business of Sino AG is of little relevance, we will only briefly discuss it.

History of Sino AG

Sino AG is a German company that specializes in securities trading. Here is an overview of the history of Sino AG:

Foundation and beginnings

- 1998: Sino AG was founded in Düsseldorf by Ingo Hillen and Matthias Hocke. The aim was to create a platform for professional traders and discerning private investors.

- 2000: Sino AG began its business operations and initially concentrated on serving institutional clients.

Development and expansion

- 2001: Launch of the online platform "sino MX-PRO", which was specially tailored to the needs of professional traders.

- 2004: Sino AG went public. The IPO took place on September 2, 2004 and the shares were traded in the "Entry Standard" segment of the Frankfurt Stock Exchange.

- 2005: Introduction of the order fee flat rate, which made trading more attractive for frequent traders.

Technological innovations

- 2006: Sino AG developed a real-time trading platform with advanced features such as real-time price data and automated trading.

- 2010: Introduction of mobile trading apps to enable trading on the go.

Strategic partnerships and investments

- 2011: Investment in Trade Republic Bank GmbH, an innovative fintech company that enables securities trading via a mobile app.

- 2017: Expansion of the stake in Trade Republic and support in expanding the business model.

Recent developments

- 2020: Trade Republic became one of the leading neobrokers in Germany and Europe, from which Sino AG also benefited.

- 2021: Sino AG recorded strong growth due to the increasing popularity of Trade Republic and the general boom in online securities trading.

Business model according to Sino AG:

"sino AG | High End Brokerage was founded in 1998 and is the broker for heavy traders in Germany. It specializes in the processing of securities transactions for the most active and demanding traders in Germany and has quickly become synonymous with high-end brokerage. With its consistent focus on the most demanding and active traders, sino pursues a clear strategy. The company offers these very active customers a special service package. This

This includes powerful and exceptionally stable front-ends, a fair and attractive fee model, competent and personal service as well as account and custody account management via $BWB (-1,09 %) Bank AG, Unterschleissheim. The original license from the Federal Financial Supervisory Authority (BaFin) to provide investment brokerage and contract brokerage services was granted to the company on September 6, 1999. "

Core business:

Not much to say here. Despite a rare profit in the last annual report, it remains to be seen whether this is sustainable. Either way, the business as a whole remains completely irrelevant.

Future prospects and plans for the core business:

"Sino AG is facing new challenges such as the development of the mobile brokerage business, deregulation, new market segments and financial market regulation. In order to master these challenges, the company has initiated several projects ranging from product development to organizational projects. Around a third of employees are continuously involved in these projects.

One particular future project is the expansion of the trading offering to include crypto assets, which can be traded via the sino MX-PRO platform from the third quarter of 2024"

Conclusion

sino AG plans to reduce its losses through more intensive customer acquisition and product improvements. The investments in various companies represent potential risks, but are assessed cautiously. The strategic projects and the planned expansion of the trading offering to include crypto assets demonstrate the company's future-oriented focus.

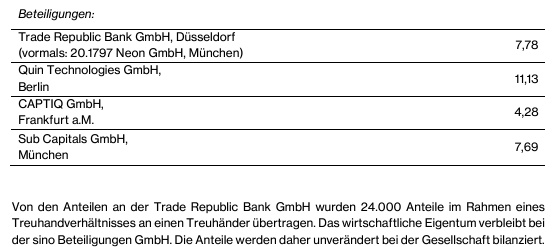

So why does such an uninteresting company have such a high valuation? Let's take a look at the holdings of "Sino Beteiligungen GmbH".

The golden piece: Trade Republic. Everyone knows it, many use it. Nevertheless, here is an explanation:

Company overview

Trade Republic is a Berlin-based fintech company that was founded in 2015 and specializes in commission-free mobile trading. The platform enables trading in shares, ETFs and cryptocurrencies without commissions, account fees or negative interest rates. In 2021, the company had a market valuation of 5.3 billion dollars and was able to raise a total of around 987.3 million dollars in funding.

Business model and services

Trade Republic's business model is based on cost efficiency and user-friendliness. It offers a mobile brokerage service that eliminates traditional commissions and thus appeals to a younger, technology-savvy target group. Users can trade with a minimum deposit of €0, making it particularly attractive to new investors. The platform also offers interest on cash deposits, a debit card and an upcoming current account, making it even more attractive for users who want to park their funds. Trade Republic was last reported to have around 5 million customers and, with over AUC 35 billion, is no longer a small player in the market.

Valuation and figures

Sino holds 2.3% of Trade Republic.

