Hello my dears,

due to the great correction in AI stocks and the upcoming interest rate hike in Japan from Thursday evening to Friday. I went through my Japanese stocks again.

And here could be a good entry opportunity with Fujikura $5803 (+11,05 %) could arise.

What do you think of the share?

I look forward to many comments.

At the very end, I have a little more exciting information about the

" Next Generation "

inserted

TOKYO: Japan's Fujikura has become a standout profile on the hot Nikkei share scale on expectations that the century-old wire maker will benefit from increased investment in artificial intelligence data centers that use its optical fibers.

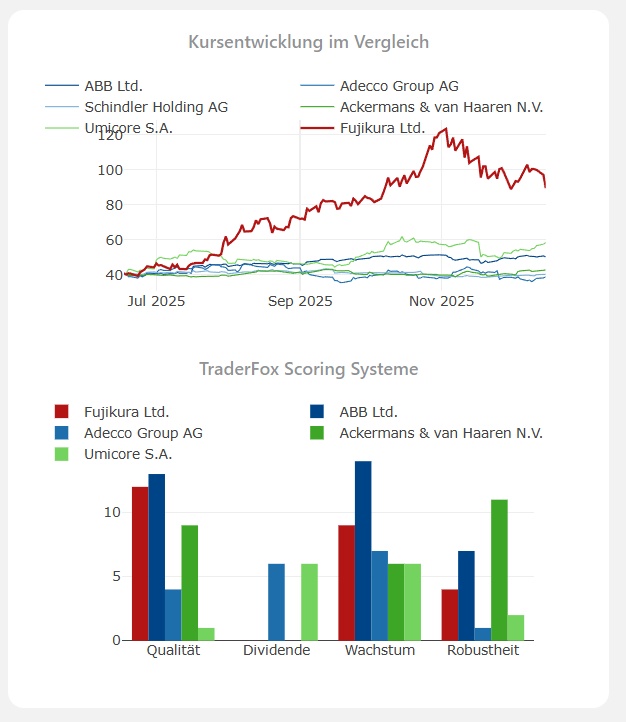

Fujikura's shares have risen more than 160 percent since the start of 2025, outpacing the Nikkei's 22 percent rise to an all-time high. Its market value of around 33 billion dollars now rivals that of better-known Japanese manufacturers such as air conditioner maker Daikin and construction equipment maker Komatsu.

In Japan, this euphoria has spread to major suppliers and investors in the AI sector such as Advantest, Tokyo Electron and SoftBank Group. These companies alone have accounted for the majority of the Nikkei's gains since the beginning of September.

Fujikura, founded in 1885 during the Meiji era of Japan's modernization, is a focal point for investors scouring the AI supply chain to find the next winning group.

"Generative AI is a big topic and a key driver for the Japanese market," said Kazuaki Shimada, chief strategist at IwaiCosmo Securities. "Now investors have started to look for new targets that could become the next Fujikura."

Mitsui Kinzoku, which makes materials for data center servers, is another AI-related top flyer in the Japanese market, up 192 percent so far in 2025. Another supplier, JX Advanced Metals, has quadrupled since entering the market in March.

Fujikura began as a manufacturer of silk and insulated wires and produced the world's first glass fiber in 1959. Today, these optical fibers are a key component of AI data centers, with around 75 percent of the company's production going to foreign customers such as Google owner Alphabet.

A spokesman said Fujikura increased fiber optic production capacity at its existing plant in February and announced in August it would spend 45 billion yen ($298.45 million) to build another factory.

($1 = 150.7800 yen)

