Foreword:

hello getquinners,

I researched everything myself in the whitepaper, on Solana's site and wrote it myself (no Ki Slop)

so there will be spelling and grammar mistakes in here (don't be mad at me)

I only did the "risks" section with AI, because it would be exhausting to work through and think about.

Solana:

Solana is a powerful network that enables fast, secure and low-cost digital transactions. It supports thousands of applications, from payments and gaming to digital art and financial services.

Like Ethereum, Solana uses smart contracts, or the Solana network: Programs

What programs are there?

Send money globally:

While traditional country and continent-wide bank transfers take days, Solana transactions are completed in less than a second and with only typically $0.00025 in transaction costs, or a quarter of a thousandth of a dollar.

Memecoins and prediction markets:

everyone knows it by now, PUMP.fun for memecoins or Polymarket competitor Kalshi to really make a bet on everything.

Solana places bets with PUMP.fun and Kalshi the technical infrastructure ready: High TPS blockchain, programs, wallets and DEX integration - without Solana, there would be no scalable basis for these booms.

NFTs:

Digital certificates on a blockchain that uniquely assign a unique digital asset to an owner and prove its authenticity.

Forgery-proof proof of ownership for digital items such as art, music, tickets, in-game items. Less fraud, better tracking, additional features such as access to events or communities and proof of identity/documents.

Stablecoins:

Stablecoins are digital currencies whose value is tied to a stable asset, usually a fiat currency such as the US dollar or the euro. This is intended to reduce price fluctuations, as with other cryptocurrencies, in order to make them more usable as a means of payment or store of value.

Tokenomics:

SOL:

SOL, the native currency of Solana, is used as the "fuel" of the Solana blockchain. The token is responsible for paying the fees for each transaction and each dApp interaction in SOL.

Staking: 2 different mechanisms

Proof of Stake:

POS

Proof of Stake is a consensus mechanismin which it is not computing power but the use of coins that decides who is allowed to create new blocks and confirm transactions. Participants lock their own coins in the network (staking) and thus become validators.

Validators who are selected check transactions, build a block from them and receive rewards in the form of SOL.

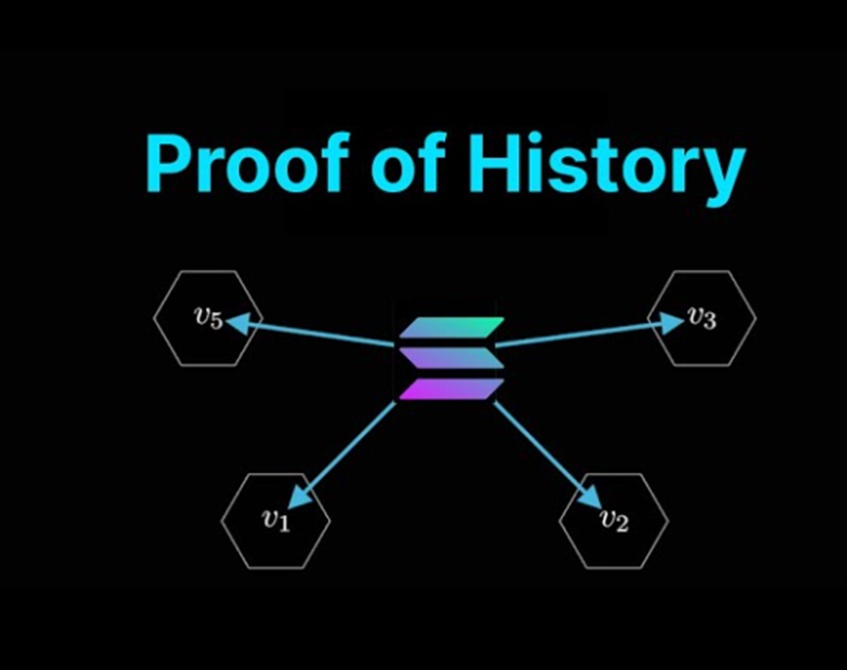

Proof of History: POH

generates a verifiable, cryptographic time/sequence trace so that the network knows in which order transactions happened. You can think of PoH as an accelerator: It's not a full consensus on its own, but makes PoS consensus extremely fast and efficient, enabling Solana's high performance.

How exactly this works technically is complicated to describe. If you are interested, I recommend the following video: "How Proof of History Works on Solana"

Max Supply:

Solana has no maximum number of tokens in circulation, but SOL is burned after each transaction.

Sol is given out to validators as a reward for keeping the network secure. Solana started with an inflation of 8% pa, which decreases 15% every year. In 2025 it was an inflation of: 4%

Locked tokens as of 14.01.2026:

Around 430 million SOL are locked in staking, which roughly corresponds to just under 68% of the circulating supply, the remaining 32% are lying around freely on exchanges, wallets or DeFi applications

Partnerships:

Solana has partnerships with: Visa, Paypal, Fiserv, Circle, Worldpay, Western union, Blackrock and many more.

Roadmap: what's next?

Solana's roadmap for 2026 focuses on scaling, latency reduction and institutional adoption through upgrades such as Firedancer, Alpenglow and expanded block capacity. Similar to Ethereum's post, explaining these projects is beyond the scope of this post (unless you really want to read this in the next one, if so let me know)

The important thing is that Solana continues to develop in the direction of security and scalability.

Price and market risks

SOL is extremely volatile; massive price drops due to macro events, memecoin hype cycles or crypto crashes are possible on a daily basis.

High crypto beta amplifies losses during Bitcoin declines; speculative bubbles (e.g. pump-and-dumps) can trigger 70-90% corrections.

Regulatory risks

Unclear securities classification and stricter crypto regulations could make DeFi, staking or NFT trading on Solana more difficult or more expensive.

National regulations (e.g. MiCA in the EU, SEC on stablecoins) hit Solana's DEX and yield farming ecosystem hard; CEX delistings for violations are conceivable.

Technical & protocol risks

Frequent network outages (over 10 major halts 2021-2025) and upgrades such as Firedancer/Alpenglow pose bug or halt risks with loss of trust.

Smart contract exploits (often with Rust code), bridge hacks or PoH/PoS edge cases could trigger billions in losses and chain halts; high validator costs increase attack vectors.

Centralization & staking risks

High hardware requirements (~6,000 USD per validator) and ~50-70 validators with >33% stake enable 51% attacks or censorship by a few actors.

Concentration of top validators (Jito, Phantom) creates governance and coordination risks; failure of a large validator can trigger congestion.

Competition and network effect risks

Modular L1/L2s such as Ethereum L2s, Sui or Hyperliquid drain DeFi/liquidity if Solana's monolith design fails to scale.

Lack of network effect against ETH (TVL, devs) makes SOL vulnerable; fees, security and relevance of the ecosystem drop rapidly in case of migration.

As with Ethereum, Solana is a strong player in the stablecoin sector, but the biggest growth driver is the gambling market with Kalshi or PUMP.fun (unfortunately) it is growing very strongly, generating billions in liquidity. This trend does not look like it will end, but rather gain even more momentum, especially if traditional betting providers such as Draftkings $DKNG (-0,06 %) and co. should also build on this.

That's why I took advantage of the dip and bought a little bit of SOL some time ago.

I thank everyone who has read this, if the response is good, I will make the effort and work out the same for another cryptocurrency for you, it was really fun!

Feel free to give feedback, also the other creators, what I could do better!