OSAKA Titanium Technologies

Overview of

OSAKA Titanium Technologies Co., Ltd. is one of Japan's leading manufacturers of titanium and titanium alloy products. The company has a broad technological base and covers the entire value chain - from titanium sponge to highly specialized powders for future technologies.

Product and value-added portfolio

- Titanium sponge High-purity raw material for aerospace alloys and industrial applications.

- Rolled products & semi-finished products Sheets, plates, wires and other processed forms of titanium.

- Titanium alloys For high-temperature and high-performance applications.

- Special powders For additive manufacturing, electronics, semiconductors and high-tech components.

Target industries

OSAKA Titanium is particularly strong in demanding segments where material quality and process stability are crucial:

1. aerospace

- Focus on aerospace grade-materials

- Titanium alloys for structural components, engine components and high-temperature environments

- Growing demand due to global fleet modernization

2. chemistry & energy

- Titanium for corrosive environments

- Use in seawater desalination, chemical reactors and energy plants

3. semiconductor & electronics industry

- High-purity titanium materials for thin-film processes

- Powder and specialty products for high-end electronics

- Particularly important strategically, as Japan is the quality leader here

Strategic orientation

OSAKA Titanium pursues a clear premium strategy:

- Focus on high-margin segments

- Aerospace grades

- Heat-resistant alloys

- High-purity materials for semiconductors

- Investments in efficiency & automation

- Process automation to reduce costs

- Quality control at the highest level

- Competitiveness against global suppliers

- USA (ATI, Timet)

- Europe (VSMPO-Avisma restricted by geopolitical situation)

- China (rapidly growing titanium sector, but lower quality standards in the high-end segment)

Strategic importance in a global context

OSAKA Titanium is a central building block for:

- the diversification of the global titanium supply,

- the stability of western aviation supply chains,

- the safeguarding Japanese high-tech industries,

- the reducing dependence on Chinese and Russian sources of titanium.

This makes the company not only industrially but also geopolitically relevant.

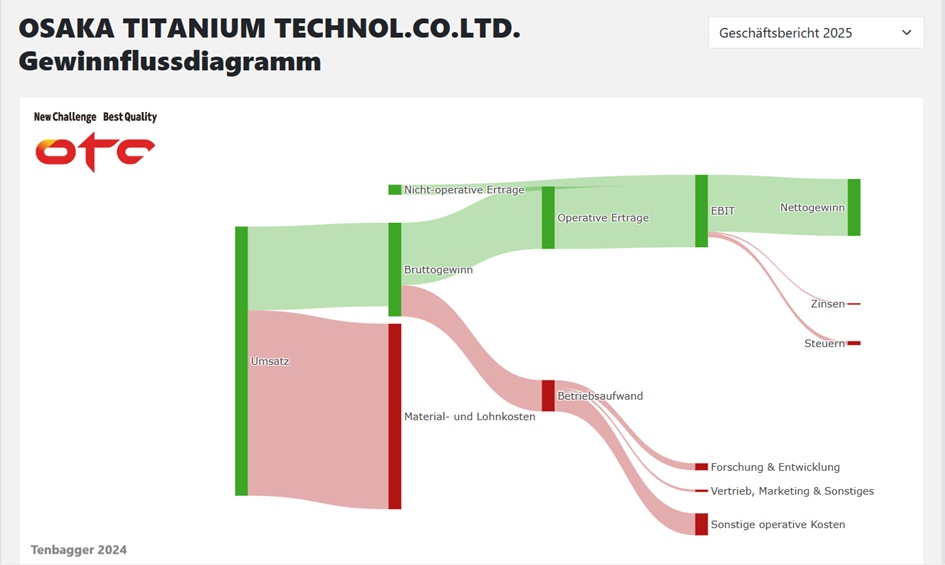

Turnover 2026 2027 2028

Osaka Titanium 50,950 54,950 62,300

Change -1.86% 7.85% 13.38%🚀

EBIT 2026 2027 2028

Osaka Titanium 5,500 6,700 9,500

Change -45.48 % 21.82 % 41.79 %🚀

Net result 2026 2027 2028

Osaka Titanium 2,900 4,600 6,500

Change -59.1 % 58.62 % 41.3 % 🚀

Net debt 2026 2027 2028

Osaka Titanium

Free cash flow 2026 2027 2028

Osaka Titanium 9,200 -4,400 -18,400

EBIT margin 2026 2027 2028

Osaka Titanium 10.79 % 12.19 % 15.25 %🚀

ROE 2026 2027 2028

Osaka Titanium 6 % 10.9 % 14.3 % 🚀

Earnings per share 2026 2027 2028

Osaka Titanium 79.45 124.8 177

Change -58.77 % 57.14 % 41.77 %🚀

Dividend/yield 2026 2027 2028

Osaka Titanium 18.5 34 49

Yield 0.69 % 1.27 % 1.82 % 🚀

P/E RATIO/PEG 2026 2027 2028

Osaka Titanium 33.8x 21.5x 15.2x

PEG -0.6x 0.4x 0.4x 🚀

Market value Number of shares (in thousands)

Osaka Titanium 98,841 36,798

There was a sale at Palfinger $PAL (-1,28 %)