It is unfortunate that Trade Republic is not yet listed on the stock exchange and largely keeps its current business figures to itself. The valuation is therefore subject to uncertainty. However, based on current market conditions, it is very likely that Trade Republic will be a "decacorn". If Sino does not sell any shares beforehand, the 230 million euros could mean that each Sino share is worth around 100 euros. At this stage, that would be a discount of just under 50% on the Trade Republic share alone. It should be noted, however, that Trade Republic is not planning an IPO in the near future and therefore has to wait until the situation changes.

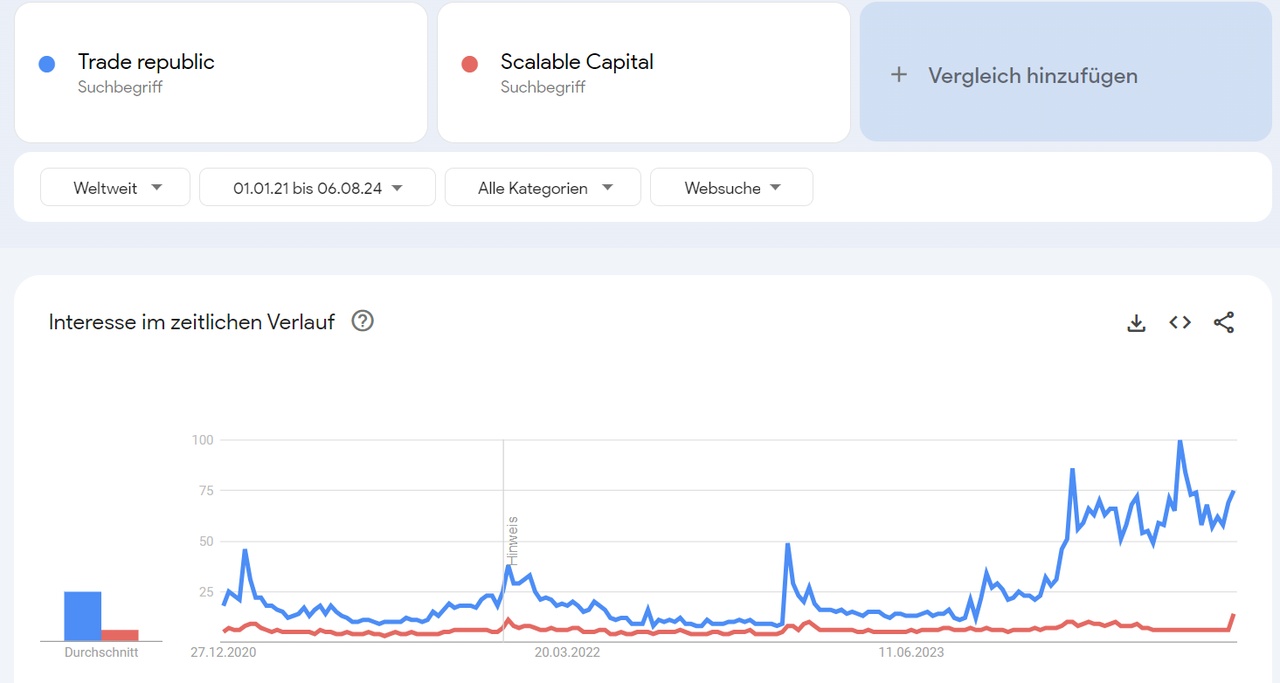

Trend

If you look at the Google trends, you know at least one thing: Trade Republic is, even if not always positive, significantly more relevant in search queries than its potential competitors.

Quin technology GmbH, known to us as Getquin.

A thing of heart.

Company overview

QUIN Technologies GmbH was founded in Berlin in 2020 and specializes in the development and distribution of software and applications for asset managers and end customers. The company is managed by the founders Christian Rokitta (CEO) @christian and Raphael Steil (COO) @TheRealRapha and Raphael Steil (COO). The head office is located at Besselstraße 14, Berlin.

Business model and services

QUIN Technologies operates mainly in the Software as a Service (SaaS) sector and is aimed at private customers. The company offers a digital platform that enables users to manage and optimize their investments independently. Revenue comes from advertising and subscriptions.

QUIN Technologies' main service is the "getquin app", which offers the following functions:

- Portfolio tracking: real-time monitoring of stocks, ETFs, dividends and alternative investments.

- Portfolio analysis: Visualization and analysis of asset development, identification of potentials and calculation of returns.

- Community features: opportunity to share ideas and experiences with other users.

The getquin app offers both a free and a premium version, with the premium version including additional functions such as individual start pages, long-term dividend forecasts and benchmarking features.

Rating and figures

As QUIN Technologies is not yet listed on the stock exchange and largely keeps its current business figures to itself, there is little information available about the company. To date, the Getquin app has over 300,000 users and monitors assets worth over USD 5 billion.

