$LLL In getquin I see that Leo Lithium has paid me a dividend, but in Trade Republic I have not received any payout!

Does anyone here have the same problem?

Postes

17$LLL In getquin I see that Leo Lithium has paid me a dividend, but in Trade Republic I have not received any payout!

Does anyone here have the same problem?

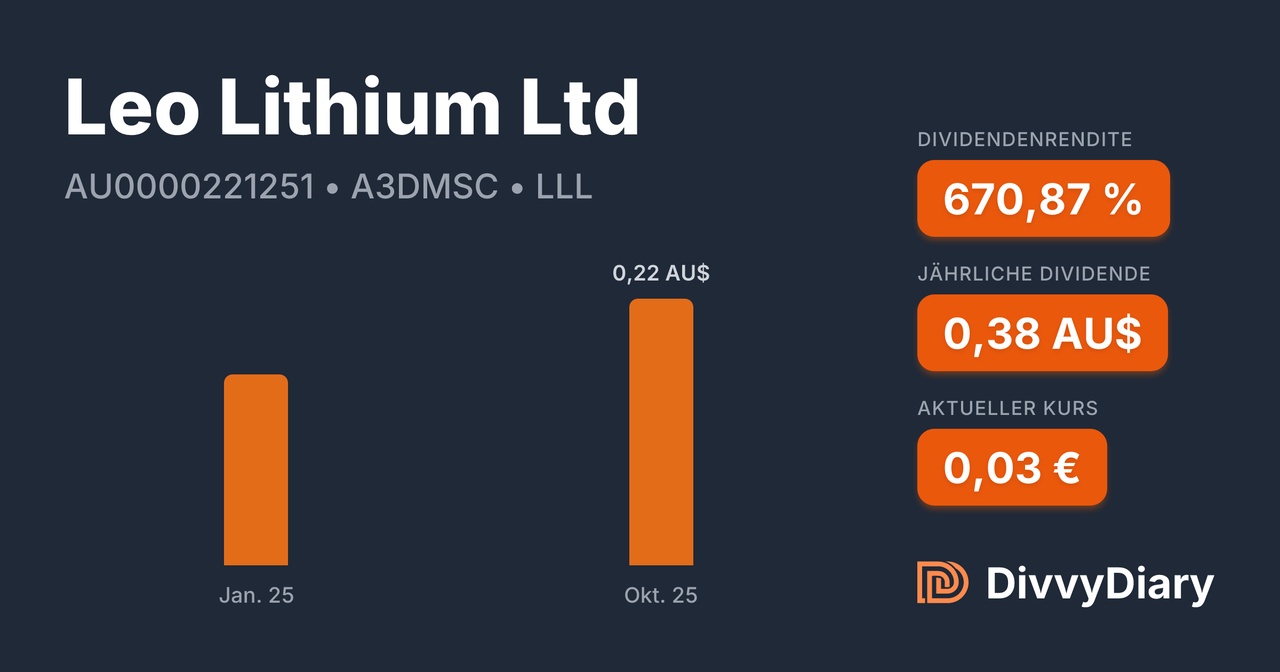

$LLL The Company recently sold its remaining interest in the Goulamina Lithium Project, which it holds through its holding company Mali Lithium BV (MLBV), to its former joint venture partner Ganfeng Lithium Co Ltd. Ganfeng will make two payments and the net proceeds from the sale of the first payment will be returned to shareholders in an initial distribution in January 2025. A second distribution is planned for July 2025.

The company is currently looking for alternative ways to deliver growth to shareholders.

But this is only available to "Titanhands" investors like me from $LLL which has not been tradable on our stock exchange for some time and which greedy institutional investors have been trying to buy from me this year with irregular, outrageous offers.

I already thought that something was up and that they probably had insider knowledge. Who else would want to buy such a share?

Well, the 500% dividend yield is now only to be seen on the "alleged" share price although it is still not tradable for me. If I take my personal yield, then it's "only" 28.7%. Actually not too bad either. If they pay out the same dividend for another three years, then at least I'll have recouped my investment😅

PS: Before everyone starts asking how I arrived at the 500% figure for the alleged GQ share price: I took a price from the Australian stock exchange where it is apparently still tradable (at least the price there fluctuates from time to time and therefore assume that it is still tradable there: https://divvydiary.com/de/leo-lithium-aktie-AU0000221251 )

With $LLL something is still happening 😂

https://www.nasdaq.com/articles/leo-lithium-announces-capital-return-and-dividend-plan

What do you think - recovering $LLL again and after the drop the ideal time to buy more?

$$LLL Finanzen.net Zero just informed me that the rate on gettex has been suspended and therefore the savings plan has been deleted.

Nice shift

Deep market analysis and steep hypothesis:

Have now all $BVB (-0,88 %) gambler switched to $LLL or from where the strong rise today in the mines?

So under the motto "stones instead of legs" 🌚

Moin I am still very new to the stock market. I am 29 years old and would like to save something for old age as well as slowly get used to the stock market.

Yes my portfolio currently consists mostly of individual stocks as well as some very questionable positions like $9866 (+1,23 %) Nio or $LLL .

For these steps I have decided to collect initially first different experiences.

In addition to individual shares, I would like to create a savings plan in ETFs to significantly expand this position in the long term.

I ask myself whether I prefer the $VWCE (-0,86 %) which is more diversified or the $IWDA (-1,16 %) with a smaller ETF for diversification.

The plan is a savings plan in the amount of 3-400 € per month.

Would be very grateful for suggestions and ideas and look forward to a lively exchange in the future.

Meilleurs créateurs cette semaine