Source: Reuters

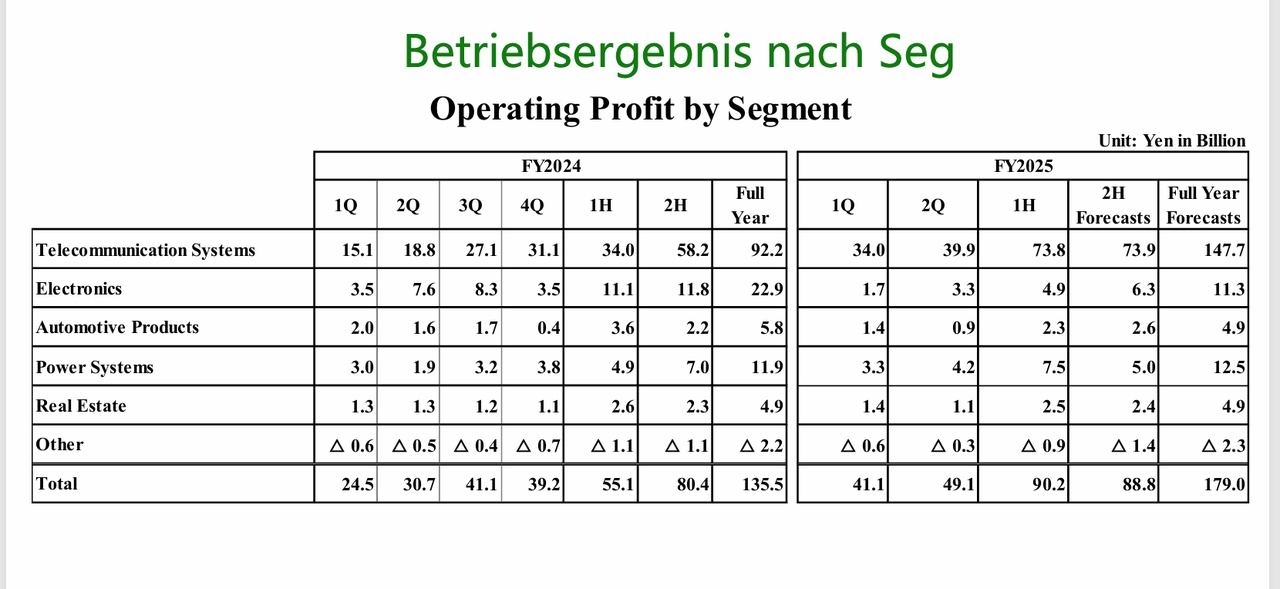

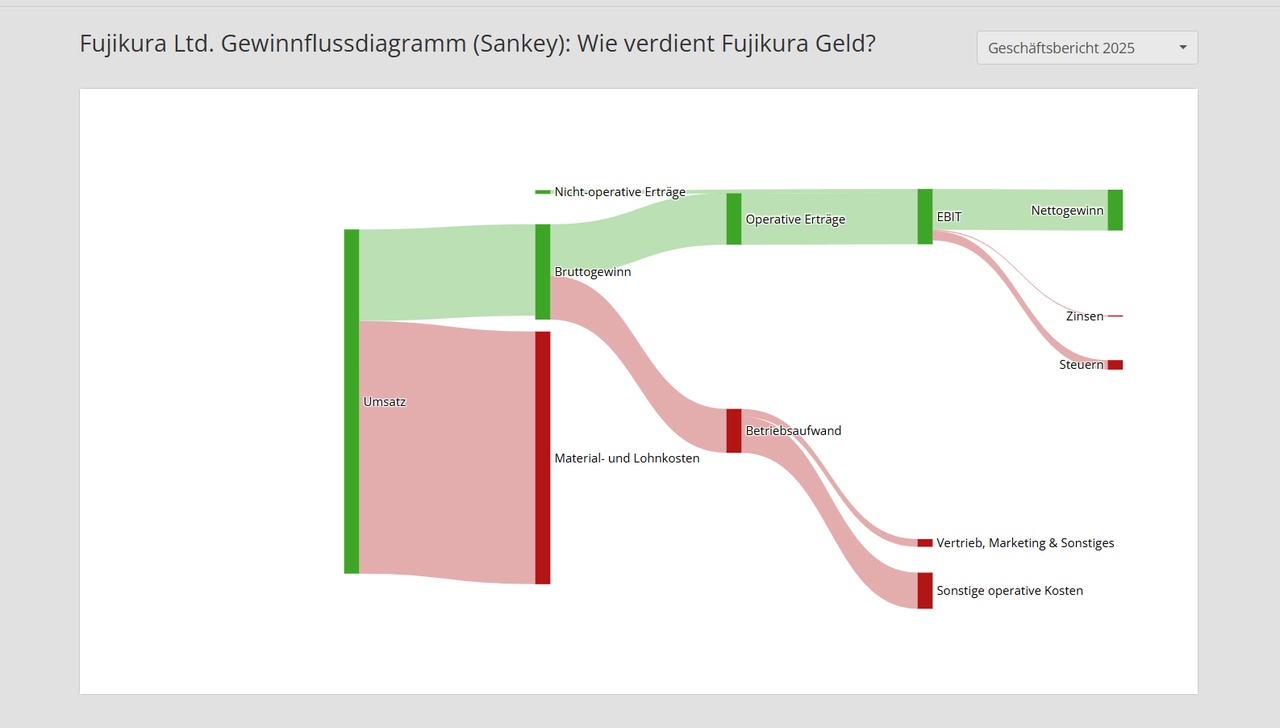

Fujikura Ltd. specializes in the development, manufacture and marketing of electronic devices, cabling systems and telecommunications equipment. The breakdown of net sales by activity is as follows:

- Sales of electronic and electronic devices (38%): printed circuits, connectors, switches, pressure transducers, etc;

- Sale of cables (37.2%): Power cables, coaxial cables, special cables for industrial installations, telecommunication cables, line wires, etc. The Group is also developing an activity for the sale of telecommunications equipment (fiber optic connectors, photometers, reflectometers, optical connectors, couplers, optical transceivers, etc.);

- Sale of automotive products (22.4%);

- Real estate leasing (1.3%);

- Other (1.1%).