They have also raised a total of 16 million USD in funding to date. This is made up of:

-1 million euros in a seed round led by Sino AG with participation from Runa Capital and APX and

-USD 15 million in a Series A financing round led by Portage Ventures and supported by Horizons Ventures, embedded/capital, sino AG and business angels Maximilian Tayenthal (N26 founder) and Erik Podzuweit (Scalable Capital founder).

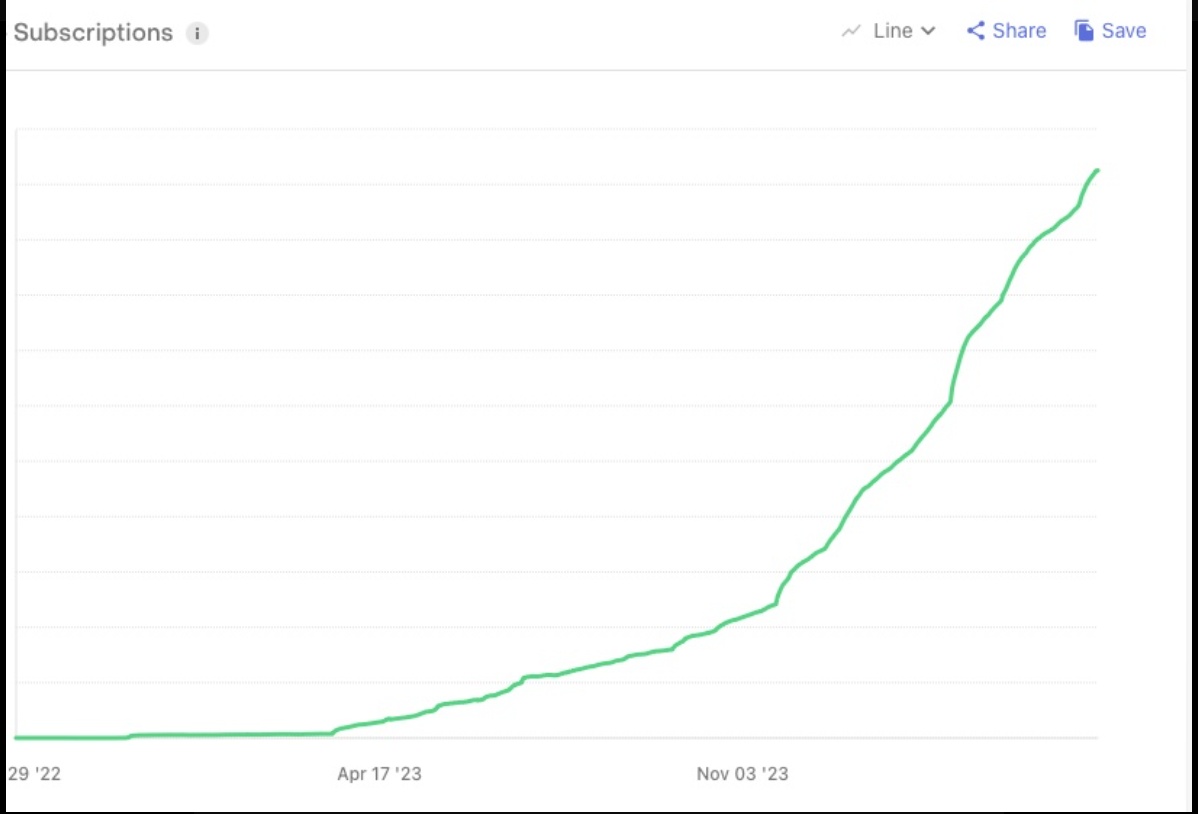

You can see the subscriber growth yourself, if without a unit, here in the picture and after your own

statement, getquin is still a cash burning scale-up.

