- Revenue: $2.55B, +19% YoY

- Net Income: $151.7M, +66% YoY vs $91.6M

- Adj. EPS: $1.11, highest quarterly EPS ever vs $0.77 YoY

- Hardware Platform Solutions revenue up 65% YoY to $0.8B

CEO Rob Mionis: "We are pleased with the company's strong performance in the fourth quarter and solid finish to 2024. For the full year 2024, Celestica achieved 21% revenue growth, while our non-GAAP adjusted EPS grew 58% year-over-year."

🌱Revenue & Growth

- CCS segment: $1.74B, +30% YoY

- ATS segment: $0.81B, flat YoY

- Full year 2024 revenue: $9.65B, +21% YoY vs $7.96B

- Two customers represented 24% and 12% of total revenue

💰Profits & Financials

- GAAP Operating margin: 8.0% vs 5.1% YoY

- Adjusted Operating margin: 6.8% vs 6.0% YoY

- Free cash flow: $95.8M vs $86.1M YoY

- Cash from operations: $143.4M vs $118.0M YoY

📌Business Highlights

- Won second 1.6T switching program with large Hyperscaler customer

- Secured HPS Full Rack AI System program with Digital Native Company

- Repurchased 0.3M common shares for $25.5M

🔮Future Outlook

- Q1 2025 revenue guidance: $2.475B-$2.625B

- Raised 2025 revenue outlook to $10.7B from $10.4B

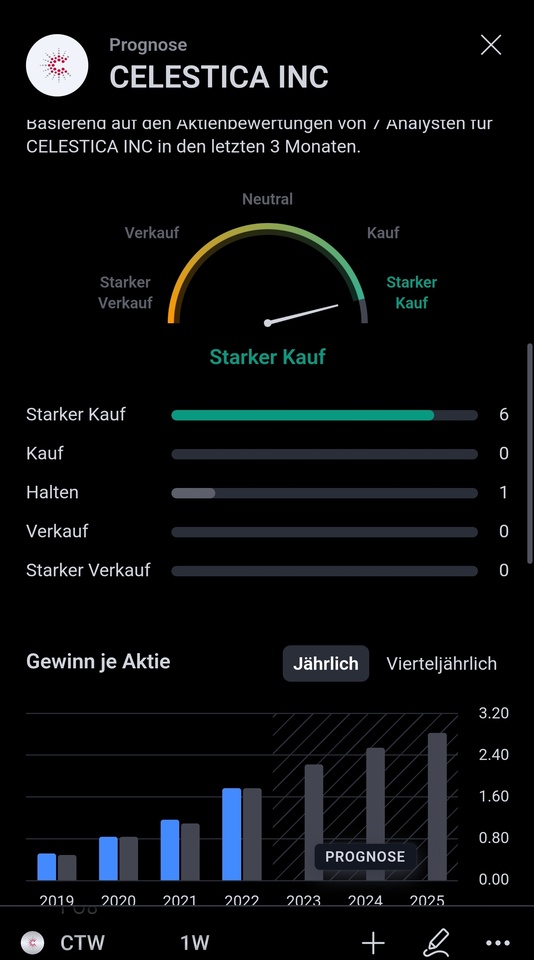

- Increased 2025 Adj. EPS outlook to $4.75 from $4.42

- Free cash flow outlook raised to $350M from $325M