The geographical breakdown of net sales is as follows: Japan (28.4%), Asia (12.7%), North America (41.1%), Europe (13.7%) and Other (4.1%).

Number of employees: 51,262

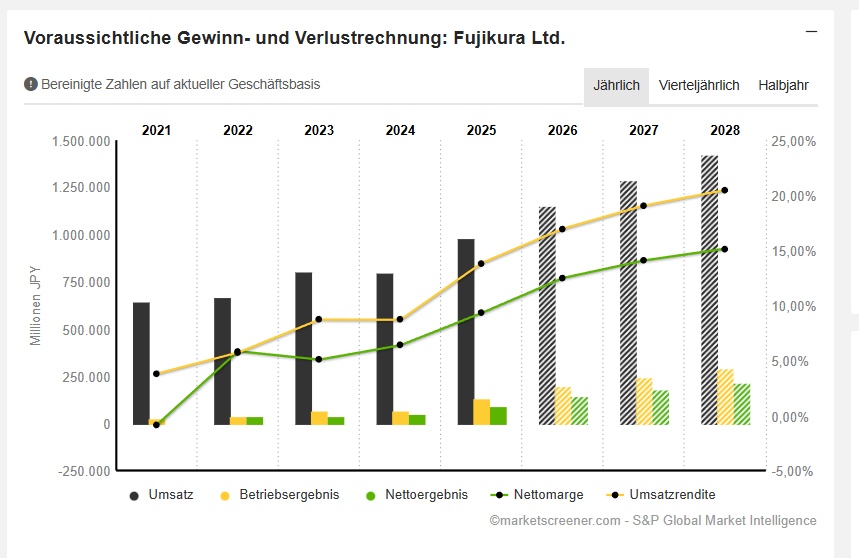

JPY in millions

Estimates

year

Turnover

Change in

2025 979.375 22,46 %

2026 1.152.166 17,64 %

2027 1.288.595 11,84 %

2028 1.425.244 10,6 %

Year

EBIT

Change in

2025 135.519 95,04 %

2026 195.397 44,18 %

2027 245.553 25,67 %

2028 291.675 18,78 %

Year

Net result

Change in

2025 91.123 78,63 %

2026 143.808 57,82 %

2027 181.362 26,11 %

2028 215.838 19,01 %

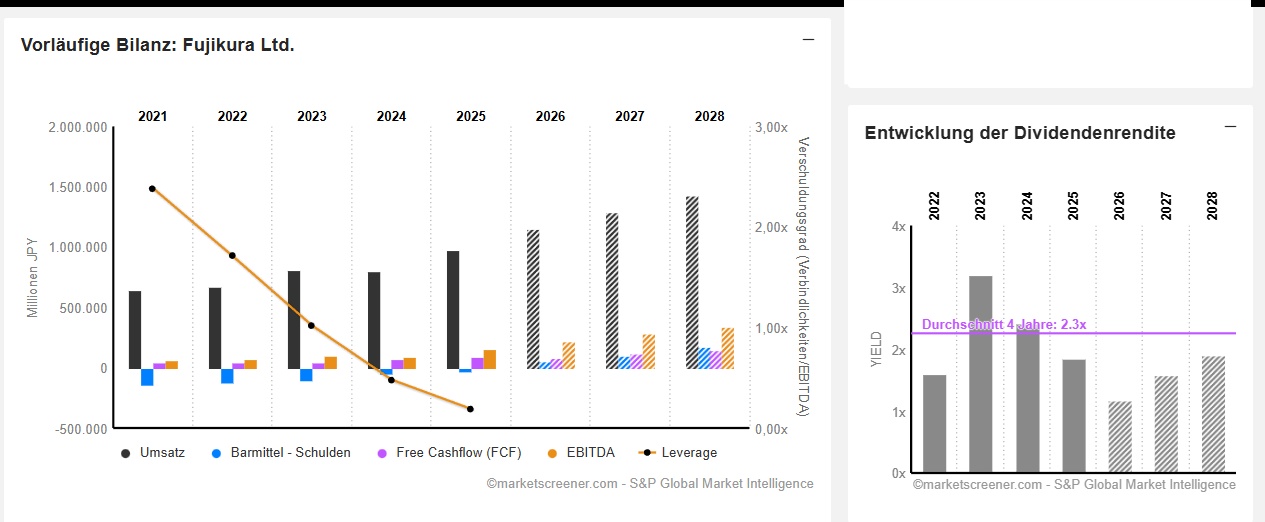

Year

Net debt

CAPEX

2025 29.806 30.673

2026 -50.919 58.672

2027 -98.386 66.000

2028 -174.329 71.503

Year to date

Free cash flow

Change in