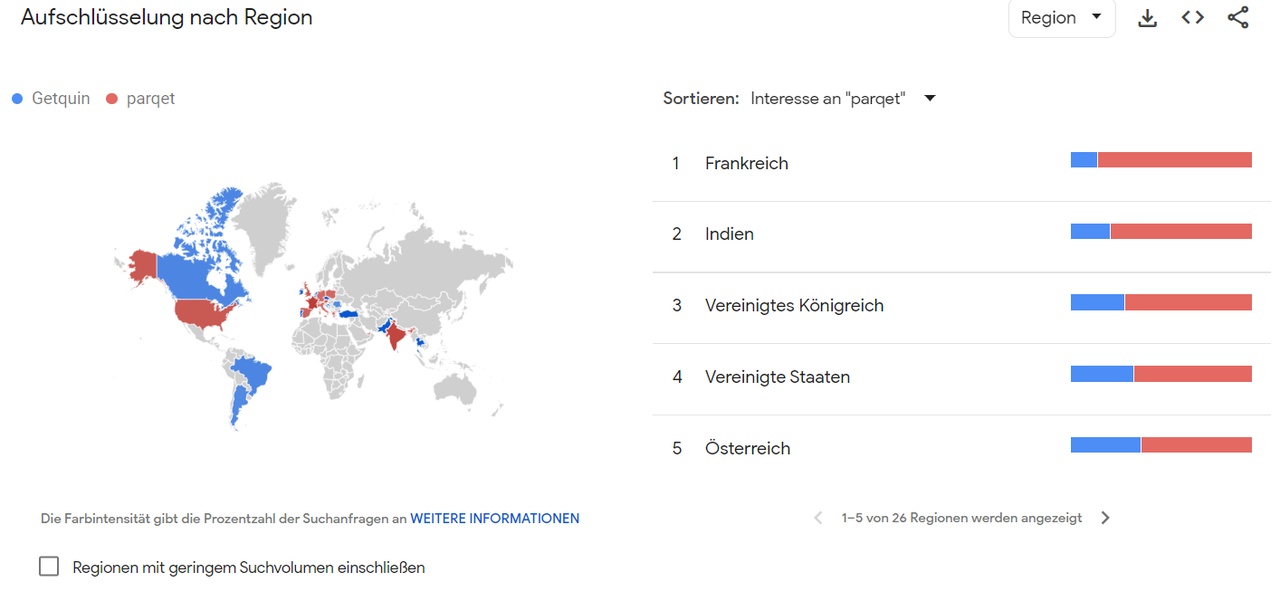

trend

Looking at Google Trends, Getquin does not seem to be the most searched portfolio tracker, although it has been doing better recently.

However, it is still behind the competition in the strong locations

The rest. CAPTIQ GmbH & Sub Capitals GmbH

CAPTIQ GmbH

Company outlook

CAPTIQ GmbH is a FinTech company based in Frankfurt that specializes in providing financing for chamber professionals. The company offers customized credit solutions for professions such as doctors, dentists, veterinarians, pharmacists, psychotherapists, architects, consulting engineers, lawyers, notaries, certified accountants, tax consultants and auditors. CAPTIQ has established itself as the first credit platform to digitize and simplify the granting of loans to chamber professionals.

Business model and services

CAPTIQ operates a B2B platform that facilitates the granting of loans to chamber professionals. The business model is based on a fully digital and automated process that makes lending efficient and fast. The loans are refinanced in securitized form via institutional investors such as pension funds, insurance companies or pension schemes. The company uses a sophisticated risk analysis algorithm to assess applicants' creditworthiness and disburse loans within a few days.They offer various financing options for chamber professionals, including:

-Furnishing and renovating practices and law firms

-Purchase of equipment and appliances

-Provision of working capital and liquidity

-modernization and expansion of business operations

-Rescheduling of debts

The loans can be up to 250,000 euros and have terms of up to 10 years. Applications are submitted via a simple online portal and the loans are disbursed quickly following an automated credit check.

Financing evaluation

CAPTIQ has successfully completed several rounds of financing to support its growth and expansion. Key financing events include:

-First financing round: over half a million euros from 15 business angels and professional investment companies.

-Series A financing: 2.6 million euros, led by sino Beteiligungen GmbH, to expand the business.

-Cooperation with Anadi Bank: provision of a refinancing contingent of up to 150 million euros for loans to chamber professionals.

-CAPTIQ also structured a bond and was the first lending platform in Europe to receive an investment grade rating, creating a new, low-risk asset class for institutional investors.

Overall, CAPTIQ demonstrates a strong financial base and a clear strategy to scale and expand in the market for chamber professional financing.

Sub Capitals GmbH

Company outlook

Sub Capitals aims to democratize artificial intelligence in the financial industry and make it accessible to all investors. The company sees itself as a pioneer in the establishment of AI-based investments and strives to create more equality in the financial markets.

Business model and services

Sub Capitals offers the following main services:

-AI-based investment decisions as "AI as a Service" (AIaaS) for professional investors.

-An exchange-traded AI certificate for private investors, offered in cooperation with UBS as issuer.

-A platform solution for institutional clients that covers the entire AI value chain in asset management.

The company uses advanced AI models and data analytics to develop and implement trading strategies.

Financial valuation

Sub Capitals has successfully obtained financing:

-A seven-figure pre-seed financing led by sino Beteiligungen GmbH.

-Support from start-up funding programs of SCE and UnternehmerTUM in the first years.

Conclusion

If you are patient and want to invest in Trade Republic, Sino AG seems to be a good option. However, it should be noted that the management might sell the stake beforehand or Trade Republic might not reach the value that is hoped for. Assuming that Trade Republic reaches a value of 10 billion euros, it might look like you could write off all other investments and still get a good deal.

Interesting in any case.

Cheers.

written on 06.08.2024