Hello my dears,

and once again $MTX (-0,33 %) MTU is here again.

But I am pleased that $AVIO (+0,55 %) Avio has been included.

At the Paris Air Show, Avio Aero, Safran and MTU Aero Engines laid the foundations for a multinational team to develop the engine for the next-generation European helicopter. A new and purely European helicopter engine is to be developed in a long-term cooperation, according to the agreement, which was announced by the three companies involved on June 18. The European Next Generation Helicopter Engine (ENGHE) is intended for the next generation of military helicopters in Europe, which are due to enter service around 2040.

EURA joint venture

Safran and MTU had already announced their collaboration on a new helicopter engine in 2023. Last year, the two companies founded a 50/50 joint venture called EURA (European Military Rotorcraft Engine Alliance) to develop the engine (ESuT reported). Avio Aero will now contribute its know-how and expertise in the field of military helicopter engines.

With equal work shares, the three companies aim to create an engine that combines reliability in service with affordable operating and maintenance costs. According to MTU, the cooperation between the companies will form the core of an extended and long-term European partnership in which other European nations will also be involved.

Features of the ENGHE

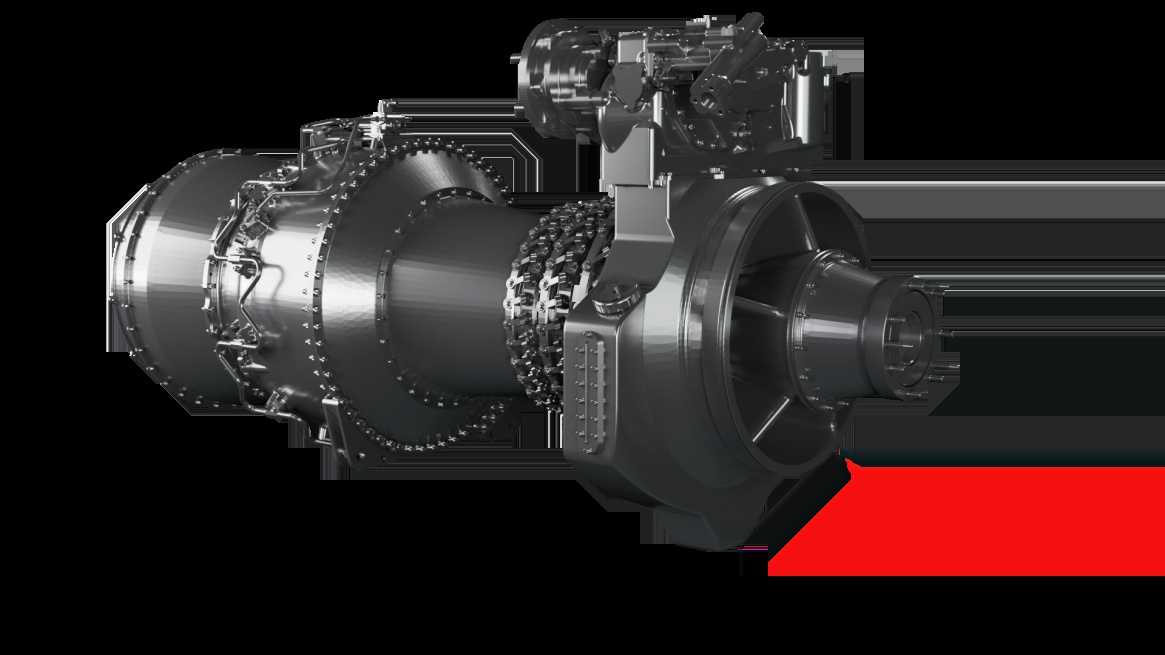

The companies say that the ENGHE will feature groundbreaking technologies. They will significantly increase its efficiency while reducing operating and maintenance costs. Such an engine meets the requirements of future military helicopter projects such as ENGRT (European Next Generation Rotorcraft Technologies) and NGRC (Next Generation Rotorcraft Capability).

The exceptional characteristics of the ENGHE will give these future helicopters improved capabilities [compared to today's models], the companies said. These include, in particular, a greater range and higher speed as well as improved maneuverability and increased availability. This will be supported by the hybrid-electric configuration. In addition, the drive will have lower fuel consumption and be 100 percent compatible with sustainable aviation fuel (SAF).

Objective

The next objective of the cooperation partners is a strong joint proposal in response to the European Defense Fund's specific call for tender for a next-generation helicopter engine. EURA will coordinate this proposal and submit it to the European Commission in October 2025.

Editorial team / gwh