2025 94.996 30,21 %

2026 80.466 -15,3 %

2027 121.086 50,48 %

2028 147.955 22,19 %

Year

EBIT margin

ROE

2025 13,84 % 24,4 %

2026 16,96 % 31,46 %

2027 19,06 % 33,39 %

2028 20,46 % 32,93 %

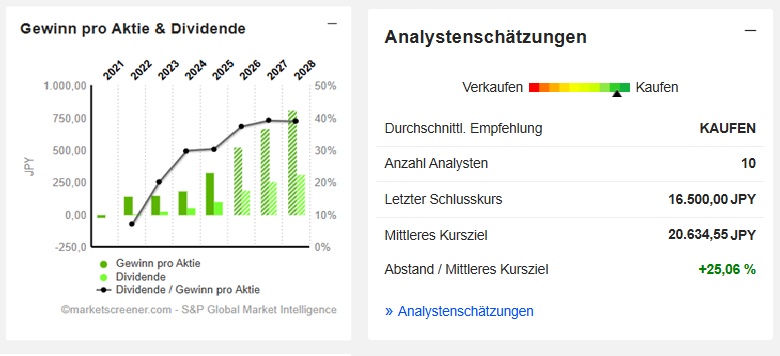

Year

Earnings per share Change

2025 330,3 78,59 %

2026 521,3 57,81 %

2027 666,4 27,83 %

2028 809,7 21,5 %

(number of shares 275,931)

Year

P/E RATIO

PEG

2025 16.3x 0.2x

2026 31.7x 0.5x

2027 24.8x 0.9x

2028 20.4x 0.9x

Year

Dividend p share

Yield

2025 100 1,85 %

2026 193,9 1,18 %

2027 259,9 1,58 %

2028 314,1 1,9 %

Market value 4,559,762

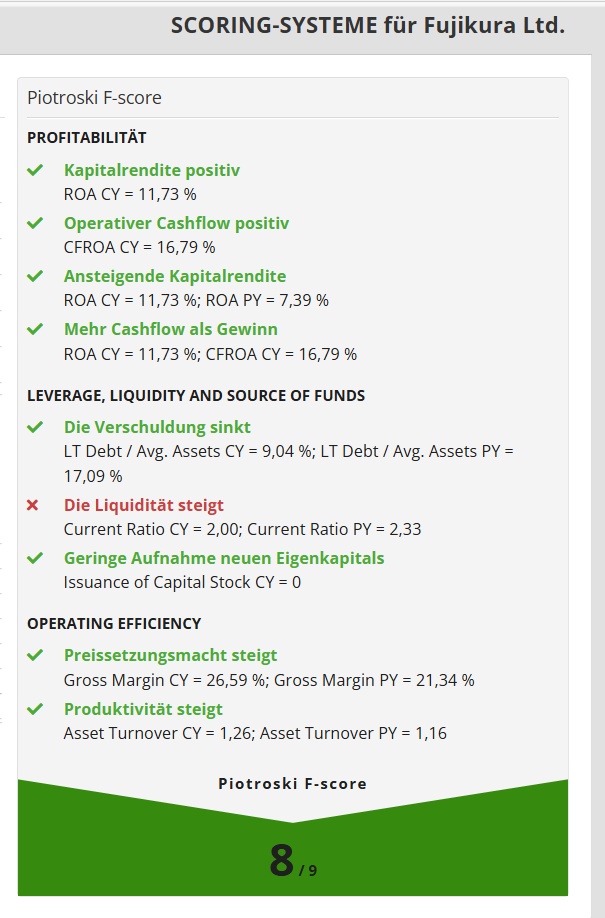

On the way to a sustainable growth phase, we are striving

to become an extremely profitable company through strategic portfolio management.

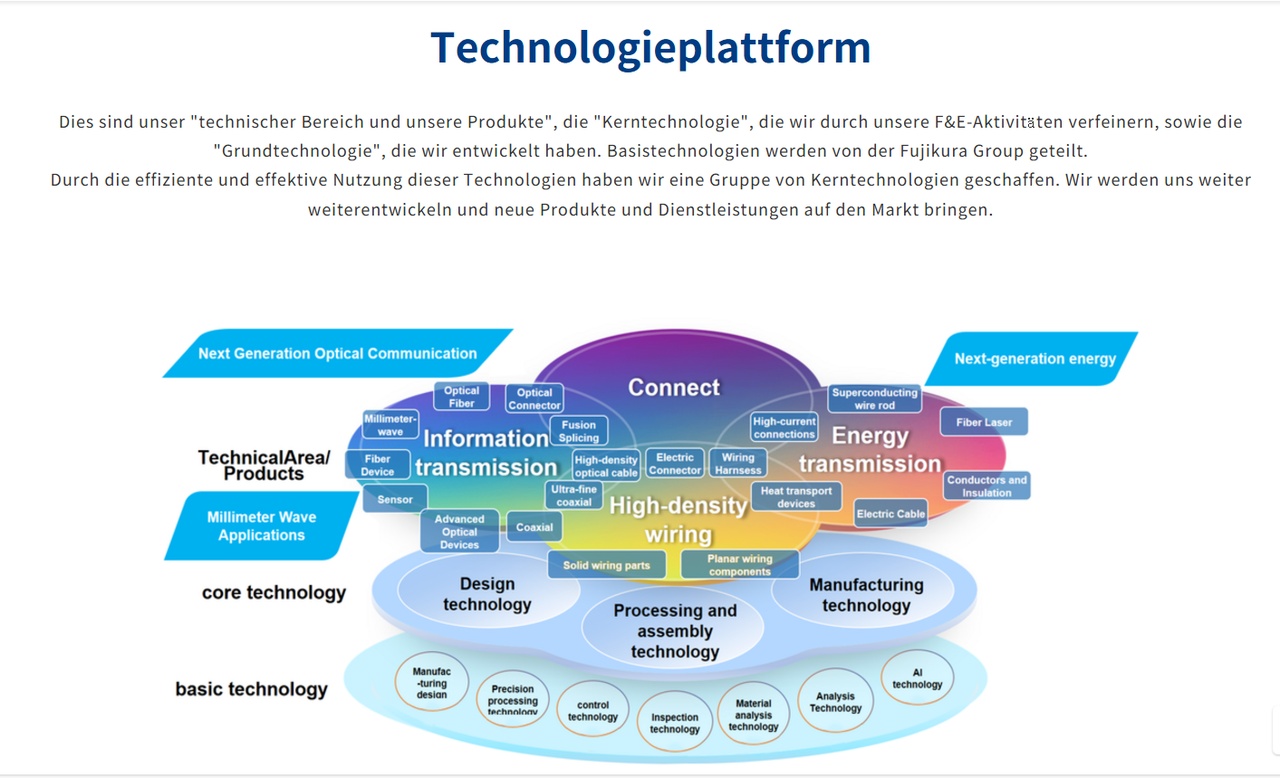

R&D topics @EpsEra

Research and development on the way to realizing the next generation of optical communication technology

Next generation optical communication

Next-generation optical communication is a technology field that meets the growing demand for higher speeds, greater capacity and lower latency in the communications infrastructure, as well as the need to reduce power consumption in line with the increasing volume of data worldwide.

Research and development towards the realization of a carbon-neutral society

Next generation energy

In the field of next-generation energy, we plan to apply high-temperature superconductor technology, which has world-class properties, to areas such as nuclear fusion generation and aircraft electrification.

Through wireless

implementation of ultra-high speed and low latency, R & D aimed at full-field millimeter wave

Millimeter wave applications

In the field of "millimeter wave applications"

promote

we promote the development and commercialization of high-performance devices and systems using antenna modules and other devices with millimeter wave frequency bands.

In order to realize an advanced information society, we have identified three core business areas in which Fujikura Group technologies can be utilized and are focusing resources on these areas.

We aim to create customer value and contribute to society through Fujikura's "Tsunagu" Technology™, a technology leader.

Information storage

We will contribute to data construction centers to store huge amounts of data through unique electronic components and ultra-high density optical wiring technologies.

Information terminal

We will contribute to the development of high-speed, high-performance and high-performance information terminals through high-resolution electronic components and wiring and assembly technology. We also regard automobiles as information terminals and will contribute to the realization and further development of CASE.

Information infrastructure

Through optical connectivity solutions via innovative optical technologies and future high-speed wireless communication technologies, we will contribute to the technologies, construction of information and communication infrastructure to realize a digitized society.